The automation platform Zapier has quietly become a cornerstone of digital workflow orchestration, enabling businesses to link apps and automate tasks without writing code. From marketing teams instantly updating CRMs to operations groups syncing spreadsheets across systems, real-world use cases span small agencies and enterprise IT alike. In one instance, a sales team used Zapier to cut manual lead entry time by over 50%, and in another, a non-profit automated donor thank you workflows to scale their outreach without hiring extra staff. Below is a deep dive into the most recent statistics on Zapier’s growth, market position, and usage.

Editor’s Choice

- $310 million revenue for 2024.

- Projected $400 million in revenue for 2025, ≈ 29% growth.

- 7.05% estimated market share in the integration / iPaaS space.

- Over 3 million users, total, and 100,000+ paying customers.

- Less than $2 million in external funding, highly capital efficient.

- Fully remote workforce across multiple countries, an early pioneer of distributed work.

Recent Developments

- Zapier launched a dedicated upmarket sales team in 2025 to move beyond self-serve growth.

- As of 2025, the platform advertises support for 8,000+ apps, reflecting the rapid expansion of the ecosystem.

- The introduction of AI orchestration features, agents, and workflow intelligence has become a focus.

- Strategic content/SEO efforts, Zapier has significantly scaled organic traffic and app landing pages in recent years.

- Continued emphasis on remote culture, new hires, and team structure supports the distributed workforce globally.

- Partnerships with major enterprise systems, e.g., embedding in AWS marketplace, have begun to surface.

- Low external funding but high valuation and profitability set Zapier apart in the SaaS ecosystem.

- Increased focus on governance, security, and enterprise-grade features as they move up market.

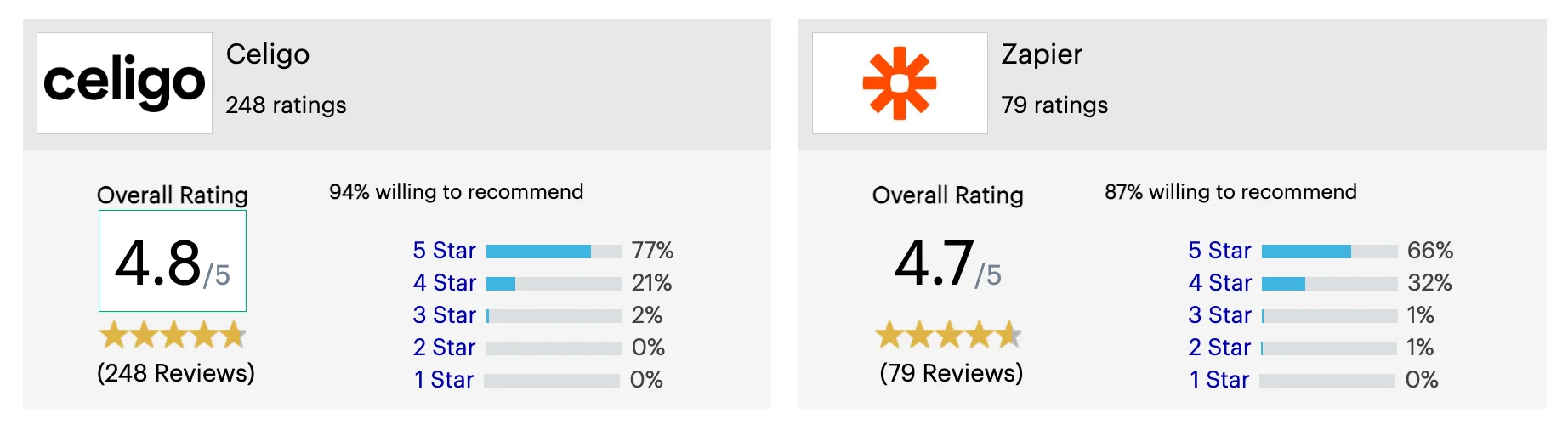

Celigo vs Zapier User Ratings Comparison

- Celigo holds an overall rating of 4.8/5 based on 248 reviews, showcasing exceptional customer satisfaction.

- 94% of users are willing to recommend Celigo, highlighting strong trust and positive user experience.

- Among Celigo’s ratings, 77% gave 5 stars, 21% gave 4 stars, and only 2% rated 3 stars, with 0% giving 1 or 2 stars.

