It began in a garage, like so many tech revolutions do. Not the one you’re thinking of, though. This was in Nairobi, early 2025, where a startup engineered an AI-powered soil sensor that transformed farming yields across East Africa. It didn’t make global headlines. But in its quiet brilliance, it captured what tech growth in 2025 really looks like: global, practical, and deeply integrated into daily life.

Technology today is less about shiny gadgets and more about interconnected systems that solve real problems. Whether it’s AI models transforming medicine, 5G driving real-time logistics, or green tech reshaping how we power our lives, the pace and purpose of innovation have shifted. Below, we unpack the data behind this accelerating momentum.

Editor’s Choice

- The global technology market is projected to reach $5.8 trillion in 2025, up from $5.3 trillion in 2024.

- Artificial intelligence spending is expected to hit $407 billion globally in 2025, a 28.6% increase over the previous year.

- The cloud computing industry will grow to $678 billion in 2025, led by demand for hybrid cloud infrastructure.

- 5G networks will serve over 1.9 billion connections worldwide by the end of 2025, covering 47% of global mobile connections.

- Cybersecurity spending is anticipated to surpass $215 billion in 2025, driven by the rise in ransomware and nation-state threats.

- More than 92% of enterprises are undergoing some level of digital transformation in 2025, compared to 81% last year.

- The number of tech startups in the US has climbed to over 81,000 in 2025, with a sharp uptick in AI and green energy sectors.

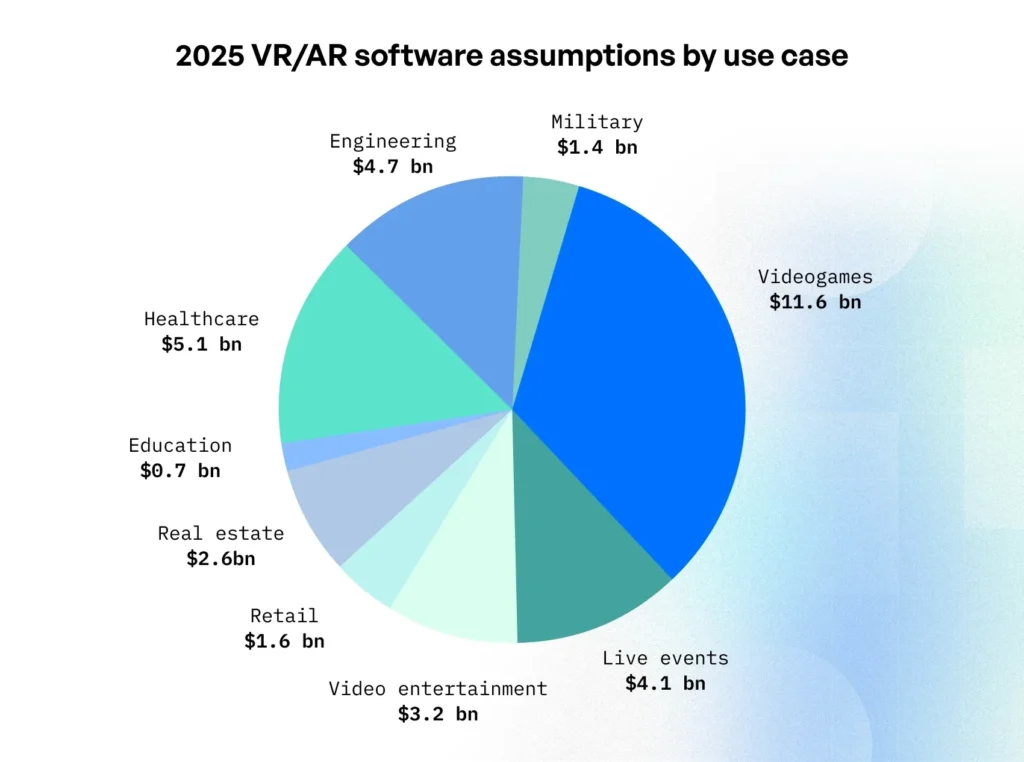

VR/AR Software Usage by Industry

- Videogames lead the market with $11.6 billion in spending.

- Healthcare is expected to reach $5.1 billion, highlighting medical innovation.

- Engineering usage stands at $4.7 billion, driven by simulations and prototyping.

