The blockchain Solana (SOL) has moved swiftly from niche experiment to major ecosystem player. In sectors such as payments, decentralized finance (DeFi) and non-fungible tokens (NFTs), Solana’s architecture is delivering real-world impact, fintech firms are leveraging its speed for micropayments, and game developers are using its low fees to build Web3 games. Below, we explore the most relevant statistics shaping Solana’s narrative.

Editor’s Choice

- ≈ $88.1 billion market capitalization as of April 2025.

- ≈ 2.2 million daily active wallets interacting on Solana in Q1 2025.

- Solana’s throughput peaked at a theoretical 65,000 TPS (with stress test bursts above 100,000 TPS), while real-world sustained rates in 2025 average only 1,000–4,000 TPS.

- Average transaction fee hovering around $0.00025, among the lowest of major Layer-1 networks.

- As of November 2025, Solana counts just 900–950 validators securing its blockchain, reflecting a trending decline despite network growth.

- DeFi TVL (total value locked) on Solana is > $9.3 billion as of April 2025.

- NFT trading volume on Solana surpassed $1.2 billion in Q1 2025.

Recent Developments

- In Q2 2025, Solana generated more than $271 million in network revenue, marking its third consecutive quarter leading all major chains.

- Solana matched the combined monthly active addresses of all other Layer-1 and Layer-2 chains in June 2025, signalling strong user-engagement momentum.

- Solana averaged 2.2 million daily active wallets in Q1 2025, with only brief outlier spikes above 3 million.

- Weekly non-vote transactions generally exceeded 600 million during early 2025, showing sustained throughput.

- Developer and ecosystem activity has accelerated, with over 2,100 dApps active on Solana as of Q1 2025, compared to ~1,360 a year earlier.

- The network’s Nakamoto coefficient, an indicator of decentralisation, rose to ~20 in mid-2025, improving Solana’s decentralisation profile.

- Data-driven research on security and fraud in Solana’s ecosystem (e.g., rug-pull datasets) indicates increasing academic attention and transparency.

