WHAT WE HAVE ON THIS PAGE

- Editor’s Choice

- E-Sports Global Market Growth (2024–2029)

- Global Esports Market Size and Revenue

- Most Popular Esports Games by Viewership and Prize Pool

- Growth in Global Esports Viewership

- Esports Audience Growth and Demographics

- Top Esports Teams and Earnings

- Most Watched Esports Teams of 2024 (By Hours Watched)

- Regional Breakdown of Esports Popularity

- Sponsorships and Brand Investments in Esports

- Most Popular Esports Games in Q1 2025 (By Peak Viewers)

- Streaming Platforms and Esports Viewership Trends

- Mobile Esports Trends and Statistics

- Top TCL Winter 2025 Co-Casters

- Esports Player Salaries and Career Data

- Economic Impact of Esports Events

- E-sports Sponsorship Spending by Industry

- College and Scholastic Esports Growth

- Gender Representation in Esports

- Recent Developments in the Esports Industry

- Conclusion

- Sources

In a packed arena in Seoul, fans wave glowsticks and chant player names like they would for rock stars. But these athletes wield keyboards, not cleats. Welcome to the world of esports—a global phenomenon that has transformed competitive gaming into a billion-dollar industry with fans, brands, and broadcasters all scrambling to get a piece of the action.

Once seen as a niche subculture, esports in 2025 has become a powerful economic engine and cultural force. From multimillion-dollar prize pools to campus varsity leagues and primetime streaming, this ecosystem is no longer emerging—it’s established. In this article, we explore the most current, verified statistics that highlight just how fast—and how far—esports has come.

Editor’s Choice

Here are the standout esports statistics every reader should know in 2025:

- The global esports industry is expected to generate $1.79 billion in revenue in 2025, a 16.2% increase from 2024.

- Esports viewership is projected to surpass 640 million by the end of 2025, with over 56% of that audience watching from mobile devices.

- League of Legends, Counter-Strike 2, and Valorant remain the top three games in terms of combined viewership and prize pool growth.

- China, the US, and South Korea account for more than 50% of total global esports revenues.

- Sponsorships remain the primary revenue stream, contributing approximately $935 million globally in 2025.

- Women now make up 28% of the esports viewing audience in North America, marking a notable shift from 22% in 2020.

- Over 240 colleges in the US offer varsity esports programs with scholarships, up from 175 in 2023.

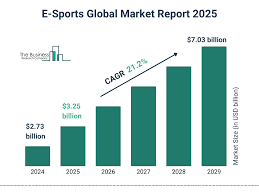

E-Sports Global Market Growth (2024–2029)

- The e-sports market size in 2024 was $2.73 billion.

- By 2025, the market is expected to grow to $3.25 billion.

- A compound annual growth rate (CAGR) of 21.2% is projected from 2024 to 2029.

- The market is set to reach $7.03 billion by 2029, more than doubling in five years.

Global Esports Market Size and Revenue

- The global esports market will be worth $1.79 billion in 2025, growing from $1.54 billion in 2024.

- Sponsorships and media rights account for nearly 65% of the industry’s total revenue in 2025.

- North America is projected to contribute over $600 million in esports revenue, the highest regional share globally.

- The Asia-Pacific region continues its dominance, generating over 48% of the global revenue.

- In-game advertising and merchandise sales will combine to generate more than $310 million globally in 2025.

- Ticket sales for live esports events are projected to hit $74 million, a sharp recovery post-pandemic.

- By 2025, the number of esports organizations valued at over $100 million will have doubled compared to 2023, now totaling 42 teams globally.

- Esports infrastructure investments are forecasted to exceed $240 million in 2025, particularly in the Middle East and Southeast Asia.

Most Popular Esports Games by Viewership and Prize Pool

- League of Legends (LoL) tops global charts with over 230 million cumulative hours watched in Q1 2025.

- Dota 2’s International 2025 broke records with a prize pool of $34.1 million, up from $32 million in 2023.

- Counter-Strike 2 now averages 1.3 million concurrent viewers during major tournaments.

- Valorant Champions Tour 2025 has awarded over $11 million across its global events.

- Fortnite’s 2025 World Cup returned with a $20 million prize pool, re-establishing its role in casual and competitive scenes.

