Imagine launching your favorite website only to find it sluggish or oddly formatted. You might not realize it immediately, but your browser choice plays a major role in that experience. Today, as the internet evolves faster than ever, browsers are battling fiercely for users’ attention, from prioritizing privacy features to fine-tuning mobile performance.

Understanding browser statistics today isn’t just for tech nerds; it’s essential for marketers, developers, and everyday users who want the smoothest ride through the digital world. Let’s dive into the latest numbers shaping the web we live on.

Editor’s Choice

- There are over 6 billion internet users worldwide, with web browsers as the primary gateway to online content across devices.

- Desktop browsers account for roughly 36% of global web traffic, maintaining a significant role despite mobile growth.

- Mobile browsers generate 62–64% of total global website traffic, emphasizing mobile-first design strategies.

- 53% of users abandon sites taking over 3 seconds to load, highlighting page speed’s direct impact.

- Browser extensions number over 111,000 in the Chrome Web Store, used by a majority of desktop users for enhanced functionality.

- Over 85% of modern websites rely on JavaScript for interactive experiences, underscoring compatibility needs.

Recent Developments

- Google Chrome abandoned the full third-party cookies phase-out, retaining support in 2026.

- Brave Browser surpasses 30 million daily active users with native crypto payments.

- Vivaldi’s Mastodon instance grew by 11,000 users since mid-November integration.

- Opera’s Aria AI supports summarization in 40+ languages across platforms.

- Arc Browser manages 60 tabs across 3 spaces with AI organization seamlessly.

- Microsoft Edge Read Aloud supports 40+ languages for accessibility.

Search Engine Host Market Share Worldwide

- Google (google.com) overwhelmingly dominates the global search landscape with a massive 87.81% market share, far ahead of all competitors.

- Bing (bing.com) ranks a distant second, capturing 4.29% of worldwide search activity.

- Yandex (yandex.com.tr) holds a modest 0.92% share, reflecting its regional strength outside Russia.

- DuckDuckGo (duckduckgo.com) accounts for 0.74%, highlighting steady demand for privacy-focused search options.

- Yandex (yandex.ru) contributes an additional 0.60%, showing continued usage in its core domestic market.

- Baidu (m.baidu.com) records 0.55%, representing mobile-focused access to China’s leading search engine.

Emerging Browsers and New Entrants

- Arc Browser holds ~0.2% global market share with millions of users among creatives.

- Mullvad Browser garners a 4.7/5 rating from 500+ Apple App Store reviews.

- Orion Browser manages 200 tabs without slowdown on macOS.

- Brave Search processes 1.6 billion monthly queries, 20 billion annually.

- Aloha Browser grew 15x in EU downloads post-DMA, 2x loyalty.

- Cliqz Anti-Tracking deployed in 1.32.1 strips cross-origin referrers.

- Beaker Browser enables P2P hosting via the Dat protocol on Chromium.

- Min Browser blocks ads/trackers with fuzzy search for visited pages.

- Puffin Secure Browser isolates browsing 100% remotely for security.

Browser Security and Privacy Features Comparison

- Brave blocks 837 ads/trackers on heavy sites like CNN with native Tor tabs.

- Safari’s ATP in iOS 26 applies fingerprinting protection across all browsing by default.

- Edge’s Defender SmartScreen blocks 95.5% phishing URLs vs Chrome’s 86.9%.

- Firefox’s Total Cookie Protection restricts third-party cookies for all users worldwide.

- Opera VPN Pro encrypts with AES-256 across 3,000+ servers in 30+ countries.

- Samsung Internet auto-switches to HTTPS for secure connections on Android.

- Vivaldi shows real-time tracker blocks with uBlock, scoring high on privacytests.org.

- Mullvad Browser disables telemetry/crash reporting entirely at compile time.

- Tor Browser loads 2x slower than VPN setups due to circuit-building delays.

