It started as a small playing card company in 1889. Today, Nintendo is a household name with global influence, transforming living rooms, handheld devices, and pop culture across generations. Whether you grew up navigating dungeons in The Legend of Zelda, racing through Rainbow Road in Mario Kart, or more recently, exploring open worlds on the Nintendo Switch, there’s a good chance Nintendo has shaped part of your gaming experience.

But beyond nostalgia and innovation, the numbers behind Nintendo tell a powerful story, one of evolving markets, cross-generational dominance, and a growing digital ecosystem. Let’s dig into the data shaping Nintendo’s footprint in 2025.

Editor’s Choice

- Nintendo Switch has sold over 141.32 million units globally as of Q1 2025, making it the third best-selling console of all time, just behind PlayStation 2 and Nintendo DS.

- Nintendo’s total revenue in FY2024 reached $14.6 billion, a 4.3% increase YoY, driven largely by first-party game titles and subscriptions.

- Mario Kart 8 Deluxe continues to dominate with 61.2 million units sold, making it the best-selling Nintendo Switch game ever.

- In 2024, digital game sales accounted for 57% of Nintendo’s total software sales, a sharp increase from 43% in 2020.

- The US remains Nintendo’s largest market, contributing approximately 42% of total annual revenue in FY2024.

- Nintendo’s subscription service, Nintendo Switch Online, surpassed 42 million subscribers by early 2025, driven by online multiplayer access and classic game libraries.

- The Legend of Zelda: Tears of the Kingdom sold 20.5 million copies within its first 10 months, making it the fastest-selling Zelda game in franchise history.

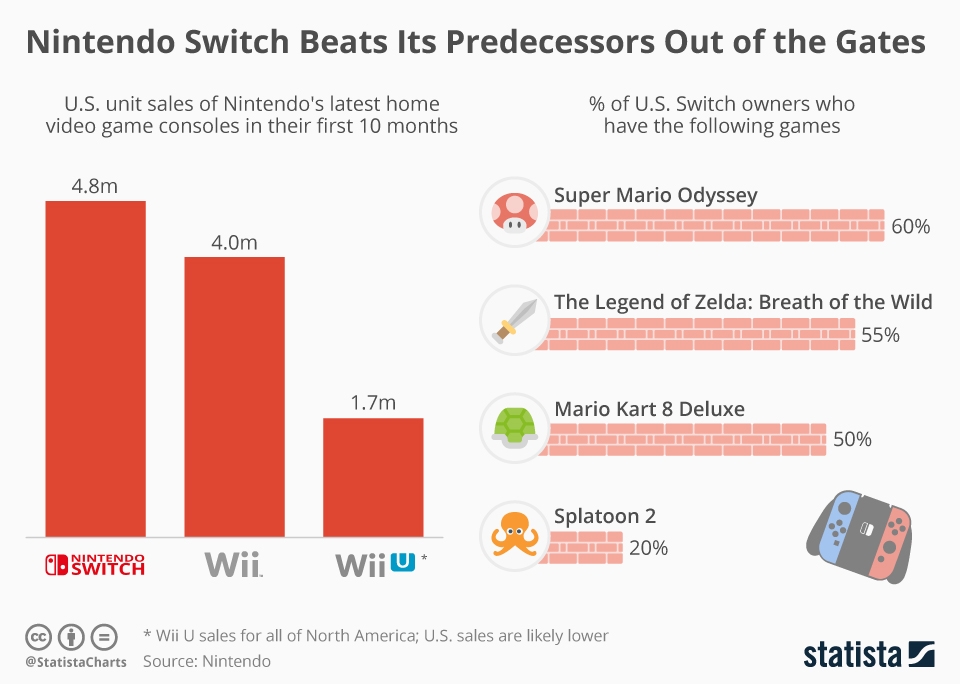

Nintendo Switch Early Sales and Game Ownership Highlights

- Nintendo Switch sold 4.8 million units in the U.S. during its first 10 months, outperforming the Wii (4.0 million) and Wii U (1.7 million).

- Super Mario Odyssey is owned by 60% of U.S. Switch users, making it the most popular title among early adopters.

