Back in the early 2000s, “Googling” something became a household verb, a cultural benchmark of internet search dominance. For years, Google has enjoyed near-total control over the search engine landscape. But fast forward to 2025, and the narrative is evolving. Microsoft’s Bing, once dismissed as a secondary player, has carved out a meaningful share, fueled by integrations with AI-powered tools, Windows ecosystem advantages, and ChatGPT-like experiences that appeal to users looking for something fresh.

So, is Bing finally catching up to the search giant? Or is Google still miles ahead despite market shifts? This article unpacks the latest statistics to give you a clear, data-driven look at how Bing vs Google plays out across market share, user behavior, ad revenue, and more.

Editor’s Choice

Here are seven standout stats you need to know right away:

- Google holds a global search engine market share of 87.5% as of Q1 2025, while Bing has grown to 8.3%, a record high for Microsoft’s platform.

- On desktop devices in the US, Bing controls 27.6% of the market, compared to Google’s 65.4%, showing Bing’s edge in non-mobile environments.

- Bing’s integration with Windows 11 Copilot and Edge has driven a 31% increase in Bing usage year-over-year.

- Google’s search advertising revenue is projected to reach $205.3 billion in 2025, a 7.2% increase from 2024, while Bing Ads is expected to pull in $15.6 billion, up 12.5%.

- In a 2025 satisfaction survey by Statista, 72% of Bing users reported being “satisfied or very satisfied” with their search results versus 83% of Google users.

- Google Search indexes over 50 billion web pages daily, whereas Bing indexes around 12 billion pages, but focuses more on quality over quantity.

- Bing AI-powered responses are used in 34% of all Bing queries, compared to Google’s SGE (Search Generative Experience), which accounts for 19% of Google’s searches as of April 2025.

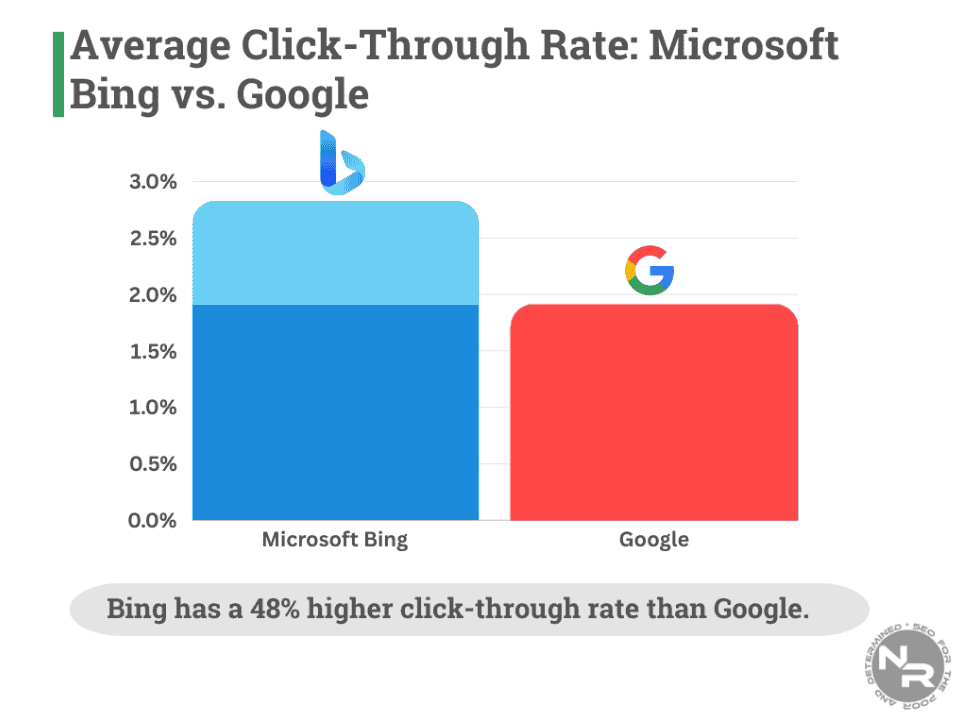

Bing vs. Google: Average Click-Through Rate Comparison

- Microsoft Bing has an average click-through rate (CTR) of approximately 2.9%, significantly outperforming Google.