- Mobile Legends: Bang Bang exceeded 42 million total views for its M5 World Championship.

- Call of Duty League (CDL) maintains a strong presence in North America with over $6 million in prize pools and a stable 650,000-viewer average per major.

- PUBG Mobile Esports is expanding fast in India and the Middle East, surpassing 900 million watch hours globally in 2025.

- Apex Legends Global Series had a prize pool of $5 million and reached a peak concurrent viewer count of 520,000.

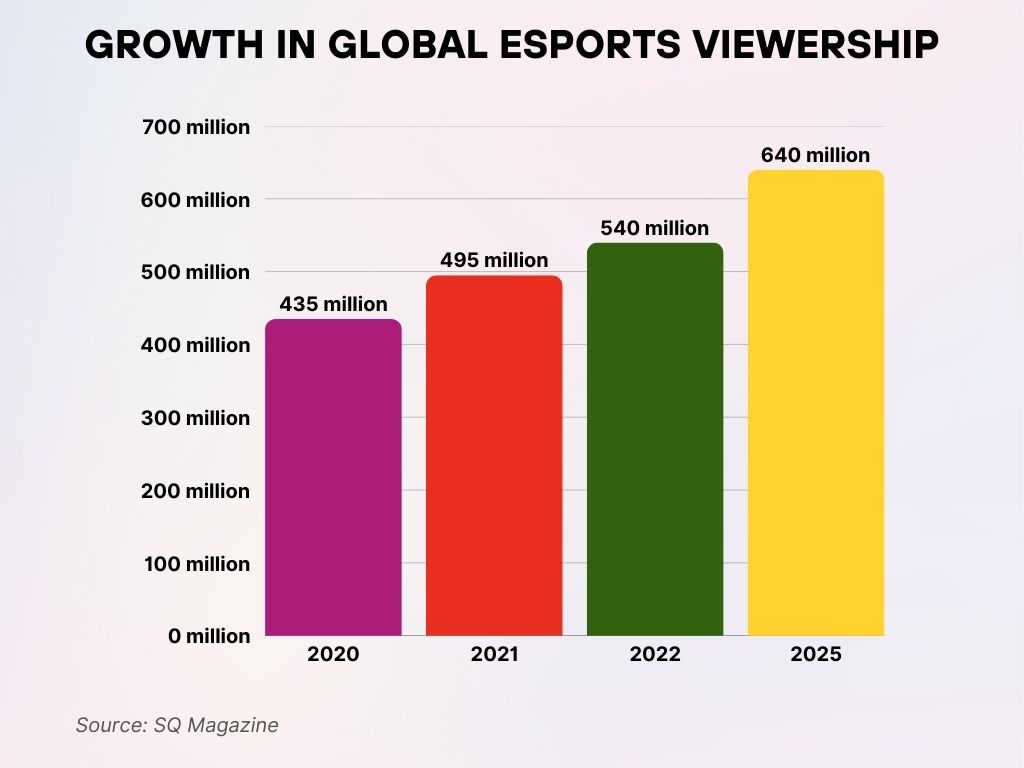

Growth in Global Esports Viewership

- In 2020, the global eSports audience reached 435 million viewers.

- Viewership grew to 495 million in 2021, showing a steady rise in popularity.

- By 2022, the global esports viewer count climbed to 540 million.

- The number of esports viewers is projected to hit 640 million by 2025, reflecting massive global engagement.

Esports Audience Growth and Demographics

- The total esports audience is projected to reach 641 million in 2025, a rise from 578 million in 2023.

- The core esports enthusiast segment now stands at 291 million, while casual viewers make up 350 million.

- In the US, 52% of esports fans fall between the ages of 18 and 34, with an average age of 26.

- Gen Z leads the charge, making up 43% of the global esports audience in 2025.

- Female viewership continues to grow, now comprising 28% of total esports fans in the US and 33% in Southeast Asia.

- Latin America saw a 19% YoY increase in viewership, with Brazil contributing the largest regional audience.

- YouTube and Twitch remain dominant platforms, but TikTok Live has increased its esports viewership share to 12% globally.

