It started as a luxury. A curious extension of the smartphone, strapped to the wrist, delivering notifications. But as the years passed, smartwatches evolved from novelty gadgets into deeply personal tools, tracking our health, guiding workouts, and even detecting medical conditions in real-time. By 2025, smartwatches are no longer just convenient; they’re essential for millions globally.

From teenagers monitoring their heart rates during HIIT sessions to older adults getting fall alerts and ECG readings, the adoption curve has steepened. With tech giants fine-tuning hardware and AI integrations, 2025 marks a pivotal moment in the smartwatch journey: a year defined by mass adoption, diversified use, and intelligent health ecosystems.

Editor’s Choice

- One in four US adults, 25%, now own a smartwatch in 2025.

- Fitness tracking remains the most cited reason for purchase, accounting for 39% of all smartwatch use cases.

- In 2025, Apple Watch retains its dominance with a 28% global market share.

- Sleep tracking adoption has grown to 46% of all smartwatch users in 2025, driven by improved sensor accuracy.

- Women aged 30-44 showed the highest smartwatch adoption growth in 2025.

- Smartwatches with blood oxygen (SpO2) sensors are now present in 67% of all new models released in 2025.

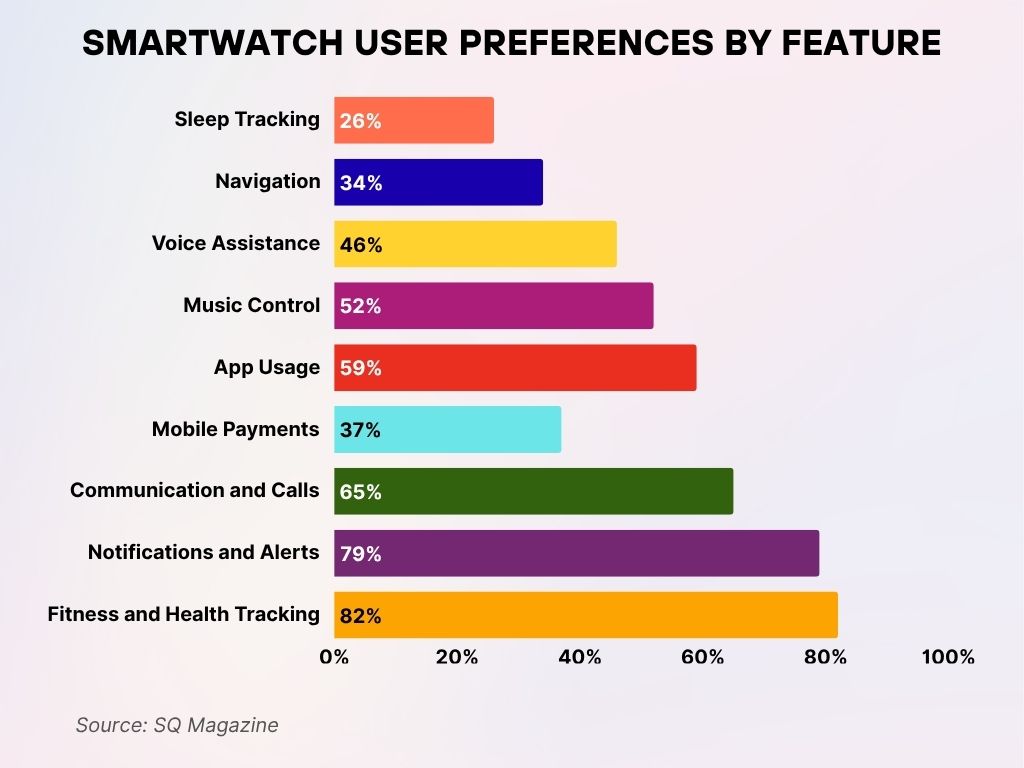

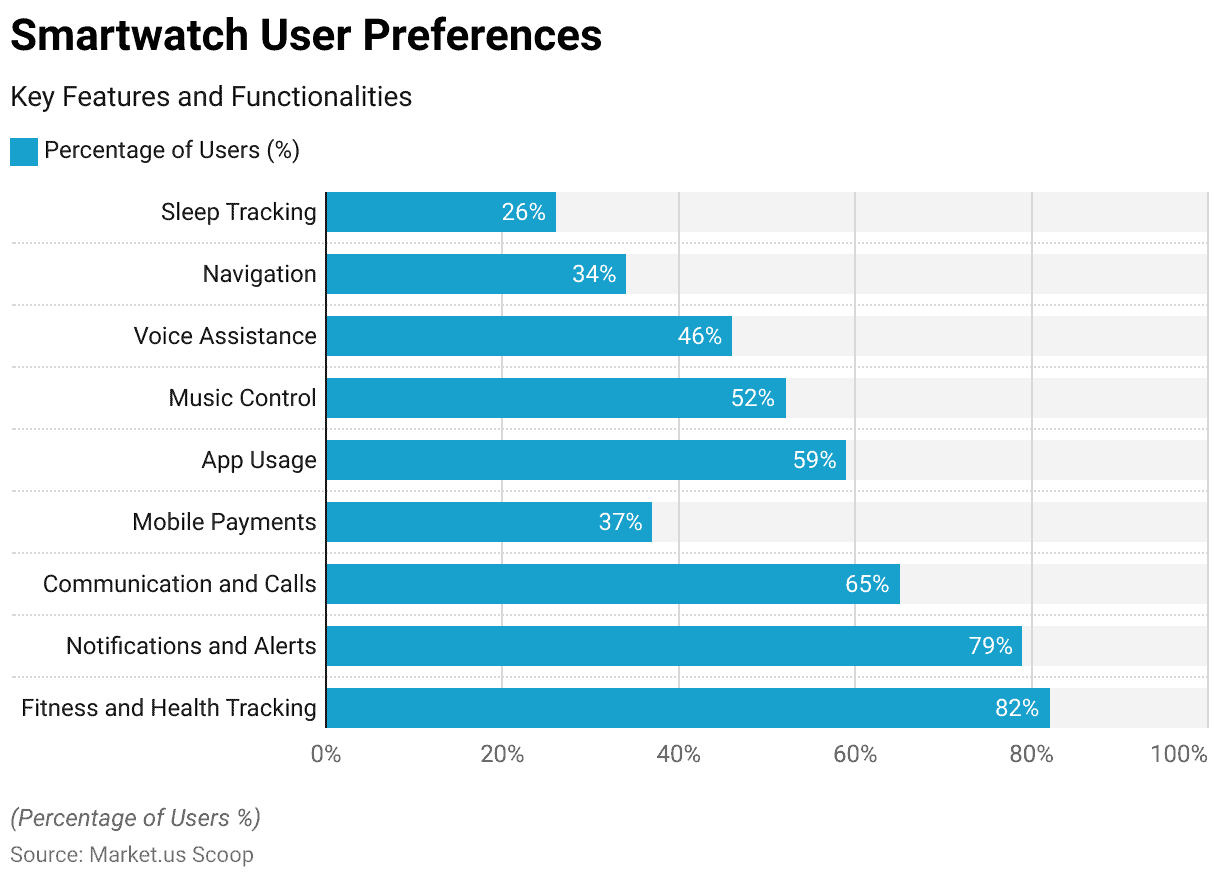

Smartwatch User Preferences by Feature

- 82% of users prioritize Fitness and Health Tracking, making it the most popular smartwatch feature.

- 79% of users value Notifications and Alerts, showing the importance of real-time updates on the wrist.

- 65% of users use smartwatches for Communication and Calls, highlighting their utility beyond fitness.

- 59% of users engage in App Usage, indicating a growing demand for multifunctional smartwatch apps.

- 52% of users utilize Music Control, reflecting the role of smartwatches in media management.

- 46% of users rely on Voice Assistance, suggesting increasing comfort with AI-powered interaction.

- 37% of users perform Mobile Payments, showing moderate adoption of smartwatches as a payment method.