- Live events follow with $4.1 billion, tapping into immersive experiences.

- Video entertainment will account for $3.2 billion in usage.

- Real estate adoption is projected at $2.6 billion, supporting virtual tours.

- Retail use cases are estimated at $1.6 billion.

- Military applications will see $1.4 billion in spending.

- Education is set to generate $0.7 billion, signaling growth in immersive learning.

Global Technology Market Size and Growth Rate

- The global technology market is forecasted to reach $5.8 trillion in 2025, with a CAGR of 5.2% year-over-year.

- North America remains the largest tech consumer, contributing 34% of total spending.

- Asia-Pacific tech spending is expected to grow 7.1% in 2025, fueled by expanding digital economies in India and Southeast Asia.

- The enterprise software market is set to grow to $915 billion by the end of 2025.

- Consumer technology hardware sales (including smartphones and wearables) are expected to decline by 2.3%, showing a market shift toward services.

- The European tech industry is projected to grow by 4.9%, reaching $1.3 trillion in 2025.

- Africa’s tech market will top $180 billion, buoyed by digital banking and mobile infrastructure expansion.

- Latin America’s tech sector is projected to grow 6.2% this year, despite macroeconomic headwinds.

- Global IT services revenue is estimated to cross $1.5 trillion, thanks to demand for managed cloud and AI integration.

Key Drivers of Technological Advancement

- AI adoption remains the single biggest growth driver in 2025, with 64% of companies deploying at least one AI use case in production.

- Remote and hybrid work models continue to push demand for collaboration platforms, now a $96 billion industry.

- Venture capital investment in automation technologies is up 38% year-over-year, signaling a long-term trend.

- Global semiconductor manufacturing is projected to grow 12.4% in 2025, hitting $648 billion.

- Government funding for tech R&D in G20 nations will exceed $330 billion this year.

- The shift to cloud-native application development is cited by 72% of CTOs as a top priority in 2025.

- AI chip development has drawn over $14 billion in new investments in the first quarter of 2025 alone.

- Quantum computing research funding surpassed $7.2 billion globally in 2025, doubling from 2023.

- Digital twin technologies are now adopted by 22% of manufacturing firms, up from 13% in 2024.

- Public-private tech partnerships are at an all-time high, with over 970 new alliances formed in Q1 2025.