- Zapier follows closely with an overall rating of 4.7/5 from 79 reviews, reflecting consistently high performance.

- 87% of Zapier users said they would recommend the platform, indicating high but slightly lower satisfaction compared to Celigo.

- Zapier’s distribution includes 66% 5-star, 32% 4-star, and 1% each for 3-star and 2-star ratings, with no 1-star reviews.

- Overall, Celigo edges ahead of Zapier in both average rating and recommendation rate, signaling stronger perceived value and reliability among users.

Revenue Statistics

- 2021 revenue estimated at ~ $150 million.

- 2022 revenue estimated at ~ $220 million.

- 2023 revenue ~ $250.7 million.

- 2024 revenue ~ $310 million, representing ~24-30% year-over-year growth.

- 2025 projected revenue ~ $400 million, implying sequential ~29% growth from 2024.

- Ratio of revenue to funding is exceptional, e.g., hitting ~$100 M ARR with ~$1.4 M funding.

- Revenue per employee metrics, estimated at ~$228,800 per employee.

- Bootstrapped model, minimal dilution, and strong profitability track record.

Zapier Market Share

- Zapier holds ~ 7.05% of the integrations / iPaaS market.

- 6sense data shows ~ 7.43% share with the tool ranked #2.

- StartupBooted notes a range of 3.70% to 8.99% depending on the definition of the integration market.

- Zapier competes against ~95-100 other integration and automation platforms.

- Within the cloud integration category, the market share is much smaller (~0.11%), reflecting a narrower definition.

- Geographically, US customers represent ~59% of Zapier’s base in the integration category.

- The majority of customer companies are small to medium-sized (e.g., 20-49 employees).

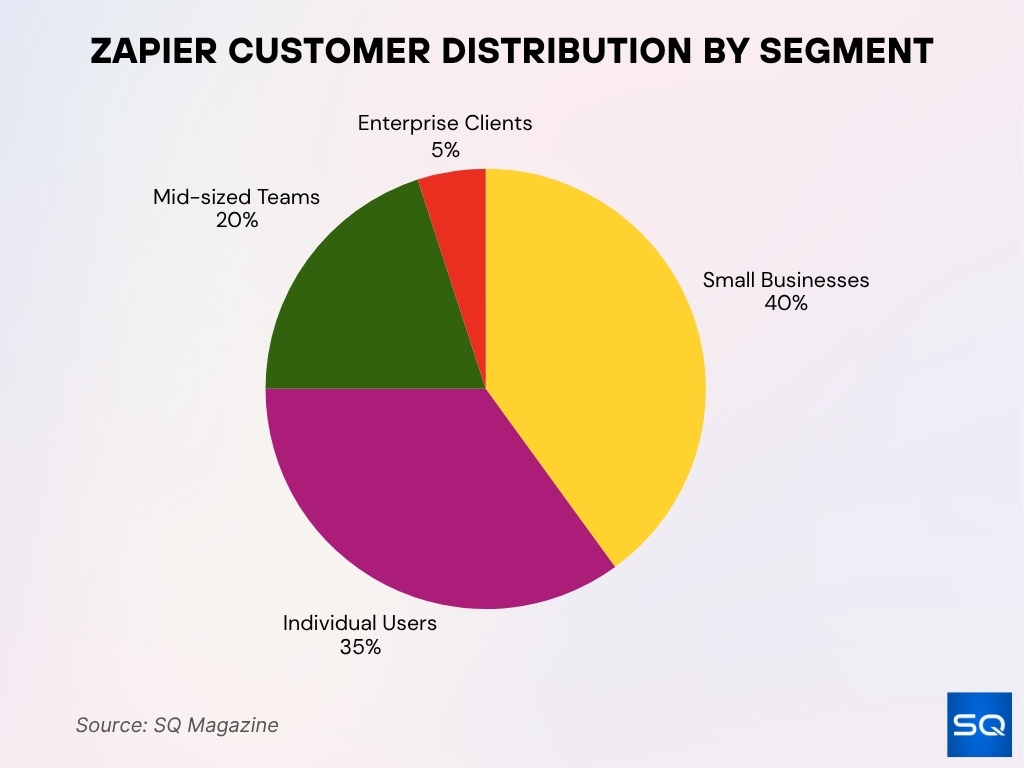

Zapier Customer Distribution by Segment

- Small businesses make up the largest share of Zapier’s customer base at 40%, highlighting its popularity among growing companies seeking affordable automation.