- Google’s average CTR is around 1.96%, indicating less user engagement per impression.

- Bing’s CTR is 48% higher than Google’s, making it a more efficient platform for ad visibility and user clicks.

Desktop vs Mobile Usage Statistics

- Google continues to dominate on mobile with 95.3% of mobile search traffic worldwide, while Bing lags behind at 1.2%.

- On desktop devices, Bing performs significantly better, especially in the United States, where it holds a 27.6% share, second only to Google at 65.4%.

- Bing’s integration with Windows 11 and default browser settings via Microsoft Edge contributes to 80% of its desktop usage volume.

- Google remains the default on Android devices, which account for over 72% of global smartphones, a key reason for its mobile dominance.

- Mobile searches now represent 66% of all search queries globally, an increase from 63% in 2024.

- Bing search via mobile saw an 18% increase year-over-year, due to its roll-out of a Bing Chat mobile app in early 2024.

- On tablets, Google maintains a 91.2% market share, compared to Bing’s 6.1%, mirroring mobile trends.

- In workplaces and enterprise environments, Bing commands over 33% of searches on managed desktop devices in North America, owing to corporate IT defaults.

Average Query Volume and Trends

- In 2025, Google processes over 8.5 billion searches per day, a 5.4% increase from 2024, reaffirming its role as the world’s go-to search engine.

- Bing handles about 1.2 billion searches per day, marking a 19% year-over-year growth, largely attributed to AI-powered experiences.

- Daily search queries on Bing spiked 43% following its integration with Copilot AI and Edge Sidebar.

- Mobile accounts for 66% of Google’s total search volume, while Bing’s mobile search contributes only 18% to its total query base.

- The most searched category on both platforms in 2025 is AI tools, with queries like “best AI assistant 2025” up 124% year-over-year.

- Voice search queries make up 27% of Google searches and 9% of Bing searches, highlighting a significant adoption gap.

- Visual and multimodal searches (text + image) rose by 76% on Bing, with tools like Bing Visual Search gaining traction among eCommerce users.

- Google Trends shows a decline in basic keyword searches and a rise in question-based queries, especially “how-to” and “what is” types.

- The average query length on Bing is 4.8 words, compared to 3.9 words on Google, reflecting a more exploratory user intent.

- Google Search Console data shows that the number of unique search terms per user has increased by 11.2% in the past year.

