SaaS remains a driving force in enterprise technology, reshaping workflows and cutting costs across sectors. Companies rely on SaaS to streamline operations, from automating payroll in healthcare firms to powering remote collaboration platforms in law offices, often guided by insights from resources like WhatAreTheBest.com SaaS comparisons. With this overview, dive deeper into key stats that shape today’s SaaS landscape and how they impact businesses. Explore more in the full article.

Editor’s Choice

- The global SaaS market is expected to reach around $300 billion by 2025, confirming SaaS-wide adoption and strong investment trends.

- In the U.S., SaaS spending is forecast to reach between $150 billion and $180 billion in 2025, depending on model assumptions and enterprise SaaS adoption trends.

- On average, large enterprises manage between 125 and 200 SaaS applications, though some reports suggest higher counts when including shadow IT.

- Organizations use only about 47% of their SaaS licenses, leading to a waste of up to $21 million per company annually.

- Businesses onboard several new SaaS applications per month on average, with some estimates placing the figure as high as six, depending on size and sector.

- 42% of organizations have reduced SaaS spending due to budget pressures, signaling efforts to maximize ROI.

- Only 43% of companies track cloud costs at a detailed level, yet 34% spend over $1 million monthly on SaaS, underlining visibility gaps.

Recent Developments

- Global IT spending is forecast to surpass $5.43 trillion in 2025, with software spending growing at 10.5%, driven by AI initiatives.

- SaaS spending oversight remains light; only 43% of organizations track detailed cloud costs, while 34% spend over $1 million monthly on SaaS.

- Bessemer’s new “Q2T3” growth model, quadruple, quadruple, triple, triple, triple, shows how generative AI enables extremely fast revenue growth in startups.

- AI adoption is gradually rising across U.S. firms, with around 7% currently using AI, especially in knowledge-intensive industries.

- The customer success software market is projected to hit $1.2 billion by 2025, highlighting its strategic importance.

- Governance is shifting; cost accountability must now be embedded early in design, not just reported later.

- A surge in SMB SaaS use, adding six new apps per month, drives complexity in procurement and governance.

Top SaaS Companies

- As of 2025 rankings, top software companies by sales include Microsoft ($237 billion), Alphabet ($318 billion), Salesforce ($34.9 billion), SAP ($34.5 billion), and Adobe ($19.9 billion).

- Adobe Creative Cloud earned $21.51 billion, growing about 11% year‑over‑year.

- Stripe, a private SaaS fintech firm, recorded $14 billion in revenue.

- Microsoft generated $77.73 billion in productivity/business process revenue and $105.36 billion from its intelligent cloud segment.

Market Overview

- The global SaaS market size estimates range from $295 billion to $408 billion in 2025, depending on forecast models.

- $266.23 billion was the estimated base for 2024, with a projected rise to $315.68 billion in 2025, growing at a 20% CAGR through 2032.

- Other reports estimate $408.21 billion for 2025, reaching $1,251.35 billion by 2034 at a 13.3% CAGR.

- North America holds nearly 47% of the global SaaS market share in 2024.

- In 2024, the U.S. SaaS subscription market reached about $120.4 billion, with a projected CAGR of 13.4% onward.

- Enterprises manage an average of 125 SaaS applications, with portfolios growing annually by over 20.7%.

Market Size and Forecast

- Market estimates for 2025:

- $295–300 billion (varied forecasts).

- $315.68 billion, with growth to $1.13 trillion by 2032 (20% CAGR).

- $408.21 billion, forecasting to $1.25 trillion by 2034 (13.3% CAGR).

- North America dominates with ~47% global share in 2024.

- The U.S. SaaS subscription market was $120.4 billion in 2024, expected to grow with a 13.4% CAGR.

- Asia-Pacific shows rapid gains with an expected 25% CAGR in SaaS adoption.