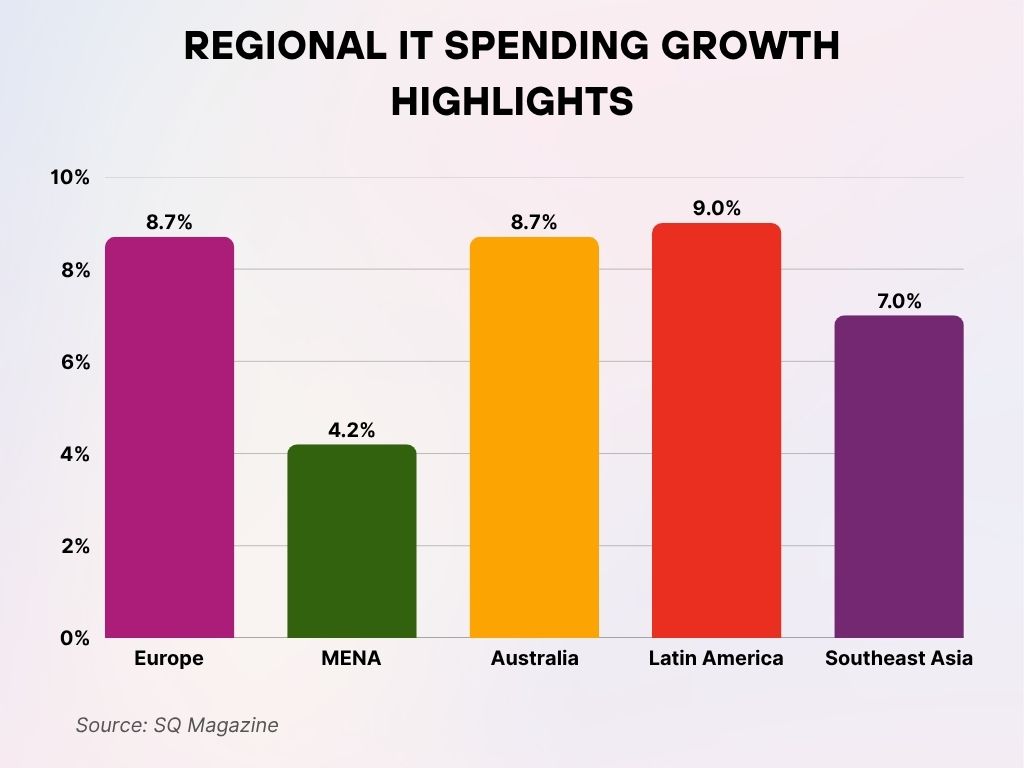

Regional IT Spending Growth Highlights

- Latin America leads with the highest IT spending growth rate of 9.0%.

- Europe and Australia follow closely, each with a growth rate of 8.7%.

- Southeast Asia shows solid expansion with a 7.0% growth rate.

- MENA (Middle East and North Africa) lags behind with the lowest growth rate of 4.2%.

Sector-Wise Technology Adoption

- In healthcare, AI diagnostic tools are used in 67% of hospitals globally in 2025.

- The education sector has seen a 46% rise in the use of immersive tech like AR/VR-based learning systems.

- Fintech adoption is at 89% among Millennials and 72% among Gen Z in the US.

- Retail technology investment reached $63 billion in 2025, focusing on automated checkout and personalization.

- Manufacturing firms reported a 28% boost in productivity from adopting industrial IoT platforms.

- Smart agriculture technologies have seen a 24% adoption rate globally in mid-2025, led by AI-enabled drones and irrigation sensors.

- In the public sector, blockchain usage in record-keeping and logistics has risen by 35% year-over-year.

- The automotive industry reports that 53% of new vehicles in 2025 will include Level 2+ autonomous capabilities.

- Smart city infrastructure investment has crossed $150 billion globally this year.

- Legal tech adoption has grown 31% in large law firms, primarily driven by document automation and analytics platforms.

AI and Machine Learning Growth Trends

- AI market valuation in 2025 is projected at $407 billion, up from $317 billion in 2024.

- Natural language processing (NLP) tools are now deployed by 62% of global enterprises.

- Generative AI use in product development has increased by 48% since January 2025.

- AI ethics compliance platforms are being used by 28% of Fortune 500 companies.

- Machine learning operations (MLOps) platforms are now considered essential by 59% of data teams in 2025.

- The top industries investing in AI in 2025 are finance, healthcare, and logistics.

- Global AI patent filings have exceeded 55,000 as of Q2 2025, a 12% increase from last year.

- AI-generated content is responsible for 31% of marketing material published by leading brands.

- AI in recruitment now handles 41% of applicant screening across large enterprises.

- Small and medium-sized businesses (SMBs) have increased AI adoption by 37% year-over-year, focusing on customer support bots and analytics.

