In 2007, a small audio-sharing platform launched in Berlin with a mission to democratize music publishing. Fast-forward to 2025, and SoundCloud is now a global powerhouse in music streaming, discovery, and creator empowerment. What began as a niche tool for indie artists is now a platform that hosts millions of creators and listeners from every corner of the world.

Today, SoundCloud is not just about streaming; it’s a social experience. From music producers dropping fresh beats to bedroom DJs curating global fanbases, the platform offers a layered picture of how modern music is made, shared, and monetized. The stats below tell that story.

Editor’s Choice

- SoundCloud now reaches 180 million total users globally in 2025, with over 40 million creators actively sharing content.

- The platform hosts more than 375 million tracks, making it the largest music catalog in the world.

- US-based listeners make up 28% of monthly users, representing the platform’s largest geographic market.

- Rap & Hip-Hop remains the most-streamed genre in 2025, followed closely by EDM and Pop.

- In 2025, SoundCloud generated approximately $485 million in revenue, marking a 12% YoY growth.

- Over 14 million tracks are uploaded each month to SoundCloud as of 2025.

- 52% of all listening now takes place on mobile devices, with app usage showing stronger growth than desktop.

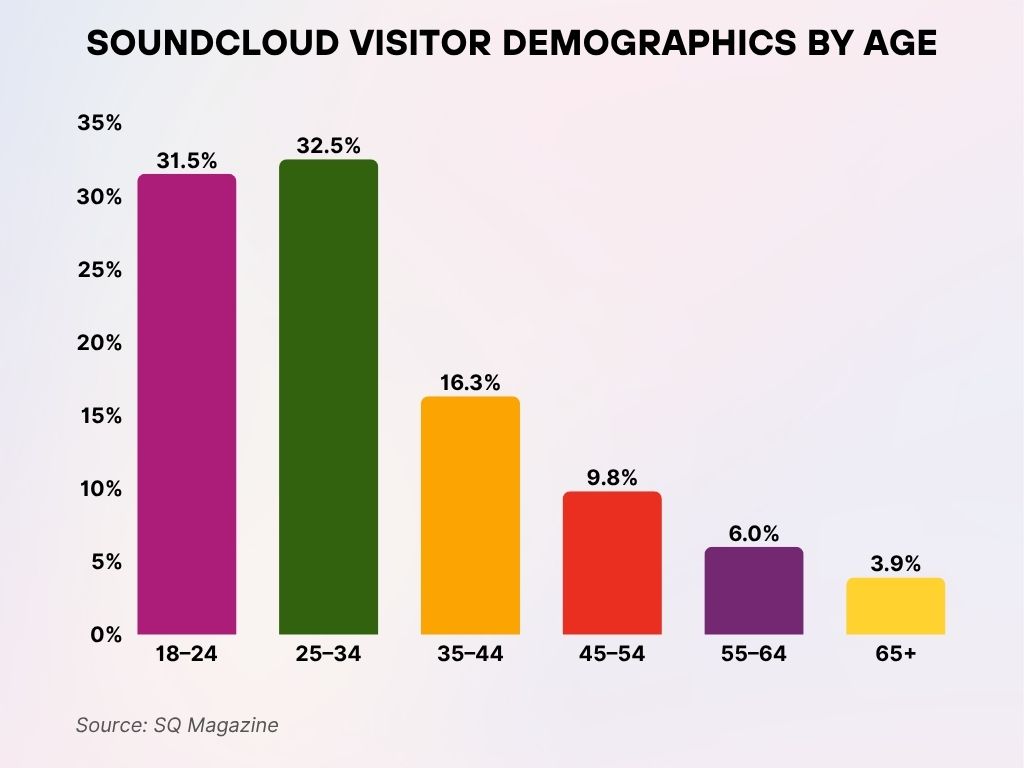

SoundCloud Visitor Demographics by Age

- The largest share of SoundCloud users is aged 25–34 years, making up 32.5% of the total audience.