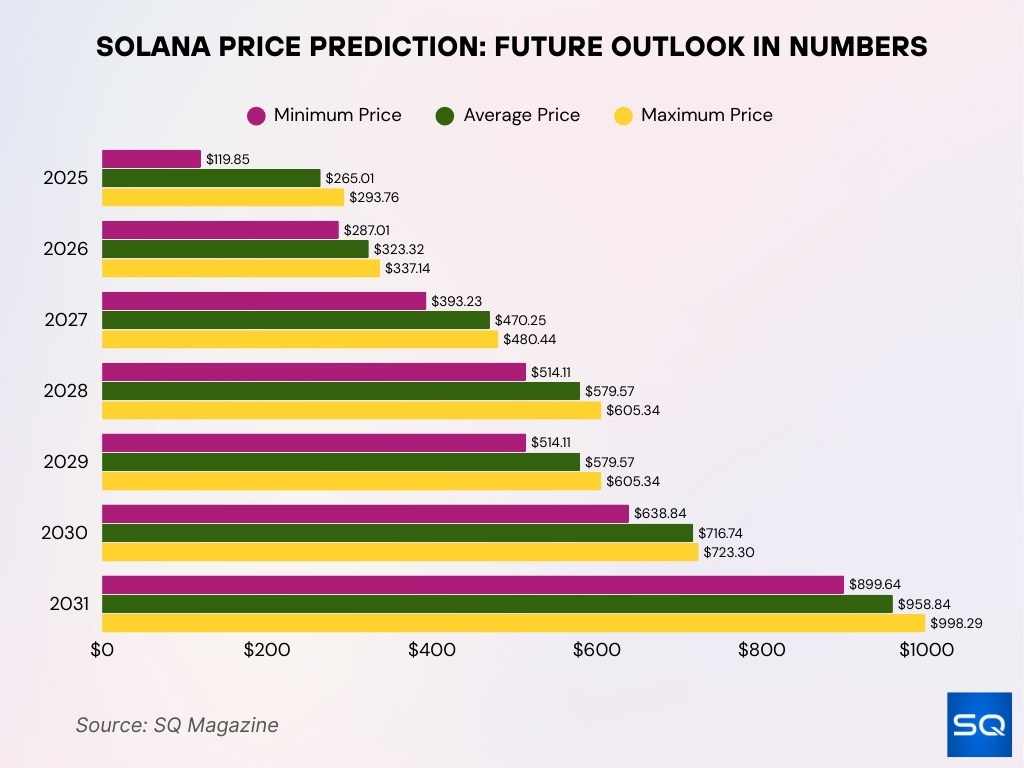

Solana Price Prediction: Future Outlook in Numbers

- 2025: Expected price range is $119.85 to $293.76, with an average of $265.01.

- 2026: Forecast shows $287.01 (min), $323.32 (avg), and $337.14 (max).

- 2027: Prices may rise between $393.23 and $480.44, averaging $470.25.

- 2028: Growth continues with $514.11 (min), $579.57 (avg), and $605.34 (max).

- 2029: Predictions match 2028 at $514.11 (min), $579.57 (avg), and $605.34 (max).

- 2030: Solana may hit $638.84 (min), $716.74 (avg), and $723.30 (max).

- 2031: Projected highs reach $899.64 (min), $958.84 (avg), and $998.29 (max).

Solana Overview and Market Position

- Solana rounds out a cohort of high-speed Layer-1 blockchains, with native token ticker SOL.

- The circulating supply of SOL stood at roughly 559 million tokens, with 24-hour trading volume near $3.6 billion as tracked in late 2025.

- Solana’s market cap in 2025 placed it among the top five cryptocurrencies globally, signalling a meaningful position in the crypto market.

- SOL’s share of total crypto market capitalisation increased from ~1.7% in 2024 to ~3.3% in 2025.

- The ecosystem benefits from both retail usage (NFTs, gaming) and institutional interest (DeFi, staking infrastructure).

- One competitive advantage, transaction cost and speed. For example, Solana’s average fee is orders of magnitude lower than some rival chains.

- The network’s validator and node footprint spans dozens of countries, enhancing its global presence and infrastructure resilience.

SOL Market Capitalization Trends

- In early 2025, Solana’s market cap reached approximately $85.7 billion, up ~96% from the previous year.

- The peak market cap briefly hit $92.6 billion in February 2025 amid heightened user activity.

- Fully diluted valuation (FDV) exceeded $120 billion in 2025.

- Average daily trading volume of SOL tokens came in at ~$2.4 billion, up ~70% from 2024.

- In 2024, the average market cap hovered around $45 billion, demonstrating a sharp year-over-year rise.

- Solana’s market cap relative to Ethereum rose from ~12% in 2024 to ~25% in 2025.

- External factors such as institutional flows, e.g., ~$2.5 billion in capital inflows in Q1 2025, contributed to valuation strength.

