In 2008, a small startup in Sweden set out to tackle a big problem, how to give people easy access to music without turning to piracy. That company was Spotify. Fast forward to 2025, and Spotify isn’t just a music platform, it’s a cultural cornerstone. Whether you’re discovering indie artists, bingeing true crime podcasts, or revisiting 90s throwbacks, Spotify is woven into the daily rhythm of over half a billion users globally.

This article unpacks the most current Spotify user statistics in 2025. Whether you’re a brand strategist, a tech enthusiast, or simply curious about where streaming is headed, these insights reveal how people are using Spotify, and how Spotify is shaping the way we experience audio.

Editor’s Choice

- Spotify reached 602 million monthly active users (MAUs) in Q1 2025, a 16% increase from Q1 2024.

- As of March 2025, Spotify Premium subscribers number 252 million, up from 210 million in Q1 2024.

- In the U.S., Spotify holds 32% of the digital streaming market, outpacing Apple Music and Amazon Music.

- Nearly 30% of Spotify listeners engage with podcasts regularly, up from 25% last year.

- Spotify has now expanded to over 190 countries, with recent launches in smaller markets like Bhutan and Yemen.

- The average Spotify user listens to 114 minutes of audio per day.

- 44% of Gen Z users say they discover new music primarily through Spotify’s algorithmic playlists.

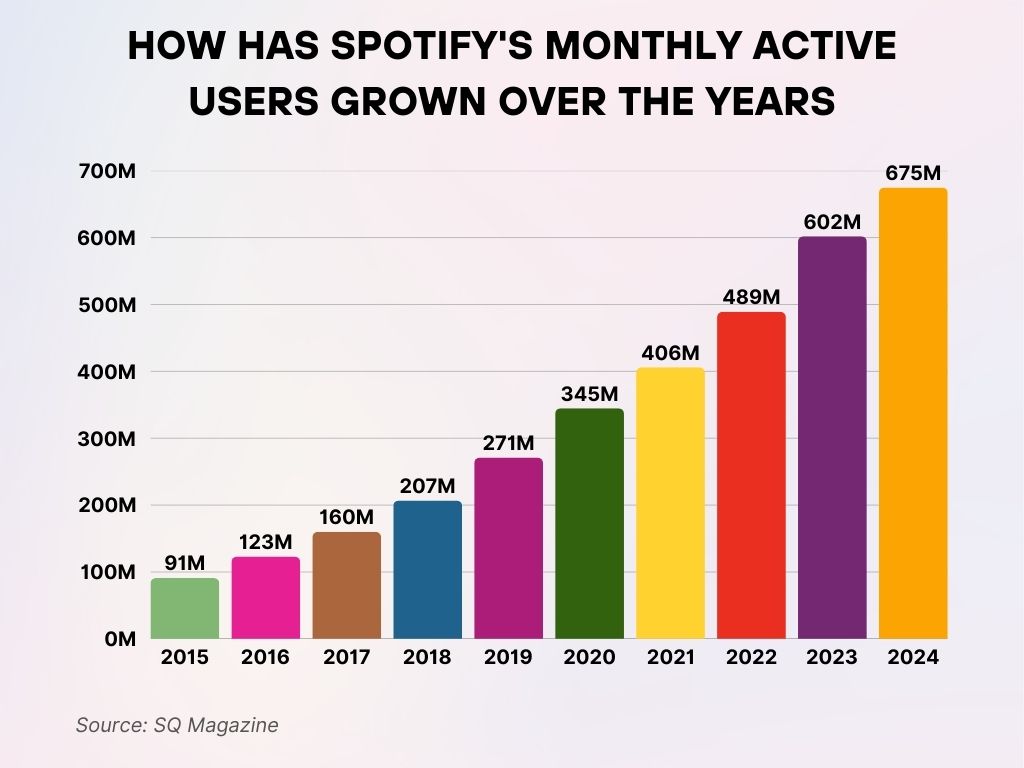

How Has Spotify’s Monthly Active Users Grown Over the Years

- In 2015, Spotify had 91 million monthly active users, marking its early dominance in music streaming. Growth picked up steadily in the following years.

- By 2016, users increased to 123 million, reflecting a 35% growth from the previous year.

- In 2017, Spotify reached 160 million users, showing the platform’s continued global expansion.

- 2018 saw usage jump to 207 million, driven by mobile app adoption and regional launches.