- 80% of esports viewers also identify as active gamers, showcasing strong ecosystem integration.

- The average esports session duration among US viewers is now 41 minutes, up from 35 minutes in 2023.

- Among global viewers, mobile devices are the preferred screen for 56% of all live tournament streams in 2025.

Top Esports Teams and Earnings

- Team Liquid leads globally with $46.3 million in total prize earnings as of Q1 2025.

- Gaimin Gladiators, dominating Dota 2 circuits, earned $9.2 million in 2024 alone.

- T1 Esports, heavily invested in League of Legends, surpassed $32 million in all-time tournament winnings.

- FaZe Clan boasts a diversified portfolio, with over $18 million in competitive winnings and a market valuation nearing $400 million.

- OG Esports remains one of the highest-earning Dota 2 teams with more than $38.5 million in total prize money.

- 100 Thieves continues to blend lifestyle branding with competitive gaming, generating over $110 million in revenue from esports and merch combined.

- NRG Esports earned $3.5 million across Rocket League and Valorant tournaments in 2024.

- In CS2, Natus Vincere (Na’Vi) is projected to surpass $25 million in historical earnings by mid-2025.

- Team Vitality, with its strategic expansion into India and Brazil, saw a 37% YoY increase in revenue in 2024.

- LOUD, based in Brazil, is the most-followed esports team on social media with over 16 million combined followers and earnings of $4.8 million in 2024.

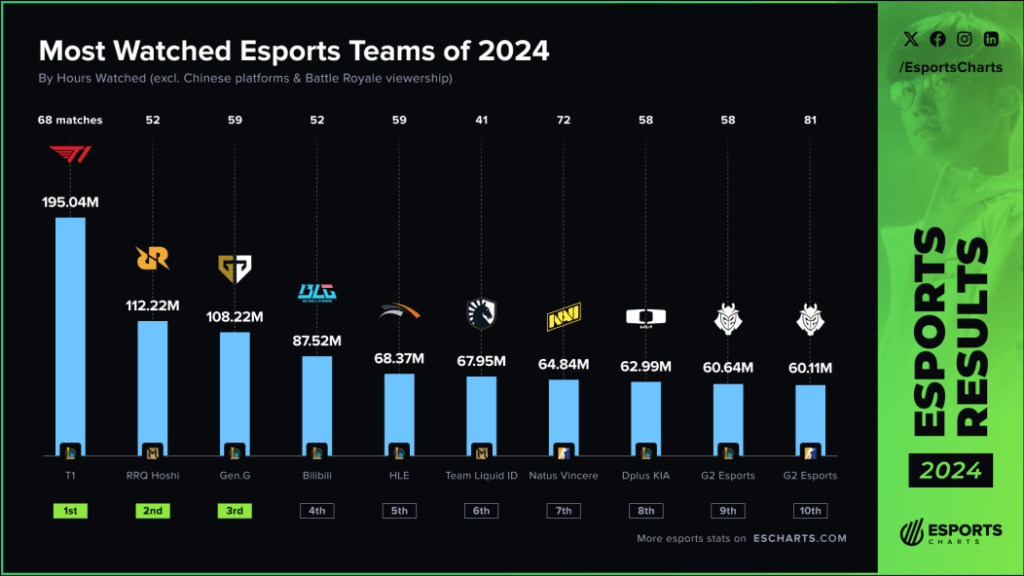

Most Watched Esports Teams of 2024 (By Hours Watched)

- T1 led the chart with 195.04 million hours watched across 68 matches, making it the most-watched team of 2024.

- RRQ Hoshi followed in second place with 112.22 million hours watched over 52 matches.

- Gen.G secured third place with 108.22 million viewing hours from 59 matches.

- Bilibili ranked fourth with 87.52 million hours watched across 52 matches.

- HLE (Hanwha Life Esports) drew 68.37 million viewing hours from 59 matches, ranking fifth.

- Team Liquid had 67.95 million watch hours over 41 matches, placing sixth.

- Natus Vincere (NaVi) earned 64.84 million hours watched from 72 matches.

- Dplus KIA was watched for 62.99 million hours in 58 matches.

- G2 Esports (first entry) recorded 60.64 million viewing hours from 58 matches.