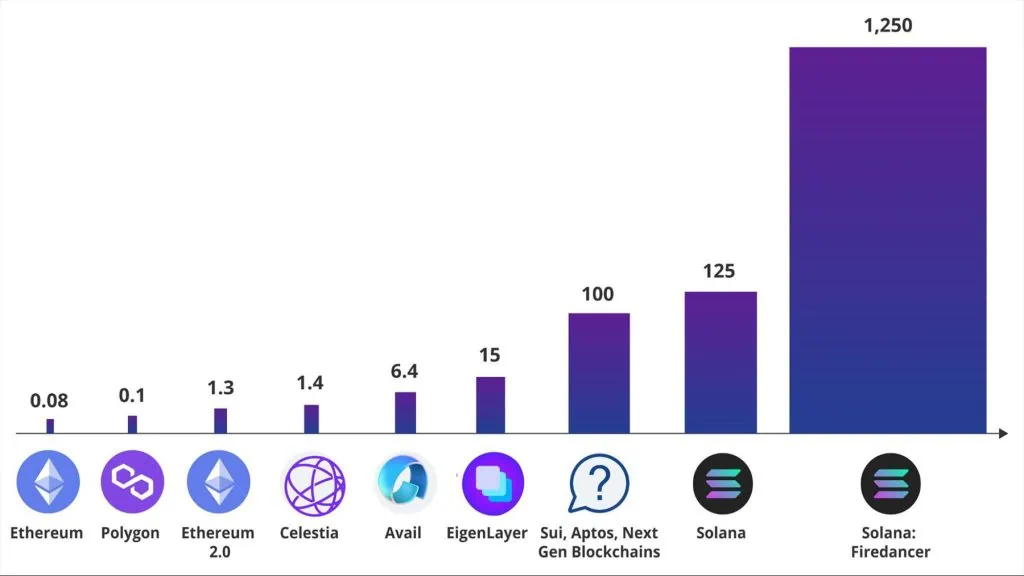

Blockchain Throughput (TPS) Comparison: A Glimpse at Scalability

- Ethereum handles just 0.08 TPS, showing major base-layer limitations.

- Polygon slightly improves scalability to 0.1 TPS as a Layer 2 solution.

- Ethereum 2.0 achieves 1.3 TPS after shifting to proof-of-stake.

- Celestia delivers 1.4 TPS, slightly outperforming Ethereum 2.0.

- Avail reaches 6.4 TPS, marking a meaningful leap in modular chain efficiency.

- EigenLayer hits 15 TPS by using restaking to boost performance.

- Sui and Aptos process 100 TPS, leveraging modern blockchain architecture.

- Solana leads with 125 TPS, emphasizing real-time scalability.

- Solana Firedancer sets a new high with 1,250 TPS, redefining blockchain throughput.

Daily and Monthly Active Addresses

- As of March 2025, Solana recorded ~2.2 million daily active wallets, up ~60% year-over-year.

- On October 5, 2025, the 7-day moving average of daily active addresses fell to 3.33 million, representing a 63% drop from a late 2024 peak of over 9 million.

- According to Artemis data, Solana’s monthly active address count in June 2025 matched the combined monthly active addresses of all other major L1/L2 chains.

- The average number of transactions per wallet increased from ~4.6 in 2024 to ~6.2 in 2025.

- Weekly user behaviour shows new wallet activity of ~200,000 new addresses per week in 2025.

- Over 32 million unique wallets had interacted at least once with the Solana network as of early 2025.

Solana Transaction Volume and TPS

- As of late October 2025, the Solana network processes around ~70 million transactions per day.

- One-hour snapshot data shows Solana averaging ~954 transactions per second (TPS) in recent periods.

- Daily “Transactions (24h)” indicate roughly 57.71 million transactions on Solana.

- The block time on Solana is exceptionally low (e.g., ~0.4 seconds reported), enabling high throughput.

- However, while Solana’s maximum theoretical TPS is high, the real-time sustained TPS in recent hours is far lower (e.g., ~5,289 TPS in a given 100-block snapshot), indicating practical limitations.

