WHAT WE HAVE ON THIS PAGE

- Editor’s Choice

- Top-Selling Video Games by Overall Sales

- Global Revenue of the Video Games Industry

- Top Video Game Publishers by Revenue

- Public Opinion on Politics in Video Games

- Most Played Games Worldwide

- Regional Insights: North America, Europe, Asia-Pacific

- Age Demographics of Video Game Players

- Consumer Spending Trends in Gaming

- Growth of Cloud Gaming and Game Streaming Services

- Teen Friendships Formed Through Video Games

- Rise of Subscription-Based Gaming Models

- Impact of Esports on the Gaming Economy

- Market Share by Platform (Console, PC, Mobile)

- Mobile Gaming Statistics and User Demographics

- Virtual Reality (VR) and Augmented Reality (AR) in Gaming

- Most Popular Video Game Genres

- In-Game Advertising and Monetization Trends

- Impact of AI and Emerging Tech on Game Development

- Video Game Industry Employment and Workforce Trends

- Regulatory Developments and Industry Challenges

- Conclusion

- Sources

Picture this: It’s 2025, and your 10-year-old cousin is playing an augmented reality (AR) Pokémon game in the backyard while your grandfather is crushing levels in Candy Crush on his phone. Video games are no longer just about consoles and teenagers locked in their rooms. They’ve evolved into a global, intergenerational, and multi-platform economy that’s touching nearly every part of our digital lives.

The video games industry in 2025 is faster, larger, and more fragmented than ever. From record-breaking revenues to the meteoric rise of mobile gaming and the continued innovation in virtual experiences, this year is shaping up to be one of the most pivotal in gaming history.

Editor’s Choice

- The global video game industry is projected to generate $260 billion in revenue in 2025, a 7.9% increase from the previous year.

- Mobile gaming continues to dominate, accounting for 49% of total global gaming revenue in 2025.

- The number of active gamers worldwide has reached 3.49 billion, up from 3.26 billion in 2024.

- Esports will surpass $3.6 billion in market value in 2025, driven by sponsorships and streaming deals.

- The average monthly spend per U.S. gamer is now $82, reflecting higher engagement across platforms.

- Game subscriptions are expected to reach 235 million users globally by the end of 2025.

- The gaming industry now supports over 330,000 full-time jobs in the U.S. alone.

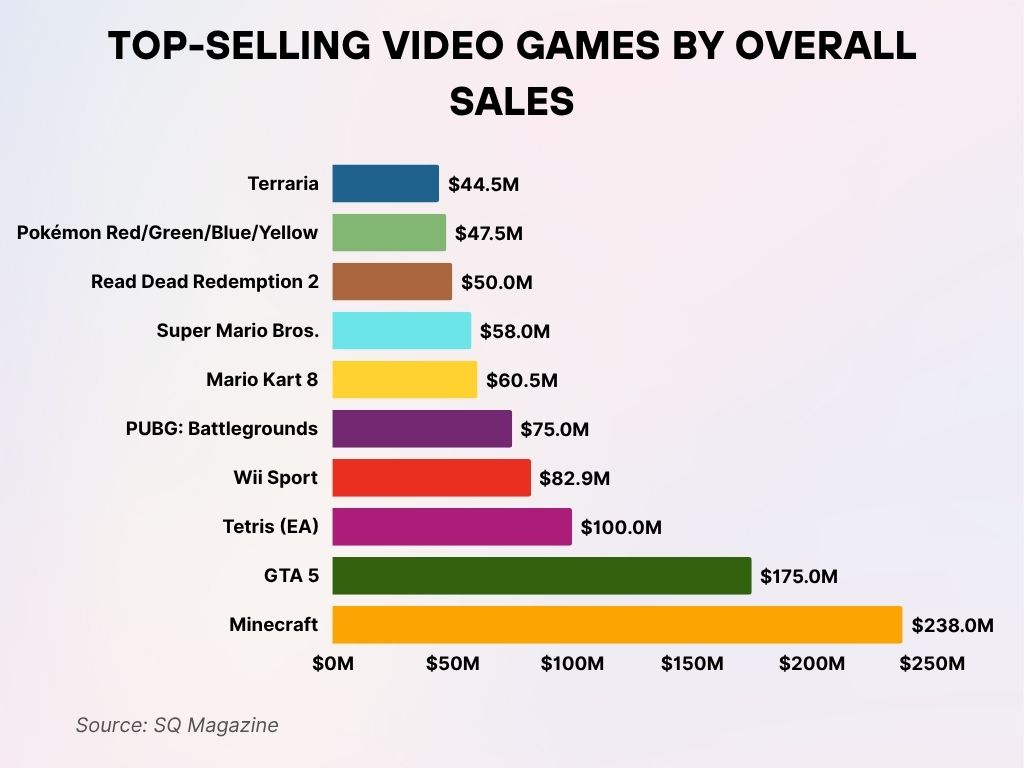

Top-Selling Video Games by Overall Sales

- Minecraft leads the chart with a staggering 238 million copies sold, making it the best-selling video game of all time.