- Individual users account for 35%, showing Zapier’s strong appeal to freelancers, solopreneurs, and personal productivity users.

- Mid-sized teams represent 20% of total users, reflecting increasing adoption by departmental and cross-functional teams within larger firms.

- Enterprise clients make up the smallest segment at just 5%, indicating limited but emerging traction among large-scale organizations.

- Overall, the data underscores Zapier’s core strength in the small business and individual markets, where ease of use and flexibility drive adoption.

App Integrations Supported by Zapier

- The Zapier platform lists 8,000+ integrated applications as of 2025.

- The directory covers major categories, marketing, productivity, sales/CRM, support, and web-app building.

- Unified platform claims to support “trusted by 3.4 million companies” through its integrations.

- The “Apps” section shows a plug-and-play model, and non-technical users can connect services in minutes.

- The developer platform notes that custom apps can be added, improving coverage beyond official integrations.

- Updates are frequent; in early 2024, the company reported 147 integration updates in a month.

Industry Adoption of Zapier

- Over 2.2 million businesses reportedly use Zapier for automation workflows.

- Among these, a large portion are small to medium-sized enterprises, e.g., companies with 10-50 employees dominate usage.

- Industry breakdown shows usage across 21+ verticals, including automotive, media & distribution.

- Country coverage spans 195 countries, illustrating global reach in adoption.

- Over 5,000 live websites in the U.S. use Zapier at the time of measurement.

- Usage penetration in the United States is high, with about 59% of users being based.

- Because of its broad app integrations, adoption in marketing, sales operations, and back office has been strong; many routine tasks are being automated.

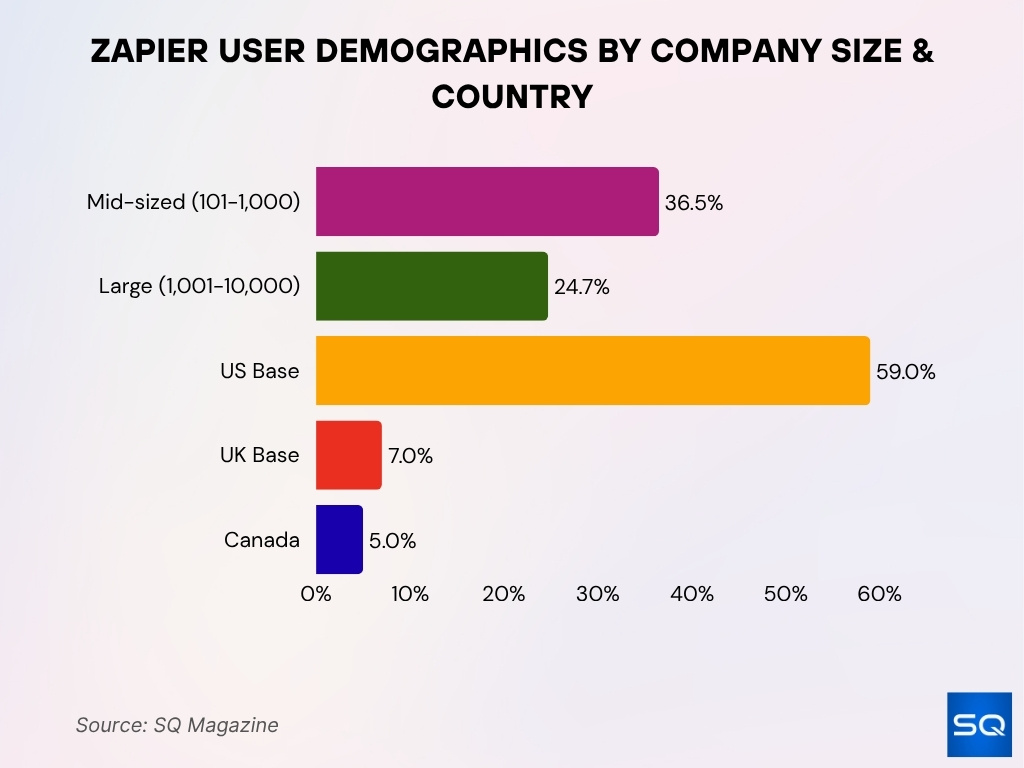

Demographics of Zapier Users

- Mid-sized firms (101-1,000 employees) make up an estimated ~36.5% of usage in one data sample.