- Close behind, 18–24 year olds represent 31.5%, highlighting SoundCloud’s strong appeal to younger listeners.

- 16.3% of users fall within the 35–44 age group, showing moderate engagement among older millennials.

- The 45–54 age group accounts for 9.8% of visitors, indicating a smaller but active user base.

- 6% of SoundCloud’s audience is aged 55–64 years, reflecting limited usage among older adults.

- Only 3.9% of users are 65 years and older, suggesting minimal engagement from senior listeners.

Total Number of Active Users on SoundCloud

- As of Q2 2025, SoundCloud boasts 180 million global users, with roughly 76 million being monthly active listeners.

- There are more than 40 million active creators uploading and interacting with content on the platform.

- The user base has grown by 8.4% year-over-year from 2024 to 2025, reflecting strong momentum across mobile and emerging markets.

- 13% of all SoundCloud users engage with the platform daily.

- Premium accounts now account for 18 million users, with creators increasingly opting for monetization tools.

- SoundCloud saw over 9 billion plays in the first half of 2025, driven by viral tracks and international collaborations.

- 25% of all users fall into the 18–24 age bracket, reinforcing its status as a Gen Z-favorite platform.

- In 2025, the average session duration increased to 35 minutes.

Monthly Active Listener Trends

- SoundCloud’s monthly active listeners reached 76 million in 2025.

- On average, users stream 51 minutes of content per session monthly, indicating strong retention.

- The number of paid subscribers grew to 18 million in 2025, up from 15.9 million last year.

- Listener growth in Southeast Asia rose by 13.2%, led by Indonesia, the Philippines, and Vietnam.

- 43% of listeners engage with at least one playlist or reposted track weekly.

- Mobile usage accounts for 72% of all monthly activity, with Android slightly leading over iOS.

- Listener engagement is highest on Fridays and Saturdays, with a 21% spike in listening hours.

- Over 22 million monthly listeners use SoundCloud’s “Discover” tab at least once per week.