- GTA 5 holds second place with 175 million units sold globally.

- Tetris (EA version) follows with 100 million sales, showing the timeless appeal of classic games.

- Wii Sport achieved impressive success with 82.9 million copies sold, largely driven by console bundles.

- PUBG: Battlegrounds reached 75 million in sales, demonstrating the popularity of the battle royale genre.

- Mario Kart 8 surpassed the 60-million mark, with 60.5 million units sold.

- Super Mario Bros., a legendary title, has sold 58 million copies since its release.

- Red Dead Redemption 2, Rockstar’s cinematic open-world western, sold 50 million units.

- Pokémon Red/Green/Blue/Yellow collectively sold 47.5 million, showing the long-standing popularity of the franchise.

- Terraria, a sandbox adventure game, achieved 44.5 million in global sales, securing its place among top indie successes.

Global Revenue of the Video Games Industry

- In 2025, global revenue from video games is expected to hit $260 billion, compared to $241 billion in 2024.

- North America will contribute $64.5 billion, while the Asia-Pacific region will lead with $102.3 billion in revenue.

- Europe is forecasted to generate $47.8 billion, marking a 6.2% year-over-year growth.

- In-game purchases make up 51% of total revenue, up from 48% last year.

- Premium console game sales account for $39.7 billion, with titles from Nintendo and Sony leading the charts.

- PC gaming revenues are estimated at $38 billion, showing stable growth due to cross-platform integration.

- Indie games now contribute nearly $5.1 billion in global sales, a 12% increase from 2024.

- The subscription model segment has surpassed $12.4 billion, growing 15.3% year-over-year.

- Microtransactions and downloadable content (DLC) combined will bring in over $68 billion in 2025.

- Virtual item trading and blockchain-based game economies will account for $4.2 billion, double last year’s total.

Top Video Game Publishers by Revenue

- Tencent retains the top spot with $33.2 billion in game revenue for 2025.

- Sony Interactive Entertainment follows with $23.4 billion, bolstered by strong PS5 sales and exclusive releases.

- Apple ranks third, generating $19.6 billion through App Store gaming alone.

- Microsoft Gaming, including Xbox and Activision Blizzard, hit $18.3 billion in combined revenue.

- NetEase secured $11.7 billion, thanks to its strong lineup of mobile MMORPGs.

- Nintendo saw $10.2 billion, driven by Switch 2 and franchise titles like Zelda: Echoes of Time.

- Electronic Arts (EA) generated $7.9 billion, with FIFA 25 and Apex Legends leading the pack.

- Take-Two Interactive crossed the $5.4 billion mark, buoyed by the launch of GTA VI Online expansions.

- Ubisoft posted $4.3 billion, supported by a resurgence in Assassin’s Creed: Red Empire.

- Epic Games, powered by Fortnite’s new creator ecosystem, recorded $4.1 billion in revenue.