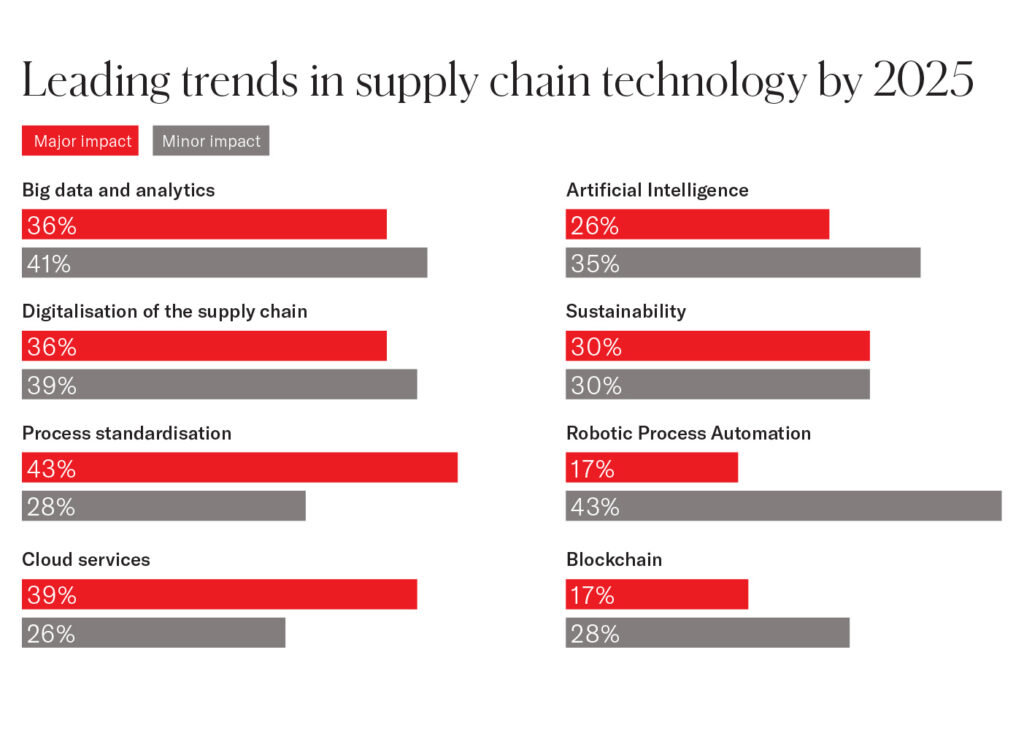

Top Supply Chain Technology Trend

- Process standardization ranks highest for major impact at 43%, with 28% seeing it as minor.

- Cloud services follow with a major impact for 39% and a minor impact for 26%.

- Big data and analytics are expected to have a 36% major and 41% minor impact.

- Digitalization of the supply chain is tied with a 36% major and 39% minor impact.

- Sustainability sees a balanced impact with 30% major and 30% minor.

- Artificial intelligence shows a 26% major and a 35% minor influence.

- Robotic Process Automation gets a 17% major but a high 43% minor rating.

- Blockchain lags behind with only 17% major and 28% minor impact perception.

Cloud Computing Market Expansion

- The global cloud computing market is set to reach $678 billion by the end of 2025, up from $609 billion in 2024.

- Hybrid cloud adoption is at an all-time high, with 82% of enterprises using a combination of public and private clouds.

- Infrastructure as a Service (IaaS) is the fastest-growing cloud segment, growing at 31% year-over-year in 2025.

- AWS, Microsoft Azure, and Google Cloud continue to dominate, together holding 66% of the global market share.

- Cloud-native applications now account for 67% of enterprise app deployments, compared to 55% last year.

- Data storage services in the cloud are projected to generate $115 billion in revenue globally in 2025.

- Serverless computing has expanded by 45% year-over-year, becoming a mainstream choice for agile development teams.

- Edge computing, tied closely with cloud, has grown to a $19.8 billion industry by 2025.

- In the US, government cloud spending has reached $15.4 billion, a 22% increase from 2024.

- Cloud security solutions are being adopted by 93% of cloud-first enterprises, showing the maturity of secure cloud ecosystems.

Internet of Things (IoT) Growth

- The number of active IoT devices worldwide has surpassed 17.1 billion in 2025, up from 15.4 billion in 2024.

- IoT in healthcare has grown significantly, with over 49% of hospitals using connected devices for patient monitoring.

- The industrial IoT (IIoT) segment now represents 29% of total IoT deployments, valued at $293 billion in 2025.

- Smart homes now account for 26% of total IoT installations, with the US leading adoption rates.

- IoT-enabled vehicles are estimated to be 87% of new car models sold in 2025.

- IoT in agriculture is on the rise, contributing $16.2 billion in global value through crop monitoring and automated irrigation.

- Smart grids and utilities using IoT technologies have improved energy efficiency by 21% year-over-year.

- IoT security spending is expected to reach $7.9 billion globally in 2025.

- IoT-generated data will account for 27% of all digital data created in 2025.

- Asia-Pacific leads in IoT growth, with a projected 38% share of new deployments in 2025.