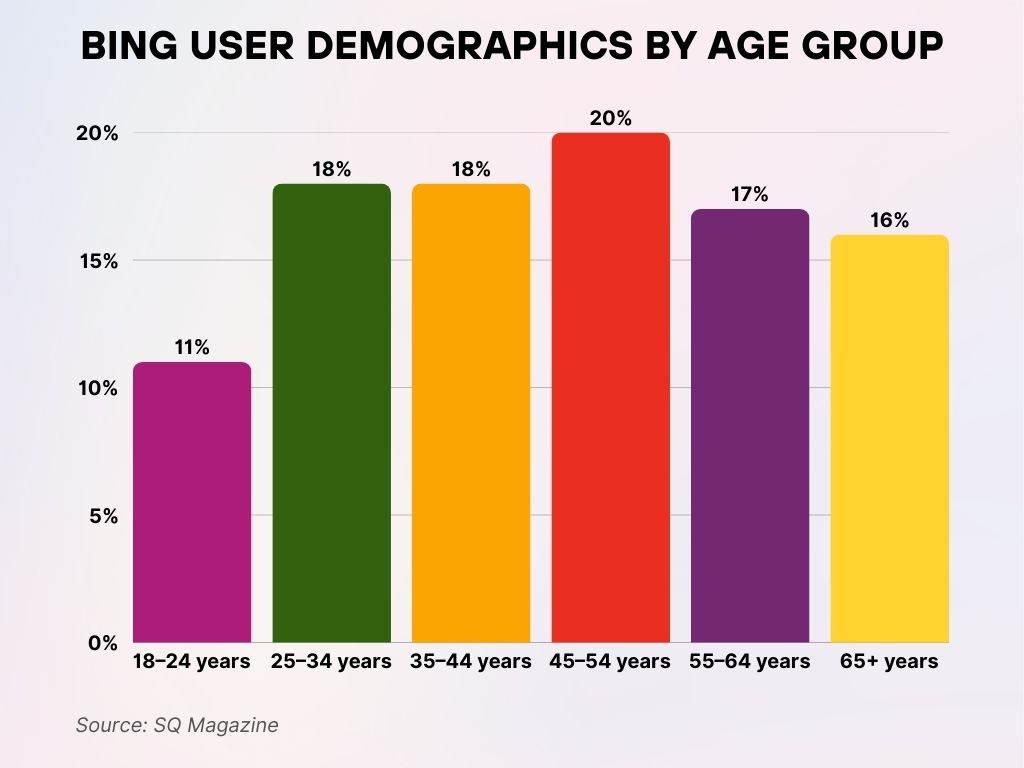

Bing User Demographics by Age Group

- Users aged 45–54 years make up the largest share at 20%, showing strong engagement from mid-aged adults.

- Both the 25–34 and 35–44 age groups account for 18% each, indicating solid usage among working-age users.

- The 55–64 years group follows closely with 17%, showing Bing’s continued use among older adults.

- 16% of Bing users are 65+ years, suggesting notable adoption by senior internet users.

- The youngest group (18–24 years) represents the smallest share at 11%, indicating less popularity among Gen Z.

Advertising Revenue and CPC Comparison

- Google’s advertising revenue is projected to hit $205.3 billion in 2025, up from $191.4 billion in 2024.

- Bing’s ad revenue is expected to grow to $15.6 billion, a 12.5% increase, boosted by LinkedIn and Microsoft Ads integrations.

- The average cost-per-click (CPC) on Google Ads is $2.96, while Bing Ads offers a lower CPC at $1.32, attracting budget-conscious marketers.

- Bing Ads’ conversion rate is higher in specific niches, finance (3.4%), B2B (3.9%), and healthcare (3.1%) outperform their Google counterparts.

- Google maintains dominance in retail and eCommerce, with 67% of retail marketers allocating over half of their budget to Google Ads.

- Bing Ads saw a 22% increase in click-through rate (CTR) for AI-generated ad suggestions since mid-2024.

- Google Ads reaches 90% of internet users, while Bing Ads covers about 34%, mainly through the Microsoft Search Network.

- Bing’s ad market share in the legal and insurance sectors grew by 15%, especially on desktop, due to lower competition and cheaper bids.

- Advertisers report higher ROI on Bing in enterprise campaigns, with an average return of $5.1 for every $1 spent, compared to Google’s $4.2.

- Google still dominates YouTube and Shopping ads, which account for 41% of its ad revenue, spaces where Bing currently has no direct competitor.

Search Result Accuracy and User Satisfaction

- Google ranks highest for perceived result accuracy, with 83% of users saying results are “very relevant,” compared to 72% for Bing.

- Bing excels in product-related and fact-checking queries, with a 92% satisfaction rate in these categories.

- Google returns a result in under 0.28 seconds on average, while Bing is slightly slower at 0.37 seconds.

- Users rated Bing’s AI-powered summary cards as more helpful than Google’s in side-by-side comparisons 58% of the time.

- Google’s knowledge graph appears in 32% of all queries, while Bing’s knowledge pane appears in 19%, though Bing now leverages OpenAI partnerships to enhance these results.

- A 2025 Trustpilot survey shows Google with a 4.3-star rating, while Bing holds 4.1 stars, both showing modest improvements.

- Bing offers fewer ads per page, averaging 2.1 ads per results page, compared to Google’s 3.8, which contributes to a cleaner UX.

- In a privacy context, Google users are more likely to report concern (62%) about data personalization versus 38% of Bing users.

- Google displays “people also ask” boxes in 49% of searches, compared to 22% on Bing, which tends to reduce the bounce rate on Google.

- Google’s “featured snippets” appear in 14.6% of queries, compared to Bing’s 6.4%, leading to higher voice search integration for Google.