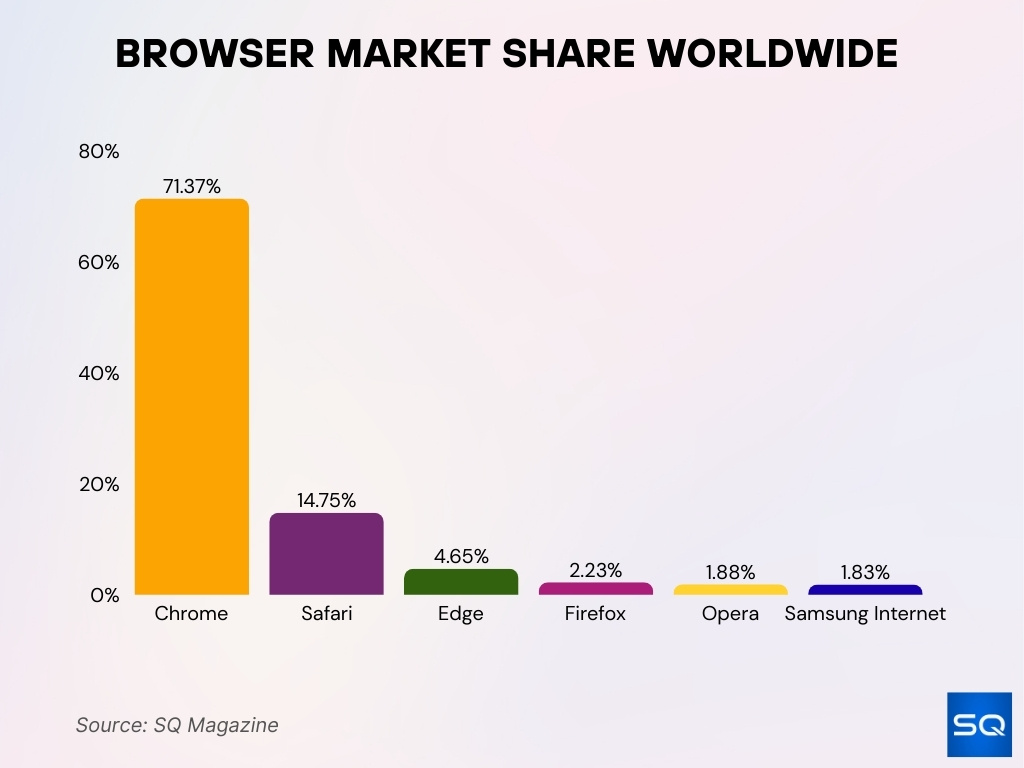

Browser Market Share Worldwide

- Google Chrome dominates the global browser market with a commanding 71.37% share, making it the default choice for the vast majority of internet users.

- Apple Safari ranks second with 14.75%, driven largely by its strong presence across iPhone and Mac ecosystems.

- Microsoft Edge holds 4.65%, reflecting steady adoption among Windows users and enterprise environments.

- Mozilla Firefox accounts for 2.23%, maintaining a niche audience that values open-source and privacy-focused browsing.

- Opera captures 1.88%, supported by its lightweight design and built-in features such as VPN and ad blocking.

- Samsung Internet records 1.83%, highlighting its role as the default browser on many Samsung mobile devices.

Most Common Google Chrome Vulnerabilities

- Denial of Service tops with 26 instances reported, mainly heap buffer overflows posing disruption risks.

- Overflow vulnerabilities second with 14 cases, including libvpx and V8 buffer issues.

- Execute Code vulnerabilities were noted 12 times via use-after-free and type confusion flaws.

- Memory Corruption recorded 10 times, risking system stability through heap exploits.

- Bypass vulnerabilities appear 8 times, allowing security restriction circumvention.

- Gain Information issues found 5 times, exposing sensitive data via leaks.

- XSS vulnerabilities were noted 2 times in WebRTC and related components.

- CSRF is rare, with 1 case in policy enforcement failures.

- Directory Traversal had 0 cases in recent reports.

- Gain Privilege vulnerabilities also have 0 occurrences lately.

Impact of Browser Updates on User Retention

- Chrome maintains 4-week release cycles with weekly security refreshes for the stable channel.

- Edge AI sidebar boosts instant responses without cloud latency for productivity.

