WHAT WE HAVE ON THIS PAGE

- Editor’s Choice

- Apple Music Users

- Apple Music Global Subscribers

- Regional Breakdown of Apple Music Free vs. Premium Users

- Apple Music Users By Country & Region

- Apple Music Revenue

- Apple Music’s Global Revenue Growth Over the Years

- Apple Music vs. Spotify and Other Streaming Services

- Popular Online Music Brands

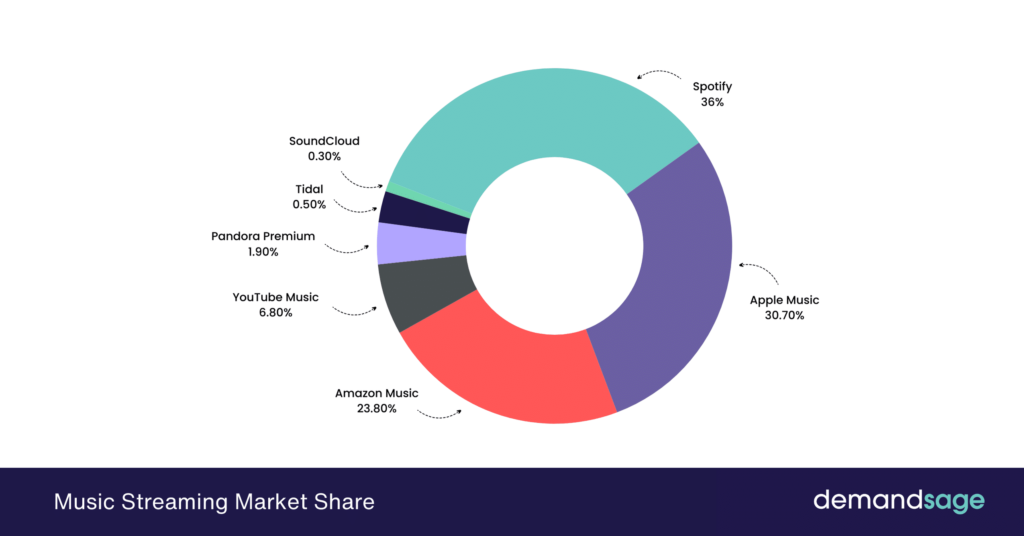

- Global Music Streaming Market Share Breakdown

- Apple Music’s Most Streamed Artist

- Most Streamed Songs and Artists on Apple Music in 2025

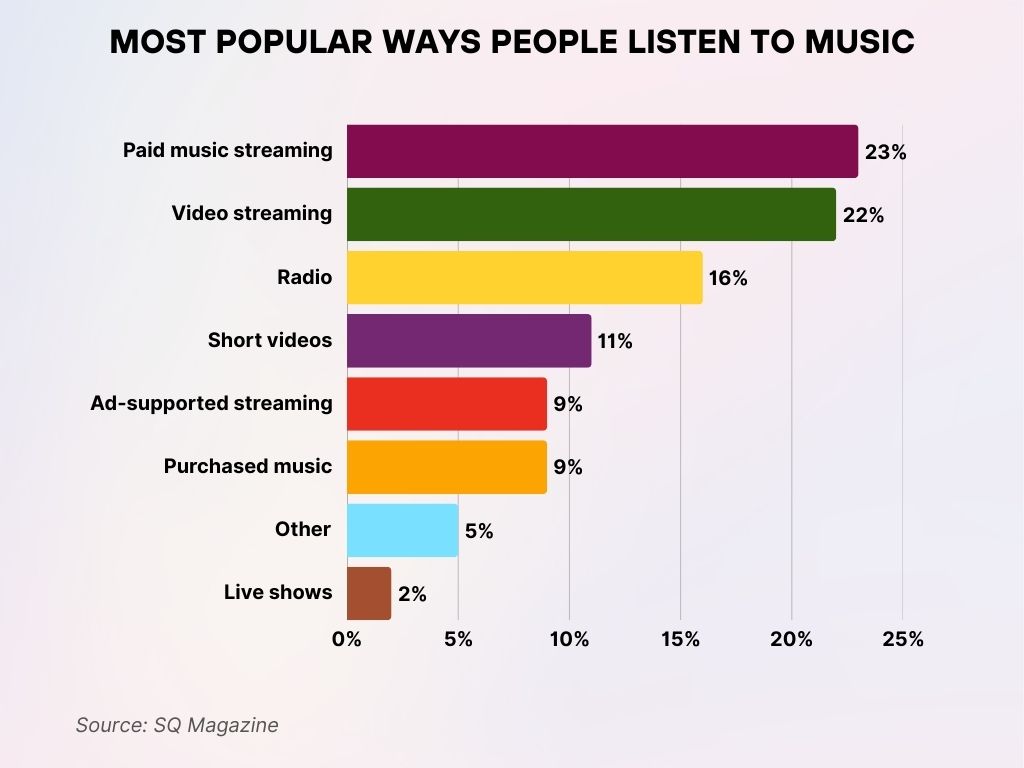

- Most Popular Ways People Listen to Music

- Demographics of Apple Music Users

- Apple Music Integration Across Apple Devices and Services

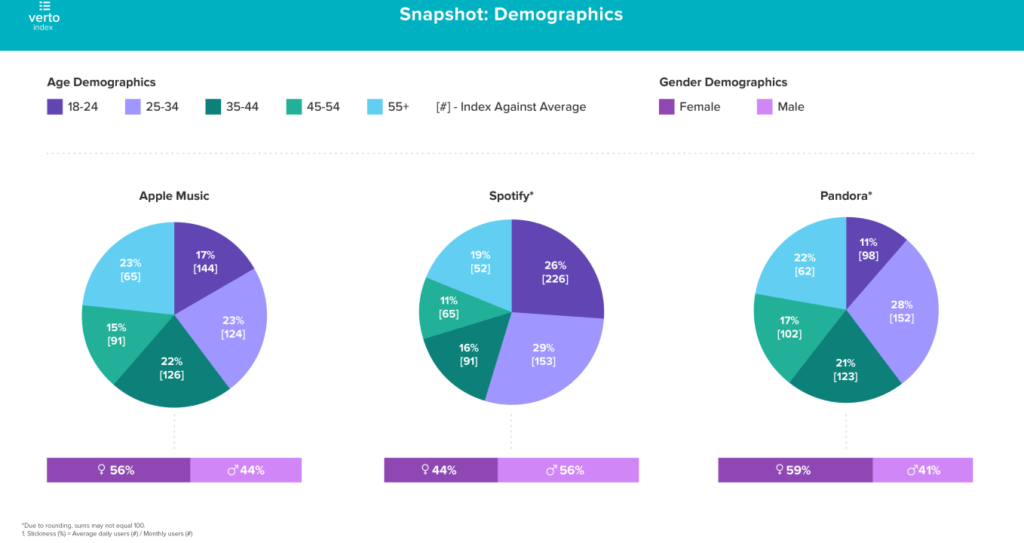

- Demographics Snapshot: Apple Music vs Spotify vs Pandora

- Trends in Apple Music Playlists and Curated Content

- Apple Music’s Role in Podcasting and Original Content

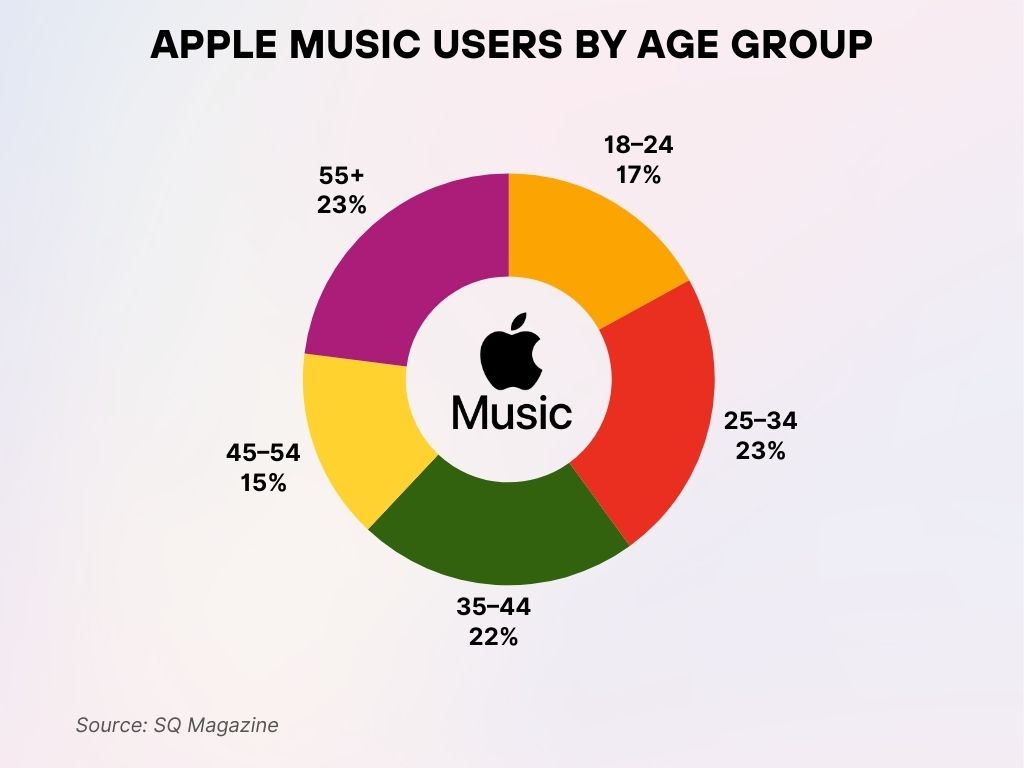

- Apple Music Users by Age Group

- Artist Earnings and Royalties on Apple Music

- Apple Music App Engagement and Listening Habits

- Lossless and Spatial Audio Adoption Rates

- Apple Music for Artists: Tools and Analytics Usage

- Apple Music’s Expansion in Global Markets

- Recent Developments

- Conclusion

- Sources

When Apple Music launched in 2015, it was Apple’s ambitious leap into the fiercely competitive world of streaming. Fast forward to 2025, and it’s no longer just another streaming service—it’s a global audio ecosystem influencing how we discover music, connect with artists, and personalize our soundtracks.