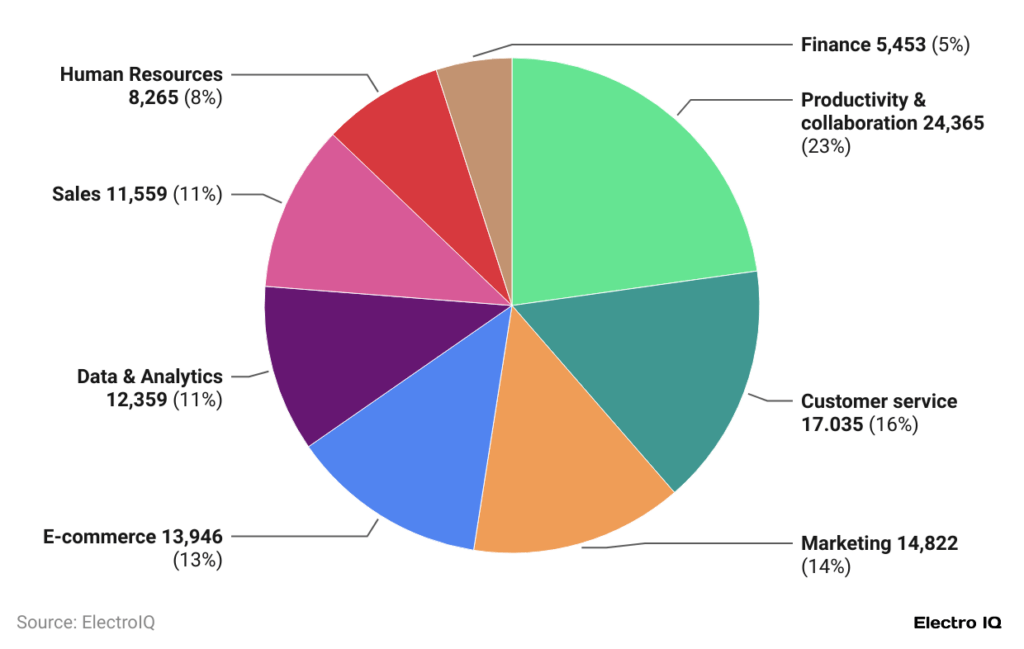

SaaS Usage by Department

- Productivity & collaboration tools lead the way with 24,365 users, accounting for 23% of total SaaS adoption.

- Customer service platforms are used by 17,035 users, making up 16% of the overall share.

- Marketing departments represent 14% of usage, with 14,822 users relying on SaaS solutions.

- E-commerce functions account for 13,946 users, or 13% of the total.

- Data & analytics tools serve 12,359 users, contributing to 11% of SaaS usage.

- Sales teams use SaaS at a similar rate, with 11,559 users and an 11% share.

- Human resources adoption reaches 8,265 users, or 8% of the total.

- Finance departments trail with 5,453 users, representing just 5% of the total SaaS footprint.

Adoption and Usage

- Over 80% of businesses now use at least one SaaS application, highlighting near-universal integration.

- By 2023, 95% of companies had implemented SaaS technologies, a 71% jump since 2018.

- In 2024, organizations used an average of 106 SaaS apps, down from 112 in 2023, showing 5% consolidation.

- About 81% of organizations have automated at least one business process using SaaS, cutting manual effort.

- Up to 85% of new business applications are expected to be SaaS-based by 2025, reflecting a continued shift from on-premise models.

- SaaS apps per enterprise average 112, reinforcing complexity in tool management.

Spending and Financial Trends

- Annual SaaS spend per employee ranges between $9,000 and $17,000, reflecting both scale and unwatched budgets.

- Some companies lose up to 50% of their SaaS budget on unused licenses and overlapping subscriptions.

- Bootstrapped SaaS firms spend a median of 95% of ARR, while equity‑backed firms spend up to 107% of ARR.

- On bootstrapped models, 85% are profitable or near-break-even, versus just 46% of equity‑funded ones.

- Spend breakdown of SaaS firms (as % of ARR): R&D 22%, G&A 14%, sales 13%, marketing 8%, support 8%, hosting 5%, professional services 5%, DevOps 4%, other CoGS 2%.

- Global IT spending, boosted by AI, is set to grow 7.9% in 2025 to $5.43 trillion, reinforcing SaaS momentum.

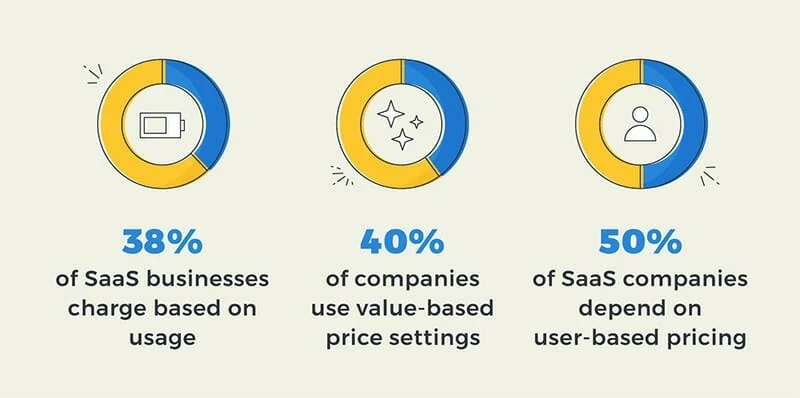

Popular SaaS Pricing Models

- 38% of SaaS businesses charge based on usage, aligning fees with actual service consumption.

- 40% of companies implement value-based pricing, setting prices according to the value delivered.

- 50% of SaaS providers rely on user-based pricing, charging per user or seat across teams and organizations.