- Safari 26.1 reaches Speed Index 51 on M4 Air, outperforming competitors.

- Opera AI Aria summarizes pages in 40+ languages, attracting knowledge workers.

- Samsung Internet UX on mid-range devices enables 90–120Hz smooth scrolling for retention.

- Vivaldi serves 2.4 million active users with 2.7 million monthly visits.

- Tor updates reduce load times to 3x slower average vs clearnet browsing.

- Arc spaces handle hundreds of tabs, boosting week-over-week engagement.

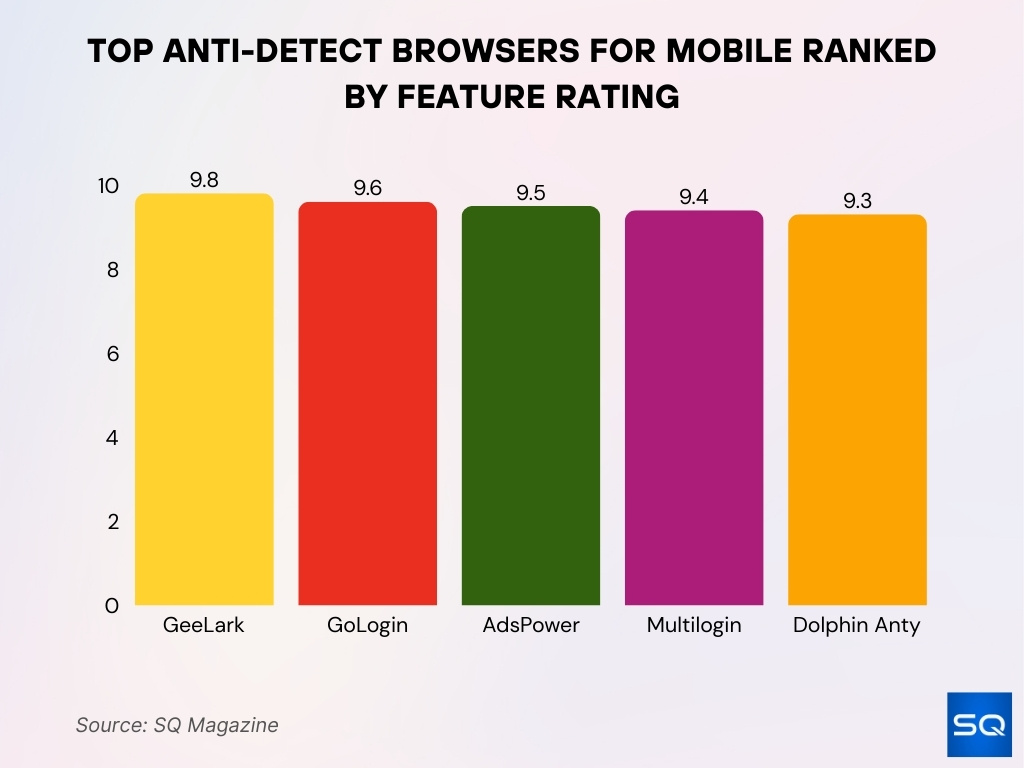

Feature Ratings of Best Anti-Detect Browsers for Mobile

- GeeLark leads with a 9.8/10 rating for AI-powered mobile profile generation and privacy.

- GoLogin secures a 9.6/10 rating as a budget champion with cloud-based Android access.

- AdsPower holds a 9.5/10 rating for powerful no-code automation and scalability.

- Multilogin achieves a 9.4/10 rating for advanced team management and fingerprint control.

- Dolphin Anty earns a 9.3/10 rating for beginner-friendly free profile creation.

User Preferences: Speed, Extensions, and Interface

- 78% drop in conversion rates between 1-second (3.05%) and 4-second loads prioritizes speed.

- Firefox users install extensions at the highest per capita rate due to customization appeal.

- Firefox extension management earns 92% satisfaction for customizability.

- Edge vertical tabs now auto-expand in Project Jupiter for 26% better multitasking.

- Safari tab grouping boosts efficiency by limiting tabs per group for focus.

- Brave and Vivaldi both support full Chrome Web Store extensions with high privacy scores.