- The Legend of Zelda: Breath of the Wild follows closely, with 55% of Switch owners having the game.

- Mario Kart 8 Deluxe is owned by 50% of users, showing a strong preference for multiplayer racing games.

- Splatoon 2 is less widespread, owned by only 20% of U.S. Switch owners.

Nintendo’s Global Market Share in the Gaming Industry

- As of Q1 2025, Nintendo holds an estimated 28.4% share of the global console gaming market, trailing only slightly behind Sony’s PlayStation at 31.2%.

- Nintendo outperformed Xbox in handheld and hybrid segments, commanding over 92% of the global hybrid console market.

- In Japan, Nintendo enjoys a market share of 78%, primarily led by the sustained popularity of portable and family-friendly titles.

- The APAC region showed a 6.5% year-over-year increase in hardware sales for Nintendo in 2024, fueled by growing Switch adoption in Korea and Southeast Asia.

- Nintendo led the family gaming genre, capturing 71% of unit sales globally in 2024.

- In terms of game titles, first-party Nintendo games comprised more than 55% of all games sold on Nintendo platforms in 2024.

- Despite competition, Nintendo remains the most profitable gaming company in Japan, ahead of both Sony and Bandai Namco.

- Latin America saw a surge in Switch sales with a 9% YoY increase, driven by expanded distribution and local game localization efforts.

Nintendo Switch Sales Figures and Milestones

- By Q1 2025, the Nintendo Switch reached 141.32 million lifetime units sold, placing it above the PlayStation 4’s 117.2 million.

- The OLED model accounted for 38% of all Switch hardware sales in 2024.

- Nintendo introduced a new Switch Lite bundle targeting younger gamers, boosting Lite model sales by 17% YoY.

- The Switch surpassed 1 billion software units sold globally as of January 2025, making it the first Nintendo console to hit this milestone.

- Top-selling territories for Switch in 2024 were the US, Japan, and the UK, making up 65% of total units sold.

- Black Friday 2024 marked a record with 2.2 million Switch units sold globally in a single week.

- A rumored successor console saw a 12% slowdown in Q4 2024 Switch sales, signaling market anticipation for new hardware.

- Nintendo has confirmed continued support for Switch until 2026, with major first-party titles scheduled throughout 2025.