From hip-hop heads in New York to K-pop fans in Seoul, Apple Music has transformed the listening experience. This article explores the platform’s rise with fresh stats and trends for 2025, offering a full-spectrum view of its reach, revenue, and user behavior.

Editor’s Choice

- Apple Music hit 108 million paid subscribers globally in Q1 of 2025, making it the second-largest streaming platform after Spotify.

- More than 37% of Apple Music’s total user base is in the U.S., accounting for nearly 40 million subscribers in the region.

- In 2024, Apple Music generated over $10.2 billion in revenue, a 9.4% year-over-year increase.

- Nearly 1 in 5 iPhone users globally is also an Apple Music subscriber, showcasing strong ecosystem synergy.

- Apple Music Classical, launched in 2023, now has over 5 million monthly users, proving niche content strategies work.

- Over 65% of Apple Music users engage with curated playlists weekly, highlighting the value of human curation.

- In 2025, Apple Music overtook Amazon Music in Japan, becoming the #2 streaming service in the country.

Apple Music Users

- As of March 2025, Apple Music has 108 million paid subscribers worldwide, a jump from 98 million in 2024.

- Including users on free trials and promotions, the total active users reached over 140 million globally.

- In the United States alone, Apple Music boasts 40 million subscribers, securing over 35% market share domestically.

- The platform sees higher engagement among users aged 25–34, who represent 42% of total listening hours.