- 34% of users use Navigation features, emphasizing location and direction support as a growing utility.

- 26% of users track Sleep, the least-used feature, but still notable in health-focused use cases.

Global User Base & Penetration Rates

- In the United States, smartwatch penetration hit 28.3% of the general population in 2025.

- China, with 112 million smartwatch users in 2025, remains the largest single-country market globally.

- India saw the highest growth rate in smartwatch adoption, with a 23% year-on-year increase in 2025.

- Western Europe reached 82 million smartwatch users in 2025.

- Among global urban populations, smartwatch usage crossed 30% in 2025, reflecting increased tech accessibility.

- Rural smartwatch adoption remains modest at 12% globally, but 2025 marks the first year this number enters double digits.

- 75% of all smartwatches sold globally in 2025 are LTE-enabled, indicating growing independence from smartphones.

Adoption Rate

- 2025 marks the first year in which over 50% of US adults aged 18–34 own a smartwatch.

- Among US teens aged 13–17, smartwatch ownership climbed to 22% in 2025.

- The global smartwatch adoption rate reached 5.2% of the total population in 2025.

- In 2025, 43% of smartwatch users report wearing their device daily.

- Smartwatch gifting increased by 19% during the 2024–25 holiday season, signaling growing mainstream appeal.

- Workplace wellness programs offering smartwatches as incentives rose by 28% in 2025, with corporations prioritizing biometric health tracking.

- The rate of smartwatch upgrades (users replacing their existing device) increased to 32% in 2025, driven by improved features and wear-out cycles.

- Among first-time smartwatch users in 2025, 61% cite health monitoring as the key purchase driver.

Smartwatch Users and Health Engagement

- 80% of users experienced a positive impact on mental health through smartwatch engagement.

- 80% of users actively track daily steps, showcasing smartwatches’ core role in activity monitoring.

- 75% of users rely on heart rate monitoring, underlining health-focused usage.

- 70% of users are motivated to lead a healthier lifestyle with smartwatch support.

- 70% of users depend on activity reminders and notifications for fitness consistency.

- 65% of users made positive changes in diet and exercise due to smartwatch use.

- 60% of users saw an increase in health-related app downloads after using smartwatches.

- 60% of users monitor physical activity and overall health, reinforcing their wellness focus.

- 55% of users increased fitness app usage, connecting wearables with digital health tools.

- 50% of users actively utilize sleep tracking, reflecting sleep health awareness.

Demographics: Age, Gender, Race/Ethnicity

- In 2025, 52% of smartwatch users are male, while 48% are female, reflecting narrowing gender gaps.

- Smartwatch adoption among Black Americans rose to 21% in 2025.

- Hispanic users now represent 18% of US smartwatch owners in 2025, with notable increases in bilingual and urban communities.

- Among seniors aged 65+, adoption reached 14% in 2025, boosted by fall detection and heart monitoring features.

- Smartwatch use among Gen Z (ages 11–26) hit 41% in 2025, driven by wellness apps and social integrations.

- Asian-American smartwatch ownership rose to 29% in 2025, the highest ethnic group penetration in the US.

- Among adults aged 45–64, 27% own a smartwatch in 2025.

- The average age of a smartwatch user globally is now 35.8 years in 2025, skewing younger in urban markets.

Sales and Shipments

- Global smartwatch shipments hit 194 million units in 2025.

- The US smartwatch market alone saw 41.6 million units shipped in 2025, a record high.

- Asia-Pacific accounted for 45% of all global smartwatch shipments, driven by growing demand in India and Southeast Asia.

- In Europe, smartwatch sales grew 9.1% year over year, reaching 35.2 million units in 2025.

- Q2 2025 was the strongest quarter ever for smartwatch shipments, with over 52 million units shipped globally.

- Wear OS devices represented 28% of all global smartwatch shipments in 2025, up from 21% the year before.

- Budget smartwatches (under $150) accounted for 38% of units sold globally in 2025, particularly popular in emerging markets.