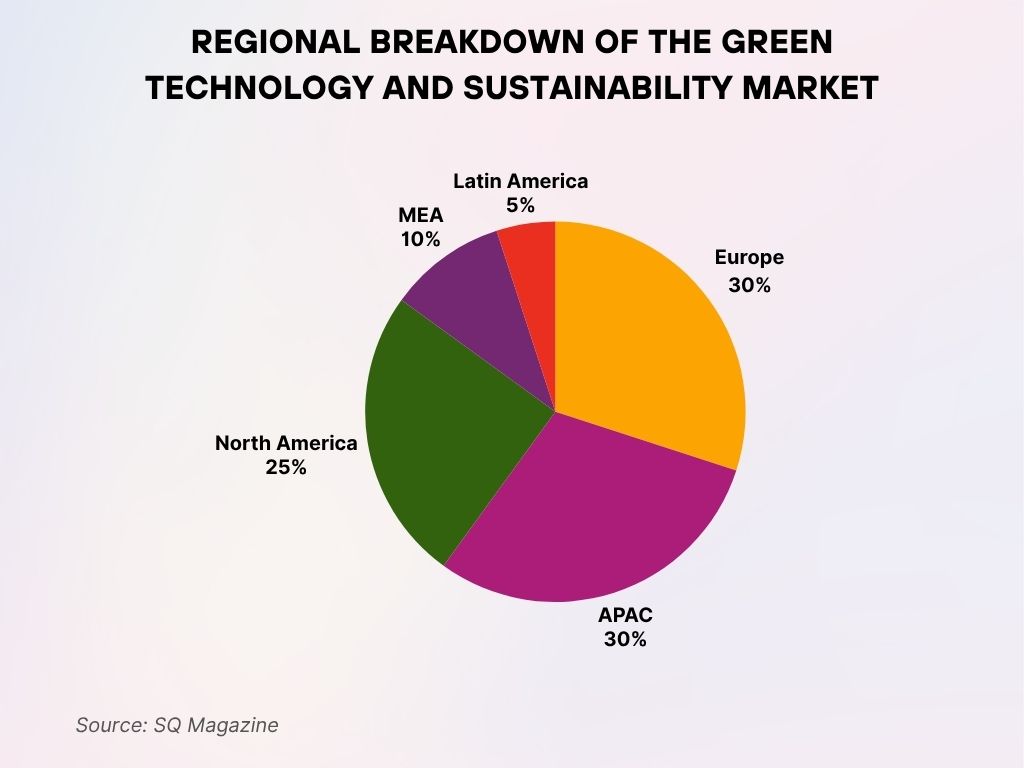

Regional Breakdown of the Green Technology and Sustainability Market

- Europe and APAC are tied as market leaders, each capturing 30% of the global share.

- North America follows with a significant 25% market share.

- MEA (Middle East and Africa) contributes 10% to the market.

- Latin America holds the smallest share at 5%, indicating room for growth.

5G Deployment and Usage

- 5G networks are expected to cover 67% of the world population by the end of 2025.

- The number of 5G connections has surpassed 1.9 billion, up from 1.4 billion in 2024.

- In the US, 5G availability now spans 92% of metropolitan areas.

- 5G-enabled devices account for 74% of all new smartphone sales globally in 2025.

- 5G private networks are deployed in 46% of Fortune 100 companies, primarily in logistics and manufacturing.

- 5G-based IoT applications in smart factories have reduced downtime by an average of 29%.

- The 5G services market is projected to exceed $425 billion in 2025, growing 21% year-over-year.

- Latency improvements have enabled advancements in telemedicine, reducing diagnostic lag by over 50%.

- In Europe, 5G adoption has increased to 61% of mobile users, compared to 48% last year.

- Rural 5G initiatives in the US now cover over 120 million residents, bridging digital gaps in under-connected regions.

Cybersecurity Spending and Threat Trends

- Global cybersecurity spending will surpass $215 billion in 2025, up from $188 billion in 2024.

- Ransomware attacks have increased by 17% in 2025, with an average breach cost of $5.7 million per incident.

- Zero-trust architecture is now deployed by 64% of large organizations.

- Phishing attacks remain the most common threat, accounting for 39% of all breaches this year.

- AI-driven cybersecurity tools are used by 58% of IT departments, showing increasing reliance on automation.

- Cloud-specific security incidents have risen by 22%, prompting demand for hybrid and multi-cloud protection.

- The US government increased federal cybersecurity funding to $14.5 billion for 2025.

- Healthcare and finance remain the most targeted industries, each comprising 27% of breach reports.

- Security as a Service (SECaaS) is projected to grow into a $23.6 billion industry by year-end.

- Insider threats now account for 21% of all data breaches, leading to major shifts in identity and access management strategies.