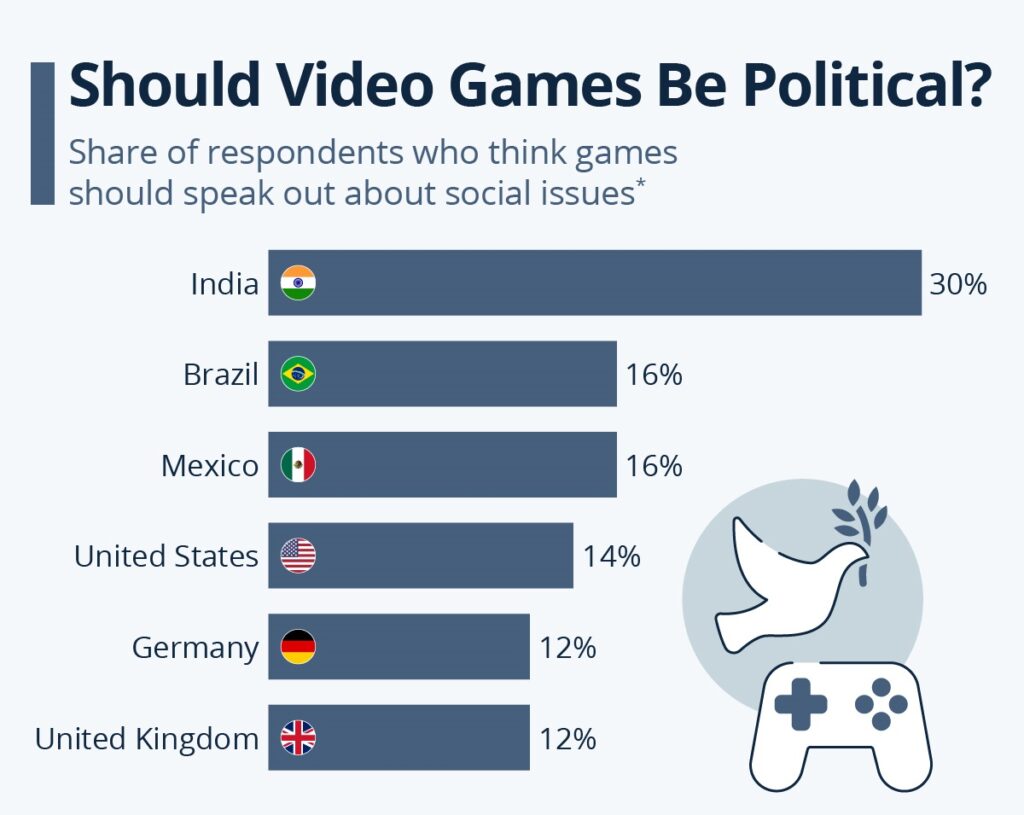

Public Opinion on Politics in Video Games

- India leads with 30% of respondents believing that games should address social issues.

- Brazil and Mexico both show 16% support for political expression in gaming.

- In the United States, 14% of respondents think video games should speak out on societal topics.

- Germany and the United Kingdom are tied at the bottom with only 12% agreement.

These insights highlight regional differences in how video games are perceived as platforms for political or social commentary.

Most Played Games Worldwide

- Fortnite remains the most-played game globally in 2025, with more than 290 million monthly active users.

- Roblox boasts 238 million monthly players, with 51% of them under 18 years old.

- Call of Duty: Warzone sees 162 million active users, driven by new seasonal content.

- Minecraft is still going strong with 185 million monthly users worldwide.

- PUBG Mobile has crossed 130 million monthly active users globally.

- League of Legends maintains a base of 98 million active players, particularly strong in Asia.

- Genshin Impact hit 80 million global monthly users, generating $2.1 billion in annual revenue.

- EA FC 25 (formerly FIFA) has 74 million monthly active players post-launch in September 2025.

- Valorant reached 65 million monthly players, with high engagement among Gen Z.

- The indie hit Palworld grew to 45 million players in under six months, fueled by its viral appeal on streaming platforms.

Regional Insights: North America, Europe, Asia-Pacific

- Asia-Pacific leads the global gaming market with $102.3 billion in revenue in 2025, up 6.7% from 2024.

- North America remains the second-largest region, contributing $64.5 billion, led by the U.S. at $57.9 billion.

- Europe saw strong growth with $47.8 billion in gaming revenue, thanks to surges in Germany, the UK, and France.

- Japan maintains its top-three status in Asia, contributing $21.6 billion, driven by console loyalty and mobile integration.

- India’s gaming market reached $4.9 billion, with over 510 million gamers—a 12.5% growth year-over-year.

- China alone generated $48.2 billion in revenue, making it the single largest country market globally in 2025.

- The Middle East & Africa gaming market is now worth $7.2 billion, fueled by mobile and esports growth in countries like Saudi Arabia.

- Latin America surpassed $5.9 billion, with Brazil accounting for 41% of the region’s gaming income.

- The U.S. saw the average gamer spend 16.8 hours per week on games in 2025, up from 15.3 in 2024.

- Regional esports viewership in Southeast Asia rose by 22%, making it the fastest-growing esports market globally.