- Online sales comprised 63% of smartwatch sales in 2025, a trend accelerated by post-pandemic digital shopping behaviors.

- Retail chains such as Best Buy and Target reported a 15% increase in smartwatch shelf space year over year.

- Refurbished smartwatch sales climbed to 7.6 million units globally in 2025, indicating growing interest in sustainable options.

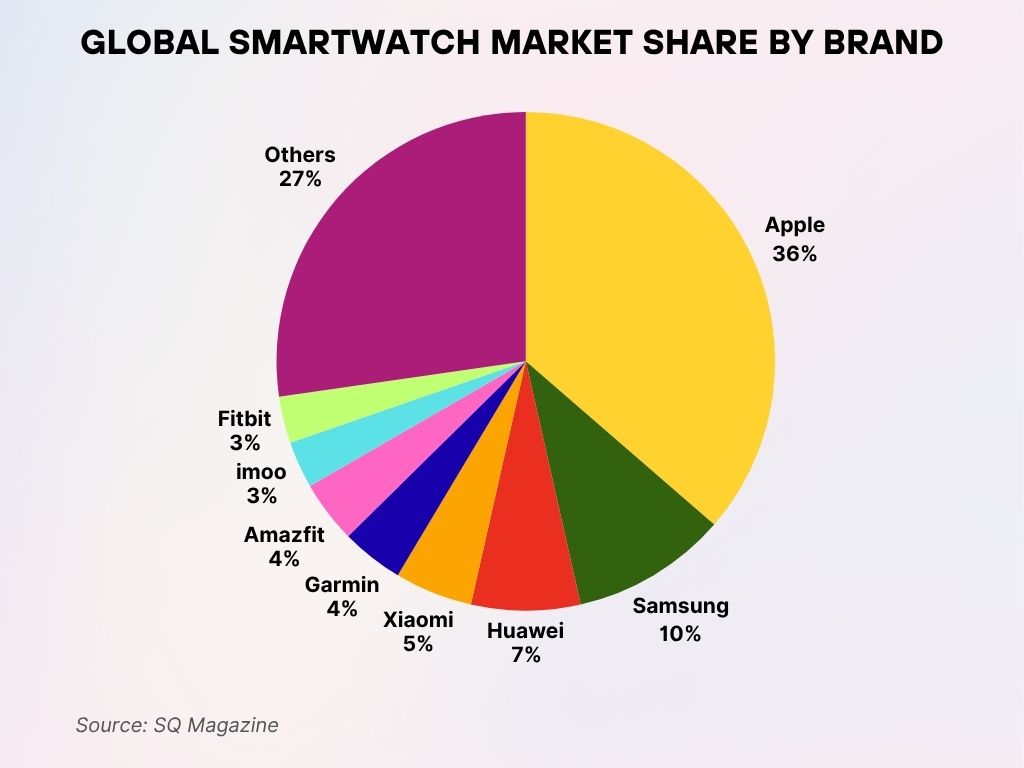

Global Smartwatch Market Share by Brand

- Apple dominates the market with a 36% share, maintaining its lead in the global smartwatch industry.

- Samsung holds the second spot with a solid 10% market share.

- Huawei captures 7%, showing steady performance in both domestic and international markets.

- Xiaomi accounts for 5%, reflecting its continued presence in the budget-friendly segment.

- Garmin and Amazfit each command a 4% share, popular for fitness and health-focused smartwatches.

- imoo and Fitbit trail with 3% each, appealing to niche user bases and health-conscious consumers.

- Others collectively make up 27%, indicating a fragmented market with numerous smaller players.

Features and Functionality

- Heart rate monitoring is now a standard feature in 98% of smartwatches sold in 2025.

- ECG (electrocardiogram) capability is present in 42% of smartwatches in 2025.

- Sleep tracking is used by 74% of smartwatch owners weekly.

- Fall detection is included in 37% of smartwatches sold in 2025 and is a key feature for users aged 60+.

- Blood oxygen saturation (SpO2) sensors appear in 67% of all new smartwatches launched in 2025.