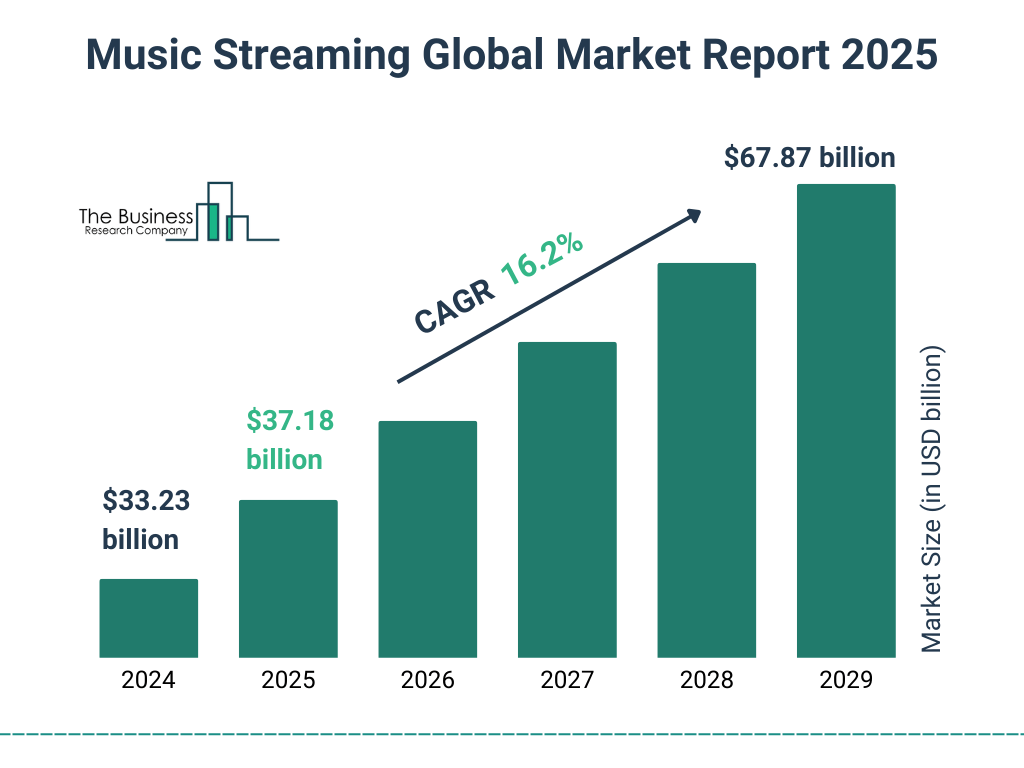

Global Music Streaming Market Growth Forecast

- The global music streaming market is projected to grow to $67.87 billion by 2029.

- In 2025, the market size is expected to reach $37.18 billion, reflecting steady year-over-year expansion.

- The market is forecasted to grow at a CAGR of 16.2%, driven by increasing smartphone usage and digital media consumption.

- By 2026, the market will surpass the $40 billion mark, continuing its upward trajectory.

The industry is set to nearly double in size within five years, showing robust global demand and digital adoption.

Top Music Genres on SoundCloud

- Hip-Hop/Rap holds the lead as the most streamed genre in 2025, accounting for 32% of all plays.

- EDM follows closely, comprising 21% of total streams, driven by rising global festival culture.

- Pop music represents 17% of all SoundCloud streams globally in 2025.

- The Afrobeats genre has grown by 48% YoY, with a strong foothold in both African and Western markets.

- Lo-fi and Chillhop continue to gain traction among students and remote worker demographics, now making up 6.5% of streams.

- Latin music, especially Reggaeton, expanded its reach with a 22% listener growth over the past year.

- K-pop listeners rose by 19%, led by fan-generated remixes and unreleased demos.

- Niche subgenres like Dark Trap, Synthwave, and Hyperpop now cumulatively account for 4.3% of total plays.

- The genre diversity has increased with over 2,300 unique genre tags used in uploads in the first half of 2025.

Number of Tracks Uploaded to SoundCloud

- By mid-2025, SoundCloud hosts over 375 million tracks, making it the largest music catalog in the industry.

- 14 million new tracks are uploaded every month, reflecting strong creator activity.

- Daily uploads average around 460,000, with peaks occurring midweek.

- Indie artists and unsigned musicians contribute to more than 71% of all new uploads.

- 51% of all uploaded tracks are original compositions; the rest include remixes, podcasts, and DJ sets.

- Since January 2025, uploads in spoken-word and podcast content have grown by 11%.

- The platform receives over 89,000 uploads from first-time creators every week.

- In 2025, collaborative uploads (with multiple artists tagged) have increased by 22% YoY.

- About 40% of tracks uploaded this year are under 2 minutes, reflecting a shift toward shorter content formats.

