WHAT WE HAVE ON THIS PAGE

- Editor’s Choice

- Spotify Podcast Monthly Listeners by Country

- Spotify Users

- Monthly Active Users (MAUs) vs. Premium Subscribers

- Age Breakdown of Spotify Podcast Users

- Users & Audience

- Geographic Distribution of Spotify Users

- Global Record Industry: YoY Revenue Growth/Decline

- Spotify Financials

- Spotify Revenue

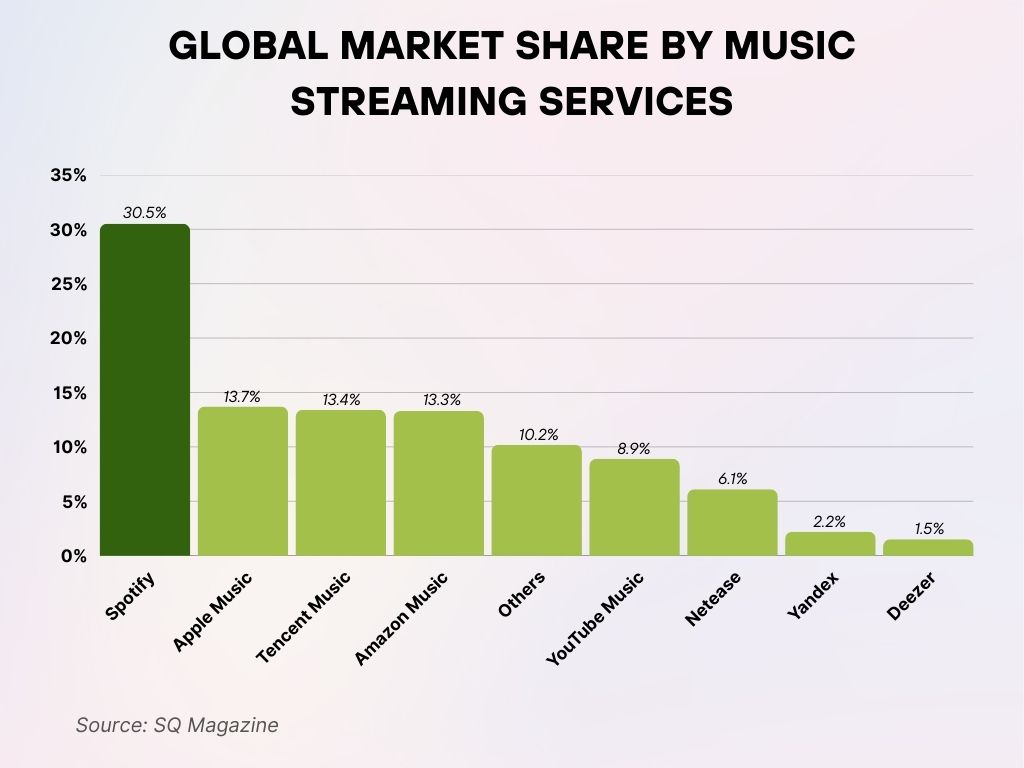

- Global Market Share by Music Streaming Services

- Most Streamed Songs and Artists in 2025

- Top Spotify Artists In Your Spotify Stats

- Key Spotify Statistics

- Top Spotify Songs In Your Listening Stats

- Spotify Top Genres For You

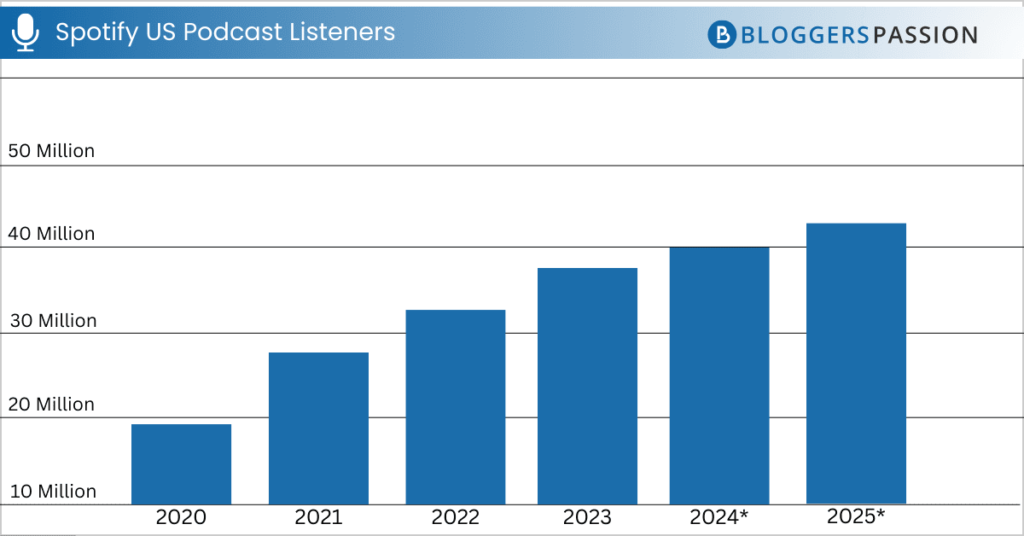

- Spotify US Podcast Listener Growth (2020–2025)