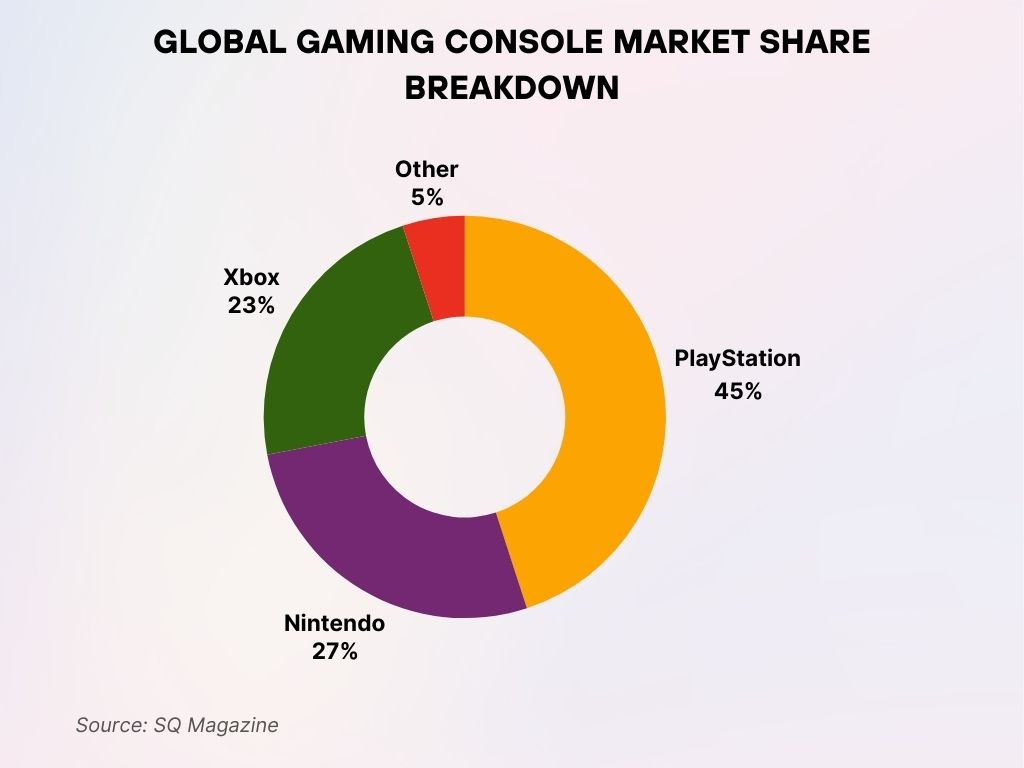

Global Gaming Console Market Share Breakdown

- PlayStation leads the global gaming console market with a 45% market share, establishing itself as the top brand worldwide.

- Nintendo secures the second spot with a 27% market share, reflecting its strong performance and loyal fan base.

- Xbox holds a 23% market share, maintaining a solid presence in the competitive gaming ecosystem.

- Other brands account for just 5% of the global market, indicating limited competition outside the major three players.

Most Popular Nintendo Franchises by Units Sold

- Mario remains Nintendo’s flagship franchise with over 830 million units sold globally across all Mario titles.

- Pokémon follows closely with 480 million lifetime units sold, including mainline and spin-off titles.

- The Legend of Zelda franchise surpassed 152 million total units sold, with notable boosts from Breath of the Wild and Tears of the Kingdom.

- The Animal Crossing series hit 82.4 million total sales, largely due to New Horizons, which remains the best-selling title in the franchise.

- Super Smash Bros. reached 78.5 million total units sold, with Ultimate alone contributing 33.3 million of those units.

- Splatoon, a newer franchise, crossed 33 million units worldwide, showing strong performance in Japan and North America.

- Metroid, once a niche title, saw a resurgence, hitting 23 million total units sold, thanks to Metroid Dread and classic remasters.

- Combined, Nintendo’s top five franchises contribute over 60% of its lifetime software sales revenue.

- Franchise anniversaries (like Mario’s 40th in 2025) continue to drive up merchandise and media licensing revenue significantly.

Digital vs. Physical Game Sales Distribution

- As of 2025, digital sales account for 63% of all Nintendo game purchases, up from 57% in 2024 and 43% in 2020.

- North America leads in digital adoption, where over 70% of Nintendo games are now purchased digitally.

- The eShop’s global revenue increased by 8.1% YoY, totaling approximately $5.9 billion in 2024.

- Physical game sales continue to dominate in Japan, where they still account for 52% of purchases, due to cultural preferences and collector appeal.

- Nintendo’s limited-edition physical releases, such as Metroid Prime Remastered, saw sell-through rates of 92% within the first two weeks.

- Indie titles on the eShop now make up 24% of total digital sales volume, showing a steady rise in third-party engagement on Nintendo platforms.

- Seasonal promotions like the eShop Holiday Sale 2024 contributed to a 16% spike in digital downloads during Q4.

- The average Switch user downloads 5.2 digital games per year, a 14% increase from the previous annual average.

- The Nintendo Switch Online + Expansion Pack membership includes access to digital-only content, which now accounts for 28% of its usage time.