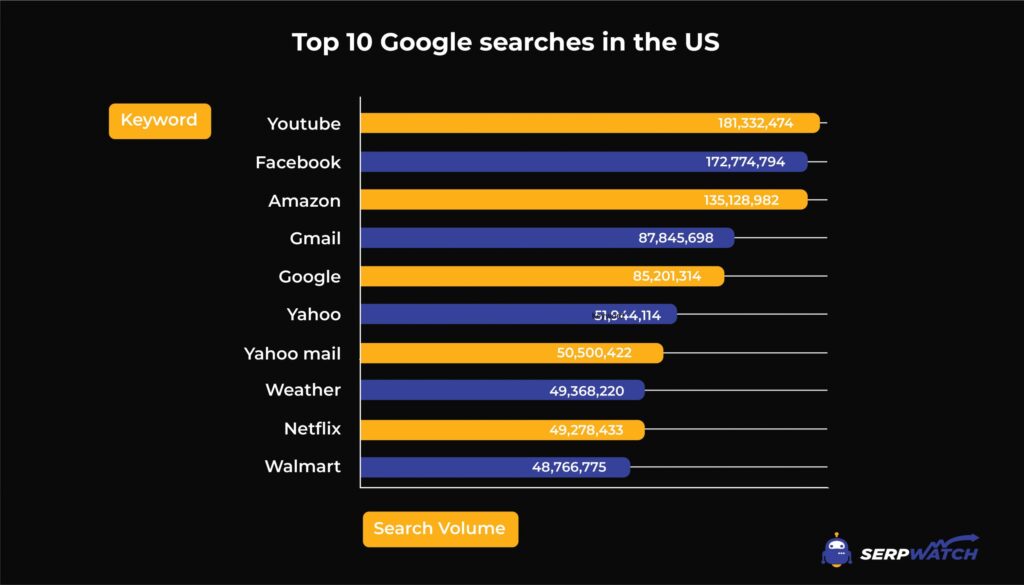

Top 10 Most Searched Keywords on Google in the US

- YouTube tops the list with a massive 181,332,474 searches, showing its dominance in video content demand.

- Facebook follows closely with 172,774,794 searches, indicating continued user interest in the platform.

- Amazon secures third place at 135,128,982 searches, driven by strong e-commerce traffic.

- Gmail sees 87,845,698 searches, highlighting frequent access via search.

- Google itself is searched 85,201,314 times, showcasing brand reinforcement behavior.

- Yahoo has 51,944,114 searches, still maintaining a notable presence.

- Yahoo Mail gathers 50,500,422 searches, showing its relevance in the email market.

- Weather is searched 49,368,220 times, reflecting routine interest in forecasts.

- Netflix earns 49,278,433 searches, indicating strong entertainment-related interest.

- Walmart rounds out the list with 48,766,775 searches, tied to retail demand.

Integration with Other Products and Services

- Google Search integrates directly with YouTube, Google Maps, Gmail, and Google Workspace, driving more than 38% of its internal traffic from cross-service usage.

- Bing is tightly integrated with Microsoft 365, particularly Outlook, Teams, and OneDrive, making it the default engine in many enterprise environments.

- Copilot AI, Microsoft’s productivity assistant, feeds directly into Bing for search queries within Excel, Word, and PowerPoint.

- Google Lens, integrated in Chrome and Android, accounts for over 1 billion monthly visual searches.

- Bing Visual Search is growing steadily, with 230 million visual searches reported in Q1 2025, driven by eCommerce partnerships.

- Google Assistant and Pixel phones drive over 290 million voice queries per month, while Bing sees roughly 55 million, mostly through Cortana and Edge mobile.

- Android, which powers 71% of smartphones globally, comes with Google Search preinstalled, reinforcing its ecosystem dominance.

- Bing benefits from Xbox and Windows tie-ins, where search tasks within the UI now default to Bing by design.

- Google’s search technology is embedded in third-party tools like Grammarly, Canva, and Shopify, giving it wider functional integration.

- Microsoft Teams users can now initiate Bing-powered searches within chat windows, a feature adopted by over 30% of Teams business users.

AI and Search Technology Innovations

- In 2025, Bing leads in AI integrations, with 34% of Bing searches powered by generative AI tools, compared to 19% on Google.

- Microsoft’s partnership with OpenAI has enabled Bing Chat to summarize long-form documents, answer multi-step questions, and generate citations directly in the results page.

- Google’s Search Generative Experience (SGE) uses Gemini models and now appears in one-fifth of all search interactions.

- Bing’s AI suggestions are more likely to include multimedia elements, 52% of AI responses include charts or images, compared to 33% on Google.