- G2 Esports (second entry) had 60.11 million hours watched across 81 matches, rounding out the top ten.

Regional Breakdown of Esports Popularity

- Asia-Pacific remains the largest market, accounting for 51% of all esports viewership globally.

- China alone contributes over 400 million esports fans, with a projected $445 million in revenue in 2025.

- In the United States, esports will generate $338 million in 2025, led by sponsorship and collegiate growth.

- South Korea, despite its smaller population, maintains elite dominance in performance, contributing to 11% of all top-tier tournament wins.

- Europe collectively adds $245 million to the global esports economy, with Germany and France leading the regional viewership stats.

- Brazil is the fastest-growing esports market in Latin America, with over 34 million active fans and growing investment from telecoms.

- The Middle East and North Africa (MENA) region is emerging quickly, with a projected $110 million esports economy by the end of 2025.

- India’s esports base has grown to over 160 million gamers, fueled by mobile-first gaming and regional league support.

- Australia maintains a niche but loyal audience, contributing about $45 million annually through events and sponsorships.

- The Philippines has become a Southeast Asian hotspot, with Mobile Legends Pro League hitting a record viewership of 1.1 million peak viewers.

Sponsorships and Brand Investments in Esports

- Global sponsorship revenue for esports will reach $935 million in 2025, up from $842 million in 2024.

- Red Bull, Monster Energy, and Intel remain the top three sponsors across Tier 1 esports events.

- Luxury brands such as Gucci and Louis Vuitton have activated campaigns around Valorant and LoL for Gen Z appeal.

- Mercedes-Benz extended its partnership with ESL, investing $12 million in esports-specific branding in 2025.

- Amazon has become a leading sponsor of collegiate esports leagues, providing $5 million in scholarships and support infrastructure.

- Crypto and Web3 companies like Coinbase and ImmutableX cut their esports investments by 35% amid regulatory shifts in 2024.

- Over 200 new brands entered the esports space globally in the past 12 months, signaling increasing advertiser trust.

- Regional brands now account for 41% of all esports sponsorship activations, especially in Southeast Asia and Latin America.

- Hybrid live-virtual events, supported by sponsorship packages, generated $57 million in additional brand exposure in 2024.

- In-game product placements and branded team skins now represent 9% of esports ad revenue, a trend expected to grow further.

