Imagine walking into a small-town hardware store in 2015. On the shelf sits a modest graphics processing unit, designed mostly for gaming. Fast-forward to today, and that same type of chip, evolved, optimized, and purpose-built, is powering the world’s most advanced AI models, from self-driving cars to generative voice assistants. This shift didn’t happen overnight. The AI chip landscape has been reshaped by explosive growth, escalating demand, and razor-sharp innovation.

In 2025, we’re no longer asking whether specialized AI chips are the future. We’re living in that future. As businesses, governments, and consumers fuel the next phase of intelligent computing, these chips are becoming the heartbeat of a new digital age.

Editor’s Choice

- The global AI chip market is projected to hit $40.79 billion in 2025.

- NVIDIA maintains its industry lead with an estimated 86% share in the AI GPU segment for 2025.

- Edge AI chips are forecast to reach $13.5 billion in 2025, driven by IoT and smartphone integration.

- AI accelerators based on ASIC designs are expected to grow by 34% year-over-year in 2025.

- Automotive AI chips are set to surpass $6.3 billion in 2025, thanks to advancements in autonomous driving.

- Google’s TPU v5p reached 30% faster matrix math throughput in benchmark tests.

- US-based AI chip startups raised over $5.1 billion in venture capital in the first half of 2025 alone.

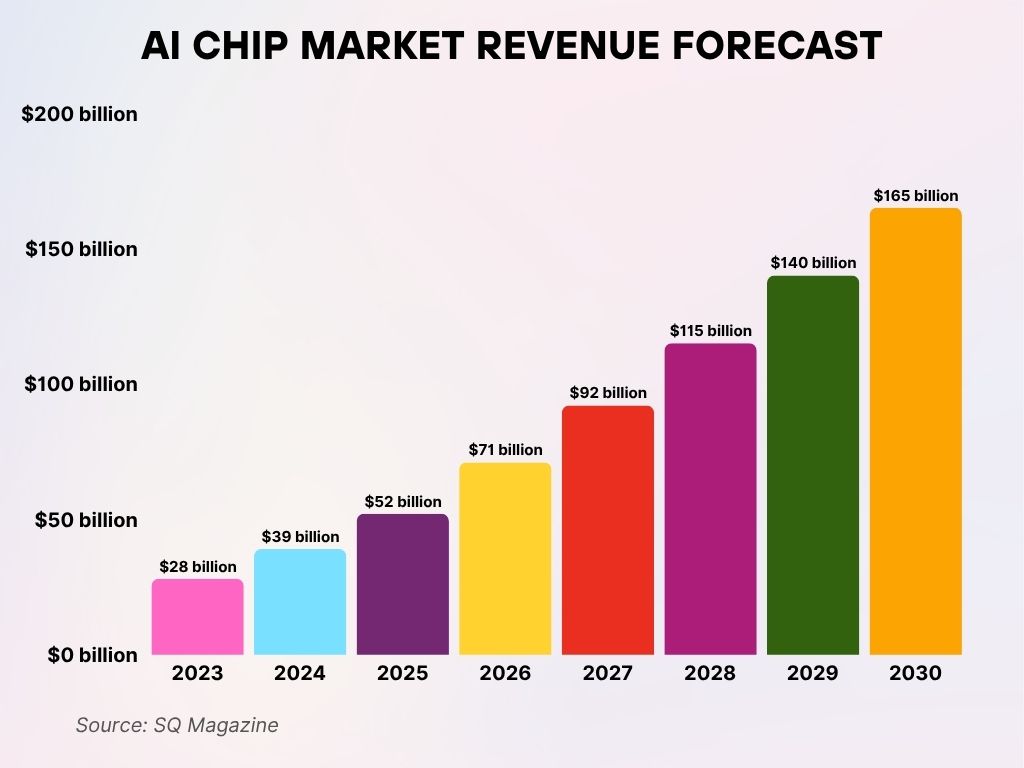

AI Chip Market Revenue Forecast

- The AI chip market is set for massive growth, reaching $165 billion by 2030.

- In 2023, the market was valued at $28 billion, highlighting early-stage momentum.

- By 2025, revenue is projected to nearly double to $52 billion, marking rapid acceleration.

- The market crosses the $100 billion threshold in 2028, reaching $115 billion.

- Between 2029 and 2030, the industry is expected to add another $25 billion, showing continued investor confidence.