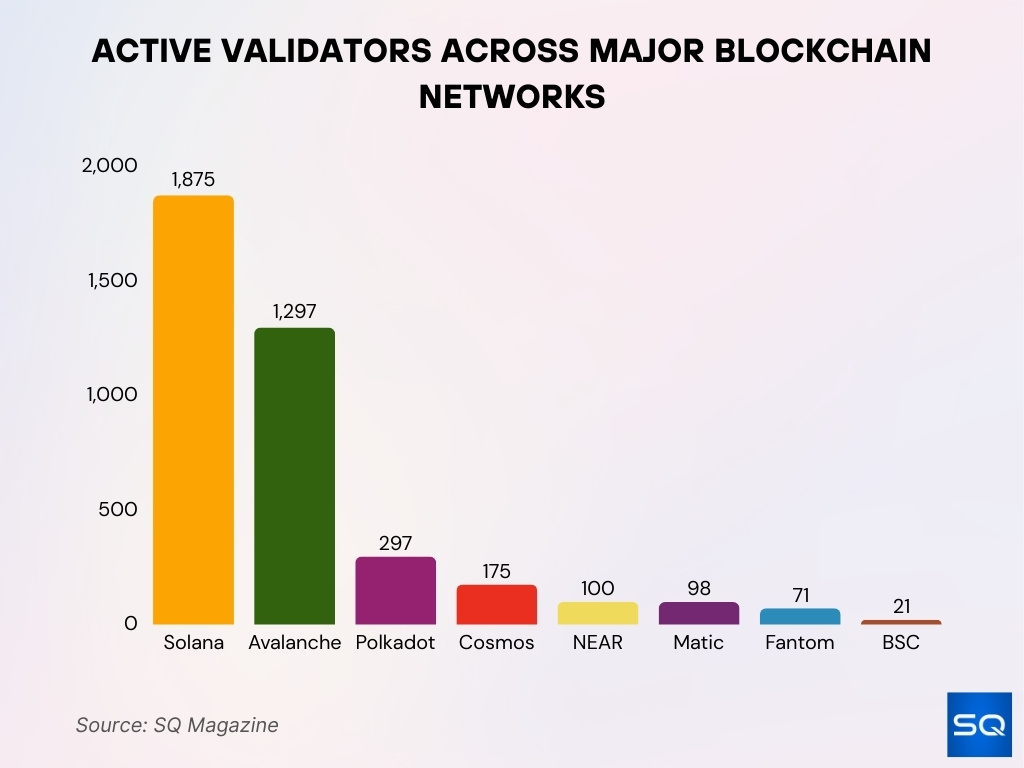

Active Validators Across Major Blockchain Networks

- Solana leads with 1,875 active validators, indicating strong decentralization.

- Avalanche follows with 1,297 validators, showing robust network participation.

- Polkadot supports 297 validators, marking a moderately sized validator set.

- Cosmos runs with 175 validators, enabling its interoperable blockchain model.

- NEAR Protocol and Polygon (Matic) operate with 100 and 98 validators, respectively.

- Fantom maintains 71 validators, reflecting a lean but functional setup.

- Binance Smart Chain (BSC) has just 21 validators, suggesting higher centralization.

Network Fees and Cost Per Transaction

- Solana’s base fee per standard transaction is 0.000005 SOL, which at typical recent SOL prices translates to about $0.0005 for a simple transfer.

- Estimates show the average transaction fee across the network is around $0.00025, i.e., a quarter of a cent.

- For comparison, some other blockchains have average fees that are multiple dollars. Solidity-based smart contract networks often see $1–10+ per transaction under load.

- Half of the base transaction fee on Solana is burned, reducing the circulating supply; the other half goes to the validator processing the transaction.

- The prioritization fee (for faster processing) remains very low even during peak demand, typically under $0.01.

- Because of these low fees, Solana supports high-volume micro-transactions, gaming use cases, and NFT interactions without prohibitive cost.

- The low-fee structure remains a core competitive advantage for project developers choosing Solana for systems requiring many transactions per second.

- Fee predictability on Solana helps project budgeting, simple operations (token transfer, swap) often cost far less than $0.01, even in busy periods.

Liquid Staking Trends on Solana

- The liquid staking universe on Solana holds over $10.7 billion in TVL as of October 2025, representing 13.3% of all staked SOL (about 57 million SOL).

- Total TVL across liquid staking protocols surpassed $87 billion by September 2025, with Solana as a significant contributor.

- The Jito Foundation’s JitoSOL pool has locked in several million SOL, ranking it as a leading liquid staking provider on Solana.

- Solana’s liquid staking yields base validator rewards of approximately 6-7% APY plus MEV-related yields, pushing effective returns above ~10% in some protocols.

- Solana’s liquid staking TVL grew by 217% year-on-year, with an additional 130% growth since Q2 2025.