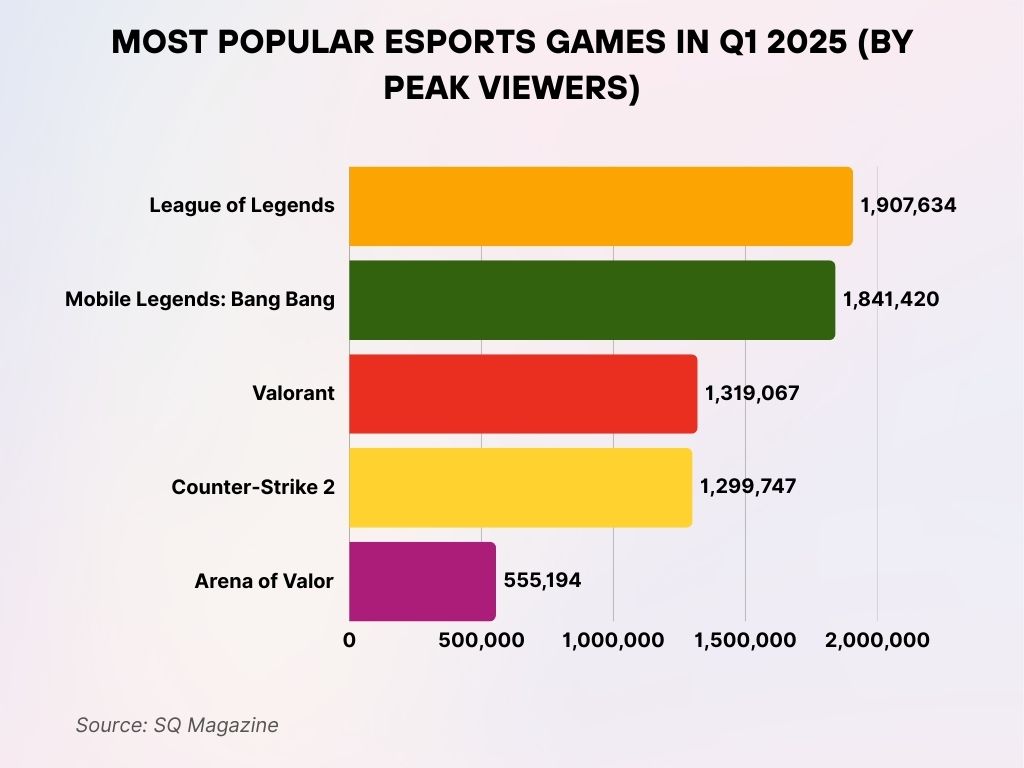

Most Popular Esports Games in Q1 2025 (By Peak Viewers)

- League of Legends dominated Q1 2025 with 1,907,634 peak viewers, making it the most-watched esports game of the quarter.

- Mobile Legends: Bang Bang followed closely with 1,841,420 peak viewers, securing the second spot in global popularity.

- Valorant attracted 1,319,067 peak viewers, maintaining its strong position among top competitive titles.

- Counter-Strike 2 drew in 1,299,747 peak viewers, showing consistent audience engagement since its release.

- Arena of Valor reached 555,194 peak viewers, rounding out the list of the top five most-viewed esports games.

Streaming Platforms and Esports Viewership Trends

- Twitch retains its leadership with 71% of total esports streaming hours, though Kick and YouTube Gaming continue to grow.

- YouTube Gaming hit 11 billion gaming watch hours in 2024, with esports accounting for 2.4 billion of those hours.

- TikTok Live increased esports-related content viewership by 39% YoY, making it the fastest-growing platform in short-form esports clips.

- Kick, a new entrant backed by gambling firms, now hosts over 1,400 esports streamers with a collective monthly viewership of 22 million.

- Facebook Gaming saw a 17% drop in esports streaming viewership, falling behind TikTok and Kick in key markets.

- The average view duration per esports stream is 32 minutes, with peak retention seen in Valorant and League of Legends matches.

- Co-streaming by influencers and pro players drives up to 28% additional viewership during large tournaments.

- Mobile streaming contributes to over 45% of esports content consumption globally in 2025.

- Simulcasting across Twitch, TikTok, and YouTube has increased tournament reach by 1.6x on average.

- AI-driven recommendation engines are now embedded in all major platforms, enhancing esports discoverability and viewer retention.

Mobile Esports Trends and Statistics

- Mobile esports will account for 38% of total esports revenue in 2025, totaling around $681 million globally.

- PUBG Mobile and Mobile Legends: Bang Bang continue to dominate, with over 1 billion combined hours watched so far in 2025.

- Free Fire’s esports events in LATAM saw a 26% increase in viewership year-over-year.

- The Asia-Pacific region leads the mobile esports charge, generating over 65% of mobile esports viewership globally.

- India’s Skyesports Championship 5.0 reached 12 million concurrent viewers, a record for any mobile esports tournament.

- Southeast Asia houses more than 350 million mobile gamers, with mobile esports forming the core of regional competition.

- Snapdragon Pro Series continues to scale, awarding $2.7 million in total prize pools across mobile-focused games in 2025.

- Mobile esports players now represent 62% of total competitive participants in emerging markets.

- Mobile game publishers are investing over $150 million in 2025 for region-specific tournaments in Africa, India, and Southeast Asia.

- Cloud gaming integration with mobile esports is expected to boost rural participation by 22% in under-connected regions.