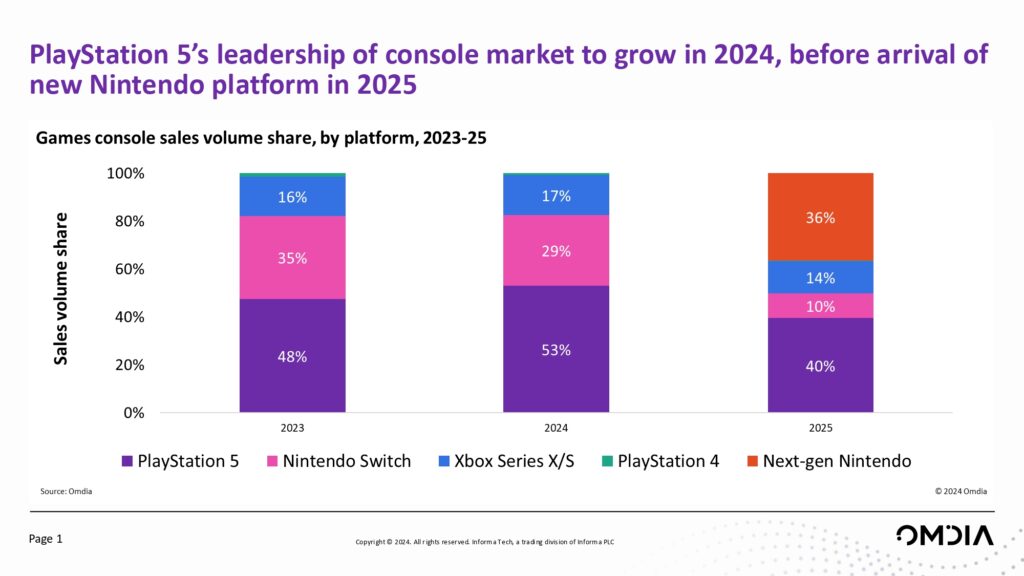

Console Market Share Trends (2023–2025)

- In 2023, PlayStation 5 led with a 48% sales volume share, followed by Nintendo Switch at 35%, and Xbox Series X/S at 16%.

- By 2024, PS5’s dominance grew to 53%, while Switch declined to 29% and Xbox rose slightly to 17%.

- In 2025, a new Nintendo platform enters the scene with a 36% share, overtaking PS5, which drops to 40%. Switch falls to 10%, and Xbox slips to 14%.

- The PlayStation 4 appears only marginally in 2023 and 2024, with no significant share shown by 2025.

Demographic Breakdown of Nintendo Players

- 43% of Nintendo Switch users in the US are aged 25 to 34, showing the brand’s strong millennial retention.

- Children and teens (under 18) represent 21% of Nintendo’s global player base, driven by family-friendly titles.

- Female gamers now make up 38% of Nintendo’s audience, up from 33% in 2020, highlighting better gender inclusivity.

- The average household with a Nintendo Switch owns 2.3 consoles, reflecting both shared and individual use.

- Parents play with their children on the Switch in 61% of US households, reinforcing Nintendo’s role in family entertainment.

- The most common Nintendo Switch use-case is “couch co-op,” cited by 62% of players, followed by single-player adventures at 47%.

- Among US gamers, 76% identify the Switch as their secondary console, used alongside PlayStation or Xbox for genre diversity.

- Retirees (65+) now account for 5% of Switch owners, often drawn by brain-training and nostalgic titles.

- The average age of a Nintendo gamer in 2025 is 29.7 years, showing a gradual upward movement from previous years.

Revenue Breakdown by Region and Platform

- The Americas generated $6.15 billion for Nintendo in FY2024, accounting for 42% of total global revenue.

- Japan contributed $2.93 billion, marking a 2.7% YoY decline due to hardware saturation and soft launch performance.

- Europe posted $3.1 billion in revenue, driven by digital sales and consistent franchise loyalty in Germany, France, and the UK.

- The Asia-Pacific region (excluding Japan) grew by 11.4% YoY, totaling $1.67 billion, with South Korea and Taiwan leading.

- Nintendo’s digital software revenue exceeded $8.2 billion, now surpassing all hardware revenue combined.

- First-party titles contributed to 78% of total software revenue globally, reflecting Nintendo’s emphasis on in-house IPs.

- Revenue from Nintendo Switch Online services and subscriptions reached $1.19 billion, a 19% increase YoY.

- Accessory sales, including controllers and Amiibo, hit $872 million, up 6.3% from 2023.

- The Switch OLED model generated more revenue than the original Switch in 2024, despite fewer units sold, thanks to higher margins.