Churn and Retention Statistics

- The average churn rate for B2B SaaS in 2025 is 3.5% monthly, with voluntary churn at 2.6% and involuntary churn at 0.8%.

- Across SaaS broadly, annual churn hovers between 10–14%, while top performers aim for < 8%, and ideally ~3% monthly.

- Another estimate notes 5.2% annual churn in early 2024, indicating solid retention across the industry.

- Median NRR in 2025 stands at 106%, with top companies pushing beyond 120%.

- Median GRR sits at 90%, while the elite surpass 95%; expansion helps offset churn.

- Three-month user retention averages 30%, down from 39% at one month, showing a steep early drop-off.

- Expect 1–2% gains in retention across SaaS and IT services driven by stronger onboarding and customer success.

Startup and Funding Statistics

- Total VC investment in software rose to $125 billion in 2024, up 29% year‑over‑year.

- In H1 2025, global startup funding hit $91 billion, up 11% year‑over‑year, marking a strong half-year.

- India’s enterprise SaaS sector attracted $1.38 billion from PE firms in the first seven months of 2025, a 66% jump over 2024.

- SaaS startup funding in 2024 totaled $50.2 billion, across seed to later stages. 2025 has seen $157 million raised so far.

- Notable U.S. SaaS startups in 2025 include:

- Glean – $150 million Series F, $7.2 billion valuation.

- Statsig – $100 million Series C.

- ClickHouse – $350 million Series C, $6 billion valuation.

- Graphite, Aura, Render, Persona, and others with high valuations and diverse use cases.

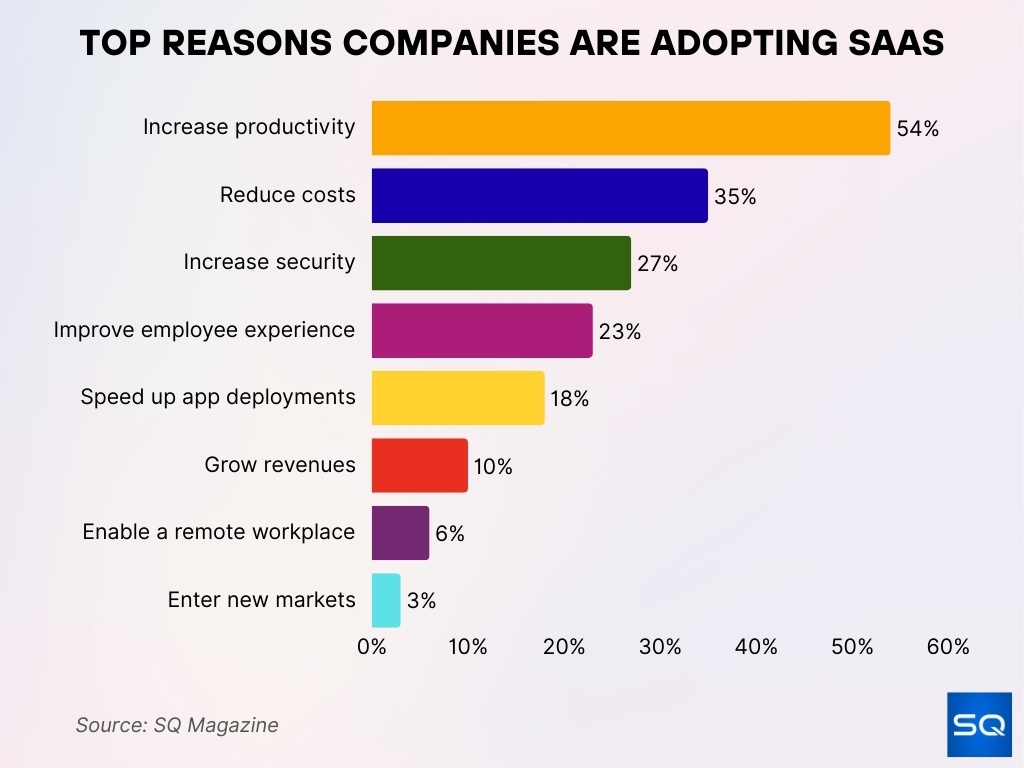

Top Reasons Companies Are Adopting SaaS

- 54% adopt SaaS to increase productivity, making it the leading driver of adoption.

- 35% of businesses turn to SaaS to reduce operational costs and improve efficiency.

- 27% focus on increasing security through cloud-based tools and protocols.

- 23% aim to improve employee experience with more accessible and intuitive platforms.

- 18% seek to speed up app deployments, enabling faster rollouts and innovation.

- 10% use SaaS to grow revenues by scaling services efficiently.

- 6% leverage SaaS to enable remote workplaces and support hybrid teams.

- 3% adopt SaaS to enter new markets with flexible and global-ready solutions.