- Apple One bundles are responsible for nearly 17% of new Apple Music sign-ups in 2025.

- 73% of iPhone users say they are more likely to stick with Apple Music because of device integration.

- On average, an Apple Music subscriber listens to 28 hours of music per week, slightly above the industry average.

- Daily active users (DAUs) grew by 12.6% year-over-year, indicating improved app stickiness and user loyalty.

Apple Music Global Subscribers

- Apple Music is now available in 173 countries, with high penetration rates in North America, Europe, and parts of Asia.

- India became Apple Music’s fastest-growing market in 2024, with a 35% year-over-year increase in paid subscribers.

- In China, Apple Music has seen a 22% growth in monthly active users, largely driven by local content partnerships.

- The UK holds the third-highest subscriber base, with over 8.2 million Apple Music users as of Q1 2025.

- In Latin America, Brazil leads with 3.9 million subscribers, and Mexico follows closely at 3.2 million.

- Australia saw a 19% YoY increase, reaching over 2.5 million subscribers in early 2025.

- Apple Music subscriptions in Africa grew by over 40%, with South Africa, Nigeria, and Kenya showing the most momentum.

- Japan now has 5.7 million users, positioning Apple Music ahead of Amazon Music for the first time in the region.

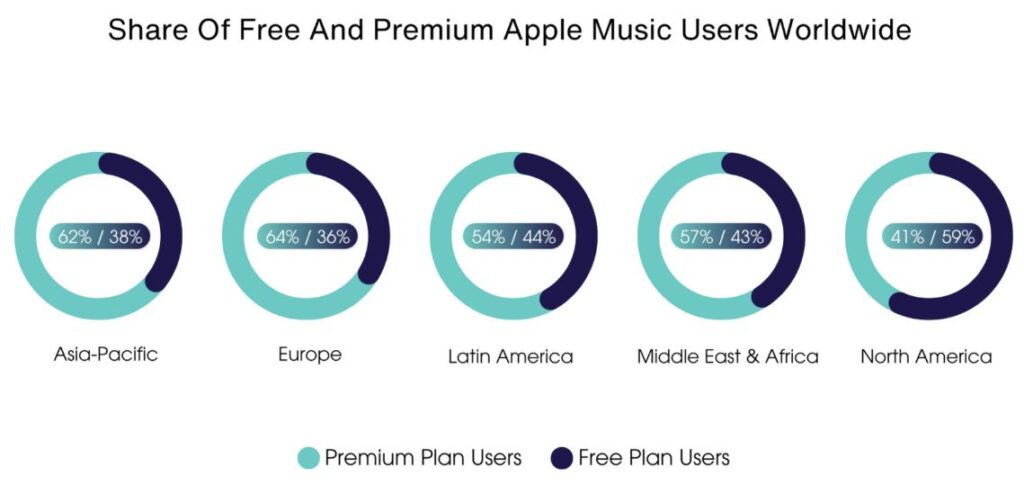

- Asia-Pacific leads in premium subscriptions, with 62% of users on the Premium Plan and 38% using the Free Plan.