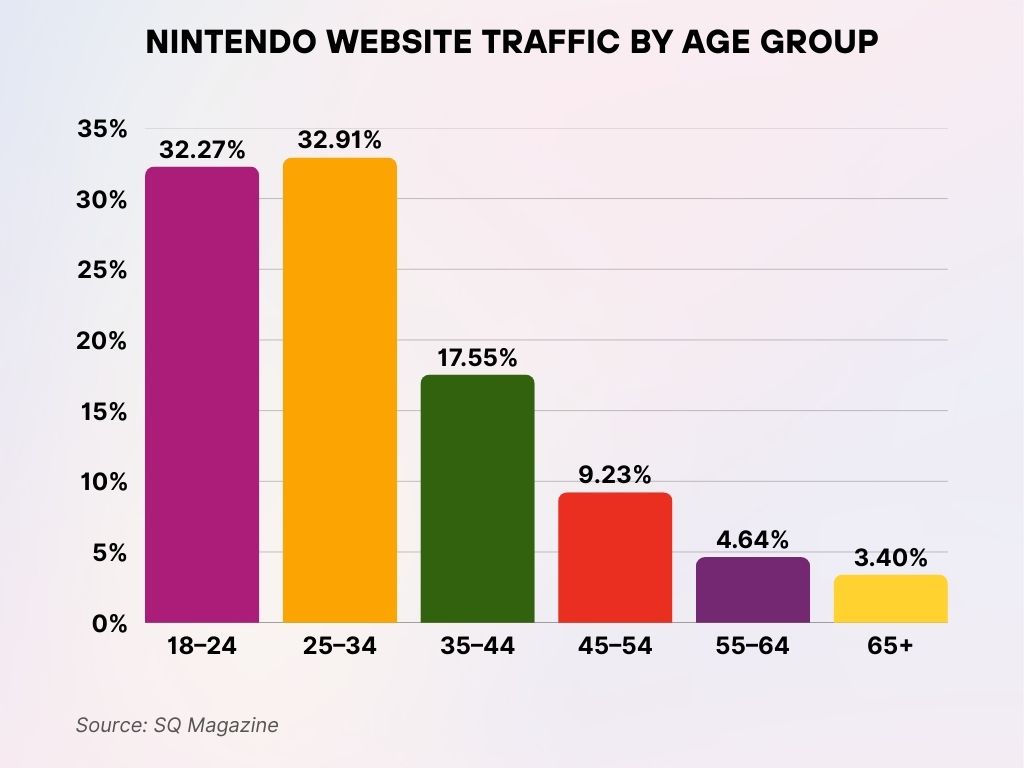

Nintendo Website Traffic by Age Group

- The largest share of traffic comes from users aged 25–34, making up 32.91% of the total audience.

- Visitors aged 18–24 are close behind, accounting for 32.27% of site traffic.

- The 35–44 age group represents 17.55%, showing solid engagement from older millennials.

- Users aged 45–54 contribute 9.23%, while the 55–64 group accounts for 4.64%.

- The 65+ demographic forms the smallest segment, with just 3.40% of traffic.

Nintendo Online Services Usage Statistics

- Nintendo Switch Online (NSO) surpassed 42 million subscribers globally by Q1 2025, up from 39.5 million in 2024.

- 35% of subscribers use the Expansion Pack tier, which offers access to N64 and GBA games.

- NSO members log an average of 7.8 hours/week in online play, with Mario Kart 8 Deluxe being the most played online title.

- Cloud saves are enabled by 93% of NSO subscribers, indicating strong platform loyalty and concern for data retention.

- The most popular classic game via NSO is Super Mario 64, with 12.3 million hours played globally in 2024 alone.

- Nintendo’s mobile NSO app was downloaded 4.2 million times in 2024, mainly for parental control and voice chat features.

- Usage of family accounts makes up 31% of all NSO subscriptions, emphasizing shared household play.

- The US accounts for 45% of all NSO users, followed by Japan at 18% and Europe at 22%.

- Subscription revenue per user (ARPU) stands at $2.36/month, slightly lower than competitors, but compensated by scale.

Nintendo’s Mobile Gaming Revenue

- Nintendo’s mobile game revenue reached $470 million in 2024, down 4.1% YoY, due to competition and reduced spending in Japan.

- Fire Emblem Heroes remains the top-grossing mobile title with $270 million in lifetime earnings.

- Mario Kart Tour contributed $86 million in 2024 alone, despite ongoing criticism over monetization mechanics.

- Nintendo’s latest mobile entry, Pokémon Sleep, grossed $25 million in its first six months, surpassing projections.