- Skin temperature monitoring was added to 22% of flagship models in 2025.

- Smart assistant integration (Siri, Google Assistant, Alexa) is active on 65% of smartwatches globally.

- Water resistance up to 50 meters is offered on 89% of new devices sold in 2025.

- Offline music playback is supported on 41% of smartwatches, especially those geared toward athletes.

- Smartwatch battery life averages 1.8 days in 2025, though specialized models can last up to 14 days.

Medical Applications

- AFib detection capabilities are now FDA-cleared on smartwatches from Apple, Samsung, and Fitbit in the US.

- In 2025, 6.5 million users globally have used their smartwatches for irregular heart rhythm notifications.

- Fall detection with emergency SOS triggered over 230,000 medical interventions in the US alone in 2024–2025.

- Blood glucose monitoring using non-invasive sensors is in pilot testing on select Samsung and Huawei models.

- Remote patient monitoring programs using smartwatches have increased by 47% among US healthcare providers.

- Parkinson’s symptom tracking via smartwatch tremor sensors is used by an estimated 420,000 people globally.

- Pulse oximetry usage in high-altitude or respiratory-risk environments has risen 2.3x since 2023.

- Medication reminders and adherence alerts are now enabled on 28% of smartwatches globally.

- Smart ECG data uploads directly to electronic health records (EHR) are supported by the top 3 US insurers in 2025.

- Smartwatch insurance discounts are offered by 7 of the top 10 US health insurance companies in 2025 for compliance with fitness goals.

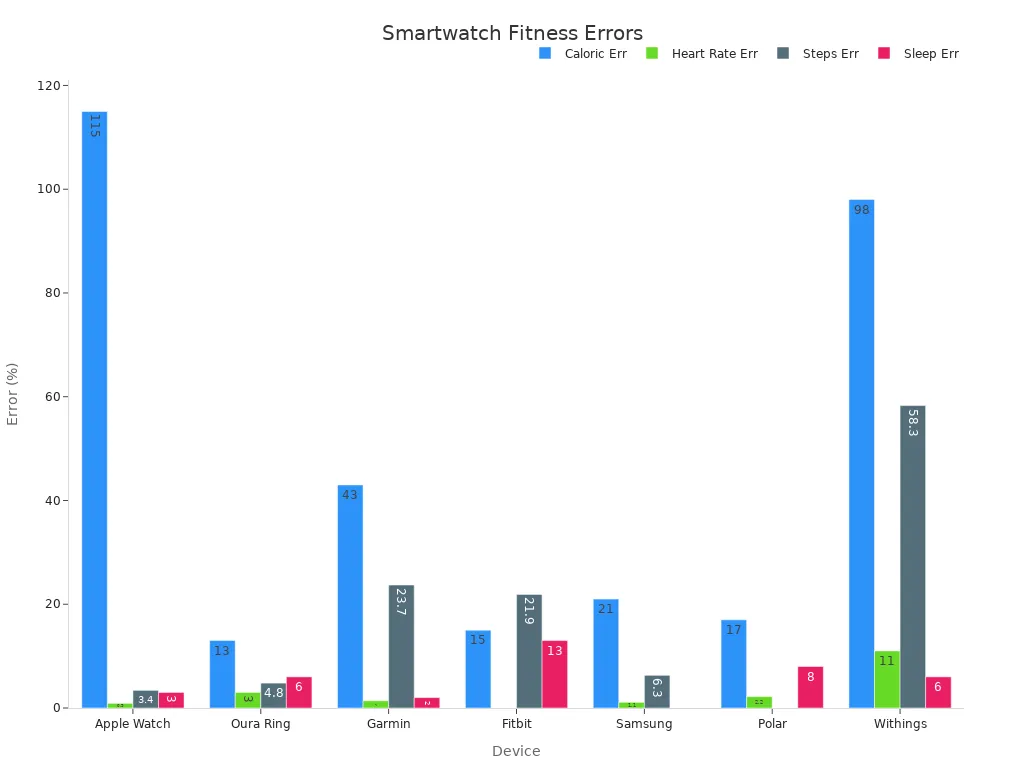

Smartwatch Fitness Tracking Error Rates

- Apple Watch showed the highest caloric error at 115%, despite low error in heart rate (3.4%), steps (3%), and sleep (3%).