- Europe shows the highest premium adoption rate at 64%, with only 36% on the free tier.

- In Latin America, the user base is more balanced, with 54% on the Premium Plan and 44% on the Free Plan.

- The Middle East & Africa also have a strong premium presence, with 57% premium users versus 43% free users.

- North America is the only region where Free Plan Users (59%) outnumber Premium Plan Users (41%), indicating a reverse trend compared to other regions.

Apple Music Users By Country & Region

- United States: 40 million subscribers (37% of the global total)

- United Kingdom: 8.2 million

- India: 7.5 million subscribers with rapid double-digit growth

- Japan: 5.7 million

- Germany: 4.1 million

- Canada: 3.3 million

- Australia: 2.5 million

- Brazil: 3.9 million

- France: 2.6 million

- South Korea: 1.8 million

- Regional adoption rates show that Western markets are maturing while emerging markets are accelerating.

- Localized editorial playlists have boosted engagement by 26% in non-English-speaking countries.

- Apple’s student subscription plan, priced competitively, accounts for 12% of all new sign-ups in global university towns.

Apple Music Revenue

- Apple Music generated $10.2 billion in revenue in 2024, expected to cross $11.3 billion in 2025.

- Revenue has grown at a compound annual growth rate (CAGR) of 12.7% over the last five years.

- The U.S. remains the largest revenue contributor, followed by the UK and Japan.

- Bundled subscriptions (via Apple One) contribute 28% of Apple Music’s total revenue.

- Family plans account for nearly one-third of all subscriptions, contributing heavily to retention.

- Royalties paid to artists crossed $2.1 billion in 2024, up 18% from 2023.

- Revenue from Apple Music for Business, a service for commercial establishments, grew by 31% YoY.

- Apple Music Classical generated over $110 million in standalone revenue, despite being available only in selected countries.

Apple Music’s Global Revenue Growth Over the Years

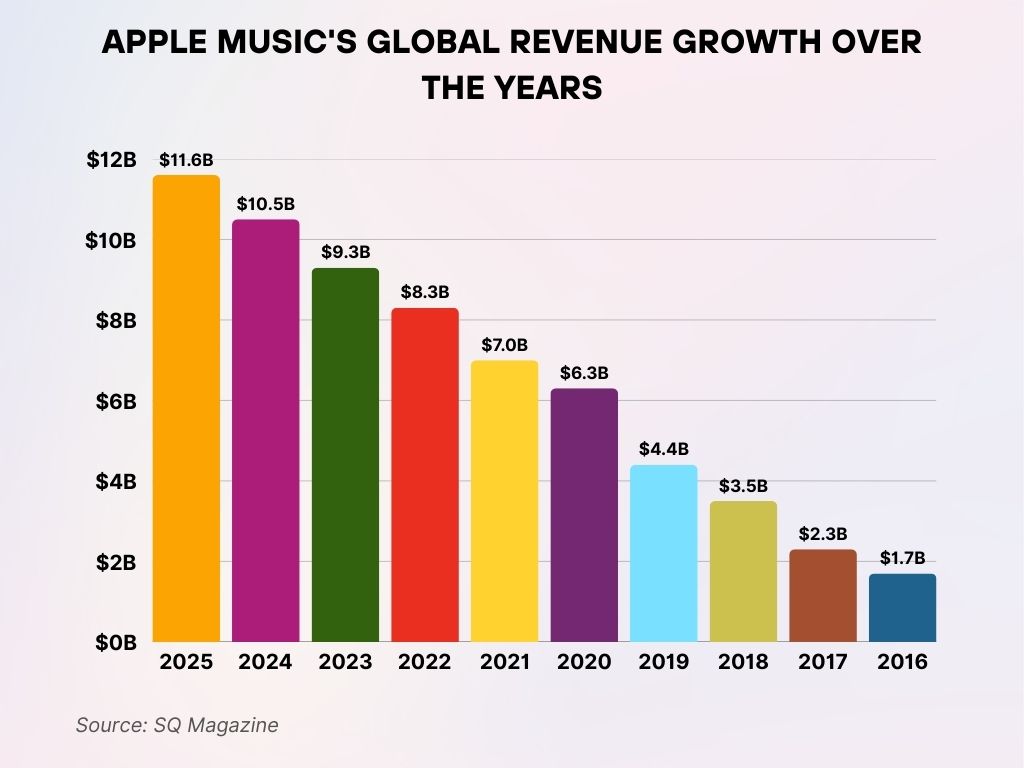

- 2016: In its early stages, Apple Music made $1.7 billion. The foundation laid this year helped fuel future exponential growth.