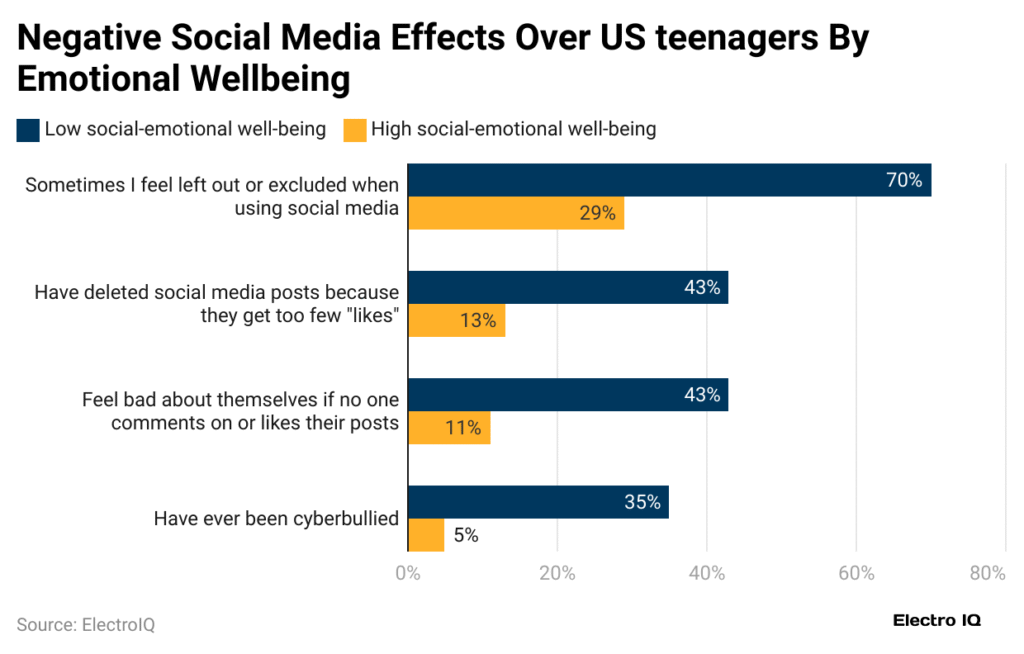

Emotional Impact of Social Media on US Teenagers

- 70% of teens with low social-emotional well-being feel left out or excluded on social media vs. 29% with high well-being.

- 43% of low well-being teens have deleted posts due to few likes, compared to 13% of those with high well-being.

- 43% of low well-being teens feel bad if no one engages with their posts, versus 11% with high well-being.

- 35% of low well-being teens have experienced cyberbullying, while only 5% of high well-being teens report the same.

This data highlights the disproportionate emotional toll social media takes on teens with lower emotional resilience.

Digital Transformation in Enterprises

- In 2025, 92% of enterprises report active digital transformation projects, up from 81% in 2024.

- Automation and robotics integration are now in place at 48% of industrial firms worldwide.

- ERP modernization has been a top focus, with 61% of companies investing in next-gen systems.

- Customer data platforms (CDPs) are deployed in 58% of marketing teams, optimizing real-time personalization.

- Digital twin implementation is up 40% in sectors like manufacturing, automotive, and urban planning.

- Employee training in digital tools has increased, with 73% of enterprises providing reskilling programs.

- The average ROI from digital transformation initiatives has reached 178%, based on 2025 benchmarks.

- Remote IT operations management tools now serve 66% of enterprise IT departments.

- Legacy system decommissioning projects rose by 31%, showing the urgency of modernization.

- Chief Digital Officers (CDOs) now exist in 87% of S&P 500 companies, compared to 69% last year.

Tech Startup Funding and Valuation Trends

- In 2025, global tech startup funding is projected to hit $358 billion, recovering from a cautious funding landscape in 2023.

- The US startup ecosystem continues to dominate, attracting $142 billion in venture capital as of Q2 2025.

- AI startups accounted for 36% of total tech investments, reflecting strong investor appetite for foundation models and automation tools.

- Climate-tech startups raised $42 billion globally in the first half of 2025, an all-time high for the category.

- Seed-stage funding rounds have grown by 19%, indicating revived early-stage investor confidence.