- Withings had the worst step error at 58.3% and the second-highest calorie error at 98%.

- Garmin recorded a caloric error of 43% and a significant step error of 23.7%, with minimal heart rate and sleep errors.

- Samsung showed a 21% caloric error, 6.3% steps error, and a low heart rate error of 1.3%.

- Fitbit reported 15% caloric error, 21.9% steps error, and a notable 13% sleep error.

- Polar had 17% calorie error and 8% sleep error, but nearly zero error in steps and heart rate.

- Oura Ring performed better in caloric (13%) and heart rate tracking (3%), but had a 6% sleep error.

IoT Integration

- In 2025, 67% of smartwatches can control smart home devices.

- Voice assistant activation for home control (e.g., lights, thermostats) was used weekly by 21% of smartwatch users.

- NFC-based door unlocking is supported by over 42% of premium smartwatch models globally.

- Smartwatch-to-car integration saw a 31% increase in usage, especially for Tesla and BMW owners.

- Real-time smartwatch alerts from home security systems rose by 18% in 2025.

- Pet tracking integrations (e.g., Tile, AirTag) managed via smartwatch saw adoption among 8% of US owners.

- Home intercom and video doorbell alerts on smartwatch screens reached 12 million active users in 2025.

- Smart appliance notifications (e.g., oven done, laundry finished) are now supported by 30% of compatible smartwatches.

- Smartwatch-controlled TV remotes are active in 15% of all households with both smart TVs and compatible watches.

- Geo-fencing automation triggers (like unlocking doors when nearby) are used by 7.4 million users worldwide.

Revenue Segmented by Feature (e.g., Payments, Sensors)

- Smartwatch payments generated $11.2 billion in global transaction volume in 2025.

- Sensor modules, including heart rate, ECG, and SpO2, accounted for $5.4 billion in OEM revenue globally.

- Sleep tracking features contributed to an estimated $3.1 billion in app subscription and hardware value in 2025.

- Health-related smartwatch apps generated over $2.7 billion in subscription revenue globally in 2025.

- Smartwatch insurance integration features (step tracking, alerts) now support a $1.9 billion wellness incentive market.

- Mobile payments via smartwatches are used by 34% of US owners weekly in 2025.

- The average revenue per smartwatch user (ARPU) globally is now $66, driven by app purchases and service subscriptions.

- Third-party health sensor licensing to smartwatch brands generated $720 million in royalties in 2025.

- Enterprise and workplace wellness partnerships involving smartwatches reached $950 million in value.

- Sleep coaching subscriptions (e.g., Oura, Fitbit Premium) now represent 11% of all wearable app revenue in 2025.