- 2025: Apple Music’s projected revenue reaches $11.6 billion, the highest to date. This marks a continued upward trajectory in its global dominance in music streaming.

- 2024: The platform earned $10.5 billion, crossing the $10B threshold for the first time. This growth reflects Apple’s expanding user base and premium subscriptions.

- 2023: Revenue hit $9.3 billion, continuing a strong momentum from the previous years. The rise highlights Apple Music’s increasing market share and customer retention.

- 2022: Apple Music generated $8.3 billion in revenue. The steady increase demonstrates consistent user engagement and monetization.

- 2021: The platform brought in $7.0 billion globally. This figure shows a significant year-over-year jump from 2020.

- 2020: Apple Music recorded $6.3 billion in global revenue. This period also marked growth despite pandemic-related global uncertainty.

- 2019: Revenue reached $4.4 billion, continuing the service’s fast-paced expansion. It was nearly a 26% increase from the previous year.

- 2018: Apple Music earned $3.5 billion, reflecting a maturing user base. Its popularity grew rapidly among iOS users during this phase.

- 2017: The platform saw $2.3 billion in global revenue. This represented a strong leap from its earlier figures as subscriptions gained traction.

Apple Music vs. Spotify and Other Streaming Services

- Spotify leads globally with 236 million paid subscribers, but Apple Music holds a stronger market share in the U.S. and Japan.

- Amazon Music has 82 million users but trails Apple Music in engagement and paid subscriber numbers.

- YouTube Music reached 100 million users, mostly free-tier, while Apple retains a paid-subscriber-heavy model.

- In the U.S., Apple Music holds 35% of the streaming market, second only to Spotify’s 42%.

- Apple Music sees more listening hours per user than any other streaming app, averaging 28 hours/week.

- Integration with iOS and Siri gives Apple Music a unique edge, especially for hands-free and smart home listening.

- In high-income demographics, Apple Music outperforms all rivals, with premium loyalty scores of 82/100.

- Apple Music ranks #1 in audio quality perception, especially due to its Lossless and Spatial Audio features.

Popular Online Music Brands

- Apple Music ranks as the #2 most-used music streaming service globally, following Spotify and ahead of YouTube Music.

- In 2025, Apple Music held a 16.8% share of global music streaming subscriptions compared to Spotify’s 31.6%.

- According to brand affinity surveys, Apple Music ranks #1 in user satisfaction among premium-tier subscribers.

- YouTube Music leads among Gen Z, but Apple Music dominates in higher-income and professional age brackets.

- Deezer and TIDAL continue to appeal to niche audiences but hold under 3% of the total market share combined.

- Pandora’s active user base continues to decline, now sitting at below 40 million, primarily U.S.-based.

- Amazon Music saw growth in smart speaker usage, but Apple Music leads in multi-device continuity and experience.

- Apple Music is the most-streamed platform on Apple Watch and ranks #1 in car-play integration usage.

- Brand trust scores place Apple Music ahead of Spotify by 12 points in U.S. consumer sentiment research.

- SoundCloud rounds out the list with 0.3%, remaining a platform for indie and emerging artists.

- Spotify leads the market with a 36% share, maintaining its position as the top streaming platform.

- Apple Music follows closely with 30.7%, solidifying its status as Spotify’s strongest competitor.

- Amazon Music holds a significant 23.8% market share, placing third among the top services.

- YouTube Music has carved out a 6.8% share, gaining popularity among younger audiences.

- Pandora Premium accounts for 1.9% of the market, showing a modest but consistent presence.

- Tidal holds a niche 0.5% market share, catering to audiophiles and exclusive content lovers.

Apple Music’s Most Streamed Artist

- Taylor Swift was Apple Music’s most-streamed artist in Q1 2025, followed closely by Bad Bunny and Drake.

- Swift’s album Midnights (3am Edition) logged over 2.6 billion streams globally on Apple Music.

- Bad Bunny retained top status in Latin America and Southern Europe, with 1.9 billion streams on the platform.

- Drake saw a 14% year-over-year increase in Apple Music streams, helped by strategic playlist placements.

- K-pop group NewJeans became the most-streamed Korean act on Apple Music, overtaking BTS in early 2025.

- Morgan Wallen topped the U.S. country genre charts, racking up over 780 million streams this year alone.