- Spotify Timeline & History

- Spotify vs. Other Music Streaming Platforms

- Artist Earnings and Royalty Distribution

- Spotify’s Role in the Podcasting Industry

- Advertising Revenue and Spotify Ad Platform Performance

- Spotify App Engagement and User Behavior

- Trends in Playlist Popularity and Curation

- Impact of AI and Personalization on Spotify Recommendations

- Recent Developments

- Conclusion

- Sources

It started with a pair of headphones and a curiosity—what’s this song playing? In coffee shops, dorm rooms, and crowded subway rides, Spotify quietly transformed how we consume music. Over the years, it’s become more than just a streaming app. It’s a personal DJ, a data mirror of our moods, and a platform that defines our digital soundtracks.

In 2025, Spotify isn’t just growing—it’s reshaping how the world interacts with music, podcasts, and creators. Let’s explore the platform’s latest data and understand the massive scale behind the sounds in our ears.

Editor’s Choice

- Spotify surpassed 615 million total users globally in early 2025, up from 574 million at the end of 2024.

- The platform now has 239 million premium subscribers, reflecting a 13% year-over-year increase.

- In the U.S. alone, Spotify maintains a 32% market share, leading over competitors like Apple Music and Amazon Music.

- Spotify is now available in 184 countries, expanding rapidly in regions like Africa and Southeast Asia.

- The number of podcasts on Spotify has exceeded 5 million, up from 4.4 million in 2024.

- Spotify Wrapped 2024 had more than 200 million participants, an all-time high for the personalized campaign.

- Spotify’s AI DJ feature usage jumped by 48%, signaling rising user interest in personalized listening experiences.

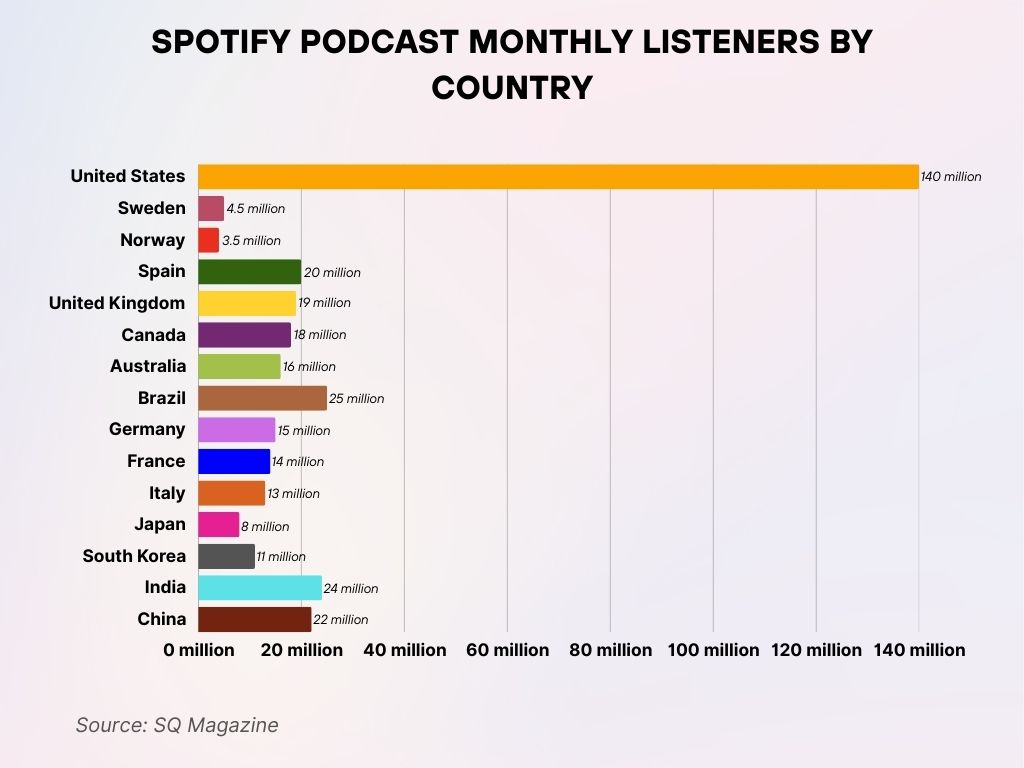

Spotify Podcast Monthly Listeners by Country

- The United States leads by a massive margin, with 140 million monthly podcast listeners on Spotify.

- India ranks second with 24 million listeners, showing strong growth in the audio content space.

- Brazil follows closely with 25 million monthly listeners.

- China has a significant audience, with 22 million Spotify podcast listeners.

- Spain reports 20 million listeners monthly, making it one of the top European markets.

- The United Kingdom and Canada come in next with 19 million and 18 million listeners, respectively.

- Australia contributes 16 million monthly listeners despite its smaller population.

- Germany and France both report around 15 million and 14 million listeners, respectively.