- Unicorn startups (those valued over $1 billion) reached a record 1,430 globally, with 78 new unicorns emerging in Q1 2025.

- Female-led tech startups saw a 27% increase in funding in 2025, rising to $6.8 billion.

- The average Series A round in the US now exceeds $15 million, up 22% from last year.

- Valuations for SaaS startups are back on the rise, with median valuations at $57 million, up from $45 million in 2024.

- Exit activity has surged, with over 390 tech IPOs and acquisitions announced globally so far this year.

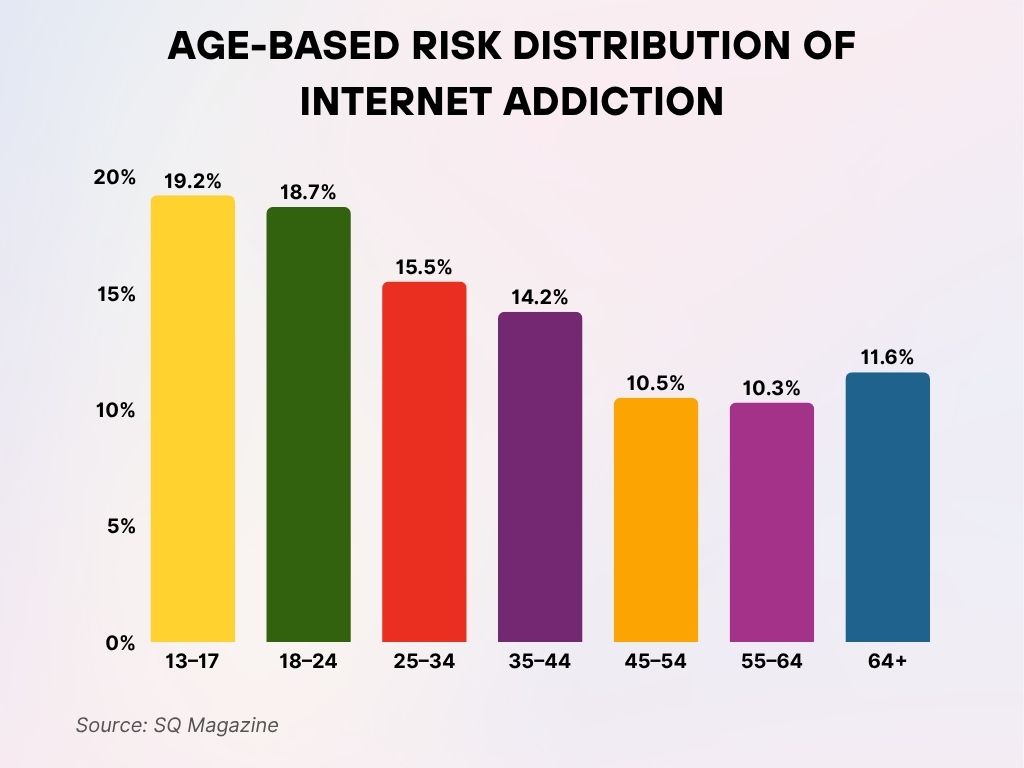

Age-Based Risk Distribution of Internet Addiction

- Teenagers aged 13–17 hold the highest share of internet addiction risk at 19.2%.

- Young adults aged 18–24 closely follow with a risk share of 18.7%.

- The 25–34 age group contributes 15.5% to the overall internet addiction risk.

- Those aged 35–44 make up 14.2% of the total risk.

- Adults aged 45–54 account for 10.5% of the share.

- Individuals aged 55–64 contribute 10.3%.

- Seniors 64 and older still represent 11.6% of the normalized internet addiction risk.

Workforce Impact and Tech-Sector Employment Data

- The US tech sector employs 12.8 million workers in 2025, making up 8.1% of the total workforce.

- Tech job openings in the US hit 682,000 in Q1 2025, with AI engineering and cybersecurity leading demand.

- The average tech salary reached $122,000, a 4.6% increase over 2024.

- Remote tech jobs now account for 48% of postings, with hybrid work continuing as the preferred model.

- AI-related roles grew by 28% year-over-year, including prompt engineers, AI trainers, and ML Ops specialists.

- Women now represent 32% of the US tech workforce, up from 29% in 2023.