- The period from 2023 to 2030 reflects a 6x increase in market size, underscoring AI’s explosive demand and integration.

Market Share by AI Chip Type (GPU, TPU, FPGA, ASIC, etc.)

- GPUs remain dominant, expected to hold a 46.5% share of the AI chip market by 2025.

- TPUs are gaining ground, accounting for 13.1% of market share in 2025, led by Google’s cloud deployments.

- Custom ASICs designed for edge inference are projected to reach $7.8 billion in 2025 revenue.

- FPGAs, though niche, are estimated to contribute $3.2 billion in 2025, favored for their reprogrammable logic.

- Hybrid AI chips, combining CPUs with NPUs, are forecast to grow 22.4% year-over-year in 2025.

- Chips optimized for Transformer architectures are expected to make up 20% of all AI compute hardware sold in 2025.

- In data center inference workloads, ASICs will surpass GPUs in efficiency, grabbing 37% of total deployment share in 2025.

- The market for neuromorphic chips is estimated to hit $480 million in 2025, reflecting early experimentation in edge AI.

- Open-source chip architectures, such as RISC-V based AI accelerators, are projected to exceed $1.1 billion in 2025.

- In mobile AI chips, NPUs are expected to ship in over 970 million smartphones globally by 2025.

Leading Companies in the AI Chip Industry

- NVIDIA is expected to report $49 billion in AI-related revenue in 2025, a 39% increase from the previous year.

- AMD is projected to grow its AI chip division to $5.6 billion in 2025, doubling its footprint in data centers.

- Intel’s Gaudi 3 platform is forecast to secure 8.7% of the AI training accelerator market by the end of 2025.

- Google continues to lead in custom AI chip deployment with TPUs expected to generate $3.1 billion in value in 2025.

- Apple’s A19 Bionic chip, launched in 2025, features a 35 TOPS neural engine, setting a new benchmark for on-device AI.

- Qualcomm is projected to ship over 800 million AI-capable chips in smartphones and edge devices by 2025.

- Amazon’s Trainium2 and Inferentia2 chips are anticipated to power 35% of all new AI workloads on AWS in 2025.

- TSMC, the leading AI chip foundry, will dedicate over 28% of its total wafer capacity to AI chip manufacturing in 2025.

- Graphcore, though smaller in scale, is expected to ship 600,000 IPUs globally in 2025, largely to academic and research institutions.

- Tenstorrent, a startup led by chip veterans, is forecast to grow its licensing and chip design revenue to $240 million in 2025.