- Italy has 13 million monthly listeners, indicating steady podcast adoption.

- South Korea reports 11 million listeners per month, ahead of Japan‘s 8 million.

- Sweden, Spotify’s home country, shows 4.5 million monthly podcast listeners.

- Norway rounds out the list with 3.5 million monthly listeners.

Spotify Users

- As of Q1 2025, Spotify reported 615 million total users, up from 574 million in Q4 2024.

- Spotify added approximately 41 million users in just the last quarter.

- Premium subscribers now total 239 million, growing steadily from 210 million in Q1 2024.

- Over 100 million users access Spotify via Android devices, while 35% use iOS.

- Desktop users now account for 9% of Spotify’s traffic, with mobile remaining dominant.

- Spotify Family and Duo plans account for 41% of all premium subscriptions.

- Gen Z (aged 18–24) represents 38% of Spotify’s global user base.

- 51% of U.S. Spotify users are female, reflecting a shift toward gender-balanced engagement.

- Spotify recorded over 33 billion listening hours in Q1 of 2025 alone.

- Spotify usage peaks between 4 p.m. and 7 p.m., with Fridays seeing the highest engagement.

- MAUs (Monthly Active Users) reached 615 million, a 7.1% quarterly increase.

- Premium subscribers reached 239 million, a 13.8% year-over-year jump.

- 61% of users are free-tier, supported by Spotify’s ad-driven model.

- India now hosts 46 million active users, with a majority still on the free tier.

- The average revenue per premium user (ARPU) is $4.58, slightly down from $4.62 in 2024 due to regional pricing strategies.

- The premium plan churn rate was reduced to 1.3%, the lowest since 2020.

- Spotify HiFi, introduced in late 2024, has a 6% adoption rate among premium subscribers.

- Over 40 million users upgraded to premium in the past year, driven by features like offline listening and ad-free access.

- Spotify Student Premium saw a 19% rise in subscription rate in university towns across the U.S.

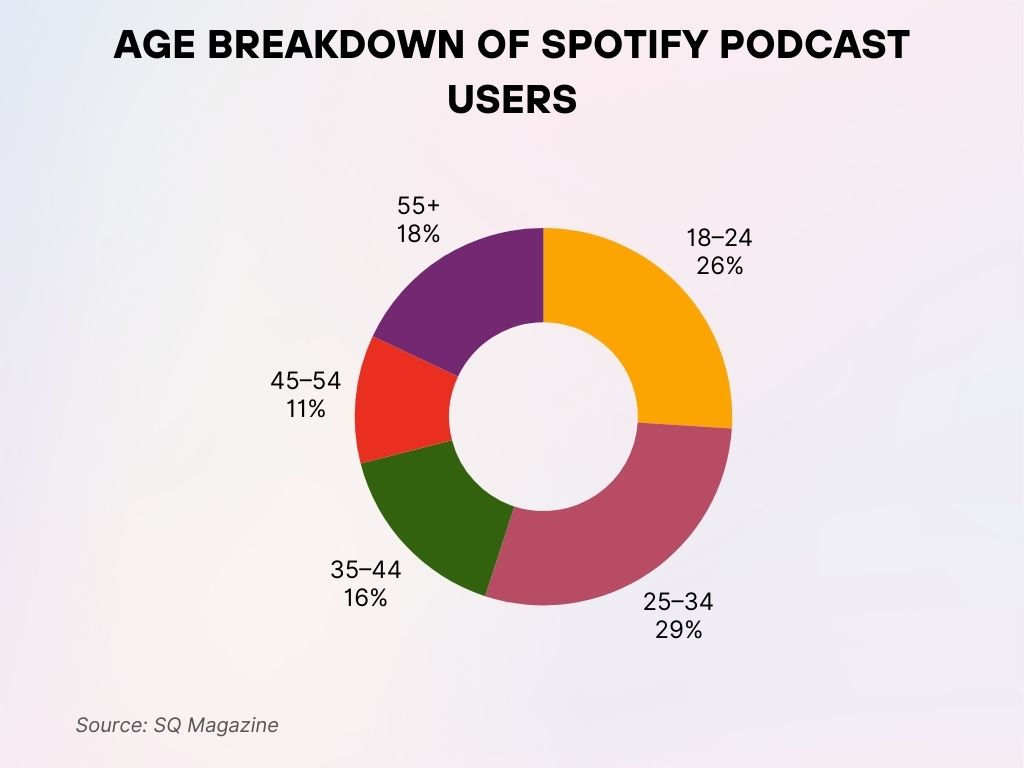

Age Breakdown of Spotify Podcast Users

- The smallest segment is the 45–54 age group, comprising only 11% of the user base.

- The largest user segment is aged 25–34, making up 29% of all Spotify podcast listeners.

- The 18–24 age group follows closely, contributing 26% to the platform’s podcast audience.

- Users aged 55 and above account for 19%, showing strong engagement from older demographics.

- The 35–44 age range makes up 16% of podcast listeners.

Users & Audience

- In 2025, 47% of Spotify’s audience is under the age of 35.