- The average revenue per mobile user (ARPU) is estimated at $6.78, lower than industry benchmarks but stable.

- 77% of Nintendo’s mobile revenue comes from Japan, where gacha mechanics and mobile-first gaming dominate.

- As of 2025, Nintendo has 6 active mobile titles, with two more announced for soft launch in Q3.

- Nintendo continues to limit aggressive monetization, citing brand protection as a priority over short-term revenue boosts.

- Mobile titles have been downloaded over 650 million times globally, though only 6.5% of users convert to paying players.

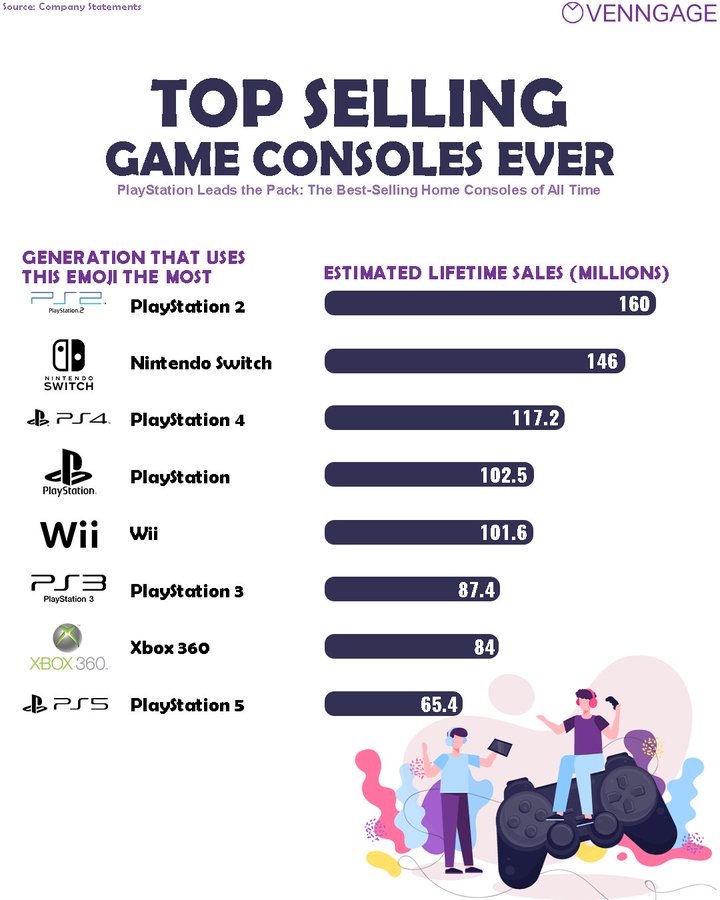

Best-Selling Game Consoles of All Time

- PlayStation 2 tops the list with 160 million units sold, making it the best-selling console ever.

- The Nintendo Switch follows closely with 146 million lifetime sales, showcasing its massive global appeal.

- PlayStation 4 ranks third with 117.2 million units sold, solidifying Sony’s dominance across generations.

- The original PlayStation and the Wii have nearly identical figures, with 102.5 million and 101.6 million units sold, respectively.

- PlayStation 3 reached 87.4 million in sales, slightly edging out Xbox 360, which sold 84 million units.

- PlayStation 5, despite being newer, has already sold 65.4 million units, showing rapid adoption since its launch.

Lifetime Gaming Software Unit Sales of Nintendo by Platform

- The Nintendo Switch leads with over 1.13 billion software units sold, making it Nintendo’s most successful software platform to date.

- The Nintendo DS holds second place with 948 million lifetime software units sold, powered by titles like New Super Mario Bros. and Nintendogs.

- The Wii sold approximately 921.8 million units of software, driven by motion-control hits such as Wii Sports and Just Dance.

- The Game Boy and Game Boy Color combined achieved 501 million units sold, with Pokémon Red/Blue/Yellow as top sellers.

- The 3DS platform closed with 390 million software units, bolstered by the Animal Crossing and Fire Emblem series.

- Software sales for the Wii U reached 103 million units, with Mario Kart 8 being its breakout hit before re-releasing on the Switch.

- The GameCube’s lifetime software sales total 208 million units, despite the system’s limited market share.