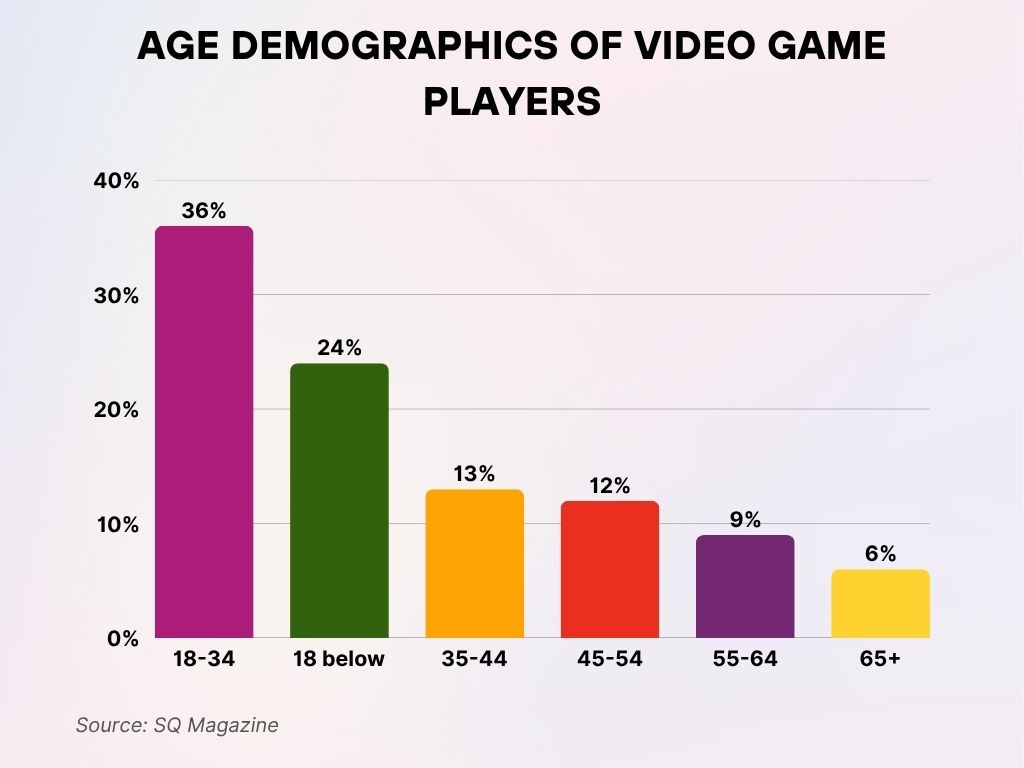

Age Demographics of Video Game Players

- The largest group of gamers falls within the 18 to 34-year range, accounting for 36% of all video game players.

- 24% of players are under 18 years old, highlighting the strong presence of younger audiences in the gaming world.

- Gamers aged 35 to 44 years make up 13% of the total gaming population.

- Those aged 45 to 54 years represent 12%, indicating notable mid-life engagement in gaming.

- The 55 to 64-year-old group contributes 9% to the gaming community.

- Players aged 65 and above account for 6%, showing that gaming reaches all age groups.

Consumer Spending Trends in Gaming

- Total consumer spending on games in the U.S. hit $58.1 billion in 2025, up from $52.6 billion in 2024.

- The average American household spends $940 annually on gaming-related expenses.

- In-game purchases remain the top spending category, comprising 54% of total consumer spend.

- Subscription services such as Xbox Game Pass and PlayStation Plus grew to a $7.1 billion segment in the U.S.

- Over 82% of U.S. gamers made at least one in-game purchase in the past six months.

- Physical game sales accounted for only 7% of total spending, down from 10% last year.

- 31% of gamers now use “Buy Now, Pay Later” options for gaming hardware purchases.

- Gift cards and prepaid gaming credits make up $3.3 billion of consumer spend.

- Teen gamers (ages 13–17) spent an average of $38/month, mostly on skins and in-game currencies.

- Women gamers aged 25–44 increased their average annual spend by 14.6% to $563 per person in 2025.

Growth of Cloud Gaming and Game Streaming Services

- Global revenue for cloud gaming is projected at $9.8 billion in 2025, a 26% increase from 2024.

- Over 41 million users globally are now subscribed to cloud gaming platforms such as NVIDIA GeForce NOW and Xbox Cloud Gaming.

- The U.S. cloud gaming market alone will generate $2.1 billion this year.

- 78% of Gen Z gamers have tried at least one cloud gaming service in the past 12 months.

- Latency improvements in 5G networks have reduced average lag to under 30ms in top cities.