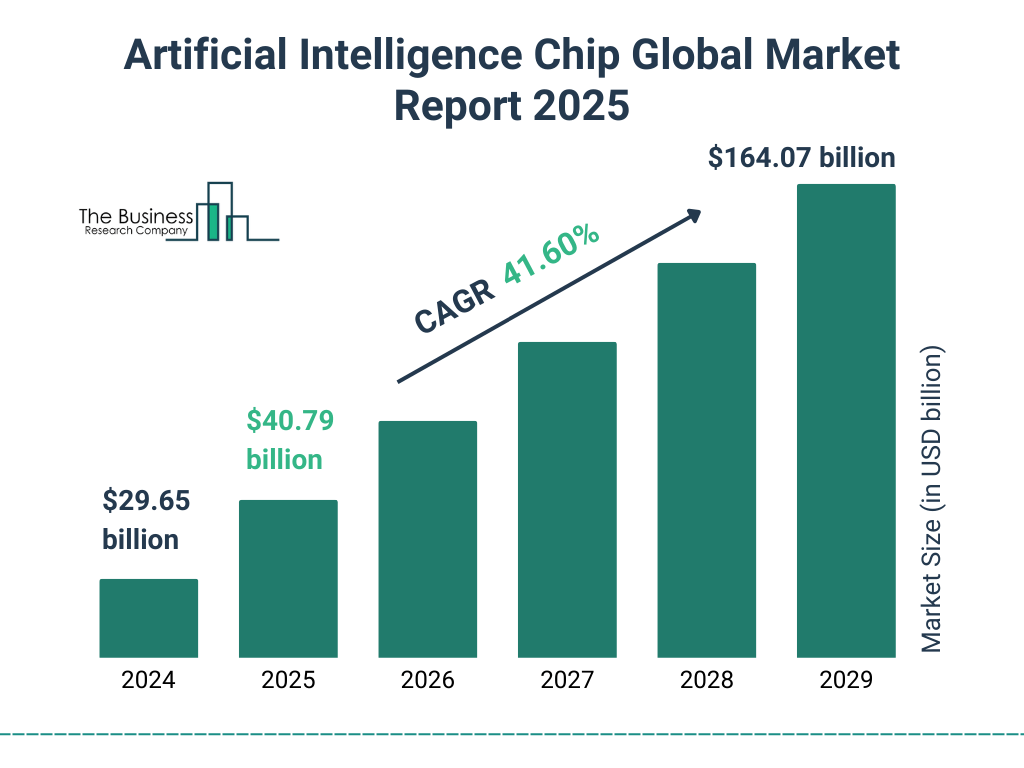

AI Chip Market Size Forecast

- The global AI chip market is projected to grow from $29.65 billion in 2024 to $164.07 billion by 2029.

- Expected to reach $40.79 billion in 2025, marking strong early growth.

- The market is forecasted to grow at a CAGR of 41.60% during this period.

AI Chip Usage by Application (Data Centers, Edge Devices, Automotive, etc.)

- Data centers continue to dominate AI chip usage, expected to consume 52% of all AI chips sold globally in 2025.

- AI chip deployments in edge devices are projected to reach $14.1 billion in 2025, driven by smart cameras, wearables, and industrial IoT.

- The automotive AI chip market is forecast to grow to $6.3 billion in 2025, propelled by advanced driver-assistance systems (ADAS).

- Healthcare AI applications, including diagnostics and medical imaging, will generate $2.2 billion in AI chip demand in 2025.

- Smartphones embedded with neural processing units (NPUs) are expected to ship over 980 million units in 2025.

- AI chips in smart home devices will account for $1.4 billion in value in 2025, led by speakers, thermostats, and security cameras.

- Robotics and automation systems in warehouses and factories will incorporate AI chips worth over $2.6 billion in 2025.

- Retail analytics platforms, using AI chips for vision-based inventory and checkout systems, are forecast to exceed $850 million in 2025.

- Drones and unmanned vehicles using AI chips will account for $1.1 billion in hardware revenue globally in 2025.

- The gaming industry’s AI chip segment, focused on real-time rendering and NPC behavior, is expected to reach $3.9 billion in 2025.

Regional Analysis of AI Chip Demand

- The United States remains the top consumer, projected to account for $26.9 billion in AI chip revenue in 2025.

- China’s AI chip market is estimated to grow to $18.3 billion in 2025, with strong government backing and domestic silicon manufacturing.

- India is emerging fast, with the AI chip market expected to reach $1.9 billion in 2025, driven by smart cities and public infrastructure digitization.

- Japan and South Korea combined are expected to contribute $6.4 billion to the global market in 2025, primarily in automotive and robotics.

- Europe’s AI chip revenue is forecast to reach $11.4 billion in 2025, with Germany and France leading the region’s investments.

- Middle East and Africa will generate $1.3 billion in AI chip sales in 2025, driven by government-led AI transformation programs.

- Brazil leads Latin America’s AI chip market, projected to contribute $970 million in 2025, thanks to edge AI in agriculture and retail.

- Southeast Asia, including Vietnam and Indonesia, is forecast to generate $2.1 billion in regional AI chip demand by 2025.

- The United Kingdom alone is expected to import and deploy AI chips worth over $2.6 billion in 2025, mainly in fintech and healthcare.

- Russia’s AI chip consumption is set to contract to $490 million in 2025, due to sanctions and limited access to advanced chip nodes.