- Large enterprises (1,001-10,000 employees) account for about 24.7% of users in another dataset.

- U.S. users represent roughly 59% of the customer base.

- U.K. users account for approximately 7%, and Canada about 5% in a specific dataset.

- The majority of usage comes from the small business segment, companies with 10-50 employees are the most common.

- Reported paying customer base exceeds 100,000 paying customers, suggesting a solid conversion from free users.

- Among customers, 93% say Zapier has made them better at their job.

Key Investors and Funding

- Despite its size, Zapier has raised minimal external funding, reports indicate funding of around $1.4 million from 9 investors historically.

- The company achieved a valuation of $5 billion in 2021 via secondary share sales.

- The capital efficiency and low dilution model mark Zapier as a rare SaaS success story using a bootstrapped approach.

- Headcount data, approximately 805 employees as of 2025, with a ~7.2% increase over the prior year.

- Operating across ~38-40 countries with a fully remote workforce.

- The company avoids aggressive venture rounds, signalling focus on profitability over growth at any cost.

- Some commentary suggests that scaling through usage-based pricing assets helps Zapier maintain growth without large capital injections.

Zapier’s Global Reach

- The platform reports that over 81 billion tasks have been automated since launching.

- More than 25 million Zaps (automated workflows) have been created.

- Approximately 69% of the Fortune 1000 companies use Zapier in their tech stacks.

- Usage spans over 38 countries, reflecting the fully distributed nature of the company.

- At least 8,731 companies use Zapier in active datasets.

- Customer base spans 3 million+ businesses.

- The U.S. remains the largest concentration of users, with smaller but meaningful portions in the U.K., Canada, and other regions.

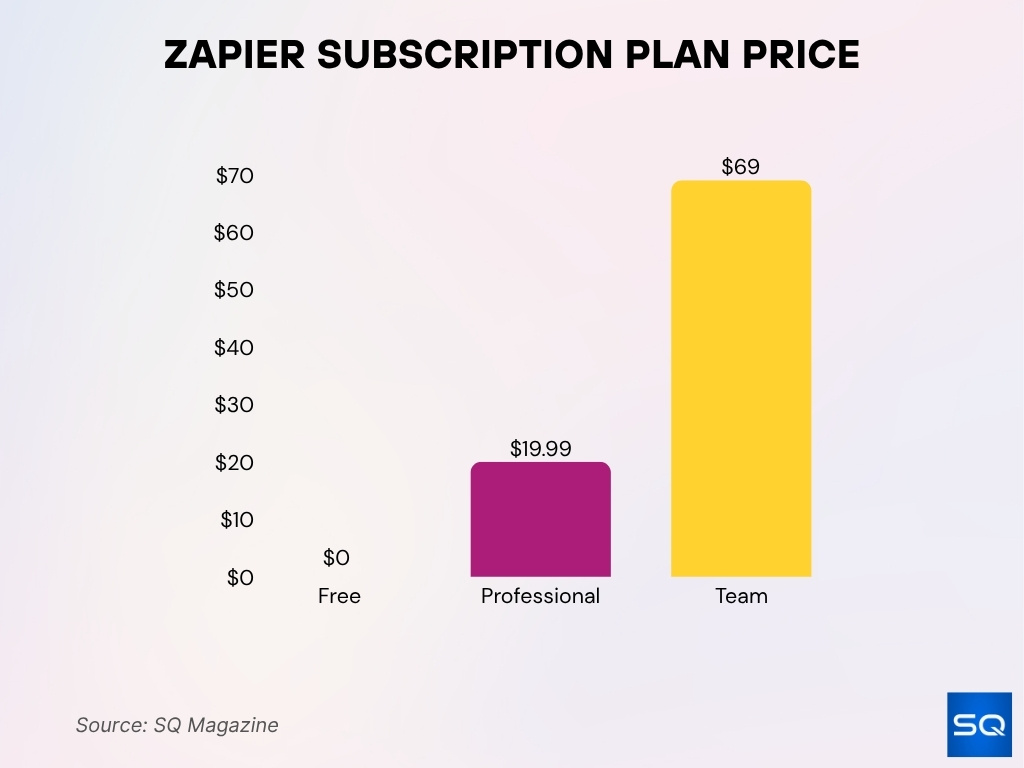

Zapier Subscription Plans

- Free plan supports basic usage, e.g., single-step Zaps and 100 tasks per month for individuals.