- Netflix Games has grown its user base to 22 million, offering over 80 playable titles via streaming.

- Browser-based cloud gaming has gained traction, with 12% of U.S. gamers using it weekly.

- Streaming-to-TV features are used by 34% of subscribers in 2025, up from 24% last year.

- Cloud gaming on handhelds like Logitech G Cloud and Razer Edge now accounts for $720 million globally.

- Twitch integration into streaming services now allows real-time viewer interaction for over 68% of live-streamed titles.

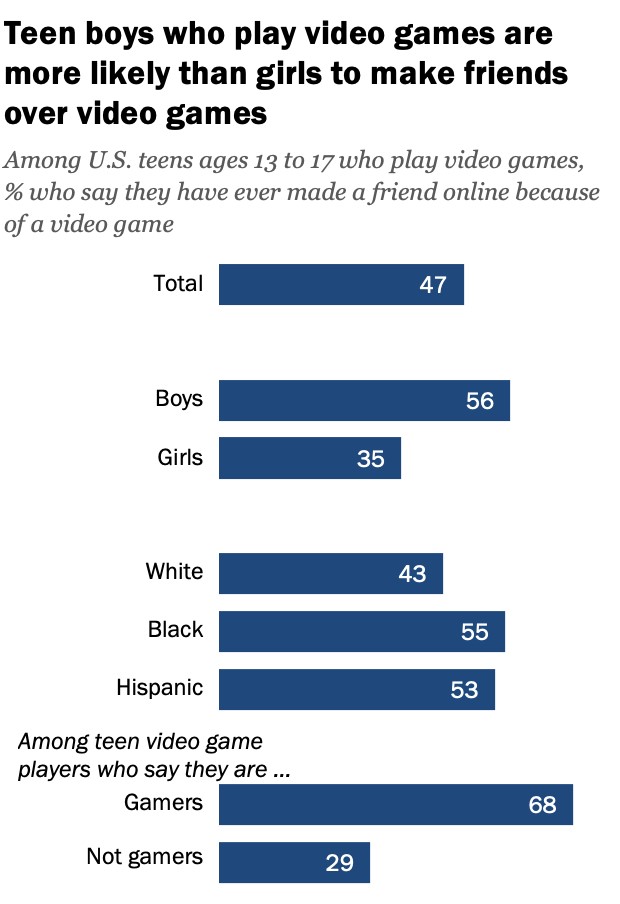

Teen Friendships Formed Through Video Games

- 47% of U.S. teens aged 13 to 17 who play video games say they’ve made a friend online through gaming.

- Teen boys are significantly more likely than girls to form friendships via games, with 56% of boys vs. 35% of girls reporting this.

- By race:

- 55% of Black teens and 53% of Hispanic teens have made friends through video games.

- In comparison, 43% of White teens reported the same.

- Among self-identified teen gamers, 68% say they’ve made a friend over a video game.

- Only 29% of non-gamers report forming friendships through video games.

Rise of Subscription-Based Gaming Models

- In 2025, global gaming subscription revenue is estimated at $14.3 billion, up 18.5% from 2024.

- Xbox Game Pass leads with 41.2 million subscribers globally.

- PlayStation Plus has expanded its user base to 49.7 million subscribers across tiers.

- Apple Arcade and Google Play Pass combined have 38.1 million paying users in 2025.

- Over 65% of Gen Alpha gamers are active on at least one gaming subscription service.

- 27% of all new games released in 2025 are available on a subscription at launch.

- Bundle models, such as Amazon Prime Gaming, increased their uptake by 22% this year.

- In Latin America, subscription adoption grew by 39%, led by Brazil and Mexico.

- Game streaming bundles now include cloud access, exclusive DLCs, and esports tickets, boosting value perception.

- The average retention rate for gaming subscription services reached 81%, up from 74% in 2024.

Impact of Esports on the Gaming Economy

- The global esports industry will surpass $3.6 billion in value by the end of 2025.

- Over 720 million people worldwide are expected to watch esports content this year.

- Sponsorship revenue alone contributes $1.7 billion, up 15.4% from last year.

- The U.S. esports economy is worth $670 million, driven by college-level tournaments and city-based leagues.

- Top esports title League of Legends generated $410 million from esports-related content and merchandising.

- Prize pools continue to rise, with The International 2025 reaching a record $39 million.

- The average salary for a top-tier esports pro player in the U.S. is now $192,000, excluding bonuses.