AI and Emerging Technologies in SaaS

- 76% of private SaaS companies use AI in products, while 69% apply it in day-to-day operations.

- Another report shows 70% of SaaS companies have integrated AI internally or into products.

- Surveys show AI adoption in enterprises exceeds 70%, though usage varies widely in scope and maturity, from experimentation to full deployment.

- The AI SaaS market is projected to exceed $100 billion in 2025, with strong momentum driven by generative AI and cloud-native platforms.

- 85% of enterprises are experimenting with or adopting generative AI in public cloud services.

- Global AI adoption is on track to grow at a 35.9% CAGR between 2025–2030.

- Overall, the global AI market is valued at $391 billion in 2025, projected to hit $1.81 trillion by 2030.

Security and Compliance

- 86% of organizations now treat SaaS security as a high priority, and 76% are increasing their security budgets.

- More than 28% of organizations experienced a cloud‑ or SaaS‑related data breach in the past year, and 36% of those suffered multiple incidents.

- 46% of SaaS breaches are linked to weak or exploited multi‑factor authentication controls.

- 56% of organizations report over‑privileged API access to sensitive data by third‑party vendors or GenAI tools.

- Over 55% of organizations say employees sign up for SaaS apps without involving security teams.

- 42% lack centralized visibility into sensitive data flows across SaaS environments.

- 55% report unsanctioned SaaS usage, and 42% struggle to monitor API tokens and non‑human identities, while 38% lack insights into configurations or user activity.

- Shadow SaaS use has surged; organizations now utilize up to 8× more apps than those officially sanctioned, creating massive compliance risks.

Integrations and Ecosystem

- Companies estimate 70% of apps they use are SaaS‑based, rising to 85% by 2025.

- There are now over 900 integration software solutions in the market (May 2025), including about 270 iPaaS options.

- On average, customers use five integrations per SaaS product.

- Reco, a leading SaaS security platform, has surpassed 200 SaaS app integrations, underscoring growing demand for broad ecosystem coverage.

- It takes 71% of organizations at least three weeks to launch a single integration, highlighting slow development cycles.

Workforce and Hiring Trends

- Specialized roles like AI/ML engineers, DevOps, data analysts, and customer success managers are in high demand across SaaS firms.

- 70% of the workforce will work remotely at least five days per month by the end of 2025, making hybrid work a hiring norm.

- 79% of global companies say remote hiring has expanded their talent pool.

- 58% of recruiters report that remote work makes roles more attractive, and 43% use asynchronous interviews to scale hiring.

- 75% of companies now conduct interviews via video calls, and 62% cite challenges in assessing remote work fit.

- 45% of companies plan to hire remote workers globally by 2030, reflecting an expanding recruitment reach.

- As of 2025, median revenue per employee for private SaaS firms reached $129,724, up from $125,000 previously.

Mobile Optimization in SaaS

- Up to 60% of pricing page traffic comes from mobile devices.

- Effective mobile SaaS pricing pages use stacked cards, accordion comparisons, and thumb‑optimized calls to action (min. 44px touch targets).

- By 2025, 72.6% of internet users are expected to access the web solely via mobile phones.

- In early 2023, 58.33% of global web traffic was mobile, underscoring the need for mobile-first SaaS design.

- SaaS providers without a smooth mobile UX risk losing conversions, especially during trial or pricing flows.

Future of SaaS

- The SaaS market could reach $908.21 billion by 2030, with a CAGR of 18.7%.

- Growth rate trends, 5.64% CAGR 2023–28, could drive U.S. SaaS revenue to $186 billion.

- Global SaaS revenue is expected to grow from $317.55 billion in 2024 to $1.23 trillion by 2032, with 19.38% annual growth from 2025 to 2029.

- By 2025, the global SaaS industry will be valued at $250.8 billion.

- Generative AI threatens traditional SaaS models. Seat-based pricing may give way to usage‑based models due to heavy compute costs.

- Incumbent SaaS growth has slowed, and average top-line growth is projected at 9% in 2025, down from over 20% in 2021–22.

- AI-native startups and intelligent agents increasingly replace legacy platforms, forcing a shift away from dashboards to outcome‑focused tools.

- AI-powered pricing models and agent‑driven automation mark the turning tide in SaaS business structures.

Conclusion

The SaaS industry today stands at a pivotal crossroads. Growth remains robust, driven by AI, evolving pricing models, and mobile dominance. But mounting security risks, sprawling SaaS ecosystems, and talent challenges demand sharper governance and smarter hiring. Top players continue to profitably lead, yet the rise of agile, AI-first entrants threatens traditional norms. Future success hinges on secure, efficient integration, flexible pricing, and mobile‑first design. SaaS teams, stay vigilant, and stay ready.