- The original Nintendo Entertainment System (NES) saw 501 million games sold, introducing millions to video games.

- The SNES (Super Nintendo) added another 379 million units, keeping franchises like Metroid and Donkey Kong Country alive.

- Combined, Nintendo’s consoles have generated more than 5.2 billion units in software sales since 1983.

Nintendo, PlayStation, and Xbox

- In FY2024, Nintendo earned $14.6 billion in revenue, behind PlayStation’s $29.4 billion, but ahead of Xbox’s $13.1 billion.

- Nintendo holds the lead in unit sales for current-gen consoles, with the Switch at 141.32 million units, compared to PlayStation 5’s 63.4 million and Xbox Series X|S’s 27.2 million.

- Despite its lead in unit sales, Nintendo lags in ARPU, with an estimated $105/user annually, while PlayStation averages $194.

- Xbox dominates in subscription services, with Game Pass reaching 34 million users in 2024, nearly double that of NSO.

- Nintendo’s market cap as of April 2025 is $64.3 billion, trailing behind Sony Group’s $112 billion but ahead of Microsoft’s Xbox division.

- Mario Kart 8 Deluxe outsold all exclusive titles from both PlayStation and Xbox in 2024.

- Nintendo leads in family-friendly and casual genres, with over 71% market share in that segment, a category underserved by competitors.

- Despite lacking high-performance hardware, Nintendo’s profitability margin remains higher, largely due to in-house development and minimal third-party licensing.

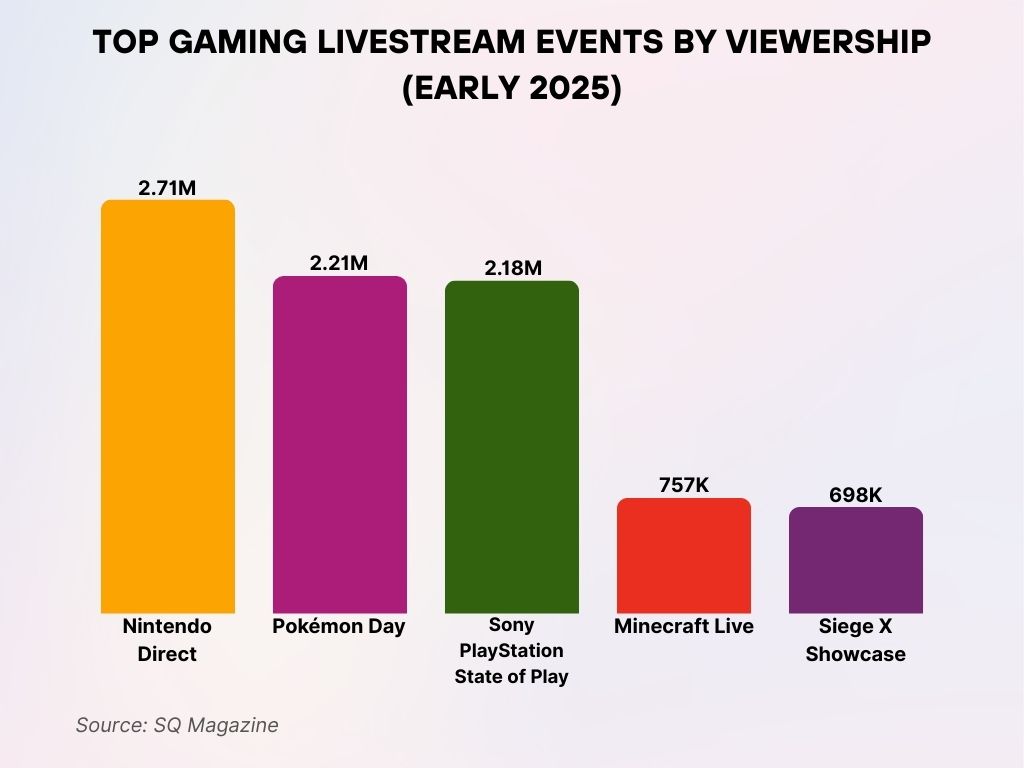

Top Gaming Livestream Events by Viewership (Early 2025)

- Nintendo Direct attracted the highest audience with 2.71 million peak viewers, leading all gaming showcases in early 2025.