- More than 70 colleges now offer accredited esports degree programs.

- Virtual stadiums and metaverse arenas generated $143 million in combined ticket and digital merch revenue.

- Esports-themed NFTs and collectibles will generate $540 million globally in 2025.

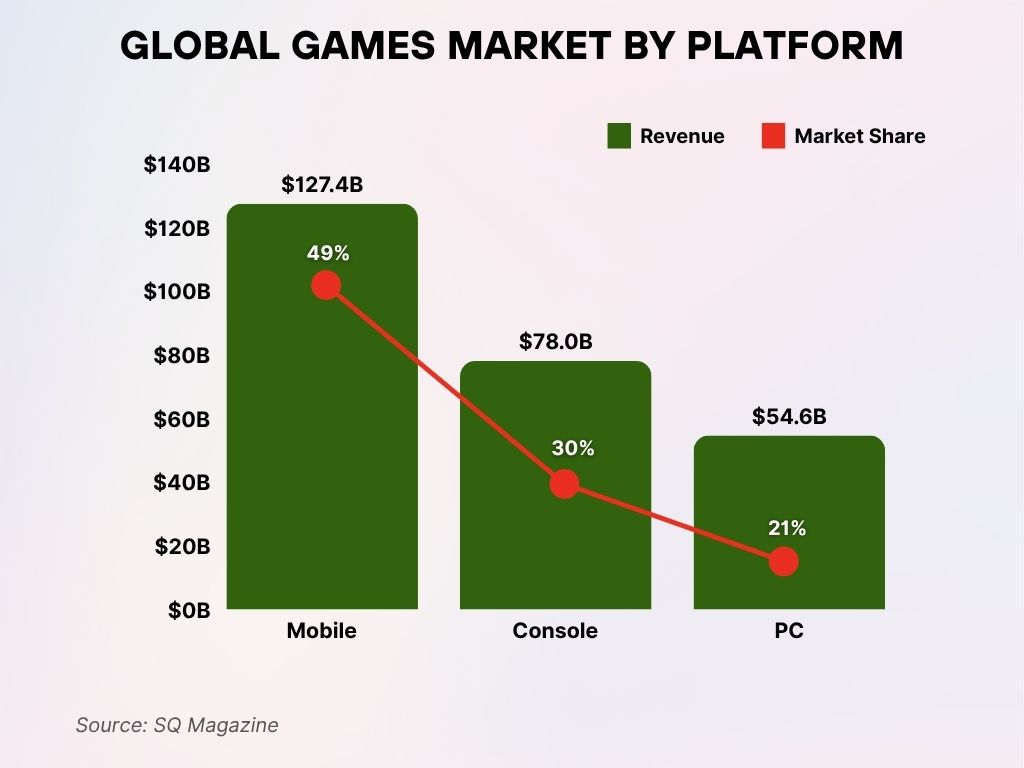

- Mobile gaming holds the largest market share at 49%, equating to $127.4 billion in 2025.

- Console gaming accounts for 30%, generating $78 billion globally.

- PC gaming comprises 21% of the market with $54.6 billion in revenues.

- Cloud gaming revenue within mobile platforms reached $9.6 billion.

- Handheld consoles like the Nintendo Switch 2 and Steam Deck 2 contribute $12.8 billion in combined revenue.

- AAA console titles generate $21.9 billion, while mobile-first titles like Honor of Kings and Genshin Impact dominate with over $2 billion each.

- Cross-platform multiplayer games account for 36% of total engagement hours across all systems.

- Gaming via smart TVs and non-traditional consoles saw a 14% increase in usage from last year.

- Tablet-based gaming represents 9.1% of mobile gaming revenues.

- Wearable device-based gaming, such as with AR glasses, is a growing niche worth $1.2 billion in 2025.

Mobile Gaming Statistics and User Demographics

- Mobile games will generate $127.4 billion globally in 2025, retaining their dominant market share.

- There are now 2.7 billion mobile gamers worldwide—77% of all gamers.

- The top three grossing mobile titles globally are Honor of Kings, Genshin Impact, and PUBG Mobile.

- In the U.S., mobile gaming accounts for 53% of all gaming time among women ages 18–34.

- Hyper-casual games lead downloads with 16.2 billion global installs so far in 2025.

- Time spent on mobile gaming per day averages 54 minutes, up 6% from 2024.

- 60% of mobile gamers are aged between 18 and 35, with women representing 46% of all users.