- R&B artist SZA had the highest first-week Apple Music debut for a female artist in 2025, surpassing 250 million streams.

- In Africa, Burna Boy led all artists in streams, with Apple Music’s curated Afrobeats playlists aiding regional exposure.

- EDM icon David Guetta saw a 21% boost in Apple Music streams following exclusive remix releases.

Most Streamed Songs and Artists on Apple Music in 2025

- The most-streamed song of 2025 (so far): “fortnight” by Taylor Swift ft. Post Malone, with 980 million plays.

- Olivia Rodrigo’s “bad idea right?” holds second place globally, clocking in at 845 million streams.

- Peso Pluma’s crossover hit “Luna” surged to the top of Latin charts with over 600 million streams.

- In the U.S., “Texas Hold ‘Em” by Beyoncé dominated country and pop playlists with 720 million+ plays.

- Emerging artist Ice Spice broke 500 million streams with her single “Like..? (Remix)” in Q1 2025.

- Apple Music’s “Today’s Hits” playlist contributed to 31% of total streams for its top 10 listed tracks.

- Songs featured in Apple’s official ads saw a 2.5x spike in streaming activity in the 24 hours following broadcast.

- Regional hits like “Snooze” by SZA and “JUMP” by Tyla topped charts in North America and South Africa, respectively.

- “Paint The Town Red” by Doja Cat saw an 18% increase in streams after live tour promotion via Apple Music exclusives.

Most Popular Ways People Listen to Music

- Live shows contribute the smallest share at 2%, possibly due to cost and accessibility limitations.

- Paid music streaming tops the list, with 23% of listeners choosing subscription-based platforms for their music.

- Video streaming comes in a close second at 22%, reflecting the popularity of platforms like YouTube for music discovery.

- Radio remains a strong contender, used by 16% of listeners, showing its continued relevance despite digital competition.

- Short videos, such as those on TikTok or Instagram Reels, account for 11% of music-listening habits.

- Ad-supported streaming services are used by 9% of users who prefer free access to music with occasional ads.

- Purchased music, including downloads and physical media, still holds 9% of the market, favored by collectors and loyal fans.

- Other listening methods make up 5%, likely including background use in apps or websites.

Demographics of Apple Music Users

- In 2025, users aged 18–34 make up 58% of Apple Music’s subscriber base, with a strong tilt toward urban areas.

- 55% of Apple Music users identify as male, while 45% are female, with gender parity shifting in younger demographics.

- 72% of Apple Music users have a college degree or higher, with a noticeable skew toward professionals and creatives.

- Income-wise, 61% of users earn $75K or more annually, aligning with the Apple device ecosystem’s premium tier.

- Urban-based users account for 68% of total subscribers, compared to 18% suburban and 14% rural.

- Hispanic and Black American users represent a combined 29% of Apple Music’s U.S. user base, influenced by hip-hop and Latin genres.

- Among Gen Z users, Apple Music has a higher net promoter score (+37) than Spotify (+21), showing stronger brand advocacy.

- Loyalty among Apple Music users is 1.8x stronger than with rival platforms, especially in high-income markets.

- 57% of global users say curated playlists are their favorite feature, followed by offline listening and exclusive content.

Apple Music Integration Across Apple Devices and Services

- Over 95% of Apple Music subscribers use the service on an iPhone, but cross-device usage is rising fast.

- Apple CarPlay accounts for over 24% of all Apple Music listening sessions in North America.

- Apple Music is pre-installed on over 1.5 billion active Apple devices worldwide as of 2025.

- HomePod streaming activity rose by 30% YoY, thanks to spatial audio and Siri integration improvements.

- Apple Watch users spend an average of 6.5 hours per week listening to music via the Apple Music app.

- Apple Music SharePlay usage grew by 43% in the past year, especially during social listening sessions.

- The platform is now natively integrated into tvOS, macOS, iPadOS, and visionOS, enabling full ecosystem reach.

- iCloud sync and offline download support make Apple Music one of the most reliable options for traveling and commuting.

- Handoff functionality between devices increased usage time by 18%, especially for users switching between iPhone and Mac.

Demographics Snapshot: Apple Music vs Spotify vs Pandora

- Apple Music’s 18–24 group also shows strong engagement, with a stickiness index of 144, while Pandora’s most engaged group is aged 35–44, indexed at 123.

- Apple Music has a fairly balanced age spread, with 23% of users aged 25–34 and another 23% aged 55+. Its gender split is 56% female and 44% male.

- Spotify is skewed younger, with 29% of users aged 25–34 and 26% in the 18–24 bracket. It has a slightly male-dominant audience at 56% male and 44% female.

- Pandora appeals most to older age groups, with 28% of users aged 25–34, 22% aged 55+, and the highest female share at 59% female and 41% male.