- In 2019, the user base hit 271 million, a 31% increase that highlighted Spotify’s aggressive market presence.

- By 2020, Spotify surged to 345 million monthly active users amid the pandemic’s boost to digital services.

- 2021 brought the number to 406 million, reinforcing Spotify’s position as the leading music streaming platform.

- In 2022, it grew further to 489 million, a gain of 83 million new users in one year.

- 2023 broke past the 600 million mark, with 602 million users globally, a strong signal of platform loyalty and content value.

- As of 2024, Spotify reached 675 million monthly active users, showcasing explosive growth and market resilience.

Total Monthly Active Users (MAUs) on Spotify

- Spotify reported 602 million MAUs in Q1 2025, compared to 515 million in Q1 2024.

- The platform added approximately 87 million new users in the last 12 months.

- Of the 602 million MAUs, 58% are ad-supported (Free tier) while 42% are Premium users.

- India became Spotify’s second-largest market in 2025, contributing to over 84 million MAUs alone.

- Spotify’s MAUs in Latin America reached 76 million in Q1 2025, growing by 12% YoY.

- Spotify’s expansion into Sub-Saharan Africa led to a 22% rise in active users from that region year-over-year.

- In the U.S., Spotify’s monthly active users rose to 102 million, a 9% increase from 2024.

- Asia-Pacific now accounts for more than one-third of all global MAUs.

- In Q1 2025, Spotify’s MAUs grew quarter-over-quarter by 5.1%, signaling healthy user retention.

Spotify Premium Subscribers Overview

- Spotify Premium reached 252 million subscribers in Q1 2025, up from 210 million in Q1 2024.

- In North America, Premium users account for 48% of Spotify’s regional base.

- Europe remains Spotify’s strongest Premium market, with 87 million paid subscribers.

- Family Plans constitute 41% of Premium accounts, according to Spotify’s 2025 internal breakdown.

- Student and Duo Plans together make up 18% of Spotify’s global Premium base.

- In 2025, Spotify’s Premium revenue reached approximately $14.2 billion, a 19% YoY increase.

- Premium churn rates dropped to 3.9% in Q1 2025, down from 4.2% in the same quarter of 2024.

- Over 65% of new Premium subscribers were acquired via promotional offers or bundles with telecom services.

- Japan saw a 30% growth in Premium subscriptions, one of the fastest among developed nations.

- Podcast-exclusive content is cited as a top reason for 17% of new Premium signups in 2025.

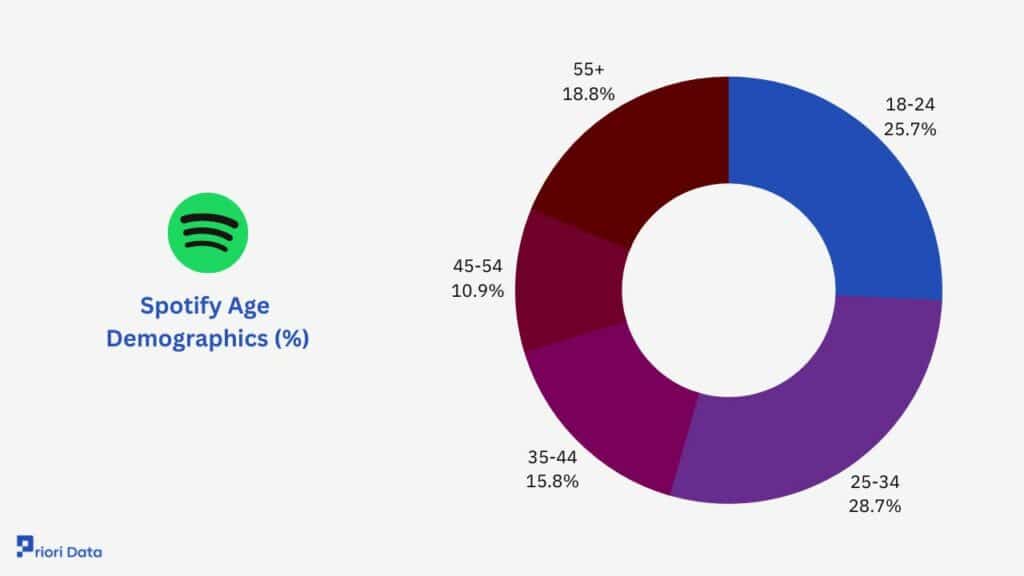

What Are Spotify’s Age Demographics in Percentage

- The 25-34 age group makes up the largest share of Spotify users at 28.7%, reflecting a core millennial audience.