- Pokémon Day came second with 2.21 million peak viewers, reflecting strong franchise loyalty and fan engagement.

- Sony PlayStation State of Play followed closely with 2.18 million viewers, showcasing continued interest in Sony’s gaming ecosystem.

- Minecraft Live saw 757,000 peak viewers, highlighting its steady popularity among global audiences.

- Siege X Showcase rounded out the top five with 698,000 peak viewers, indicating niche but passionate interest in Rainbow Six.

Nintendo Competitors Catching Up

- Sony’s PlayStation 5 saw a 17.4% YoY sales increase in 2024, closing in on Switch’s dominance in Western markets.

- Xbox Series X|S expanded into 14 new markets in 2024, gaining 9.3 million new users globally.

- Valve’s Steam Deck shipped 3.2 million units in 2024, becoming a strong handheld competitor in the PC gaming hybrid space.

- Meta’s Quest 3 gained traction among younger gamers, marking a 15% overlap with Nintendo’s target demo.

- Cloud gaming adoption increased by 23% globally, with services like GeForce Now and Xbox Cloud Gaming reducing hardware dependence.

- Competitors increasingly mimic Nintendo’s nostalgic approach with remakes and remasters, especially from Sony’s PlayStation Classics lineup.

- Tencent’s gaming division grew by 11.6%, with Honor of Kings and PUBG Mobile pulling attention away from Switch mobile crossovers.

- Sony acquired 2 more indie studios in late 2024, aiming to boost exclusive content, an area where Nintendo still leads.

Environmental and Sustainability Statistics

- Nintendo pledged to achieve carbon neutrality by 2050, with a milestone target of 60% carbon reduction by 2035.

- In 2024, the company reported a 13% decrease in greenhouse gas emissions compared to 2022, mainly from supply chain optimizations.

- All Switch packaging is now 100% recyclable, and the company has eliminated plastic inserts from new game boxes.

- Nintendo’s Kyoto HQ uses 100% renewable energy, part of its wider shift to sustainable operations.

- Over 12.8 million hardware units in 2024 were shipped using carbon-offset logistics.

- Nintendo launched a buyback and recycling program for old consoles and accessories in Japan and select US states.

- Environmental-themed game content, like Pikmin Bloom, saw 18% more user engagement following Earth Day campaigns.

- Supplier audits increased by 21% to ensure compliance with ethical sourcing and labor practices.

- The company is investing in eco-friendly chip manufacturing, with a projected 15% energy savings per unit by 2027.

Recent Developments

- Nintendo announced it is working on its next-gen console, rumored to release by March 2026, with developer kits already in circulation.

- The Switch 2 (working title) is expected to support DLSS-like upscaling, a first for Nintendo.

- Metroid Prime 4 was finally given a November 2025 release window, after years of delay.

- A new partnership with LEGO will expand Mario-themed sets, aiming at collectors and younger audiences alike.

- Nintendo Pictures, the studio behind The Super Mario Bros. Movie, is producing a Legend of Zelda animated series, set to debut on Netflix in 2026.

- The company opened a new experience store in Osaka, modeled after its popular New York location, which attracted over 3 million visitors in 2024.

- A new IP titled “Starshard Chronicles” is in development, aimed at older RPG fans, with previews expected at E3 2025.

- Nintendo continues to invest in AI-assisted development tools, aiming to cut localization time by 30% in multilingual releases.

- Animal Crossing: New Horizons will receive a major expansion pack in late 2025, with multiplayer sandbox features.

Conclusion

Nintendo’s numbers for 2025 show more than just impressive sales, they reveal a brand deeply rooted in innovation, nostalgia, and community. Whether it’s outpacing competitors in unit sales, reshaping family gaming experiences, or committing to sustainability, Nintendo’s ability to evolve without losing its identity is its superpower.

Looking ahead, its next-generation console, bold IP expansion, and deep digital integration hint at a future where Nintendo continues to lead, not by brute force, but by creative charm and strategic resilience. If the past few decades have taught us anything, it’s this: Nintendo plays the long game, and often, it wins.