- Millennials (25–34) make up 29% of the global user base.

- Over 62% of Gen Z users listen to music daily through Spotify.

- In the U.S., 68% of Spotify users identify music as their top use case, while 22% prefer podcasts.

- The average time spent on Spotify per day is 102 minutes globally.

- The most engaged audience is in Mexico, where the average daily listening time exceeds 120 minutes.

- Spotify Kids, a sub-platform for children, grew by 12% year-over-year in active users.

- U.S. Latino listeners on Spotify grew by 15%, driven by regional content and curated playlists.

- Spotify’s wellness and ambient categories are up 34% in listener engagement.

- 72% of Spotify users report that algorithmic recommendations influence their playlist choices.

Geographic Distribution of Spotify Users

- Europe remains Spotify’s largest market, with 32% of total users.

- North America follows closely with 25%, led by strong U.S. adoption.

- Latin America makes up 19%, showing rapid year-over-year growth.

- Asia-Pacific now accounts for 17%, with growth strongest in India, Indonesia, and the Philippines.

- Spotify launched in 6 new countries in 2024, bringing the total to 184.

- Nigeria and Kenya saw user growth of over 40%, showing Spotify’s commitment to emerging markets.

- Japan, traditionally dominated by local services, reported a 25% increase in Spotify subscriptions.

- The top five countries by user count are the U.S., Brazil, Mexico, the U.K., and Germany.

- Over 2 billion playlists are streamed monthly in Brazil alone.

- Spotify’s regional headquarters in Singapore reports record regional ad revenues in Q1 2025.

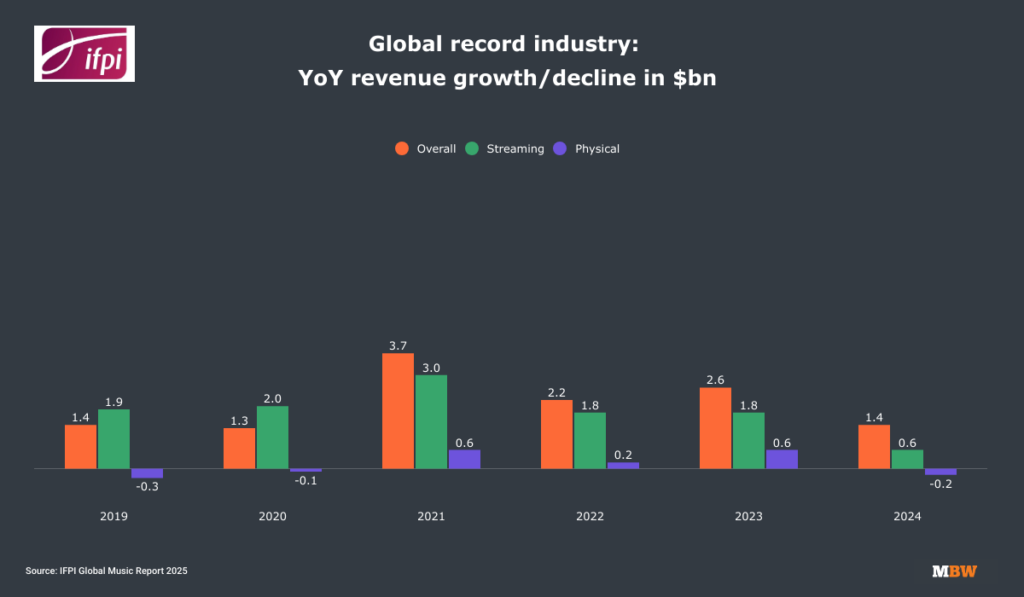

Global Record Industry: YoY Revenue Growth/Decline

- By 2024, growth slowed significantly to $1.4 billion overall; streaming rose just $0.6 billion, while physical declined again (–$0.2 billion).

- In 2019, overall revenue grew by $1.4 billion, led by streaming ($1.9 billion) while physical declined (–$0.3 billion).

- In 2020, growth slowed slightly to $1.3 billion overall, with streaming up $2.0 billion and physical down –$0.1 billion.

- 2021 marked the biggest jump, with total revenue up $3.7 billion, including a $3.0 billion rise from streaming and $0.6 billion from physical sales.

- In 2022, growth cooled to $2.2 billion overall; streaming added $1.8 billion, and physical $0.2 billion.

- 2023 saw a rebound with a $2.6 billion total increase, again led by streaming ($1.8 billion) and physical ($0.6 billion).

Spotify Financials

- Spotify’s Q1 2025 revenue hit $3.9 billion, up from $3.2 billion in Q1 2024.

- Premium subscriptions generated $3.15 billion, while ads contributed $750 million.

- Total annual revenue in 2024 closed at $13.9 billion, with projections to reach $16.2 billion by the end of 2025.

- The operating profit in Q1 2025 was $284 million, signaling continued profitability momentum.

- Spotify’s R&D expenditure rose to $564 million, largely invested in AI and recommendation algorithms.

- Gross margin sits at 26.5%, compared to 25.1% the previous year.