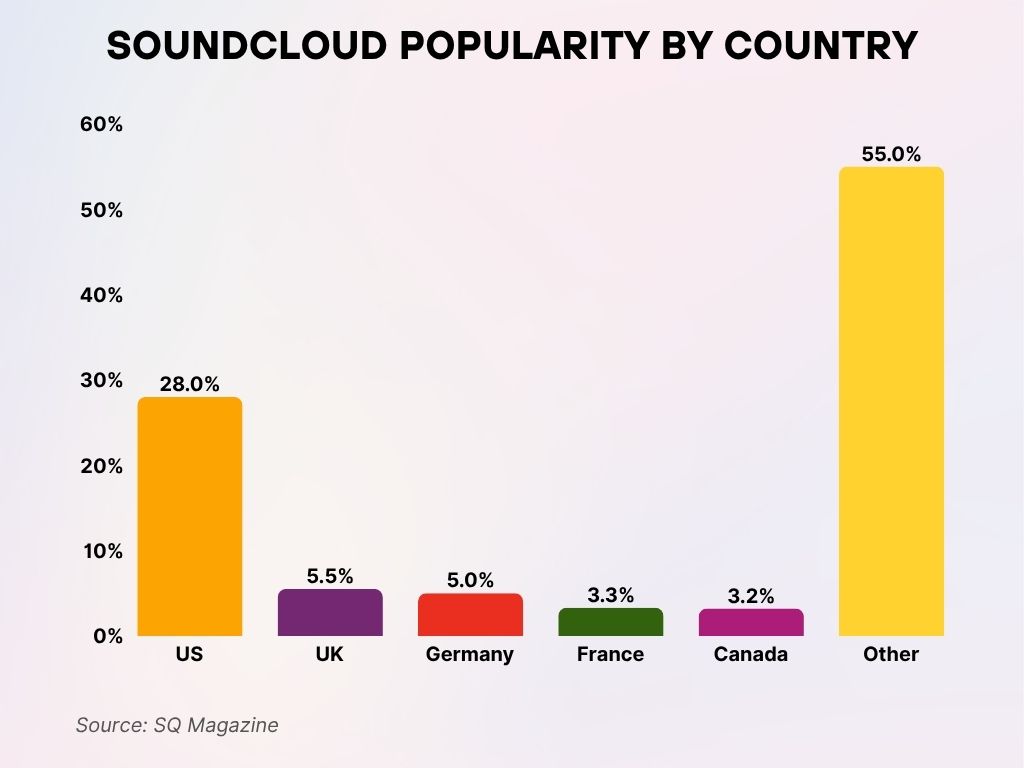

SoundCloud Popularity by Country

- The United States leads with 28% of SoundCloud’s total user base, making it the platform’s largest market.

- The United Kingdom contributes 5.5%, reflecting strong engagement in English-speaking Europe.

- Germany follows closely at 5%, highlighting a solid listener base in Central Europe.

- France accounts for 3.3% of users, showing moderate popularity among French listeners.

- Canada holds a 3.2% share, reinforcing North America’s dominant role in the platform’s reach.

- A combined 55% of SoundCloud’s traffic comes from other countries, showcasing its broad global presence.

SoundCloud Revenue and Monetization

- SoundCloud’s revenue in 2025 reached approximately $485 million, a 12% increase from the previous year.

- Monetization from creator tools and subscription accounts for 58% of total revenue.

- Advertising generated $126 million in 2025, with audio ads now outperforming visual ads in engagement.

- Revenue from SoundCloud Pro plans rose to $97 million, a 9% YoY growth.

- The average revenue per user (ARPU) is now at $6.31.

- Over 340,000 creators earned money via SoundCloud’s fan-powered royalty model in 2025.

- The Top 5% of monetizing artists on SoundCloud earned a combined $110 million this year.

- Revenue from API and developer tools (such as track embedding and streaming access) saw 17% growth.

- SoundCloud for Artists (formerly Repost) expanded into six new territories for distribution monetization.

Mobile vs Desktop Usage

- In 2025, 72% of all SoundCloud sessions occur on mobile devices, led by Android users at 39%.

- Desktop usage accounts for 23%, while smart speaker and web player integrations make up the rest.

- The SoundCloud mobile app now has 112 million downloads, with a 4.6-star average on Google Play.

- Session length on mobile is slightly higher than desktop, 35 minutes vs 32 minutes.

- SoundCloud’s mobile uploads increased by 28% YoY, due to improved creator studio features.

- The mobile app’s Discover tab drives 60% of new track engagement.

- iOS users engage with playlists 18% more than Android users on average.

- Push notifications deliver a 24% higher click-through rate on mobile compared to email alerts on desktop.

- In 2025, mobile is also the preferred channel for in-app purchases and subscription upgrades.