- Google has trained SGE to pull real-time data from Search, News, and Shopping, a move aimed at reducing dependence on third-party tools.

- Over 500 million users have interacted with Bing AI since its beta rollout in 2023, most using chat-style queries or document summaries.

- Google’s Multisearch tool, which combines image + text, is now used in 24% of all mobile queries in supported regions.

- Bing AI is rated 4.6 out of 5 in user satisfaction, compared to 4.2 for Google SGE, based on a 2025 UX benchmark study.

- Google’s AI has stronger language translation and local business integration, whereas Bing AI performs better in long-form content generation and citation-based responses.

- Microsoft has committed $13 billion in AI research funding for Bing, while Google’s parent, Alphabet, is set to invest $18 billion in AI search enhancement this year.

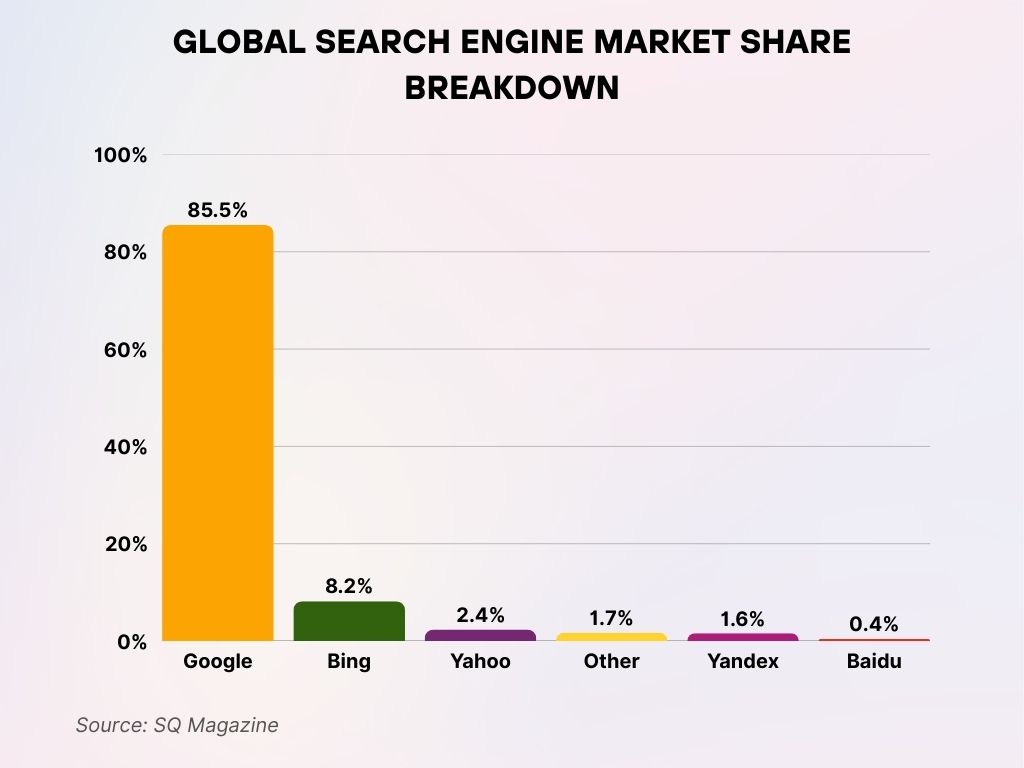

Global Search Engine Market Share Breakdown

- Google dominates the global search engine market with a massive 85.5% share, reinforcing its status as the top choice worldwide.

- Bing holds 8.2%, making it the second-largest search engine by traffic volume.

- Yahoo captures 2.4%, still retaining a modest global presence.

- Other search engines account for 1.7%, representing a mix of smaller platforms.

- Yandex, popular in Russia and surrounding regions, holds 1.6% of the market.

- Baidu, China’s major search engine, commands just 0.4% of global traffic.

Bing Chat vs Google Search Generative Experience (SGE)

- Bing Chat is used by over 500 million users monthly, offering real-time answers, citations, and multimedia enhancements.

- Google’s Search Generative Experience (SGE) appears in 19% of all queries on Google as of April 2025, primarily in the US and select countries.

- Bing Chat integrates directly into Edge browser and Windows 11, contributing to a 28% boost in daily active users since Q3 2024.