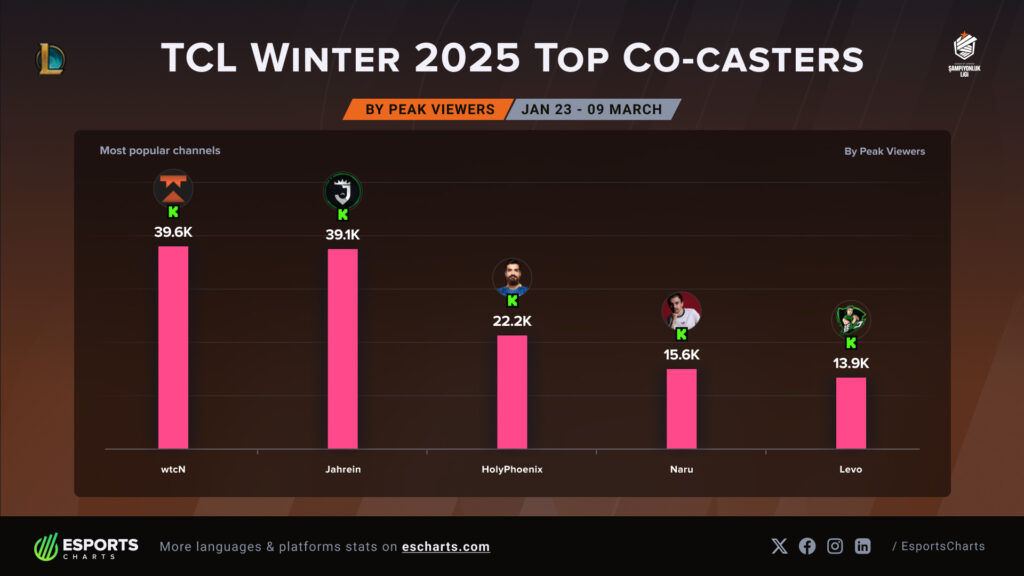

Top TCL Winter 2025 Co-Casters

- wtcN topped the charts with 39.6K peak viewers, making him the most-watched co-caster during the tournament.

- Jahrein followed closely with 39.1K peak viewers, ranking second among all co-casters.

- HolyPhoenix attracted 22.2K peak viewers, showcasing solid audience engagement.

- Naru reached 15.6K peak viewers, placing fourth in the co-caster lineup.

- Levo rounded out the top five with 13.9K peak viewers during the event.

Esports Player Salaries and Career Data

- Top-tier esports professionals can earn annual salaries exceeding $500,000, excluding sponsorships and streaming income.

- The average salary of a pro player in North America is now $83,000, a 12% increase from 2023.

- Content creation partnerships now generate over 40% of income for many players, alongside tournament winnings.

- The highest-paid player in 2024, Lee “Faker” Sang-hyeok, reportedly earned $3.1 million, including endorsements.

- Esports coaches now earn between $50,000 and $120,000 annually, with performance bonuses during championship runs.

- Over 9,000 players worldwide earned official tournament prize money in 2024.

- The global esports ecosystem supports approximately 64,000 full-time roles, including analysts, editors, social media managers, and event staff.

- Esports agents and managers are a growing category, with top reps earning 6-figure commissions from sponsorship deals.

- Burnout and mental health remain concerns; 37% of players reported taking breaks for well-being in 2024.

- Streamer-to-pro pipelines are growing; over 12% of 2025 rookies were scouted through their personal Twitch or Kick channels.

Economic Impact of Esports Events

- Esports tournaments in the US generated an estimated $145 million in local economic activity in 2024 through hotels, travel, and services.

- Riyadh’s Gamers8 Festival contributed more than $90 million to the Saudi Arabian economy in 2024 alone.

- IEM Katowice 2025 brought in 150,000 live attendees, contributing $32 million to Poland’s regional tourism economy.

- DreamHack Atlanta generated over $21 million for the city across hospitality, catering, and infrastructure services.

- Esports venues like Toronto’s OverActive Media Arena and Shanghai’s Esports Park are revitalizing urban districts with year-round programming.

- A 2024 Deloitte study shows that each major esports event generates $1.30 for every dollar invested in local infrastructure.

- The esports industry contributed over $3.4 billion to global GDP in 2024, including both direct and indirect economic activity.

- Merchandise and concessions at live events now account for 9% of on-site revenue, up from 6% in 2022.

- City partnerships with tournament organizers are expanding; 30+ US cities now have incentive programs for esports events.

- The economic benefits of esports tourism are prompting regional governments to reclassify esports as a “priority industry.”

E-sports Sponsorship Spending by Industry

- Consumer goods lead esports sponsorship spending with 21.80%, showing strong brand engagement in the gaming space.

- The technology industry follows with 15.90% of total sponsorship investment in esports.