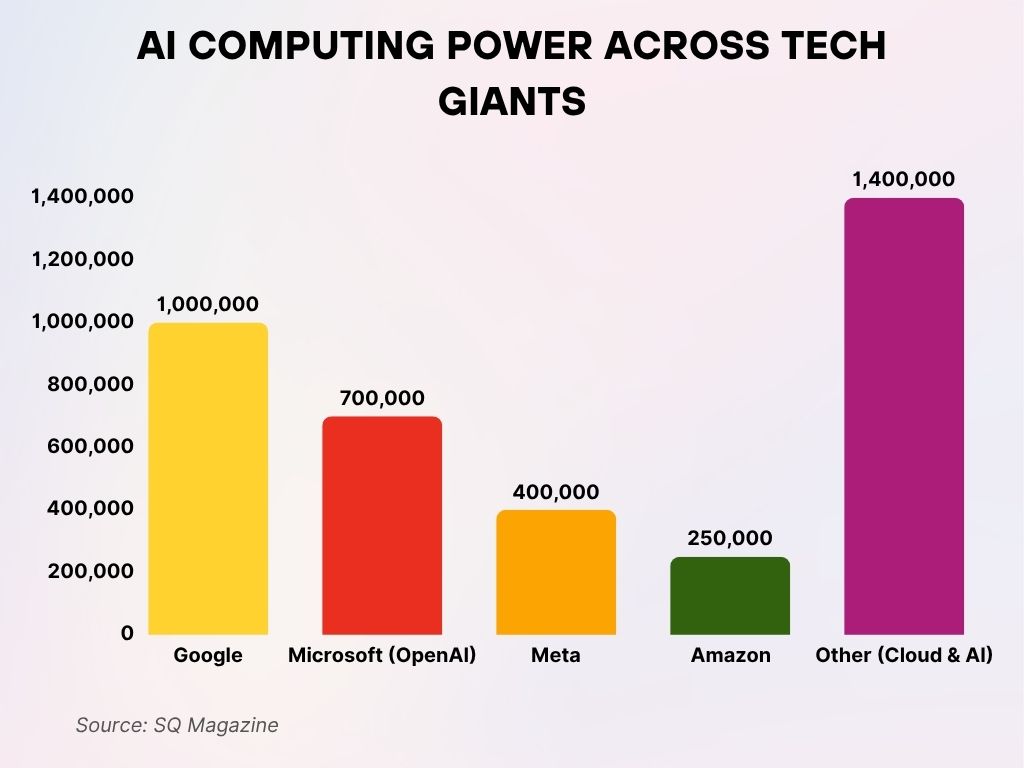

AI Computing Power Across Tech Giants

- Google leads with a total of 1 million H100 equivalents, combining 400,000 from NVIDIA and 600,000 from TPUs.

- Microsoft, including its partnership with OpenAI, holds about 700,000 H100 equivalents, all sourced from NVIDIA.

- Meta follows closely with 400,000 NVIDIA H100 equivalents, highlighting its strong AI infrastructure.

- Amazon maintains an AI capacity of 250,000 H100 equivalents, entirely based on NVIDIA GPUs.

- The “Other” category, which includes various cloud providers and AI labs, dominates with a collective 1.4 million H100 equivalents, showcasing significant investments beyond the major tech firms.

AI Chip Performance Benchmarks and Efficiency Trends

- NVIDIA H200 Tensor Core GPU achieves 4.2x speedup on LLM inference tasks compared to the H100, setting the benchmark for 2025.

- Google TPU v5p shows a 30% improvement in throughput and 25% lower energy consumption than its previous generation in 2025.

- AI chips in smartphones now routinely deliver 35 TOPS (trillion operations per second) of AI performance in 2025.

- Apple’s A19 Bionic chip features a new machine learning controller that is 20% more efficient in multitasking across vision and voice models.

- Graphcore’s IPU-3 hits 300W TDP, with 50% higher FLOPS-per-watt efficiency in 2025, leading in energy-scaled compute.

- AMD’s MI400 series posts a 2.3x improvement in training speed for image classification models compared to MI300, as of Q2 2025.

- Qualcomm’s Snapdragon X80 AI processor delivers 45% power reduction for on-device voice processing in 2025.

- Samsung’s Exynos AI cores, embedded in Galaxy devices, now support real-time language translation with <10ms latency in 2025.

- TSMC’s N3E process node, used in custom AI chips, has led to 18% performance gains and 30% area reduction over N5 in 2025.

- Liquid-cooled AI accelerator cards, now standard in hyperscale deployments, deliver 20–30% better thermal efficiency than air-cooled versions in 2025.

Investments and Funding in AI Chip Startups

- Global investments in AI chip startups surpassed $11.6 billion in 2025, with over 140 deals closed by mid-year.

- US-based companies attracted $5.1 billion of that total, including mega-rounds from Series C and D-stage startups.

- Tenstorrent, a RISC-V-based AI chip developer, raised $320 million in 2025, led by Fidelity and Samsung Catalyst Fund.