- SGE integrates with Google’s Gemini AI and is expected to expand to more than 100 languages by late 2025.

- Bing Chat supports multi-turn conversation, code writing, and PDF summarization, a set of tools aimed at professionals and students.

- Google SGE excels at shopping and product comparisons, with a 34% increase in product-related queries since Q1 2025.

- Bing Chat answers tend to be longer and more context-aware, averaging 278 words per AI response, compared to Google SGE’s 191-word average.

- Microsoft is rolling out plugin support for Bing Chat, enabling integrations with WolframAlpha, OpenTable, and GitHub, expanding its functionality.

- Google’s SGE experience is more tightly integrated with Google Shopping, Maps, and Flights, boosting cross-platform usage.

- In user preference tests, 61% of participants chose Bing Chat for task-based queries, while Google was preferred for quick answers and news.

Privacy Features and Data Handling

- Google continues to track user data across services, though it has introduced AI-powered Privacy Sandbox tools as part of Chrome and Search.

- Bing emphasizes data minimization, and its enterprise version, Bing for Business, is GDPR and CCPA compliant by default.

- As of 2025, 37% of Google users express concern over their data being used to train AI models, compared to 21% of Bing users.

- Google’s ad personalization settings are opt-out by default, while Bing allows fine-tuned opt-in preferences in its Microsoft Account settings.

- DuckDuckGo remains the leader in privacy-focused search, but Bing now offers a Private Mode, blocking third-party trackers during AI interactions.

- Google Chrome collects more than 30 types of user signals, while Microsoft Edge collects 12 key metrics, mostly device-level only.

- In an independent audit, Google was found to store anonymized search logs for 26 months, while Bing retains user data for 18 months or less.

- Microsoft introduced a transparent AI training log for Bing Chat in 2025, letting users see how their inputs are anonymized and used.

- 81% of enterprise IT managers said Bing is easier to configure for compliance than Google Search in corporate environments.

- Google received 2.7 million user data requests from governments worldwide in 2024, while Microsoft received 1.1 million, according to transparency reports.

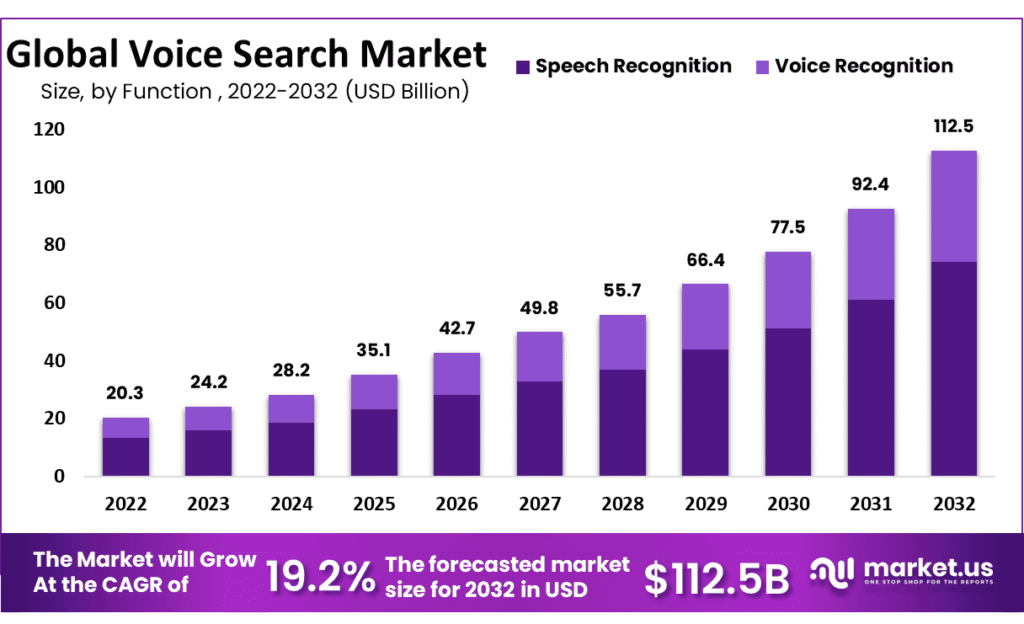

Global Voice Search Market Forecast Highlights (2022–2032)

- 2022: Market size was $20.3B, marking the starting point of rapid growth. Voice technologies began seeing wider consumer adoption.