- Professional plan begins at $19.99/month for individuals, starts at ~750 tasks/month.

- Team plan listed around $69/month for small to medium teams with ~2,000 tasks/month and shared features.

- As of 2025, Zapier offers a tiered pricing model including, Free plan, a Professional plan, a Team plan, and an Enterprise plan.

- Enterprise (or “Company/Enterprise”) plan is custom pricing; one marketplace source shows median buyer at $15,000/year.

- On April 2, 2024, Zapier introduced a new Enterprise plan, replacing their previous “Company” plan.

- For enterprise usage, some reports suggest that the monthly cost can scale to ~$2,299/month for large task volumes (e.g., 1 million tasks).

- The pricing model shows usage-based growth, as tasks increase, cost increases, making scaling visible in spend.

Popular Automation Use Cases

- Around 38% of Zapier users leverage automation for data entry reduction.

- In e-commerce workflows, automated order fulfilment, shipping updates, and cross-platform notifications are common.

- For marketing operations, lead capture, CRM updates, and pipeline notifications are automated frequently via Zapier.

- A company named Remote reports 27.5% of IT help desk tickets handled automatically thanks to Zapier + AI.

- That same company saved 616 hours/month on IT support and avoided ~$500k in hiring costs.

- Multi-step workflows tying tools like Slack, Notion, Okta, and Zapier Tables are now typical in mid-sized firms.

- The self-service model appeals to solo entrepreneurs, agencies, and small teams, automating routine tasks without dev resources.

- Enterprises increasingly use Zapier not just for task automation, but for governance, observability, and cross-department orchestration.

Automation Volume and Performance

- Zapier clarifies that only successful actions count toward task usage in its plans.

- The company claims billions of tasks run per year, globally, 81 billion tasks to date.

- In the Remote case study, 11 million tasks were automated in 2024 alone for that company.

- Companies report significant time savings, e.g., thousands of days saved annually across departments from automation.

- As automation scales, performance monitoring and task limit notifications (e.g., reaching 50% or 80% of quota) become standard.

- For larger workflows, companies monitor task consumption, task performance bottlenecks, and error handling in real time.

- The usage-based pricing model means that as tasks grow, cost and operations complexity both rise, which invites optimization.

- Through improved automation, firms are shifting more capacity from manual processing to strategic work.

Zapier and AI Automation Statistics

- AI-related tasks on Zapier have grown over 760% in the last two years, making AI the fastest-growing category on the platform.

- Within Zapier’s own workforce, AI tool usage rose from 65% in late 2023 to 77% by the end of 2024, up to ~89% by spring 2025.

- Zapier positions itself as “the most connected AI orchestration platform” supporting AI Workflows, AI Agents, and AI Chatbots across its app ecosystem.

- Modular AI first pricing was announced in 2025, reflecting growing demand for AI automation capabilities.

- Businesses deploying Zapier’s AI workflows report reductions in manual ticket hand-offs, faster resolution, and fewer human interventions in routine tasks.

- Zapier’s public blog emphasises that AI agents can “train themselves” via workflow data and scale operations without extra headcount.

- As of 2025, enterprise offerings now include AI governance, observability, and orchestration features built into the Zapier platform.

- The merging of no-code, AI, and automation is creating a new “automation economy” where speed, scalability, and flexibility matter more than traditional custom coding.

Frequently Asked Questions (FAQs)

More than 3.4 million companies.

Around 805 employees, up 7.2% from the prior year.

Roughly 59%.

Conclusion

The latest data on Zapier paint a clear picture: the platform has matured from a simple “connect apps” tool into a global automation engine, widely adopted across industries, scaling into enterprise orchestration, and now firmly anchored in AI-driven workflows. With billions of tasks already automated, a strong foothold in large enterprises, and rapid growth in AI usage, Zapier’s trajectory underscores the strategic importance of automation in today’s digital economy. As firms continue to invest in efficiency, scalability, and intelligence, platforms like Zapier will play a central role.