- Users aged 18-24 account for 25.7%, highlighting Spotify’s strong appeal among Gen Z listeners.

- The 55+ demographic comprises 18.8%, showing notable adoption among older users.

- The 35-44 age group represents 15.8%, contributing a significant portion of mid-career listeners.

- Only 10.9% of users fall within the 45-54 age group, making it the smallest demographic segment.

Geographic Distribution of Spotify Users

- As of 2025, Europe contributes 32% of total Spotify users, with over 192 million active accounts.

- North America accounts for 19%, equating to 114 million users, with the U.S. as the top single market.

- Latin America’s share stands at 13%, reflecting strong engagement despite slower economic growth.

- The Asia-Pacific region has surged to 34% of Spotify’s global user base.

- African users represent 2% of the total MAUs, though growth is accelerating due to mobile-first usage.

- In Mexico, Spotify is used by 84% of mobile internet users aged 18–34.

- Indonesia’s user base has grown to over 42 million, reflecting Spotify’s localized marketing efforts.

- Germany remains Europe’s largest Spotify market with 28 million users, surpassing the UK for the first time.

- South Korea joined Spotify’s top 10 markets with 18 million users, driven by K-pop and podcast demand.

- Spotify’s U.S. audience alone streams over 1.9 billion hours of audio per month.

Spotify Usage by Device Type

- 72% of global Spotify sessions occur on smartphones, making mobile the dominant access method.

- Desktop usage accounts for 19%, while smart speakers and wearables make up the remaining 9%.

- Spotify Connect-enabled devices are now used by 24% of Premium users.

- In the U.S., smart speakers like Amazon Echo and Google Nest are used by 16% of all Spotify listeners.

- Desktop usage is highest during work hours, with a spike between 10 a.m. and 3 p.m. on weekdays.

- Tablet usage is declining, with only 4% of sessions globally initiated on tablets.

- Car integrations (via Android Auto and Apple CarPlay) account for 14% of total listening time in 2025.

- Wearable listening (Apple Watch, Fitbit) has grown to 6% of usage among health-conscious users.

- Gaming consoles like PlayStation and Xbox represent 2.5% of global device usage, often for background listening.

- In-home smart TVs account for 7% of Spotify’s session starts, especially during weekends.