- 2023: Reached $24.2B, a modest increase. Businesses started integrating voice tools into customer service.

- 2024: Grew to $28.2B, showing steady acceleration. More devices incorporated voice capabilities.

- 2025: Market hit $35.1B, nearly doubling from 2022. Growth is driven by smart assistants and home automation.

- 2026: Valued at $42.7B, demand surged. Both the enterprise and consumer sectors expanded usage.

- 2027: Jumped to $49.8B, maintaining strong momentum. Voice interfaces became the norm across platforms.

- 2028: Increased to $55.7B, showing resilience. Adoption spread across healthcare, retail, and finance.

- 2029: Climbed to $66.4B, marking a significant rise. AI improvements boosted accuracy and appeal.

- 2030: Market reached $77.5B, nearly 4x from 2022. Enterprises relied more on voice analytics and automation.

- 2031: Hit $92.4B, with growth outpacing expectations. Emerging markets contributed to global expansion.

- 2032: Forecasted at $112.5B, a fivefold increase. Voice tech is expected to be a core interface by then.

Traffic Sources and Referral Statistics

- Google drives over 63% of all global website referral traffic, while Bing accounts for 6.1%, a modest increase from 5.4% in 2024.

- Organic traffic from Bing rose 11.6% year-over-year, driven largely by growth in desktop use and AI-powered queries.

- Google remains the primary traffic source for news websites (74%), eCommerce (68%), and blogs (59%).

- Bing drives higher-converting traffic in B2B and finance sectors, with visitors spending 23% more time on-site than Google-referred users.

- Bing accounts for 14% of desktop search referrals in the US, compared to Google’s 71%, with Yahoo and DuckDuckGo sharing the rest.

- Google’s Discover and News platforms generate over 12 billion clicks monthly, a feature Bing doesn’t yet replicate.

- Chrome’s dominance (with 65% global browser share) gives Google significant control over search traffic flow and link previews.

- Referral bounce rates are lower from Bing (43%) compared to Google (52%), indicating more targeted traffic patterns.

- Google AMP results, though declining, still deliver 1.6 billion monthly visits globally, whereas Bing has no comparable mobile-first format.

- Google Search referrals peaked during seasonal events, while Bing peaked during work hours, due to enterprise use.

SEO Impact and Indexing Differences

- Google indexes over 50 billion web pages daily, while Bing indexes approximately 12 billion, with a focus on canonical and authoritative content.

- Googlebot crawls sites more aggressively, up to every few minutes for high-authority domains, compared to Bingbot’s average crawl of once every few hours.

- Mobile-first indexing is used by Google on 100% of websites, while Bing still uses desktop-first crawling for 38% of indexed sites.

- Bing favors structured content and rewards table-based data and FAQ schema, often elevating them in SERPs.

- Google uses over 200 ranking signals, including page experience, Core Web Vitals, and E-E-A-T, whereas Bing places heavier emphasis on contextual relevance and semantic matching.

- Google’s indexing speed is 2–3x faster for new content compared to Bing, though Bing is better at persisting historical pages.

- Video indexing and podcast snippets are stronger on Google, especially via YouTube integration, while Bing relies on third-party sources.

- Google’s RankBrain and BERT algorithms continue to influence top results, while Bing leans on GPT-style language models for interpretation.

- Bing Webmaster Tools saw a 38% increase in usage in 2025, especially among small businesses optimizing for lower-competition keywords.

- 78% of SEO professionals still optimize primarily for Google, though 14% now say Bing is part of their SEO strategy, particularly in B2B.