- The average revenue per user (ARPU) dropped slightly due to an increased uptake in lower-priced markets.

- Spotify’s stock price rose 11% in Q1 2025, buoyed by new market entries and exclusive podcast deals.

- Ad-supported revenue grew 20% year-over-year, reaching a record high in Q1 2025.

- CEO Daniel Ek confirmed plans to reinvest over $1 billion in creator tools and artist discovery tech.

Spotify Revenue

- Spotify’s total revenue for 2024 was $13.9 billion, projected to grow by 16.5% in 2025.

- Revenue from premium subscriptions accounted for approximately 81% of total earnings.

- The advertising-supported tier generated $2.3 billion in 2024, up from $1.8 billion in 2023.

- Spotify’s average revenue per premium user (ARPU) globally is $4.58, but it varies by region—$5.92 in North America vs. $2.14 in Southeast Asia.

- The company invested over $1.2 billion in exclusive content and licensing deals last year.

- Spotify’s podcasting unit contributed $453 million in revenue in 2024, a 17% year-over-year increase.

- The platform’s freemium conversion rate improved to 39%, up from 36% a year earlier.

- Revenue from in-app purchases on iOS and Android hit $211 million, boosted by upselling initiatives.

- Spotify Wrapped merchandise partnerships alone brought in $68 million in global revenue during the 2024 holiday season.

- Spotify’s ad tech investment in 2024 exceeded $230 million, supporting features like dynamic audio ads and real-time targeting.

- Deezer rounds out the list with 1.5%, showing a niche audience.

- Spotify dominates the market with a leading 30.5% share.

- Apple Music holds the second-largest share at 13.7%.

- Tencent Music follows closely with 13.4%.

- Amazon Music is right behind at 13.3% market share.

- Other streaming platforms collectively make up 10.2% of the market.

- YouTube Music accounts for 8.9%, showing a steady global presence.

- Netease captures 6.1% of the streaming market.

- Yandex represents a smaller portion with a 2.2% market share.

Most Streamed Songs and Artists in 2025

- Taylor Swift remains Spotify’s most-streamed artist globally for the third consecutive year in 2025.

- Her song “Midnights (2025 Version)” reached over 2.1 billion streams within three months.

- Peso Pluma climbed to the top 5 globally, showing the explosive growth of regional Mexican music.

- SZA’s album “CTRL+” earned 1.5 billion streams in just Q1 2025.

- Newcomer Ice Spice crossed 900 million streams for her debut 2025 album.

- The most-streamed song so far in 2025 is “Planet Echo” by The Weeknd, at 2.8 billion streams.

- Bad Bunny has five songs in the global Top 50, totaling over 6.5 billion combined streams.

- Genre crossover hit “Digital Love Affair” by AI-collaboration project NovaAI reached 1.2 billion streams, highlighting Spotify’s AI-powered content wave.

- In the U.S., Drake, Taylor Swift, and SZA held the top three artist spots from January to March 2025.

- Global Spotify charts now update in real-time, a feature that increased playlist engagement by 24%.

Top Spotify Artists In Your Spotify Stats

- Taylor Swift leads as the most-added artist to user playlists in Q1 2025.

- Morgan Wallen ranks #1 in the U.S. country genre, with over 740 million unique listeners.

- Doja Cat’s tracks appeared in more than 14 million “On Repeat” user playlists.

- BTS still dominates in Asia, especially in Japan and South Korea, driving over 3 billion streams in early 2025.

- Peso Pluma was the top “breakout artist” featured in Spotify Wrapped 2024 for North America.

- Artists who released Spotify-exclusive singles saw 29% higher playlist additions on average.

- Ed Sheeran’s songs were saved more than 920 million times in Q4 2024.

- Billie Eilish became the most-streamed female artist on Spotify for sleep and focus playlists in early 2025.

- Latin artists like Karol G and Feid entered Spotify’s global Top 10 for the first time this year.

- AI-assisted artists, such as those using Boomy and Soundraw, now account for 4.7% of all new releases added to Spotify in 2025.

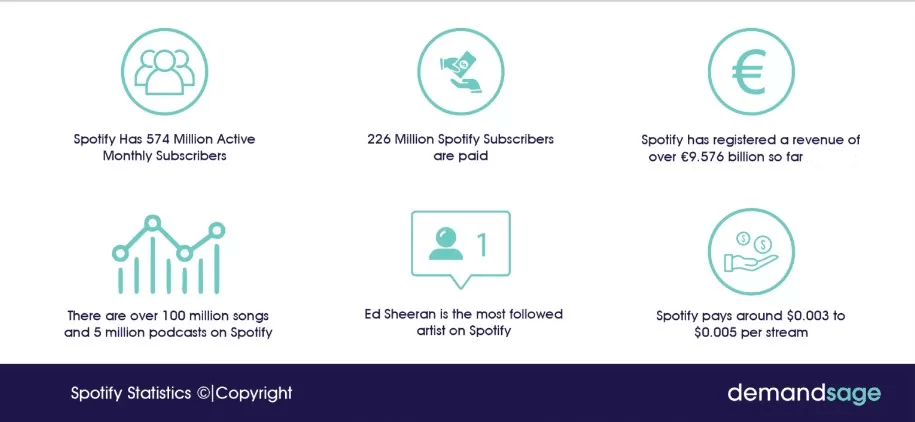

Key Spotify Statistics

- Spotify pays artists around $0.003 to $0.005 per stream.