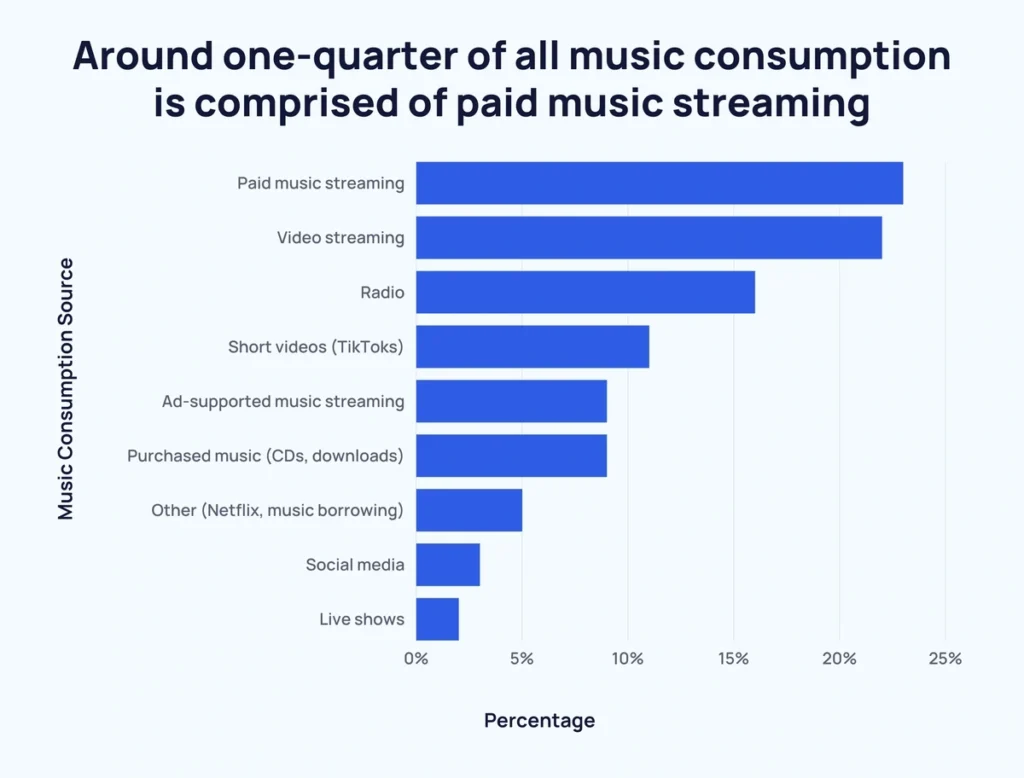

Music Consumption Breakdown by Source

- Paid music streaming accounts for the largest share, making up around 25% of all music consumption.

- Video streaming platforms follow closely, contributing just under 25% of total music engagement.

- Radio remains a key source, capturing about 15% of listener activity.

- Short videos (TikTok) generate roughly 10%, showing the influence of social-driven music discovery.

- Ad-supported music streaming and purchased music (CDs, downloads) each make up nearly 9–10% of usage.

- Other sources like Netflix and music borrowing account for under 8%, while social media and live shows contribute the least, each below 5%.

SoundCloud Pro and Subscription Usage

- As of 2025, 18 million users subscribe to SoundCloud Go+, SoundCloud Pro, or Pro Unlimited tiers.

- Pro Unlimited remains the most popular plan, chosen by 62% of paying creators.

- Monthly subscription prices remain at $4.99 for Go, $9.99 for Go+, and $16 for Pro Unlimited.

- SoundCloud for Artists now supports payout integration with PayPal, Stripe, and local bank transfers in 42 countries.

- 78% of creators on Pro plans use analytics tools monthly to guide their upload and promotion strategies.

- Subscription revenue contributes 40% of the platform’s overall revenue in 2025.

- In 2025, creators on Pro plans received prioritized algorithm visibility, boosting exposure by 23%.

- 47% of new creators who sign up for Pro plans retain their subscription for at least 12 months.

- Free-tier users still account for the largest share of uploads but generate only 7% of overall engagement.

Advertising Reach and Audience Insights

- In 2025, SoundCloud’s advertising network reached an estimated 110 million monthly users globally.

- Audio ads generate an average CTR of 2.8%, outperforming display ads by nearly double.