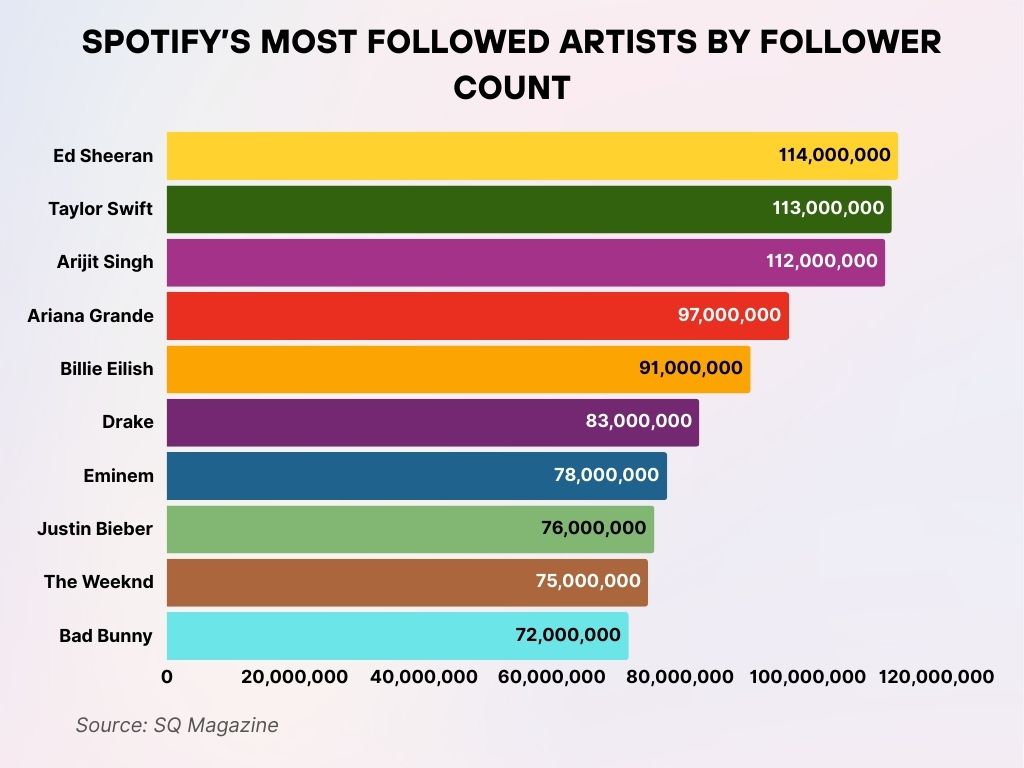

Spotify’s Most Followed Artists by Follower Count

- Ed Sheeran tops the list with approximately 114 million followers, making him the most followed artist on Spotify.

- Taylor Swift follows closely with around 113 million followers, driven by her global fanbase and recent album successes.

- Arijit Singh holds third place with 112 million followers, showcasing the immense popularity of Indian music worldwide.

- Ariana Grande has about 97 million followers, maintaining a strong influence across pop and R&B audiences.

- Billie Eilish attracts nearly 91 million followers, reflecting her appeal among younger listeners and alt-pop fans.

- Drake commands a massive 83 million followers, fueled by his consistent chart presence.

- Eminem has built a loyal base of 78 million followers, sustained by decades of iconic hip-hop releases.

- Justin Bieber remains highly followed with 76 million followers, despite years of competition from newer artists.

- The Weeknd draws in 75 million followers, thanks to his genre-bending style and global hits.

- Bad Bunny rounds out the top ten with 72 million followers, proving the global rise of Latin music.

Average Listening Time per User

- In 2025, the average Spotify user streams 114 minutes per day, up from 101 minutes in 2024.

- Premium users listen 30% longer daily compared to Free users, averaging 142 minutes per day.

- Users who follow more than 10 playlists average 2.1 hours of daily listening.

- Spotify’s “Daily Mix” and “Discover Weekly” account for 29% of listening time among regular users.

- In the U.S., weekday listening peaks at 9 a.m. and 5 p.m., aligning with commuting and work transitions.

- Podcast listeners spend 39% of their total listening time on talk content.

- In-car users listen for an average of 36 minutes per drive session.

- Users with connected home devices stream Spotify for an average of 3.6 hours per weekend day.

- Gen Z users stream the most, averaging 126 minutes per day.

- Listeners in Brazil spend the most time on the platform globally, averaging over 2.4 hours per day.

Growth Trends in Spotify’s User Base

- Spotify’s user base grew by 16% YoY, from 518 million in Q1 2024 to 602 million in Q1 2025.

- Premium subscribers increased by 20%, outpacing growth in the Free tier.

- Spotify added over 25 million users in India alone during the past 12 months.

- The company experienced 11% quarterly user growth in Southeast Asia.

- Spotify’s global monthly download rank rose to #3 among all apps across iOS and Android in Q1 2025.

- Latin America saw an 8% annual growth rate in MAUs, driven by youth adoption and mobile plans with data perks.

- The podcast category is growing fastest, with a 32% increase in monthly active podcast listeners.

- Spotify’s in-app marketing contributed to 12 million user upgrades from Free to Premium in the past year.

- The platform expanded to 8 new countries in the last 12 months, targeting smaller emerging markets.

- Spotify forecasts reaching 660 million MAUs by the end of 2025, based on current trend lines.