- Spotify has 574 million active monthly subscribers.

- Out of those, 226 million are paid subscribers.

- Spotify has generated over €9.576 billion in revenue so far.

- The platform hosts over 100 million songs and 5 million podcasts.

- Ed Sheeran holds the title of the most followed artist on Spotify.

Top Spotify Songs In Your Listening Stats

- “As It Was” by Harry Styles remained in the top 50 global listens list into early 2025, nearly three years post-release.

- “Vampire” by Olivia Rodrigo saw a 46% spike in listens after its viral TikTok remix.

- The average listener played their top song of the year over 97 times.

- The most saved song globally in Q1 2025 is “Echo State” by NovaAI, with 420 million saves.

- In the U.S., “Cruel Summer” by Taylor Swift continues to be the #1 car ride song based on Spotify’s driving mode usage.

- The fastest-growing new entry on global playlists is “Blue Venom” by Aespa, streamed 1.1 million times daily.

- Songs under 2 minutes have risen by 31% in popularity, influenced by short-form video consumption habits.

- Indie Pop and Synthwave Revival are genres with the most listener growth for repeat streams in 2025.

- The average Spotify user’s Top 10 songs span 6.8 genres, showing high diversity in personal playlists.

- Spotify has introduced a “Mood Tracker” that ties users’ top songs to sentiment ratings—already used by over 18 million people.

Spotify Top Genres For You

- Pop remains the #1 genre globally, accounting for 23% of all Spotify streams.

- Hip-hop holds the second spot with 19%, though it’s slowly declining in some Western markets.

- Latin music is Spotify’s fastest-growing genre, with a 28% annual increase in stream volume.

- Afrobeats grew by 36% globally, with Nigeria and the UK leading in listener engagement.

- K-pop streams surged by 22% and now account for over 5.2 billion monthly listens.

- Lo-fi continues to trend, especially in study and sleep playlists, with a 31% growth in usage.

- Electronic and Deep House playlists saw 40% higher engagement during weekend hours.

- Podcast music genres, like true crime intros and ambient beds, grew by 17%, especially among U.S. females aged 25–34.

- Instrumental film scores are increasingly used in concentration playlists, up 13% year-over-year.

- Regional niche genres like Corrido Tumbado and Folk Tronica are seeing breakout success in 2025.

Spotify US Podcast Listener Growth (2020–2025)

- By 2025, the number is expected to reach 43 million.

- In 2020, Spotify had 18 million podcast listeners in the US.

- By 2021, the number grew to 26 million listeners.

- In 2022, it climbed further to 32 million.

- 2023 saw a jump to 36 million listeners.

- The projected figure for 2024 is 40 million US podcast listeners.

Spotify Timeline & History

- Spotify was founded in 2006 in Stockholm, Sweden, and launched publicly in 2008.

- The first U.S. launch came in 2011, leading to exponential user growth.

- Spotify introduced the freemium model in 2013, revolutionizing digital music access.

- Spotify Wrapped was launched in 2016 and is now a globally anticipated annual experience.

- Podcasts were added in 2015, becoming a major revenue stream by 2022.

- In 2020, Spotify acquired Anchor and Megaphone, which are central to its podcast dominance today.

- The AI DJ feature debuted in 2023 and is now used by over 80 million users.

- By 2024, Spotify surpassed 500 million users, doubling its base in under five years.

- Spotify launched in India in 2019, a key move that brought in tens of millions of new users.

- In 2025, Spotify introduced its Real-Time Global Charts, reshaping music discovery through live rankings.

Spotify vs. Other Music Streaming Platforms

- Spotify maintains the largest global market share at 32%, followed by Apple Music at 16% and Amazon Music at 13%.

- YouTube Music has seen a 12% growth, primarily among Gen Z listeners in North America and Asia.

- Apple Music leads in Hi-Res Audio, but Spotify’s upcoming HiFi tier is expected to challenge that.

- TIDAL has just 1.7% of the market despite its artist-owned branding and high-quality audio claims.

- Pandora’s user base has dropped below 45 million, continuing a steady decline since 2021.

- Deezer leads in France and parts of Europe but has only a 2% market share globally.

- Amazon Music’s bundling strategy via Prime drives retention over discovery, unlike Spotify’s algorithm-first approach.

- SoundCloud maintains dominance in indie and emerging artist uploads but only commands 1.2% of total music streams.

- Spotify has over 5 million podcasts, while Apple Podcasts hosts approximately 2.6 million.

- Spotify offers music in 62 languages, more than any other streaming platform today.