- Liquid staking protocols on Solana support capital efficiency by making staked SOL deployable through derivative tokens for DeFi usage.

- The yield for some Solana liquid staking protocols can go as high as 15% APY, combining staking and MEV optimisation.

- Solana’s liquid staking market is projected to potentially grow over fivefold, reaching close to $18 billion in TVL.

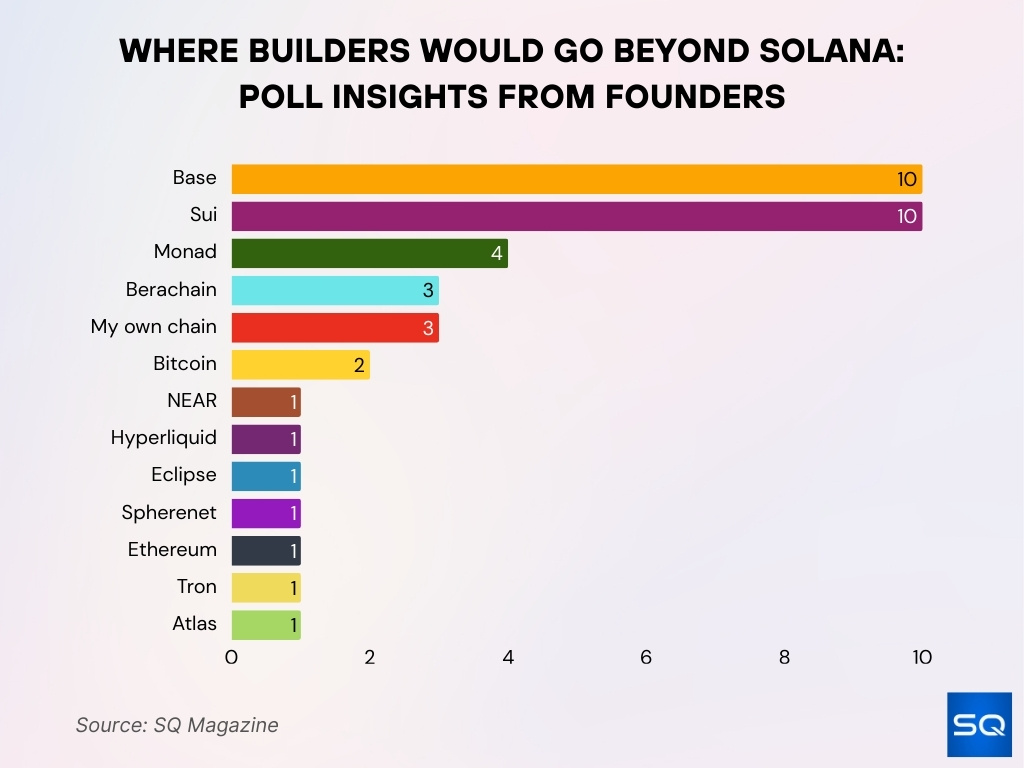

Where Builders Would Go Beyond Solana: Poll Insights from Founders

- Base and Sui lead with 10 votes each out of 41, showing top founder confidence.

- Monad ranks third with 4 votes, reflecting rising interest in its design.

- Berachain and custom chains follow with 3 votes each, pointing to trust in new or tailored solutions.

- Bitcoin gets 2 votes, valued for its legacy but seen as less flexible.

- NEAR, Hyperliquid, Eclipse, Spherenet, Ethereum, Tron, and Atlas each received 1 vote, indicating niche or emerging appeal.

Solana DeFi Ecosystem Numbers

- As of May 2025, Solana’s DeFi Total Value Locked (TVL) was reported at around $13 billion.

- Earlier data (June 2025) indicated Solana’s DeFi TVL at over $9.3 billion, with strong growth from previous years.

- Daily DEX volume figures on Solana list DEXs’ volume at ~$2.344 billion for 24-hour snapshots.

- In 2025 Q3 alone, Solana DEX volumes hit ~$326 billion, a ~21% increase from Q2.