- In-app purchases are most common among players aged 25–34, with an average spend of $68/month.

- Multiplayer mobile titles are played by 1.2 billion users—nearly half of all mobile gamers.

- Rewarded video ads remain the most preferred monetization format, with a 56% opt-in rate among users.

Virtual Reality (VR) and Augmented Reality (AR) in Gaming

- The VR and AR gaming market is projected to reach $14.1 billion in 2025, up from $11.3 billion in 2024.

- Over 51 million people globally now engage with VR/AR games at least once a month.

- Meta Quest 3 leads headset sales in 2025, with over 5.7 million units sold year-to-date.

- AR gaming apps like Peridot and Minecraft Earth 2.0 saw a 48% increase in daily active users.

- The average VR gamer spends 4.5 hours/week immersed in virtual environments.

- 36% of all new VR games launched in 2025 support full hand tracking and haptics.

- VR arcades are rebounding post-pandemic, contributing $580 million globally in venue-based gaming revenue.

- Multiplayer VR titles like Population: ONE and Ghosts of Tabor saw a 63% jump in active users.

- Apple Vision Pro’s gaming division is expected to contribute $1.3 billion in platform revenues by year-end.

- 59% of VR gamers use the technology primarily for fitness, puzzle-solving, or narrative adventures.

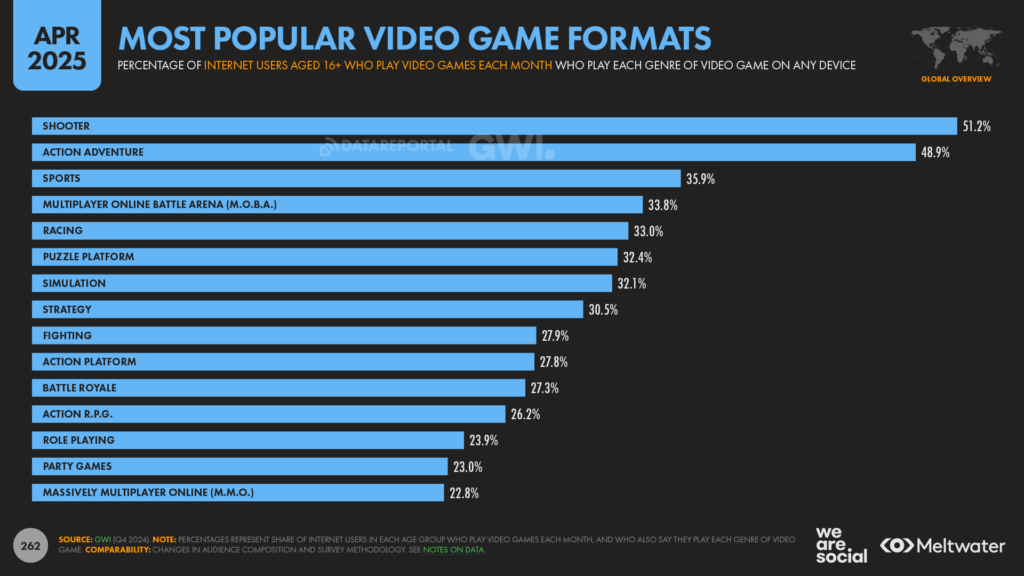

Most Popular Video Game Genres

- Shooter games are the most played genre, with 51.2% of internet users aged 16+ playing them monthly.

- Action-adventure titles follow closely with 48.9% monthly engagement.

- Sports games attract 35.9% of players worldwide.

- MOBA (Multiplayer Online Battle Arena) titles are played by 33.8% of gamers.

- Racing games are favored by 33.0% of players.

- Puzzle platformers engage 32.4% of monthly gamers.

- Simulation games see 32.1% regular player participation.

- Strategy games maintain a strong presence with 30.5% player engagement.

- Fighting games and action platformers are each played by around 27.9% and 27.8%, respectively.

- Battle royale games continue their popularity with 27.3% of players.

- Action RPGs (Role-Playing Games) are chosen by 26.2% of users.

- Traditional RPGs hold a smaller share at 23.9%, followed by party games at 23.0%.

- MMOs (Massively Multiplayer Online) close the list at 22.8% monthly usage.

In-Game Advertising and Monetization Trends

- In-game advertising revenue will surpass $18.6 billion in 2025, reflecting a 16% year-over-year growth.

- Programmatic ads now make up 61% of in-game ad placements globally.