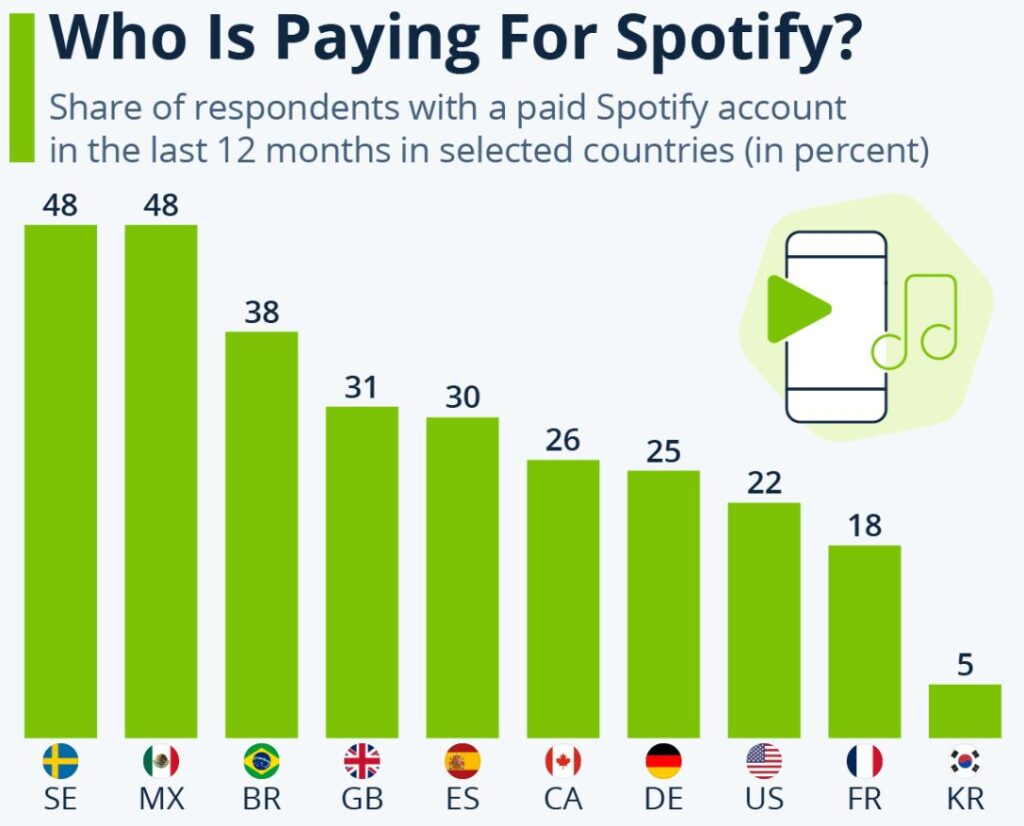

Spotify Premium Usage by Country

- Sweden and Mexico lead Spotify premium adoption, with 48% of respondents in both countries having paid accounts in the past year.

- Brazil follows with 38%, showing strong interest in Spotify’s paid services across Latin America.

- The United Kingdom records 31%, while Spain closely trails at 30% of paid users.

- Canada sees 26% of respondents paying for Spotify, just above Germany at 25%.

- In the United States, only 22% reported paying for a Spotify subscription in the past 12 months.

- France has a smaller premium base at 18%, indicating slower uptake of paid streaming.

- South Korea ranks the lowest, with just 5% of users subscribing to Spotify Premium.

User Engagement Through Personalized Features

- 69% of users interact with at least one personalized playlist each week.

- “Discover Weekly” has a user satisfaction rate of 88%, according to Spotify’s internal surveys.

- Over 55 billion minutes of music were streamed via algorithmically generated playlists in Q1 2025.

- Users who engage with “Daily Mixes” stream twice as long as users who don’t.

- 20% of Premium users created collaborative playlists in the past 30 days.

- Spotify’s AI DJ feature, launched in late 2024, is used by 1 in 6 Premium users weekly.

- Playlist sharing on social platforms increased by 47% year-over-year, driven by TikTok integrations.

- Spotify Wrapped 2024 saw record-breaking engagement, with over 150 million users sharing their data insights.

- Smart shuffle and playlist blend features contributed to a 12% increase in track discovery.

- 43% of users listen to artist-curated or influencer-generated playlists monthly.

Spotify Free vs. Premium User Behavior

- Premium users are 2.3x more likely to complete a full album than Free users.

- Free users skip more than 45% of tracks before the 30-second mark.

- Ads interrupt Free sessions approximately every 3–4 songs, while Premium users have uninterrupted playback.

- Premium users average 6.7 playlists followed, compared to 3.2 playlists for Free users.

- Free-tier users are 3 times more likely to listen to music passively (background listening).

- 2025 data shows Premium users interact with the app 38% more often on a weekly basis.

- Free users engage heavily with Spotify’s top charts and mood-based playlists like “Chill Vibes” or “Workout Hits.”

- The conversion rate from Free to Premium rose to 5.4% per quarter, a significant bump from 3.9% in 2023.

- Premium users are 4x more likely to share Spotify content on social platforms.

- Spotify observed that Free users in the U.S. aged 18–24 were the fastest-growing ad-listening demographic.

Spotify Paid Subscriber Growth Over the Years

- In 2019, Spotify had 124 million paid subscribers, laying the foundation for its premium model success.