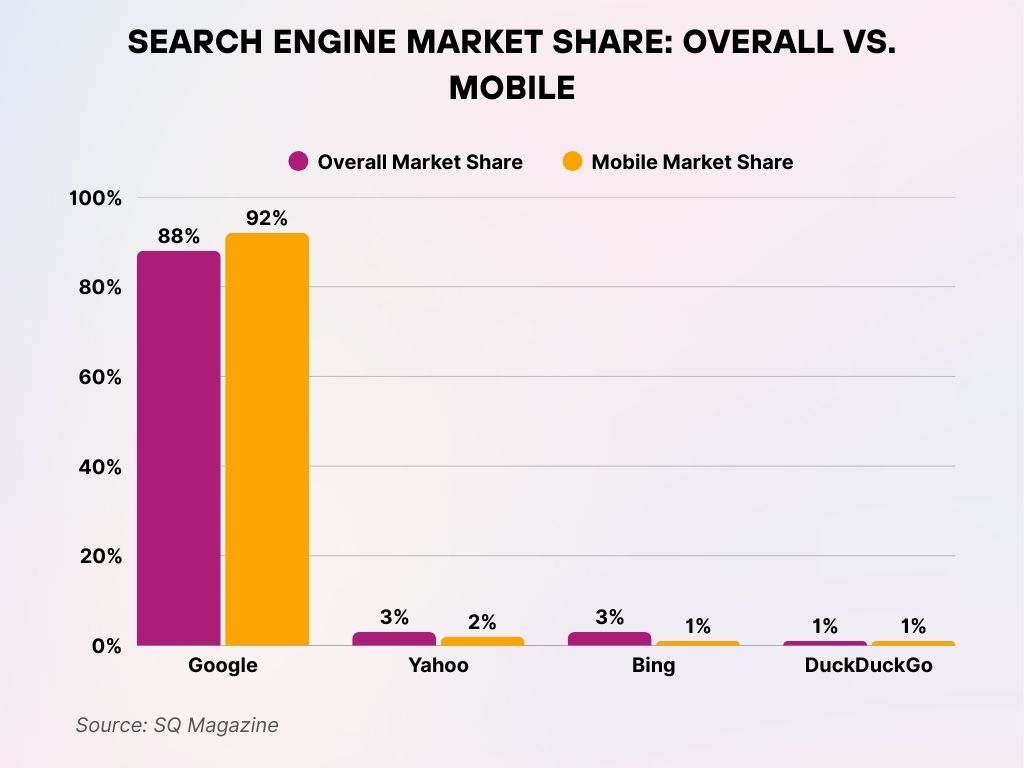

Search Engine Market Share: Overall vs. Mobile

- Google dominates both segments with 88% overall and an even higher 92% on mobile, confirming its global search leadership.

- Yahoo holds 3% overall market share and 2% on mobile, maintaining a minor yet consistent presence.

- Bing also has 3% overall, but only 1% mobile share, indicating lower usage on smartphones.

- DuckDuckGo accounts for 1% in both overall and mobile markets, reflecting steady niche usage focused on privacy.

Recent Developments

- In early 2025, Google rolled out SGE to over 120 countries, expanding its AI-driven search capabilities beyond English and US-based users.

- Bing introduced Bing Chat Pro, a premium-tier search assistant for enterprise users, offering document generation, spreadsheet analysis, and CRM plug-ins.

- Google is experimenting with Gemini AI responses embedded into Gmail, Docs, and Calendar, enhancing multi-app productivity.

- Microsoft added live citations and footnotes to Bing Chat results in March 2025, addressing prior concerns over transparency and hallucination.

- Google’s antitrust investigations continue in the EU and US, especially around search bundling with Android, while Microsoft has gained positive regulatory attention for “competitive innovation.”

- Bing announced a zero-click search interface, surfacing answers inline with no need to open pages, mirroring Google’s earlier moves.

- Google added a Search Customization Score to its console, showing users how personalized their results are and offering control toggles.

- Bing partnered with LinkedIn Learning to serve job-focused search enhancements within Bing AI responses.

- Microsoft Edge surpassed 600 million users globally, many of whom default to Bing due to native settings.

- Google continues to invest heavily in multilingual search AI, pushing Gemini to outperform ChatGPT in non-English search fluency tests.

Conclusion

As we move deeper into 2025, the search engine landscape is no longer a one-horse race. Google still leads by a wide margin in terms of reach, speed, and monetization, but Bing has carved out a formidable space, particularly among enterprise users and desktop searchers. With the rise of AI integrations, voice and visual search, and a growing interest in privacy-first alternatives, the future of search is not only about answers, but how and where we get them.

Whether you’re a marketer, developer, researcher, or everyday user, understanding the differentiated strengths of Bing and Google will help you navigate the evolving digital ecosystem more intelligently.