- The average CPM (cost per 1,000 impressions) on SoundCloud in 2025 is $8.75, making it cost-effective compared to Spotify’s $10.90.

- 70% of advertisers use SoundCloud’s geotargeting tools, with top markets being the US, UK, Germany, and Canada.

- Branded playlists and artist sponsorships drove over 420 million impressions in the first half of the year.

- 35% of Gen Z listeners report discovering new products via SoundCloud ads in 2025.

- Podcast ads saw a 14% YoY growth in engagement, particularly in tech, music, and health categories.

- Advertisers targeting mobile users saw 28% higher engagement than desktop-only campaigns.

- SoundCloud introduced AI-generated ad spots in 2025, reducing production costs by up to 40% for small businesses.

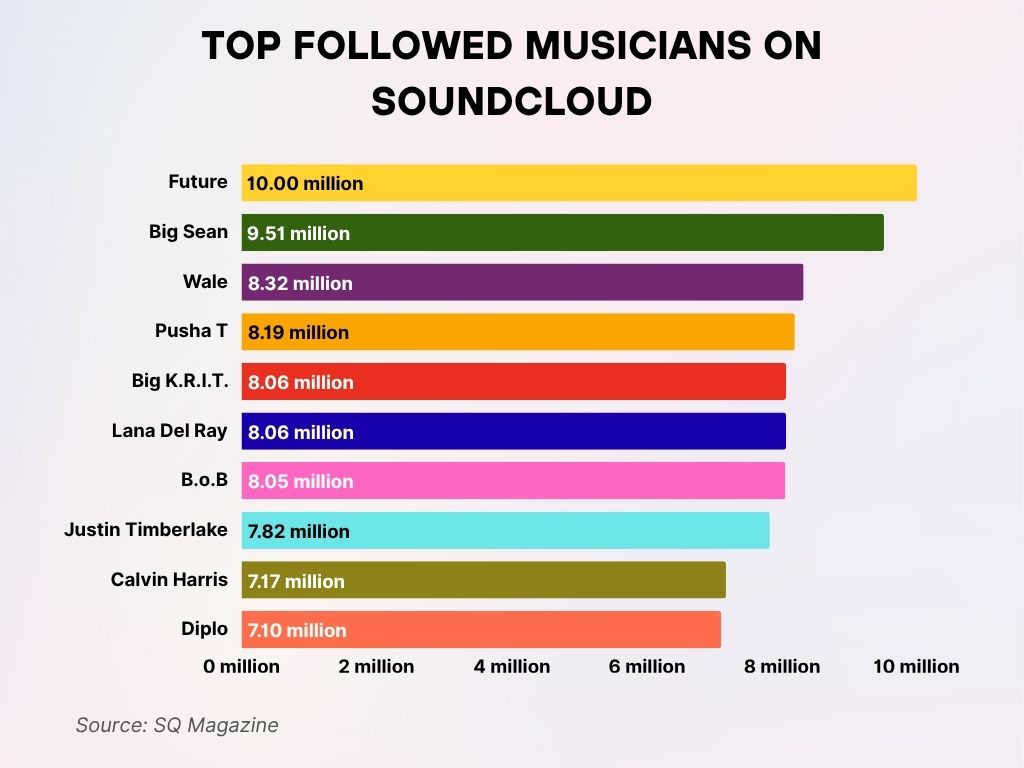

Top Followed Musicians on SoundCloud

- Future tops the list with 10 million followers, making him the most followed artist on SoundCloud.

- Big Sean holds second place with 9.51 million followers, showcasing strong fan engagement.

- Wale has built a solid following of 8.32 million, placing him in the top three.

- Pusha T closely follows with 8.19 million followers, reflecting his continued popularity.

- Both Big K.R.I.T. and Lana Del Ray are tied with 8.06 million followers each.

- B.o.B is just behind with 8.05 million, nearly matching his closest competitors.

- Justin Timberlake enjoys a follower count of 7.82 million, reinforcing his legacy appeal.

- Calvin Harris has 7.17 million followers, supported by his global EDM fanbase.