- Mythic AI, focused on analog computing for AI, secured $190 million in fresh funding in 2025.

- Cerebras Systems announced a $2.2 billion valuation after raising $400 million in a 2025 Series F round.

- Untether AI, targeting ultra-low power edge inference, received $140 million in growth capital in 2025.

- Esperanto Technologies, a leader in energy-efficient RISC-V AI chips, raised $115 million to expand its 7nm lineup in 2025.

- China’s Enflame Technology received $700 million in public-private investment rounds in 2025.

- India’s AI chip ecosystem saw an injection of $410 million from venture and strategic capital sources in 2025.

- Europe’s Graphcore, despite restructuring, received a $280 million bailout and innovation grant in 2025 to preserve AI chip development.

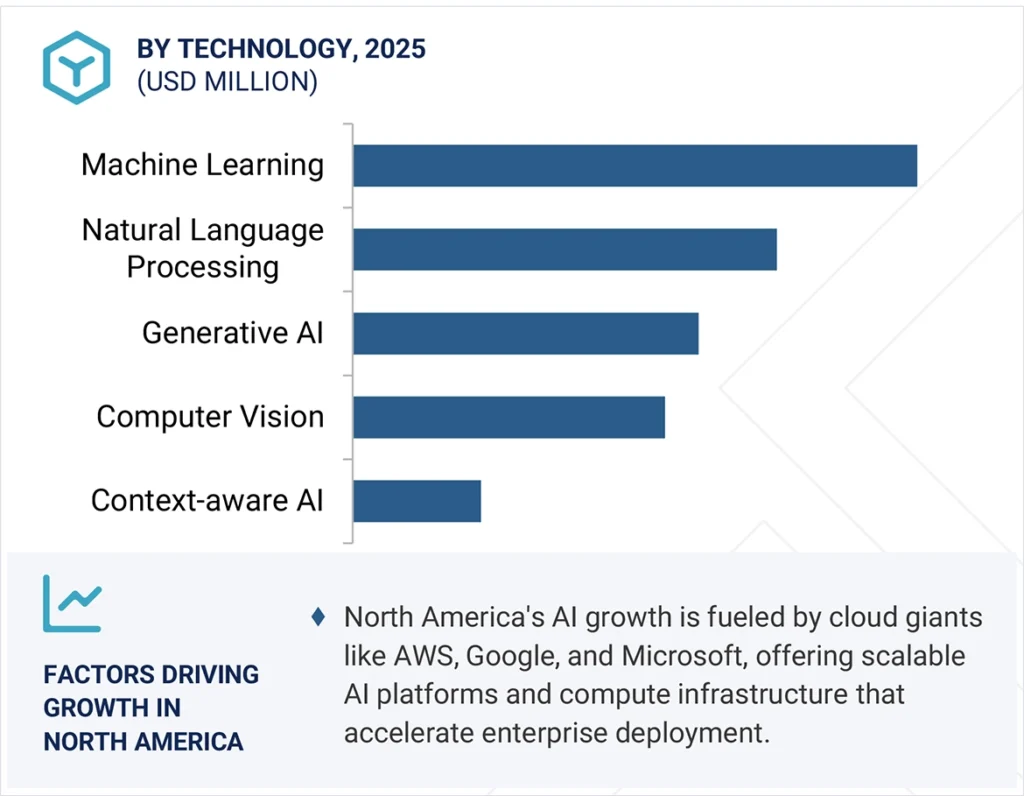

AI Technologies Market Breakdown

- Machine Learning is projected to dominate the AI market in 2025, accounting for approximately 33% of total revenue, making it the most adopted AI technology across industries.

- Natural Language Processing (NLP) comes in second with around 24%, driven by growing enterprise use of chatbots, virtual assistants, and automated text analysis tools.

- Generative AI is expected to hold about 18% of the market, fueled by rapid innovation in AI-generated content, especially in media, design, and marketing applications.

- Computer Vision secures an estimated 15% share, maintaining steady demand in areas like healthcare diagnostics, autonomous vehicles, and surveillance systems.

- Context-aware AI represents the smallest segment at 10%, yet it remains relevant for delivering personalized, adaptive user experiences.

- North America leads the regional AI growth, powered by tech giants such as AWS, Google, and Microsoft, offering scalable platforms and advanced compute infrastructure to accelerate enterprise AI deployment.