- By 2020, the number rose to 155 million, reflecting a 25% year-over-year increase.

- 2021 continued the upward trend with 180 million subscribers, driven by global expansion and exclusive content deals.

- In 2022, paid users climbed to 205 million, marking a strong 13.9% growth from the previous year.

- The platform reached 236 million premium subscribers in 2023, showing robust demand for ad-free listening.

- As of 2024, Spotify boasts 239 million paid subscribers, maintaining its lead despite slowing growth.

Spotify’s Market Share Compared to Other Streaming Platforms

- Spotify holds a 31% global market share in music streaming as of Q1 2025.

- Apple Music ranks second with a 15% market share, showing slower growth in emerging markets.

- Amazon Music captures 13%, driven by integration with Alexa-enabled devices.

- YouTube Music follows with 11%, popular among Gen Z due to video-based content.

- Tidal and Deezer together hold under 4% combined, primarily focused on niche audiophile and regional markets.

- Pandora, once a leader in the U.S., now holds less than 2% of the market.

- In the U.S., Spotify commands 32% of market share, leading comfortably ahead of Apple Music (23%).

- In Europe, Spotify holds over 40% of the streaming market, making it the dominant platform by a large margin.

- In Brazil, Spotify leads with 55% market share, nearly triple that of its closest competitor.

- Global revenue share matches usage trends, with Spotify generating 44% of paid streaming revenue industry-wide in 2024.

Mobile vs Desktop Usage Patterns

- 72% of Spotify sessions globally are initiated on mobile devices.

- Desktop users account for 19% of sessions, mostly during weekday work hours.

- Mobile engagement peaks on weekdays at 8 a.m. and 6 p.m., while desktop use peaks between 10 a.m. and 2 p.m..

- Premium users are more likely to use desktop apps, accounting for 26% of all desktop activity.

- In the U.S., 89% of Gen Z users stream Spotify exclusively on mobile devices.

- Users in rural areas rely on desktop/web versions more often due to limited mobile data availability.

- Smart TVs and connected devices account for 6% of Spotify access, especially during evenings and weekends.

- Android devices account for 58% of global mobile streams, with iOS covering the remaining 42%.

- Wearable device usage is rising in fitness contexts, contributing to 3.5% of all mobile Spotify usage.

- Mobile users also tend to skip songs 28% more frequently than desktop listeners.