- Stablecoin market cap on Solana, Example figure lists steady ~$13 billion for stablecoins on the chain.

- Protocol revenue from DApps on Solana shows growth, app revenue on chain ~$2.69 million in one snapshot.

NFT Ecosystem and Marketplace Data

- Solana hosted over 33 million NFT mints with more than $3 billion in total sales volume as of April 2025.

- NFT trading volume on Solana reached $1.2 billion in Q1 2025, mainly driven by gaming and collectables.

- NFT minting costs on Solana typically remain under $0.10 per mint, attracting many creators.

- Solana’s native wallets, like Phantom, support over 2.2 million daily active wallets, facilitating NFT trading.

- Solana’s NFT market grew 30% in Q1 2025 compared to the previous quarter.

- Gaming NFTs represent about 28% of Solana’s total NFT market, fueling ecosystem growth.

- Secondary sales for the top Solana NFT collection, “Mutant Foxes,” surpassed $48 million in 2025.

- Solana’s NFT transaction energy use is 260x lower than Ethereum, boosting eco-friendly appeal.

- Major marketplaces like Magic Eden and Tensor contribute to 70%+ of Solana’s NFT trades.

- Solana’s uptime for NFT and DeFi activities reached 99.99% in 2025, outperforming most layer 1 blockchains.

Solana DEX (Decentralized Exchange) Volumes

- 24-hour DEX volume on Solana stands at ~$2.344 billion in recent snapshots.

- Weekly DEX volume for Solana has reached ~$20.269 billion.

- Monthly DEX volume exceeded $143 billion in October 2025.

- Projected year-to-date 2025 totals for DEX volume on Solana exceed $500 billion, showing explosive growth.

- DEX vs CEX dominance, on Solana, DEX (on-chain exchange) volume share remains nearly 10.6% in some metrics compared to centralized exchange flows.

- The volume surge is associated with growing derivatives, perpetual trading, and high-frequency DeFi flows migrating to Solana due to its infrastructure.

Institutional Adoption Statistics

- Solana ecosystem’s Total Value Locked (TVL) hit approximately $10.26 billion in August 2025, driven mostly by institutional DeFi and tokenized assets.

- Solana added 11,534 new developers in the first nine months of 2025, signalling growing institutional interest.

- Solana’s spot and staking ETFs gained traction in late 2025, with Bitwise’s Solana Staking ETF seeing over $55 million in volume on its opening day.

- Institutional holdings include roughly 5.9 million SOL, about 1% of the circulating supply in corporate treasuries.

- Estimates show Solana’s market cap share among institutions rising from under 5% in 2023 to over 12% in 2025.

Ecosystem Growth and Developer Activity

- Solana had approximately 17,708 active developers as of November 2025, with the ecosystem adding over 11,500 new developers in the first nine months of the year.

- Year-over-year, Solana’s new developer growth rate was around 83% between 2023-24, leading among major chains.

- The ecosystem has seen increased activity in tooling, open-source contributions and hackathons, supporting its developer growth.

- According to the network health report of June 2025, validator client diversity and participation continue to improve, e.g., 34 validators were running the new “Firedancer” client (~7% of the network stake).

- Regional developer engagement in the Asia-Pacific region grew ~69% year-over-year in the 12 months ending June 2025, benefitting ecosystems such as Solana.

- The initiation of large grant programmes (e.g., a $200 million Web3 game-grant programme) in 2025 further supports ecosystem expansion.

Solana Network Reliability and Downtime Metrics

- The network had achieved 100 % uptime for 18+ months, with no full outages since February 2023.

- Median block time reported around 400 milliseconds, demonstrating high speed and responsiveness.

- Skip rates, a measure of block‐production interruptions, fell below 0.3% during H1 2025.

- One snapshot reported Solana processing ~162 million transactions/day in early 2025.

- While no full network halt was reported in the 18-month period referenced, smaller network slowdowns or validator consensus issues still occurred.