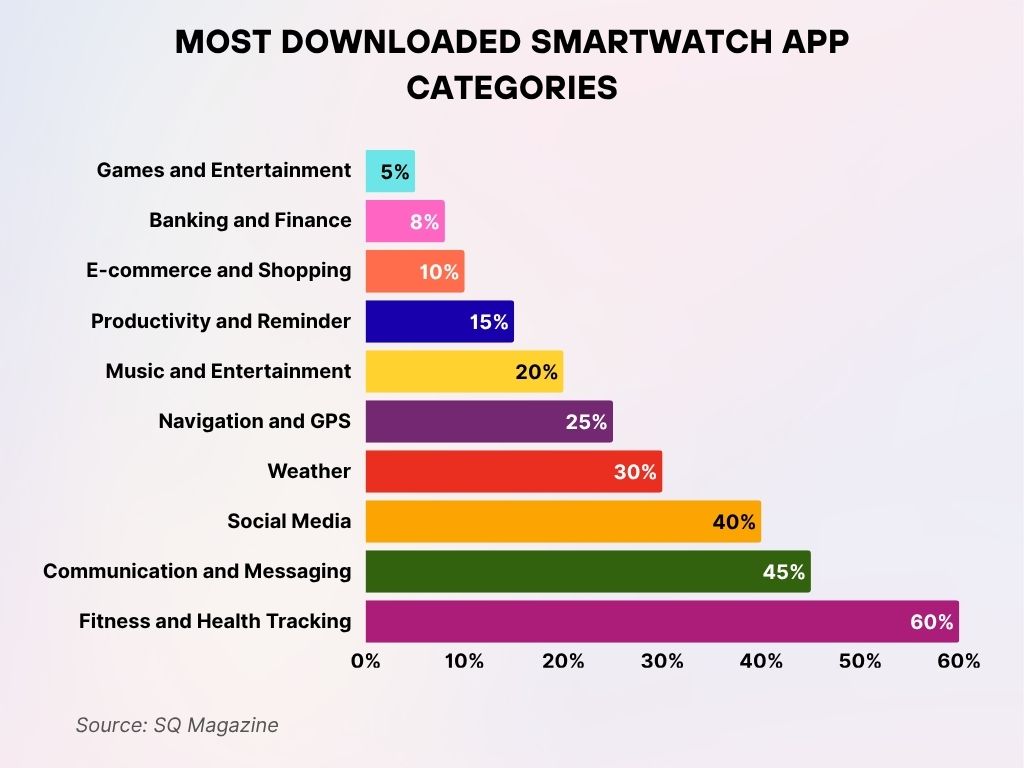

Most Downloaded Smartwatch App Categories

- 60% of smartwatch users downloaded Fitness and Health Tracking apps, making it the top category.

- 45% of users favor Communication and Messaging apps for seamless wrist-based interaction.

- 40% of users have Social Media apps installed, reflecting high engagement with social platforms.

- 30% of users rely on Weather apps for real-time climate updates.

- 25% of users use Navigation and GPS apps for travel and location guidance.

- 20% of users downloaded Music and Entertainment apps for audio control and streaming.

- 15% of users prefer Productivity and Reminder apps for managing tasks and schedules.

- 10% of users use E-commerce and Shopping apps on their smartwatches.

- 8% of users installed Banking and Finance apps, indicating cautious financial interaction on wearables.

- 5% of users downloaded Games and Entertainment apps, the least popular category.

Emerging Trends and Innovations

- Blood pressure monitoring is now available in early-stage beta on over 5 smartwatch models from Samsung and Huawei.

- Non-invasive glucose sensing made headlines in 2025 with major trials launched by Apple and a Swiss med-tech firm.

- Flexible display smartwatches entered the market in Q2 2025, with initial units priced at over $900.

- Mental health biomarkers, like stress and mood tracking via HRV and skin temperature, are in development for 2026 rollouts.

- AI-driven coaching assistants (e.g., Fitbit’s new Gemini AI) offer real-time fitness insights based on past trends.

- Carbon-neutral smartwatch manufacturing practices are adopted by 6 of the top 10 brands in 2025.

- UWB (Ultra-Wideband) chips are now embedded in 12% of 2025 smartwatch models for advanced location precision.

- Smart rings and bracelets are merging with smartwatch ecosystems, especially in women’s health tracking.

- Gesture-based control interfaces are in pilot phase with Samsung, allowing touch-free watch interaction.

- Voice biometrics for authentication is now tested on select Pixel Watch models, reducing dependence on PINs or biometrics.