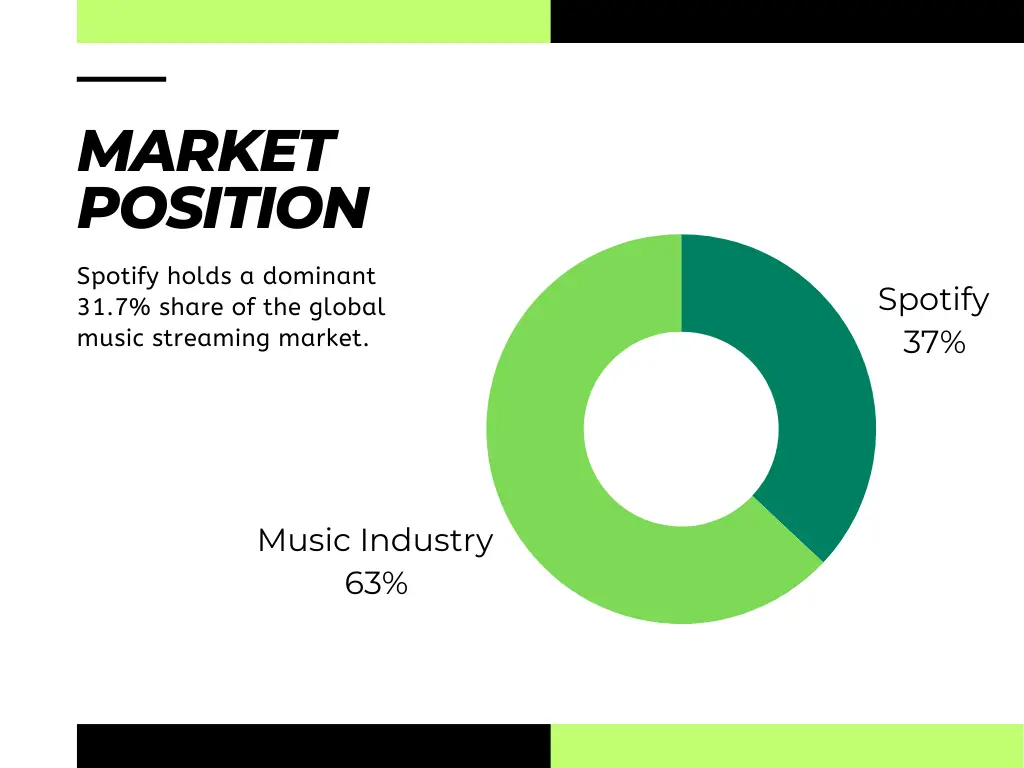

Spotify’s Market Position in Global Music Streaming

- Spotify commands 37% of the global music streaming market, securing its spot as the undisputed leader in the space.

- The rest of the music industry accounts for the remaining 63%, divided among various competing platforms.

- A supporting note on the graphic also mentions a 31.7% share, suggesting different methodologies or reporting periods.

Impact of Podcasts on User Growth

- Spotify now hosts over 6 million podcasts, up from 5 million in 2024.

- As of Q1 2025, 33% of Spotify users globally engage with podcast content monthly.

- In the U.S., 42% of Spotify listeners use the platform primarily for podcasts over music.

- Spotify’s exclusive podcasts, like Call Her Daddy and The Joe Rogan Experience, account for 18% of total podcast streams.

- Podcast listeners spend an average of 34 minutes per session, longer than music-only users.

- Spotify’s podcast audience has grown by 29% year-over-year, outpacing Apple Podcasts’ 18% growth.

- Among Premium subscribers, 25% say podcast content was a key reason for upgrading.

- In Q1 2025, Spotify’s podcast ad revenue reached $423 million, marking a 22% increase YoY.

- Gen Z listeners are twice as likely to listen to educational and self-help podcasts on Spotify.

- Spotify’s podcast user retention is 19% higher than for music-only users.

Retention and Churn Rates Among Spotify Users

- Spotify’s global user retention rate is 77% in 2025, a 3% improvement from 2024.

- Premium users have a higher retention rate of 84%, with most churn occurring within the first 90 days.

- The overall monthly churn rate for Free users stands at 7.6%, down from 9.1% in 2023.

- Spotify’s average lifetime value (LTV) for a Premium subscriber is now $186, up from $159 last year.

- Re-engagement campaigns led to 2.8 million users returning to the platform after 30+ days of inactivity.

- Users who create personal playlists have a 34% higher retention rate than those who don’t.

- Music + podcast users show 1.7x higher retention than music-only users.

- The introduction of AI-powered music summaries helped reduce churn by 5.1% among Gen Z users.

- Spotify’s Premium retention is strongest in Europe, especially in Germany and the UK, at 88%.

- Among mobile-only users, retention averages 74%, slightly below multi-device users at 79%.

Recent Developments in Spotify User Metrics

- In early 2025, Spotify introduced AI DJ enhancements with voice cloning and dynamic playlist mood shifts.

- The “Spotify Jam” feature now supports real-time group sessions for up to 20 people globally.

- Spotify launched “Daily Vibes,” a mood-based playlist with personalized intros and contextual voice drops.

- The company added regional insights dashboards for artists, helping boost creator engagement and listener targeting.

- Spotify announced that over 50 million Blend sessions were created in Q1 2025 alone.

- New in-app stats allow users to view personal stream history up to 5 years back, increasing engagement.

- The Kids and Family category grew by 31%, with educational and bedtime playlists leading in play counts.

- Spotify introduced Carbon Neutral Listening Mode, allowing users to offset streaming emissions for $0.10/month.

- The rollout of AI-assisted playlist naming and cover design features led to a 22% spike in playlist saves.

- Spotify introduced “Soundscape Mode” for smart speakers, streaming ambient sounds, nature, and white noise, gaining traction among wellness-focused users.

Conclusion

Spotify continues to redefine audio consumption in 2025. With a user base now exceeding 600 million, rapid growth in podcast engagement, and an expanding suite of personalized tools, it remains the leader in global music streaming. Its dominance is especially clear in the under-35 demographic, mobile-first markets, and among creators who now rely on Spotify’s tools for distribution and analytics. Whether through AI-generated playlists, mood-based listening, or smarter podcast discovery, Spotify isn’t just keeping up with user habits, it’s shaping them.

As the platform integrates deeper personalization and explores new content formats, it’s well-positioned to drive the future of how we listen.