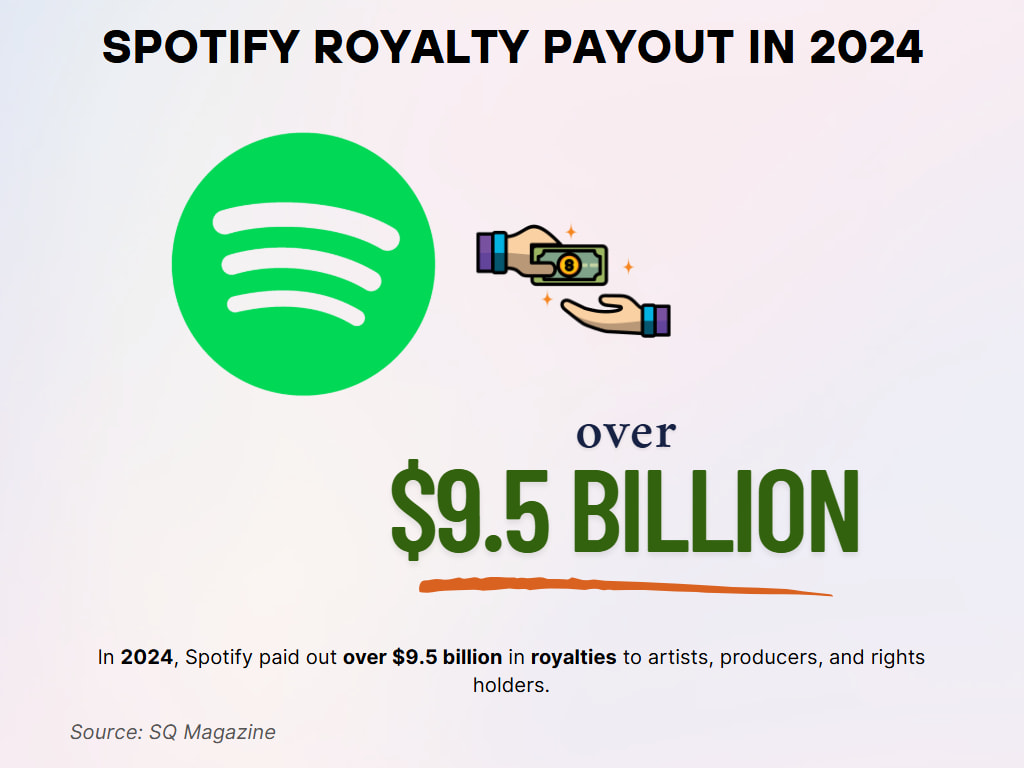

Artist Earnings and Royalty Distribution

- In 2024, Spotify paid out over $9.5 billion in royalties to artists, producers, and rights holders.

- More than 65,000 artists generated over $10,000 each on Spotify last year—up from 57,000 in 2023.

- Over 1,250 artists earned more than $1 million in royalties from Spotify alone.

- Spotify pays out approximately $0.003 to $0.005 per stream, depending on location, subscription type, and rights agreements.

- Artists using Spotify’s Merch Bar integration saw a 21% boost in revenue during the Wrapped season.

- Spotify introduced Fan Funding in early 2024, and over 400,000 fans have directly contributed to artists.

- The Equalizer program, aimed at promoting underrepresented voices, saw a 45% increase in playlist placement success for enrolled artists.

- Independent musicians (DIY distribution) now represent 27% of all music streamed on Spotify.

- Spotify’s Royalty Calculator tool, launched in 2023, is used by over 300,000 artists monthly.

- The top 1% of Spotify artists earned over 90% of total payouts, sparking ongoing debate around streaming economics.

Spotify’s Role in the Podcasting Industry

- Spotify now hosts over 5 million podcasts, making it the largest podcast library among all streaming platforms.

- As of Q1 2025, podcasts account for 14.3% of total listening time on Spotify.

- 53% of Spotify users in the U.S. report listening to podcasts weekly.

- Spotify surpassed Apple Podcasts in total U.S. podcast listens back in 2023 and widened the gap by 9% in 2024.

- Top Spotify Originals like Call Her Daddy and The Joe Rogan Experience consistently rank in the global Top 10.

- Spotify has localized podcast content in over 40 languages.

- Over 400,000 podcast creators earn income through Spotify’s monetization tools.

- Spotify’s Podcasts Charts API, launched in 2024, now powers over 1,200 third-party apps.

- The average podcast listener spends 38 minutes per session on the platform.

- Spotify’s auto-transcription tool increased podcast discoverability by 31% year-over-year.

Advertising Revenue and Spotify Ad Platform Performance

- Spotify’s ad revenue hit a record $2.3 billion in 2024, with projections to surpass $2.7 billion in 2025.

- The Spotify Audience Network (SPAN) now supports over 100,000 advertisers, up from 87,000 in 2023.

- Dynamic Ad Insertion (DAI) is now used in 89% of podcast ad placements.

- Spotify’s Click-through Rate (CTR) for podcast ads rose to 1.91%, higher than traditional display ads.

- Spotify Ad Studio saw a 22% rise in self-service advertisers, reflecting growing accessibility for small businesses.