- Tech apprenticeships and non-degree credential programs have surged, now involving over 430,000 learners in 2025.

- Layoffs in the sector dropped by 14% compared to the same time last year, signaling renewed stability.

- Employee retention in tech firms improved by 11%, largely due to enhanced workplace flexibility and mental health benefits.

- Freelance tech work is up 35%, supported by platforms offering AI design, data labeling, and development gigs.

Regional Comparison of Technology Growth

- North America leads in overall tech spending, expected to reach $1.94 trillion in 2025.

- Asia-Pacific is growing the fastest, with a projected 7.1% increase in tech sector revenue year-over-year.

- Europe continues to focus on regulatory-led growth, investing heavily in AI ethics, green tech, and digital sovereignty.

- China’s tech industry is forecasted to reach $960 billion in value, driven by AI, semiconductors, and electric vehicles.

- India’s tech exports are set to cross $208 billion, with significant contributions from SaaS and fintech.

- Latin America saw a 6.2% growth in 2025, especially in Brazil and Mexico’s e-commerce and digital banking sectors.

- Africa’s digital economy is growing rapidly, reaching a value of $180 billion, with Kenya, Nigeria, and South Africa as the front-runners.

- Middle Eastern countries, especially Saudi Arabia and the UAE, are investing over $14 billion in AI and smart city development.

- Canada’s tech employment increased by 8.7%, supported by strong public-private innovation partnerships.

- Australia’s startup ecosystem secured $6.2 billion in funding this year, a 34% jump from 2024.

Green and Sustainable Tech Adoption Rates

- Green technology investments globally have exceeded $481 billion in 2025, up 18% from last year.

- Solar and wind energy tech startups raised $63 billion, showing high investor confidence in renewables.

- Electric vehicle (EV) adoption hit a new milestone, with 28% of all cars sold globally in 2025 being electric.

- Smart grid infrastructure upgrades reached $42 billion in global investments this year.

- Green data centers now make up 21% of new data center projects, emphasizing carbon neutrality and energy efficiency.

- Corporate net-zero pledges in tech have increased, with 61% of Fortune 500 tech firms setting firm deadlines by 2040 or earlier.

- Circular economy tech solutions grew by 39%, particularly in e-waste recycling and materials reuse.

- Sustainable packaging technologies saw a 24% growth in enterprise adoption, led by e-commerce and logistics sectors.

- Climate-focused AI models are being used by 33% of energy firms to optimize emissions tracking and resource use.

- Green blockchain initiatives are gaining traction, reducing energy consumption by over 65% compared to legacy protocols.

Recent Developments in Technology Growth

- Open-source AI frameworks gained rapid traction in 2025, with usage growing 54% year-over-year.

- Digital ID and biometric authentication are used by 42% of financial institutions, enhancing security and compliance.

- Space tech investment crossed $16.8 billion globally in 2025, driven by satellite internet and private space ventures.

- Voice AI assistants are embedded in 71% of new smart devices, reflecting rising demand for hands-free interfaces.

- Tech giants are partnering with universities, funding $9.2 billion in R&D initiatives in 2025 alone.

- Wearable health technology is a $58 billion industry in 2025, with real-time diagnostics and chronic disease monitoring.

- Decentralized storage platforms like IPFS are used by 19% of Web3 developers, signaling shifts in internet infrastructure.

- Neuromorphic computing prototypes have doubled since 2024, with new commercial use cases emerging in simulation and robotics.

- Low-code and no-code platforms are now used by 47% of enterprise developers, streamlining rapid application deployment.

- Digital therapeutics (DTx) and virtual care platforms are being reimbursed in 32 countries, validating the intersection of tech and healthcare.

Conclusion

From cloud platforms scaling faster than ever to AI reshaping every layer of business, 2025 is a pivotal year in technology’s evolution. What makes this year stand out isn’t just the pace, but the direction. Growth is no longer about gadgets alone. It’s about systems that empower, connect, and regenerate.

Innovation now comes with impact: smarter energy, broader access, sharper tools, and safer networks. Whether you’re a startup founder in San Francisco, a farmer using IoT in South Africa, or a patient accessing AI-enabled care in New York, technology in 2025 is closer, faster, and more relevant than ever.

Let’s continue to monitor the numbers, because the story they’re telling is just getting started.