- Diplo rounds out the top ten with 7.10 million, maintaining his long-standing digital presence.

SoundCloud’s Role in Music Discovery

- 69% of users in 2025 say SoundCloud is their primary platform for discovering new music and artists.

- The “Discover” tab and algorithmic suggestions drive over 1.2 billion discovery-based streams per month.

- SoundCloud Radio, introduced in late 2024, now serves over 16 million unique listeners per month.

- Independent musicians report that SoundCloud is their top source for building initial fan bases, ahead of YouTube and TikTok.

- SoundCloud Premier creators saw a 23% higher discovery rate when using in-platform promotion tools.

- The “Fans Also Like” feature is responsible for 18% of all cross-genre artist discoveries in 2025.

- A/B testing tools released in early 2025 allow creators to optimize track intros, leading to 7.5% more saves per track.

- 45% of users follow at least one new artist every week, highlighting SoundCloud’s community-led discovery engine.

- DJ sets remain a major discovery tool, with over 58,000 new mixes uploaded weekly and linked to original tracks.

Comparison with Competing Music Streaming Platforms

- SoundCloud has 180 million total users, surpassing TIDAL and Deezer, but trailing behind Spotify (656 million) and Apple Music (105 million).

- Its 375 million track catalog is over 3x larger than Spotify’s 100 million, giving it the broadest audio library.

- Unlike Spotify and Apple Music, over 70% of uploads on SoundCloud are from independent creators.

- The average time spent per session on SoundCloud is 35 minutes, compared to 31 minutes on Spotify.

- SoundCloud remains the only major platform offering fan-powered royalties, giving artists earnings based on listener loyalty.

- Pro and Pro Unlimited tiers allow artists to directly monetize, whereas other platforms typically require label intermediaries.

- In 2025, SoundCloud had the highest creator-to-listener ratio, with 1 creator per 4.5 users, vs. Spotify’s 1 per 9.

- Social engagement is stronger: SoundCloud averages 2.4 comments per track, while Apple Music offers none.