- In terms of stickiness (daily use vs monthly users), Spotify’s 18–24 group scores highest with an index of 226, showing deep engagement among young users.

Trends in Apple Music Playlists and Curated Content

- Over 65% of users interact with curated playlists weekly, up from 52% in 2023.

- Apple’s editorial team now manages more than 40 genre-specific flagship playlists, refreshed daily or weekly.

- “Rap Life,” “Pop Chill,” and “Afrobeats Weekly” are among the most-followed Apple-curated playlists in 2025.

- User-generated playlists now represent 22% of all listening sessions, up 6% from last year.

- Apple Music’s playlist followers have grown 15% year-over-year, with standout growth in Asia and South America.

- Mood- and activity-based playlists (e.g., sleep, focus, gym) are the most popular category, with 40% usage rates.

- “Replay 2025” personalized playlist series has seen a 26% higher engagement rate than in 2024.

- Playlist collaborations between artists and Apple’s editors have boosted streaming numbers by up to 3x.

- Dynamic playlist AI recommendations rolled out in late 2024 are showing 10% better retention vs static lists.

Apple Music’s Role in Podcasting and Original Content

- Apple Music hosts over 80,000 podcasts, separate from Apple Podcasts, emphasizing exclusive music content.

- In 2025, Apple Music Originals saw a 29% increase in listens, especially in behind-the-scenes artist storytelling.

- Zane Lowe’s interviews and “From Apple Music With Love” series remain flagship content with millions of monthly listens.

- Podcasts featuring music artist commentary see 2.2x longer listening sessions compared to standard episodes.

- The “Essential Albums” documentary series gained over 18 million combined plays in its first quarter of 2025.

- Apple Music Radio now includes 12 genre-focused stations with live-hosted and AI-enhanced segments.

- Time spent in Apple Music’s podcast tab grew 19% YoY, driven by long-form interviews and cultural commentary.

- Integration with Shazam and Apple Music allows seamless music discovery-to-podcast transitions.

- Apple is rumored to invest over $100 million into original audio content in 2025 to expand this vertical further.

Apple Music Users by Age Group

- The 45–54 age group rounds out the chart with 15%, making it the smallest segment but still a significant portion of users.

- 25–34-year-olds make up the largest segment, accounting for 23% of Apple Music users. This reflects strong adoption among millennials.

- The 55+ age group also represents 23% of users, showing Apple Music’s broad appeal beyond younger audiences.

- Users aged 35–44 follow closely at 22%, suggesting high engagement among middle-aged professionals.

- The 18–24 demographic contributes 17% of the user base, showing notable but slightly lower usage among Gen Z.

Artist Earnings and Royalties on Apple Music

- In 2024, Apple Music paid out over $2.1 billion in royalties, marking an 18% increase YoY.

- Apple Music pays an average of $0.01 per stream, slightly higher than Spotify’s $0.003–$0.005 average.

- Over 75% of royalty payments went to independent artists and small labels, reinforcing Apple’s “artist-first” pitch.

- More than 5,000 artists earned over $100,000 from Apple Music alone in 2024, a 23% increase from 2023.

- Apple Music for Artists dashboards have seen a 42% increase in log-ins, reflecting rising interest in data-driven growth.

- Female artists on Apple Music saw a 15% increase in revenue share, partially due to curated campaigns like “Women in Music.”

- Direct-to-fan monetization features, such as pre-saves and ticketing links, now appear on over 60% of artist profiles.

- Artists in emerging markets like Nigeria, India, and Colombia saw royalty increases of 28%–34% due to localized playlisting.

- Sync royalties for Apple Music’s TV, Film, and Ad sync placements hit $150 million+ in 2024.

Apple Music App Engagement and Listening Habits

- The average Apple Music user listens to 28 hours of content per week, slightly above Spotify’s 26-hour average.

- Monthly active users (MAUs) crossed 140 million globally, including paid and bundled users.

- The retention rate after three months of subscription is 79%, the highest among all major music platforms.

- Top listening times are between 7–9 a.m. and 5–7 p.m., aligning with commuting patterns.

- 70% of users use the offline download feature at least once a week, especially for workouts and travel.

- Daily app opens increased 11% YoY, driven by smart recommendations and notification prompts.

- 40% of listening happens through personalized playlists or algorithmic mixes like “New Music Mix.”

- Search-driven listening accounts for only 14% of sessions, indicating strong playlist-first engagement behavior.

- Sleep timers and crossfade playback features have boosted listening durations, especially among Gen Z users.

Lossless and Spatial Audio Adoption Rates

- In 2025, over 57% of Apple Music users have enabled Lossless Audio, a jump from 42% in 2024.