AI Chip Manufacturing and Supply Chain Insights

- TSMC allocated 28% of its total wafer capacity to AI chip production in 2025.

- Samsung Foundry reached 90% yield rates on its 3nm GAA nodes for high-volume AI chip manufacturing in 2025.

- Intel Foundry Services (IFS) added 4 new AI-focused clients to its 2025 portfolio, expanding its advanced packaging capabilities.

- Global AI chip packaging revenue grew to $4.7 billion in 2025, driven by 2.5D/3D stacking technologies.

- Substrate shortages, a problem in previous years, were largely resolved by Q2 2025 due to expanded capacity in Taiwan and Malaysia.

- ASML’s EUV lithography tool shipments reached 57 units in 2025, supporting aggressive AI chip tape-outs at <5nm nodes.

- Global average AI chip lead time dropped to 12 weeks in 2025, due to better inventory planning.

- COB (chip-on-board) packaging saw a 38% YoY growth in AI chip applications, particularly in automotive and wearable sectors in 2025.

- Foxconn committed to building two new AI-focused assembly plants in Arizona by late 2025, aiming for a localized US supply.

- NVIDIA’s supply contracts with TSMC and Samsung accounted for over $14 billion in wafer starts and backend services in 2025.

AI Chips in Consumer Electronics and Enterprise Use Cases

- AI chips embedded in smartphones are expected to surpass 980 million unit shipments in 2025, driven by generative voice and image features.

- Laptops and tablets with dedicated NPUs (neural processing units) will reach 42% of the consumer computing market in 2025.

- Smart TVs with on-device AI for content optimization are projected to sell over 135 million units globally in 2025.

- In wearables, AI chips enabling health analytics and gesture tracking will account for $2.3 billion in component revenue in 2025.

- Home robotics (e.g., vacuums, assistants) with embedded AI chips are forecast to generate $1.2 billion in global sales in 2025.

- Enterprise AI servers, led by demand from Fortune 500 companies, will account for $21.6 billion in chip consumption in 2025.

- Virtual collaboration devices (e.g., smart displays, AI-powered webcams) will ship over 47 million units in 2025, with embedded AI hardware.

- In retail and point-of-sale, AI chips enabling real-time analytics and customer engagement will see spending reach $1.6 billion in 2025.

- AI-powered surveillance systems, used across public and private sectors, will consume chips worth over $4.1 billion in 2025.

- Generative AI hardware for creators, including AI accelerators in cameras and audio tools, will be a $870 million niche by 2025.