- The U.S. remains Spotify’s top ad market, generating 43% of the total ad revenue in Q4 2024.

- The average CPM (cost per thousand impressions) for audio ads is $23.50, while video ads command $32.10.

- Brands using Spotify’s multi-format campaigns reported 13% higher brand recall compared to single-format campaigns.

- Programmatic ad sales on Spotify rose by 38% year-over-year, driven by third-party integrations.

- Ad targeting capabilities now include real-time context and mood signals, allowing brands to match listener energy.

Spotify App Engagement and User Behavior

- The average user opens the Spotify app 12 times per day.

- Mobile remains dominant, with 91% of total sessions taking place on smartphones.

- Voice search queries on the app increased by 37%, largely driven by smart speaker usage.

- Spotify Connect-enabled devices saw a 17% increase in engagement across smart TVs and game consoles.

- Personalized playlists like Discover Weekly and Release Radar are accessed by 72% of active users weekly.

- Spotify Wrapped 2024 had a completion rate of 83%, with users spending an average of 11 minutes engaging with their results.

- Users interact with Spotify Canvas (looping visuals) 43% more when songs contain video enhancements.

- Sleep and Chill playlists are the most saved playlists globally, making up 19% of saved collections.

- Spotify’s AI DJ mode is used by 1 in 5 active users daily.

- Gamified features like Music Match and Playlist Bingo saw 27% engagement growth in Gen Z segments.

Trends in Playlist Popularity and Curation

- Spotify users create over 9 million playlists every single day.

- Curated playlists now account for 32% of all streams on the platform.

- Today’s Top Hits has more than 34 million followers, remaining the most influential editorial playlist.

- Personalized playlists generate 44% more engagement than editorial playlists.

- AI-generated mood playlists now account for 14% of total streams, especially in the wellness and fitness categories.

- Collaborative playlists saw a 41% surge in creation, particularly among users under 30.

- On Repeat playlists generated 11% higher session durations compared to standard user libraries.

- Spotify’s Blend feature, which merges music tastes, grew by 53% year-over-year.

- Seasonal and themed playlists (e.g., Halloween, Valentine’s Day) bring in 35% higher ad revenue per stream.

- Regional playlists like Viva Latino and Desi Hits saw double-digit growth in engagement across diaspora audiences.

Impact of AI and Personalization on Spotify Recommendations

- Spotify’s personalization engine now uses over 1,000 data signals per user to recommend content.

- The AI DJ feature boosted daily retention rates by 22% among Gen Z users.

- Spotify’s new AI-powered feature, Smart Shuffle, reorders playlists based on real-time mood analysis.

- More than 80 million users engage with personalized features weekly.

- Personalized podcast suggestions have increased episode discovery by 28%, especially for niche creators.

- In-app surveys show that 72% of users feel Spotify “gets their music taste”, an all-time high.

- Spotify’s AI engine now evaluates tempo, emotion, key, and lyric sentiment to generate recommendations.

- AI-assisted artist promotion tools led to a 12% uplift in first-day stream counts.

- Spotify is testing a voice-cloning narration tool for podcasts, allowing hosts to scale content across languages.

- In 2025, Spotify plans to roll out hyper-personalized live radio, curated in real time for each listener.

Recent Developments

- Spotify launched its Live Events Discovery tab in early 2025, connecting users to concerts in their area.

- The Spotify Ticketing platform now offers direct sales in 11 countries, including the U.S. and Germany.

- A new “Year in Podcasting” feature lets podcasters create end-of-year recaps for their shows.

- Spotify partnered with Roblox to create immersive audio-driven virtual worlds.

- The company is piloting carbon offsetting for streaming, a sustainability initiative led by its Greenroom division.

- Spotify announced a $100 million Creator Fund aimed at supporting emerging podcasters and indie musicians.

- Spotify’s AI Research Lab opened new offices in Toronto and Berlin, signaling a major push in voice and sound AI.

- The Spotify mobile app UI underwent a redesign to improve accessibility and reduce cognitive load.

- Spotify integrated with Tesla’s dashboard OS, now available in all new models sold in the U.S. and EU.

- Spotify is expected to unveil a multi-modal music search (by humming or describing lyrics) later in 2025.

Conclusion

Spotify’s 2025 landscape is both familiar and futuristic—a platform where human touch and AI coexist to shape how we discover, connect, and groove. With rising revenue, growing global influence, and hyper-personalized tools, Spotify isn’t just keeping pace—it’s setting the beat.

For artists, marketers, and listeners alike, the numbers tell a powerful story: Spotify is more than a streaming service—it’s a digital culture engine. As the platform evolves, it continues to set new standards for how we experience sound in the streaming era.

Sources

- https://vpnalert.com/resources/spotify-statistics

- https://electroiq.com/stats/spotify-statistics/

- https://thesocialshepherd.com/blog/spotify-statistics

- https://www.businessofapps.com/data/spotify-statistics/

- https://backlinko.com/spotify-users

- https://soundcharts.com/spotify-analytics

- https://startupbonsai.com/spotify-statistics/