- Opera sidebar used by favorites accessing Gmail/Calendar integrations modularly.

- Samsung Internet’s one-handed mode is activated via 3 Home button taps on mid-size phones.

- 81.9% Android users adopt dark mode across apps and browsers.

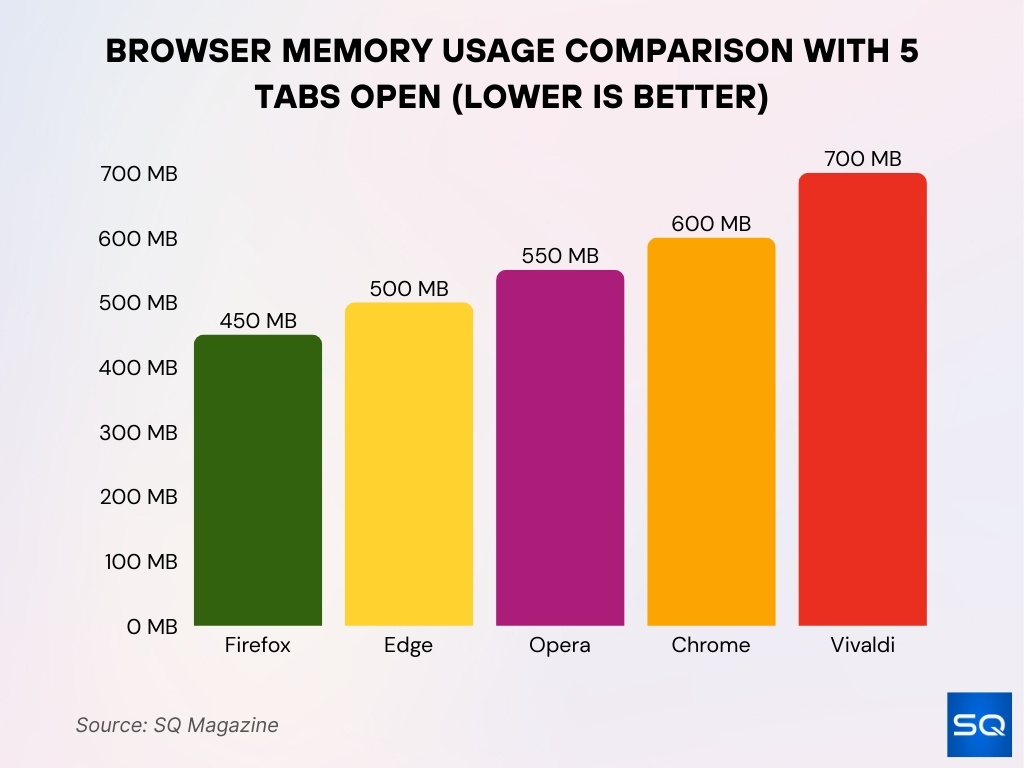

Browser Memory Usage (With 5 Tabs Open on Typical Sites)

- Firefox is most efficient at ~450 MB with 5 tabs on Windows 2026 benchmarks.

- Edge consumes ~500 MB, the second lowest via sleeping tabs optimization.

- Opera uses ~550 MB across 5 tabs, balancing features and efficiency.

- Chrome demands ~600 MB baseline, scaling higher with extensions.

- Vivaldi tops at ~700 MB due to extensive customization overhead.

Frequently Asked Questions (FAQs)

About 6.04 billion people globally use the internet in 2026.

Around 3.62 billion people use Google Chrome worldwide.

Other browsers collectively represent about 4% of usage.

Conclusion

The battle for browser supremacy today is more dynamic than ever. While Chrome continues to lead the charge globally, challengers like Brave, Edge, and Safari are carving out strongholds with innovations in privacy, speed, and user experience. User expectations have shifted dramatically; speed, minimalism, security, and personalization now outweigh simple brand loyalty.

Emerging browsers show that niche needs are rising fast, and regulatory changes hint that market shares could further fragment over the next few years. In this ever-shifting web landscape, the true winner will be the browser that can adapt the fastest to user desires and technological evolution.