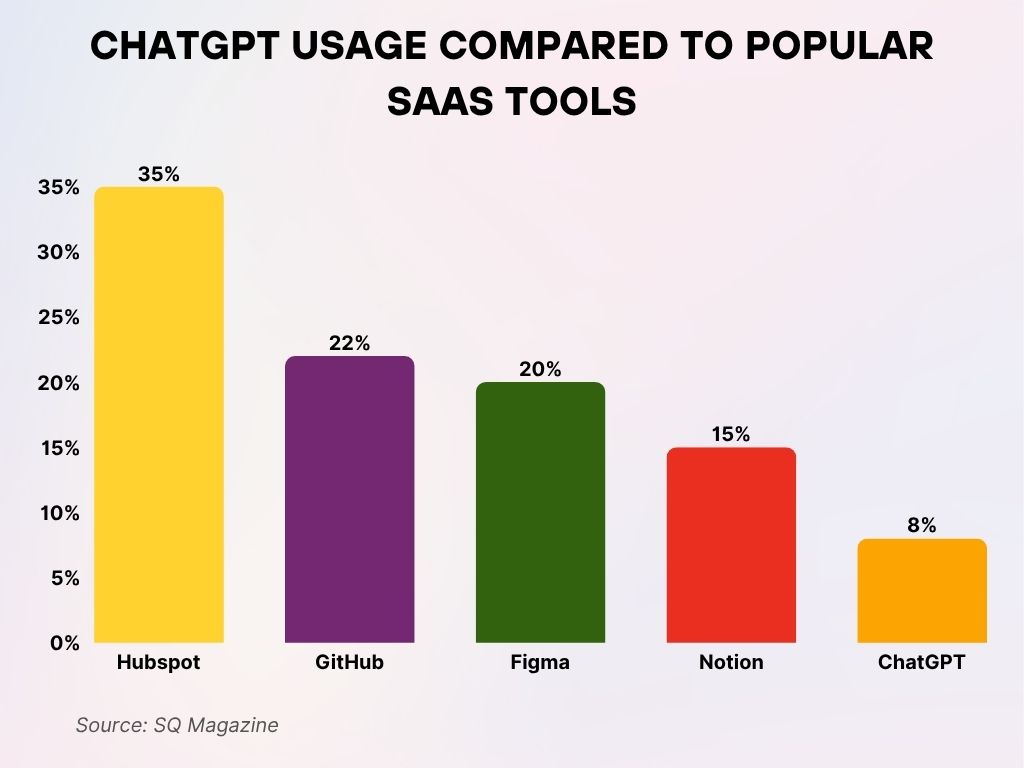

ChatGPT Usage Compared to Popular SaaS Tools

- Hubspot leads SaaS tool usage with an estimated 35%, highlighting its dominance in CRM and marketing platforms.

- GitHub ranks second with around 22% usage, reflecting its strong presence in software development workflows.

- Figma captures about 20% of usage, making it a key tool for collaborative design teams.

- Notion holds 15% usage, popular for note-taking and team knowledge management.

- ChatGPT lags behind with just 8% usage, indicating it is still gaining traction compared to more established SaaS tools.

Impact of Generative AI on AI Chip Demand

- The generative AI boom is responsible for 32% of all new AI chip deployments in 2025.

- Training large language models (LLMs) like GPT, Gemini, and Claude drove $18.9 billion in chip demand across hyperscalers in 2025.

- Inference chips for generative AI tasks are expected to reach $11.4 billion in global spending in 2025.

- Fine-tuning LLMs on edge devices (phones, routers, laptops) prompted chipmakers to release more compact and power-efficient accelerators, fueling a 26% rise in edge inference chips in 2025.

- Data center buildouts for generative AI workloads led to the deployment of over 6.5 million new AI accelerator units globally in 2025.

- Memory bandwidth and capacity improvements for generative workloads reached an average of 1.2TB/s, influencing AI chip design in 2025.

- Audio generation, particularly in podcasting and virtual voices, accounted for $520 million in AI chip revenue in 2025, a new and growing category.

- Real-time video generation tasks in AR/VR and gaming led to the adoption of AI chips with frame-level inference abilities, projected at $1.6 billion in revenue in 2025.

- Multimodal generative AI platforms, combining vision, audio, and text, consumed AI chips worth over $2.3 billion in 2025.

AI Chip Pricing Trends and Production Costs

- The average price per AI training chip dropped to $8,960 in 2025, down 11.3% YoY due to increased competition and better yields.

- Inference chips for cloud deployment saw a sharper decline to $470 per unit in 2025, from $520 in 2024.

- Consumer-grade NPUs cost an average of $12.90 per unit in 2025, as integration improved across smartphones and laptops.

- Production costs for AI chips using 3nm process nodes fell by 14% in 2025, thanks to higher maturity in EUV-based manufacturing.

- Advanced packaging costs remained high, averaging $3.2 billion per foundry in capex investment by 2025.

- Liquid cooling requirements increased average system TCO (total cost of ownership) by 18% in high-performance AI chip installations in 2025.

- Cloud providers like AWS, Azure, and GCP reduced AI compute pricing by 6–12%, due to the falling costs of underlying AI chips in 2025.

- China’s local AI chip makers undercut US and EU suppliers with a 15–20% lower price point in 2025, spurring geopolitical concerns.

- RISC-V AI chips emerged as low-cost alternatives, with a unit cost under $5 in some edge deployments by 2025.