- Clothing brands contribute 13.35% to sponsorships, indicating growing fashion visibility in esports.

- The beverage sector accounts for 4.75%, targeting hydration and energy products for gamers.

- Financial services make up 4.65% of esports sponsorship spending, reflecting rising fintech and banking interest in the gaming world.

College and Scholastic Esports Growth

- Over 240 colleges in the US offer varsity esports programs as of 2025, a 37% increase since 2022.

- NAECAD and NACE collectively represent over 15,000 student esports athletes in North America.

- More than $24 million in scholarship money was awarded to student esports athletes in 2024.

- High school esports participation in the US has doubled since 2020, reaching 200,000+ registered players in 2024.

- Esports curriculum and degrees are now offered at 50+ accredited universities, including Boise State and Full Sail.

- HBCUs and community colleges are increasingly participating in collegiate leagues, supported by non-profit grants and sponsors.

- College esports teams have official varsity status and access to training facilities at over 70 institutions.

- Female participation in scholastic esports increased to 18%, up from just 11% in 2021.

- Esports job placement rates for graduates of esports programs are now above 78%, often in media, marketing, or event production.

- The National High School Esports League (NHSEL) saw a record 83% renewal rate from participating schools in 2024.

Gender Representation in Esports

- Women now make up 28% of the global esports audience, and this number is steadily rising.

- All-female teams, like Shopify Rebellion GC, are gaining traction in Valorant and CS2 circuits.

- Prize pools for female-only tournaments reached $6.4 million globally in 2024.

- 28% of esports professionals working behind the scenes (e.g., production, marketing) identify as women.

- Brazil and Southeast Asia have the highest female player base in competitive mobile esports, at 33% and 31%, respectively.

- Esports organizations are implementing DEI policies, with over 45% reporting new diversity hiring initiatives in 2024.

- Twitch data shows that female streamers in the “Just Chatting” and esports categories saw a 23% increase in subscribers year-over-year.

- Educational workshops and boot camps for female gamers grew by 52% globally, primarily funded by nonprofits and gaming brands.

- Sexual harassment reports in esports spaces are down 13% YoY, with stronger moderation and zero-tolerance policies now in effect.

Recent Developments in the Esports Industry

- Counter-Strike 2 replaced CS:GO as Valve’s flagship shooter in late 2024, resulting in 40% higher average tournament engagement.

- Riot Games expanded its Valorant leagues to the Middle East and Oceania, adding $3 million in regional funding.

- Microsoft’s acquisition of Activision Blizzard finally closed, reshaping competitive landscapes for Call of Duty and Overwatch.

- Tencent announced a $300 million esports investment plan focused on mobile games and cloud-based competition.

- The Esports World Cup Foundation, based in Riyadh, launched a $45 million prize fund for international tournaments.

- AI-assisted coaching is being used by over 60% of top-tier teams, boosting player retention and strategy development.

- Web3 and NFTs in esports have declined significantly, with only 12% of orgs still running blockchain experiments as of 2025.

- Apple’s Vision Pro integration with esports is being trialed for VR arena spectating, offering real-time POV switching.

- Mental health initiatives and certified therapists are now standard on most Tier 1 esports teams’ staff rosters.

- Esports is now recognized as a varsity sport in 12 US states, enabling funding parity with traditional athletics.

Conclusion

Esports is no longer just a subculture—it’s an industry that influences economies, educates students, reshapes urban spaces, and entertains millions. As of 2025, the data paints a picture of maturity, momentum, and transformation. With growing inclusion, mobile-first strategies, and global expansion, the question isn’t if esports will become mainstream—it already has. The more accurate question is: What’s next?

Sources

- https://www.statista.com/outlook/amo/esports/worldwide

- https://scoop.market.us/esports-statistics/

- https://www.fortunebusinessinsights.com/esports-market-106820

- https://www.demandsage.com/esports-statistics/

- https://explodingtopics.com/blog/esports-statistics

- https://influencermarketinghub.com/esports-stats/

- https://www.skillademia.com/statistics/esports-statistics/

- https://www.linkedin.com/pulse/gaming-esports-statistics-matter-brands-right-now-ben-jackson