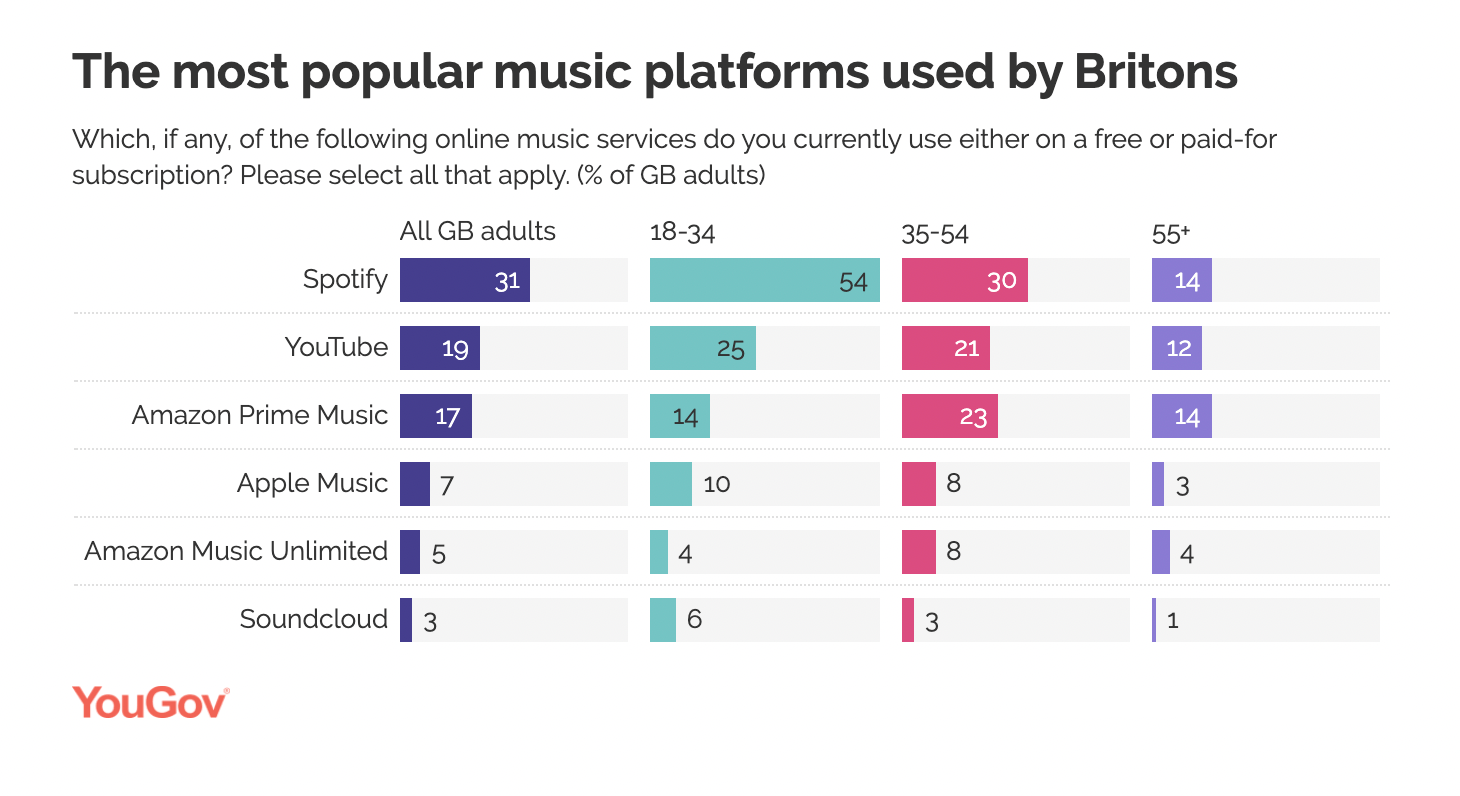

Most Popular Music Platforms Among Britons

- Spotify is the top platform, used by 31% of all GB adults, peaking at 54% among those aged 18–34.

- YouTube ranks second with 19% overall usage, and is most popular among 18–34 year olds (25%).

- Amazon Prime Music sees 17% total usage, highest among the 35–54 age group (23%).

- Apple Music is used by 7% of all adults, led by 10% in the 18–34 group.

- Amazon Music Unlimited has a modest 5% usage overall, with 8% among 35–54 year olds.

- SoundCloud is the least used, with just 3% overall, and only 1% usage among those 55+.

Recent Developments and Platform Updates

- In February 2025, SoundCloud launched a real-time mastering assistant powered by AI that allows creators to preview audio quality on different devices.

- The new “Artist Hub” dashboard provides heatmaps of listener engagement, track skips, and geo-listener breakdowns.

- SoundCloud Charts were revamped to include engagement score, not just play counts, making charting more reflective of listener retention.

- A partnership with Audius introduced limited blockchain-based track ownership features.

- The Royalty Insights Report now breaks down per-fan earnings, boosting transparency for creators.

- Native integration with FL Studio and Ableton Live allows seamless one-click uploads from DAWs as of Q1 2025.

- Creator Tiers now offer custom branding, press kits, and advanced metadata control to high-performing accounts.

- SoundCloud added native podcast monetization tools, allowing podcasters to insert mid-roll ads and track retention metrics.

- A mobile-only feature, “QuickDrop,” lets artists share demos to private fans in under 10 seconds.

- The platform is expanding its Latin America operations, with new offices in São Paulo and Mexico City in 2025.

Conclusion

In 2025, SoundCloud continues to bridge the gap between creators and listeners with a deep focus on empowerment, discovery, and independence. Its unmatched track volume, artist-first monetization model, and socially driven engagement tools make it more than just a streaming service; it’s a creative ecosystem. Whether you’re an aspiring beatmaker or a die-hard music hunter, the platform remains one of the most dynamic spaces in the modern music landscape.