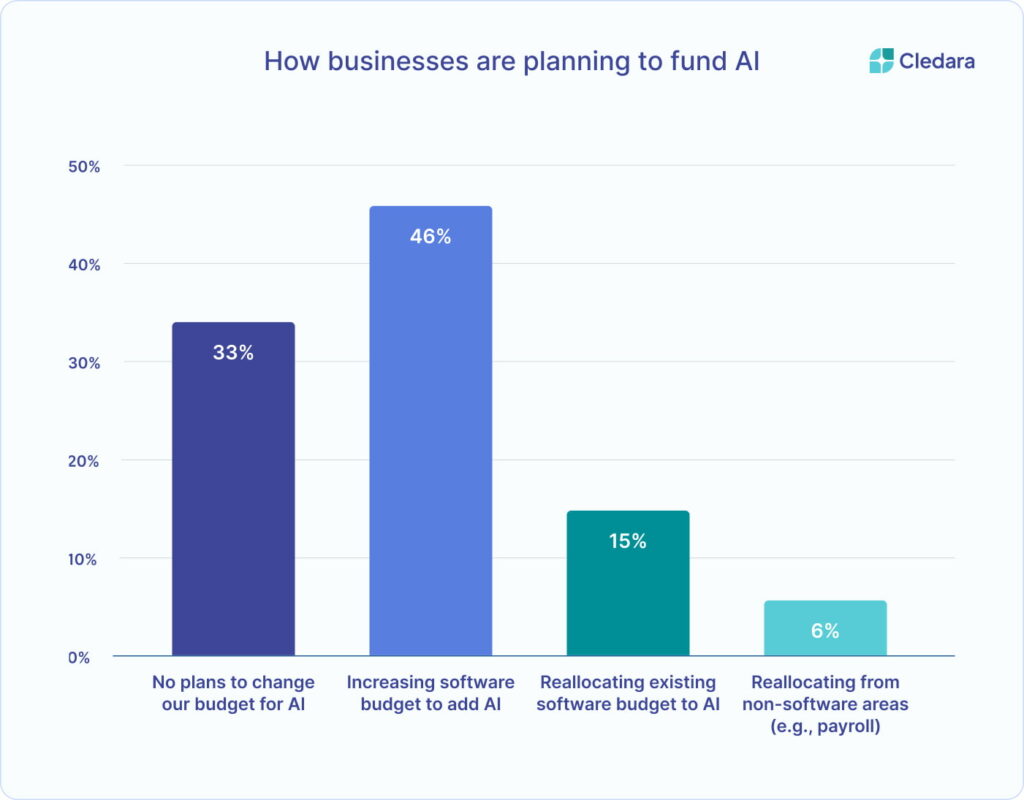

How Businesses Plan to Fund AI Initiatives

- 46% of businesses are increasing their software budget specifically to add AI capabilities.

- 33% report no plans to change their current budget for AI-related investments.

- 15% are reallocating existing software budgets to support AI adoption.

- 6% plan to reallocate funds from non-software areas like payroll to finance AI efforts.

Recent Developments in AI Chip Design and Innovation

- NVIDIA’s Blackwell architecture launched in 2025, offering 2x faster transformer acceleration and better sparsity handling.

- Intel’s Gaudi 3, released in Q1 2025, focused on open software stack integration and offered competitive cost-per-watt metrics.

- Google’s TPU v5p introduced multi-slice matrix fusion, optimizing large model training speeds by 35% in 2025.

- AMD’s MI400X incorporated chiplet-based modularity, allowing for dynamic scaling across tasks in 2025.

- Samsung’s GAA-based AI SoC, fabricated on its 3nm node, improved energy efficiency by 22% compared to previous gen chips in 2025.

- IBM’s neurosynaptic chip design entered early trials, using spike-based computation, and claimed 10x lower power consumption for select AI tasks in 2025.

- ARM Cortex-X5 AI cores were adopted in over 480 million mobile devices in 2025, thanks to their multitask AI scheduling ability.

- Meta’s MTIA v2 chip, tailored for recommendation engines, launched with optimized graph AI support, gaining traction in internal deployments in 2025.

- TSMC’s Backside Power Delivery technology, adopted in AI chip designs for the first time in 2025, resulted in up to 12% performance uplift.

- Startups like Rebellions (Korea) and SiMa.ai (US) pushed forward with domain-specific edge AI chips, targeting healthcare and robotics markets in 2025.

Conclusion

AI chips have quietly become the infrastructure powering everything from your personal assistant to autonomous fleets and enterprise analytics. In 2025, they’ve moved from the periphery to the core of innovation, economics, and geopolitical competition. With continued advances in specialized architectures, regional expansion, and cost-efficiency, AI chips are not just enabling the future; they are the future.

As consumer expectations grow and enterprise demands intensify, the spotlight will stay fixed on AI silicon. Whether you’re building a model, deploying smart infrastructure, or streaming media on your phone, somewhere beneath the surface, a next-gen AI chip is doing the heavy lifting.