- Interactive ad formats, such as playable demos and reward-based video ads, have a 72% completion rate.

- 43% of gamers aged 18–24 say they’ve discovered a new brand through in-game advertising.

- Ad revenue from mobile games alone accounts for $11.2 billion in 2025.

- Console and PC platforms combined are expected to generate $6.4 billion through in-game branded integrations.

- Branded skins and collectibles represent a $1.1 billion monetization segment this year.

- Native advertising in metaverse-style games grew 28%, with platforms like Roblox and Fortnite leading the way.

- Esports sponsorship via in-game billboards and overlays has brought in $830 million globally.

- Gamers who engage with in-game ads spend 21% more on in-game content on average.

Impact of AI and Emerging Tech on Game Development

- 87% of AAA studios are using AI in some part of their game development pipeline in 2025.

- AI-assisted NPC behavior now features in 64% of new game titles.

- Procedural content generation through AI has reduced dev cycles by 28% on average.

- Real-time voice cloning and language localization powered by AI now support over 90 languages in top titles.

- AI-driven cheat detection software reduced ban appeal rates by 41% in competitive online games.

- Generative AI tools are used by 52% of indie developers for asset creation and prototyping.

- Predictive AI models help tailor game difficulty, used in 34% of mobile and console games this year.

- Neural rendering is enabling photorealistic cutscenes with 60% fewer resources than pre-rendered cinematics.

- Blockchain-backed AI game economies are being trialed in over 40 mid-tier studios.

- Voice-to-motion tools using AI are now standard in performance capture for AAA RPGs and simulators.

Video Game Industry Employment and Workforce Trends

- The global gaming workforce is expected to grow to over 530,000 employees in 2025.

- The U.S. alone now employs more than 330,000 professionals in gaming, from development to marketing.

- Women now represent 28% of the industry workforce, with 12% in technical roles.

- Remote work remains dominant, with 57% of game developers working in hybrid or fully remote setups.

- Union membership among game workers rose by 8.5%, especially in QA and narrative design sectors.

- Average salaries for senior developers in the U.S. are $121,000/year, a 6% increase from last year.

- Game localization jobs have risen 21% due to the global expansion of franchises and language offerings.

- Studios focused on DEI (Diversity, Equity, and Inclusion) report 23% higher retention rates than average.

- The top 5 fastest-growing job titles in 2025 are: AI Developer, Community Manager, UX Researcher, Cloud Infrastructure Engineer, and Narrative Designer.

- Internship programs have grown, with over 8,400 students placed in gaming-related roles in North America this year.

Regulatory Developments and Industry Challenges

- The U.S. Federal Trade Commission (FTC) has introduced new guidelines on loot boxes, effective Q3 2025.

- China continues its gaming curfew, now applying restrictions to users under 21 and adding biometric enforcement.

- The European Commission’s Digital Markets Act impacts mobile gaming storefronts, demanding fairer app store policies.

- India passed a national framework for gamified education and esports, encouraging domestic investment.

- Data privacy compliance under GDPR 2.0 now requires game studios to verify data deletion mechanisms.

- Misinformation and deepfake mods have prompted platform-level content moderation laws in Australia and the EU.

- Environmental regulations are pushing publishers to reduce game file sizes and server energy usage.

- Cybersecurity threats rose 18%, with ransomware attacks targeting popular gaming studios and streamers.

- The industry is under pressure to address crunch culture, with California considering legislation capping workweeks.

- Gamers’ class-action lawsuits around misleading DLC and preorders increased by 37% in 2025.

Conclusion

The video game industry in 2025 stands as a dynamic frontier, blending technology, culture, and global economics. With mobile games commanding nearly half of the market, esports becoming a mainstream spectacle, and AI redefining how games are built and played, this ecosystem is more diverse and complex than ever. New regulations, social expectations, and technological advancements will continue to shape what comes next, but one thing remains clear: the games are only getting better, and the players more engaged.

Sources

- https://www.statista.com/topics/868/video-games/

- https://explodingtopics.com/blog/number-of-gamers

- https://www.precedenceresearch.com/video-game-market

- https://www.fortunebusinessinsights.com/video-game-market-102548

- https://www.theesa.com/resources/essential-facts-about-the-us-video-game-industry/2024-data/

- https://en.wikipedia.org/wiki/Video_game_industry

- https://techjury.net/industry-analysis/video-games-industry-statistics/

- https://www.mordorintelligence.com/industry-reports/global-gaming-market