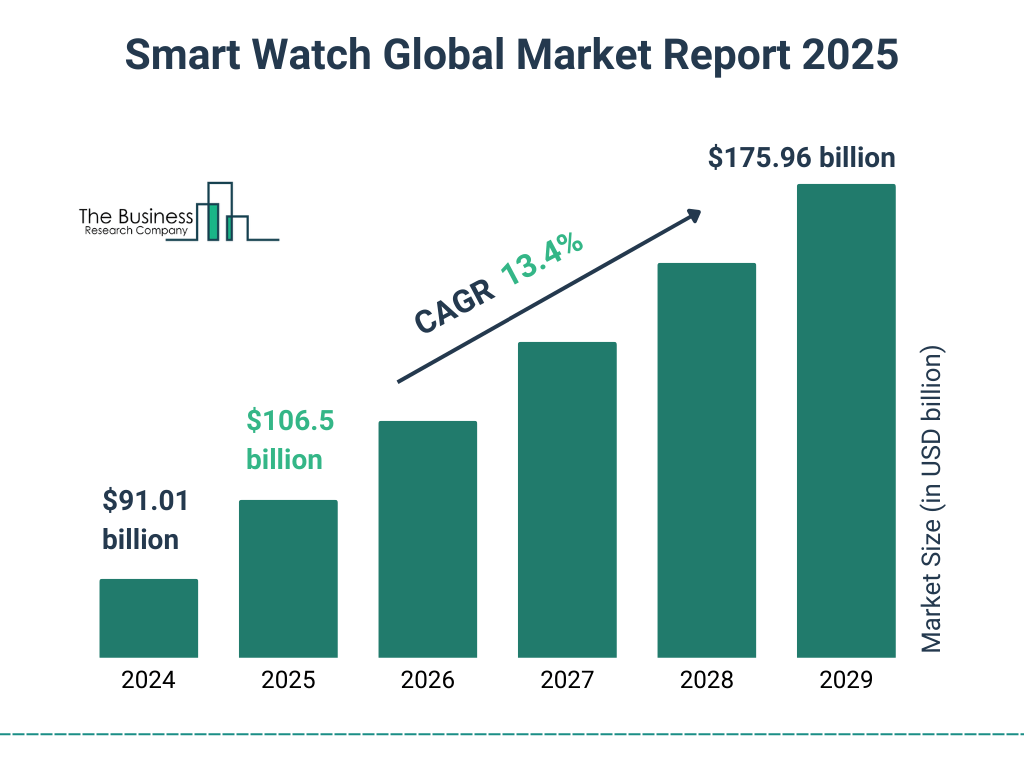

Global Smartwatch Market Growth Forecast

- The smartwatch market size in 2025 is projected to reach $106.5 billion.

- The market is expected to grow at a CAGR of 13.4% between 2025 and 2029.

- By 2026, the market is forecasted to surpass $120 billion.

- In 2027, the projected size is approximately $140 billion, showing continued momentum.

- By 2028, the market is set to reach close to $160 billion.

- The global smartwatch market is projected to hit $175.96 billion by 2029, nearly doubling in five years.

Recent Innovations & Forecasted Growth

- The global smartwatch market is projected to reach $74 billion by 2027, growing at a CAGR of 8.6% from 2025.

- Apple’s 2025 update introduced dual-band GPS, enhanced blood pressure modeling, and adaptive workout AI.

- Google’s 2025 Wear OS update cut app battery usage by 18%, improving user retention.

- The US smartwatch penetration rate is expected to cross 31% by the end of 2026.

- Wearables that support multi-day medical monitoring will be standard in 20% of smartwatches by 2027.

- AI health assistants built into smartwatches will support personalized medicine for over 50 million users by 2028.

- Modular smartwatches allowing sensor add-ons are in development and could launch as early as Q4 2026.

- Privacy-first health data encryption is a top feature request among 35% of new smartwatch buyers.

- The enterprise smartwatch sector is forecasted to grow 3x by 2027, led by logistics and fieldwork industries.

Conclusion

Smartwatches in 2025 aren’t just tracking steps; they’re transforming how people manage their health, connect with technology, and live safer, more informed lives. With deeper AI integration, enhanced biometric sensors, and growing adoption across every age group, the device that once buzzed with calendar reminders now stands at the center of personal well-being.

From blood glucose prediction to real-time emergency alerts, the capabilities of smartwatches are only beginning to unfold. As hardware gets smarter and software more predictive, expect wearables to play an even more vital role in digital health ecosystems, insurance models, and connected homes. The wrist is now one of the most valuable pieces of real estate in tech, and it’s only getting smarter.