- Spatial Audio adoption grew to 38%, largely due to AirPods Pro and AirPods Max compatibility.

- Listeners using Spatial Audio spend 19% more time on the app weekly, especially in immersive genres like classical and EDM.

- Hi-Res Lossless usage is highest in Japan, Germany, and the U.S., with classical and jazz genres leading adoption.

- Apple’s catalog now features over 100 million tracks in Lossless and 15 million+ tracks in Dolby Atmos format.

- “Spatial Audio with Dolby Atmos” is now a default setting on all new iOS installs, accelerating discovery.

- User satisfaction ratings for audio quality exceed 91%, the highest in the music streaming category.

- Spatial Audio exclusives, including live concert replays, increased subscriber sign-ups by 7.4% in Q1 2025.

- Podcasts are next in line for Spatial Audio, with early tests showing 21% higher completion rates.

Apple Music for Artists: Tools and Analytics Usage

- The Apple Music for Artists platform now supports over 95% of signed and independent artists on the platform.

- Real-time stream tracking is now available in over 130 countries, making it one of the most robust analytics tools.

- Heat maps for song popularity by city or region are the most used feature in 2025, followed by playlist add tracking.

- Insights into Shazam-originated streams helped artists boost exposure via targeted releases and geo campaigns.

- Artists using A/B testing for song titles and artwork saw an average 12% increase in click-through and plays.

- In-app artist messages, such as voice intros for songs, were used by over 8,400 artists last quarter.

- Playlist pitch success rates have increased to 15% thanks to clearer submission dashboards.

- Weekly trend notifications via iOS push alerts are enabled by 62% of active artist accounts.

- Apple is rumored to launch AI-powered fan segmentation tools in late 2025 for smarter marketing.

Apple Music’s Expansion in Global Markets

- Apple Music is now live in 173 countries, with localized playlists and editors in over 70 markets.

- India became the fastest-growing market, with a 35% increase in subscriptions YoY.

- Brazil, Mexico, Nigeria, and Vietnam showed the highest streaming growth, each exceeding 25% YoY increases.

- Apple Music partnered with local telecom providers in emerging markets, offering bundled access plans.

- Multi-language support, regional artist promotions, and local chart integrations are fueling growth outside the U.S.

- In China, Apple Music saw a 22% surge in monthly users, driven by partnerships with local artists and TV shows.

- In-app concert livestreams, especially from Asia and Latin America, reached 15 million unique viewers in Q1 2025.

- Middle East and North Africa (MENA) region adoption grew by 40%, fueled by curated Arabic and North African music playlists.

- Apple plans to invest in artist development centers across Southeast Asia and Africa in 2025.

Recent Developments

- In March 2025, Apple Music rolled out “Collaborative Playlists”, allowing multiple users to curate shared mixes.

- Apple acquired Classical Archives, integrating its vast metadata for deeper search and discovery in Apple Music Classical.

- AI-powered DJ Mixes are now available, offering genre-specific transitions and personalization.

- The 2025 Grammy Awards were live-streamed exclusively on Apple Music, a first in award show streaming.

- New subscription tiers were tested in Canada and Australia, including a lower-priced audio-only plan.

- Apple Music introduced 360-degree concert videos in Spatial Audio for immersive artist experiences.

- Cross-app integration with Apple Fitness+ now includes energy-based playlists dynamically adjusted to workout intensity.

- A beta feature lets artists release “audio merch”, such as exclusive intros, behind-the-scenes clips, and previews.

- Apple announced its 2025 “Voices Rising” program, supporting emerging artists from underrepresented backgrounds.

Conclusion

Apple Music has evolved into more than a streaming service—it’s a storytelling engine, a discovery platform, and a financial engine for artists worldwide. From AI-powered playlists to localized content strategies, Apple is doubling down on personalization and precision.

With over 108 million subscribers, a renewed push into Spatial Audio, and strong artist support tools, Apple Music is clearly playing a long game. Whether you’re an artist, a curator, or a casual listener, 2025 shows there’s more to hear—and more ways to listen—than ever before.

Sources

- https://electroiq.com/stats/apple-music-statistics/

- https://www.businessofapps.com/data/apple-music-statistics/

- https://www.coolest-gadgets.com/apple-music-statistics/

- https://music3point0.com/2025/01/15/apple-music-statistics-that-you-just-gotta-know/

- https://www.forbes.com/sites/eamonnforde/2022/06/14/forecast-apple-music-to-hit-110-million-subscribers-by-2025/

- https://www.demandsage.com/apple-music-statistics/

- https://www.statista.com/study/72650/digital-music-apple-music-users-in-the-united-states/

- https://www.linkedin.com/posts/musicfutureslab_apple-music-stats-2025-you-need-to-know-activity-7294383182659956736-yMTT