- As of April 2025, over 90% of Solana validators ran the Agave/Jito client, though diversification is improving with initiatives like Firedancer capturing ~7% share of total stake.

- The network health report emphasised ongoing improvements in decentralisation and telemetry, signalling a proactive reliability approach.

- Despite the strong performance record in recent quarters, Solana’s past outage history continues to inform perceptions of reliability and risk.

Security Incidents and Exploit Data

- From April 2020 to April 2025, the Solana ecosystem experienced an estimated $530 million+ in losses from exploits, primarily in application-layer DeFi hacks.

- Academic research covering 2021-2024 found 62,895 suspicious liquidity pools on Solana, with ~22,195 tokens exhibiting rug-pull patterns.

- A separate study found 8,058 phishing instances on Solana, causing nearly $1.1 million in losses.

- The failed-transactions study detected over 1.5 billion failed transactions across 72 million blocks on Solana, highlighting congestion and spam risk even as throughput scales.

- While Solana’s core protocol has stabilised, the ecosystem layer (dApps, bridges) remains a vulnerability vector, with risk emphasised by multiple past events.

- Users and projects on Solana still face elevated risk compared to more mature ecosystems, chiefly due to rapid growth, composability and experimental DeFi activity.

Comparative Statistics, Solana vs Other Blockchains

- In Q3 2025, Solana’s DEX volume hit $326 billion, surpassing Ethereum for that period.

- Developer growth, Solana added ~11,534 new devs in 2025 vs ~16,181 for Ethereum in the same period, placing Solana second but growing rapidly.

- In network performance, Solana’s block time (~400 ms) and skip-rates (<0.3%) compare favourably to many older chains.

- Fee cost, Solana’s average fee (~$0.00025), remains far lower than many competitive Layer-1s under load.

- Reliability, while Solana improved strongly, older chains still carry fewer outage/stability risks historically, a point of differentiation for cautious users.

- Ecosystem depth, Ethereum still commands larger TVL globally, but Solana’s faster growth rate suggests it is catching up in several metrics.

- The pace of new developer onboarding and protocol upgrades on Solana provides a competitive advantage in ecosystems that prioritise speed, cost and user experience.

Energy Efficiency and Environmental Impact

- Solana uses about 0.00051 kWh (or 0.51 Wh) of energy per transaction, comparable to a few Google searches.

- Solana’s energy consumption per transaction is roughly 2,707 joules, making it 260x more efficient than Ethereum.

- The network’s total annual energy use is around 1.9 GWh, comparable to the energy used by 190 average U.S. homes.

- Solana’s carbon footprint cut by 69% from 2023 to 2024, with an estimated 2,671 tons of CO2 emissions in 2024.

- Solana is about 99.98% more energy-efficient per transaction than Bitcoin, dramatically lowering environmental impacts.

- Over 100 Solana validators operate in eco-certified, green data centres as part of an energy-conscious incentive program.

- Average energy use per Solana validator node is only 0.2 kWh per day, thanks to runtime improvements and state compression.

- Solana achieved carbon neutrality in 2021 and continues offsetting emissions through on-chain carbon credit purchases.

- Energy efficiency advancements have reduced NFT minting energy costs on Solana by 94% since 2022.

Frequently Asked Questions (FAQs)

About 900–950 active validators.

Over $271 million in network revenue for Q2 2025.

Over 32 million unique wallets.

Conclusion

Putting it all together, the Solana ecosystem is characterised by rapid growth, increasing institutional adoption, and a maturing developer base, while still navigating reliability and security challenges. As the chain accelerates in throughput, low cost and developer engagement, it remains an appealing platform for dApps, DeFi and tokenized infrastructure, especially for a U.S.-centric audience interested in actionable data. That said, the ecosystem is not yet free from risk, with past security exploits and infrastructure concentration still relevant. Ultimately, Solana’s trajectory hinges on whether it can sustain performance, grow decentralisation and deepen institutional flows in concert.