The universe of decentralized autonomous organizations (DAOs) is rapidly evolving, reshaping how communities and stakeholders collaborate without traditional central authorities. From gaming guilds to decentralized investment clubs, DAOs are influencing real-world scenarios such as a music collective funding artist releases via token voting, and a DeFi protocol governed by thousands of token-holders deciding on treasury allocation. This article dives into key statistics behind this movement and invites you to explore deeper insights across multiple dimensions of DAO growth and governance.

Editor’s Choice

- More than 13,000 DAOs globally exist as of 2025, collectively managing large treasuries.

- There are over 6.5 million DAO governance token holders globally in 2025, with active participation rates remaining below 20%.

- DAOs collectively manage approximately $21.4 billion in liquid assets in 2025, while the total treasury value tracked across all DAOs reaches $24.5 billion.

- DAO voter participation averages 17% in 2025, with top DAOs exceeding 22% for critical votes.

- The Asia-Pacific region is leading the charge in DAO expansion, particularly in India, South Korea, and China.

- Research reveals governance token concentration remains a concern, with a few actors holding significant voting power.

Recent Developments

- In 2024 and early 2025, non-financial DAOs (gaming, media, content) posted year-over-year growth of more than 25%.

- Snapshot and Tally reported user growth between 35–45% between 2023 and 2025, reflecting a broad increase in DAO proposal and voting infrastructure adoption.

- DAO-focused Web3 events such as DAOist and ETHGlobal DAO tracks recorded a 35–40% increase in attendance in 2025 compared to the previous year.

- Research publications on DAO governance and decentralization mechanisms increased markedly in 2025.

- AI-driven governance and cross-chain DAO integrations are emerging as key themes in 2025.

- Sustainability-focused DAOs (environmental and social impact) are increasing, estimated 500-600 such DAOs globally by early 2025.

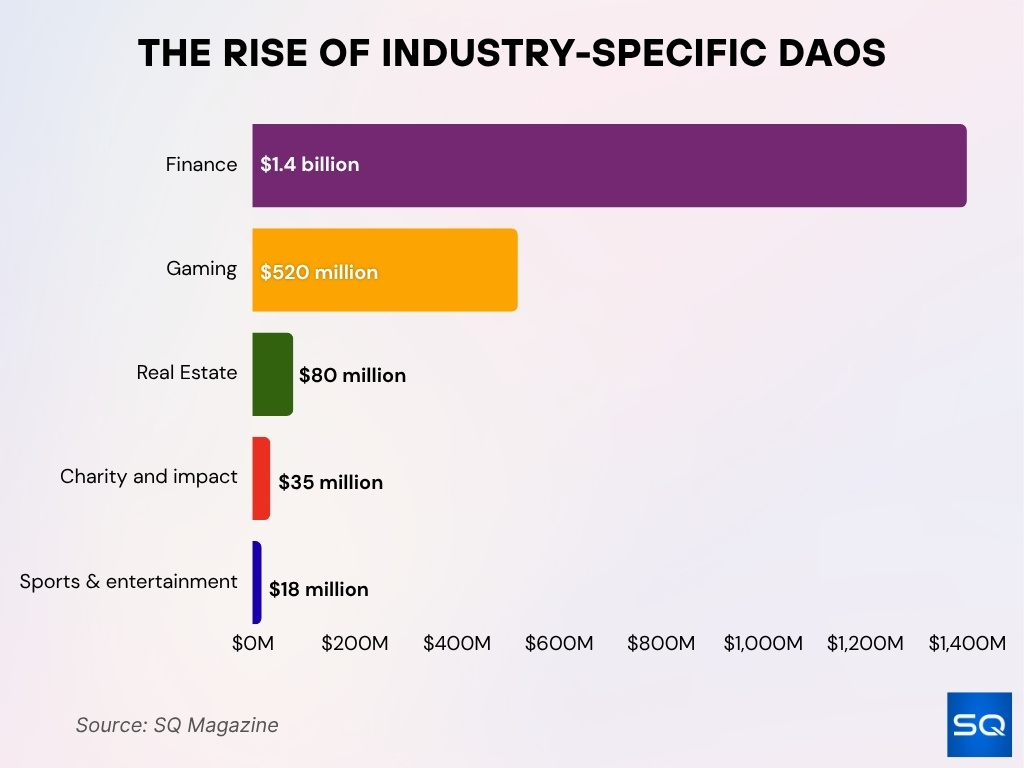

DAO Industry Adoption and Use Cases

- Finance DAOs lead with over $1.4 billion in diversified investment assets.

- Gaming DAOs like Yield Guild Games manage $520 million in digital assets.

- Media DAOs make up 18% of all DAOs, enabling collaborative content and revenue sharing.

- Real estate DAOs reached around $80 million in tokenized assets, though full data remains limited.

- Social media DAOs are growing, giving users governance rights on platforms like BitClout.

- Charity DAOs such as Giveth have distributed over $35 million to social and environmental causes.

- Legal DAOs like LexDAO provide compliance tools and legal support in decentralized systems.

- Sports and entertainment DAOs control over $18 million in fan-led decision-making assets.

DAO Market Overview

- There are over 13,000 DAOs established globally, and more than 6,000 exhibiting regular activity in 2025.

- The DAO development market was valued at $170 million in 2024, projected to reach $333 million by 2031 (CAGR ~9.3%).

- The top five DAOs by treasury value include Optimism with $3.8 billion and Uniswap with $2.9 billion.

- Ethereum remains the leading platform, hosting the majority of DAO activity.

- DAO formation tools like Aragon and Snapshot enhance governance efficiency and transparency.

- Research shows 64-80% average participation rates in DAO voting activities.

- Total DAO assets grew by approximately 50% from the previous year (2023-2024).

Number of Active DAOs

- Among the 13,000+ DAOs globally, more than 6,000 show regular activity in governance and operations.

- Over 80% of active DAOs were launched after 2020.

- Between 2019 and 2022, deployments surged by approximately 660%.

- Community-oriented DAOs make up about 60–65% of all active DAOs globally.

- The growth in active DAOs reflects not just quantity but a diversification of use-cases beyond finance (gaming, media, social).

- DAO launches continue to accelerate, though many remain small in treasury size and operations.

- The number of active DAOs in non-financial sectors increased by 25%+ year-over-year in 2024.

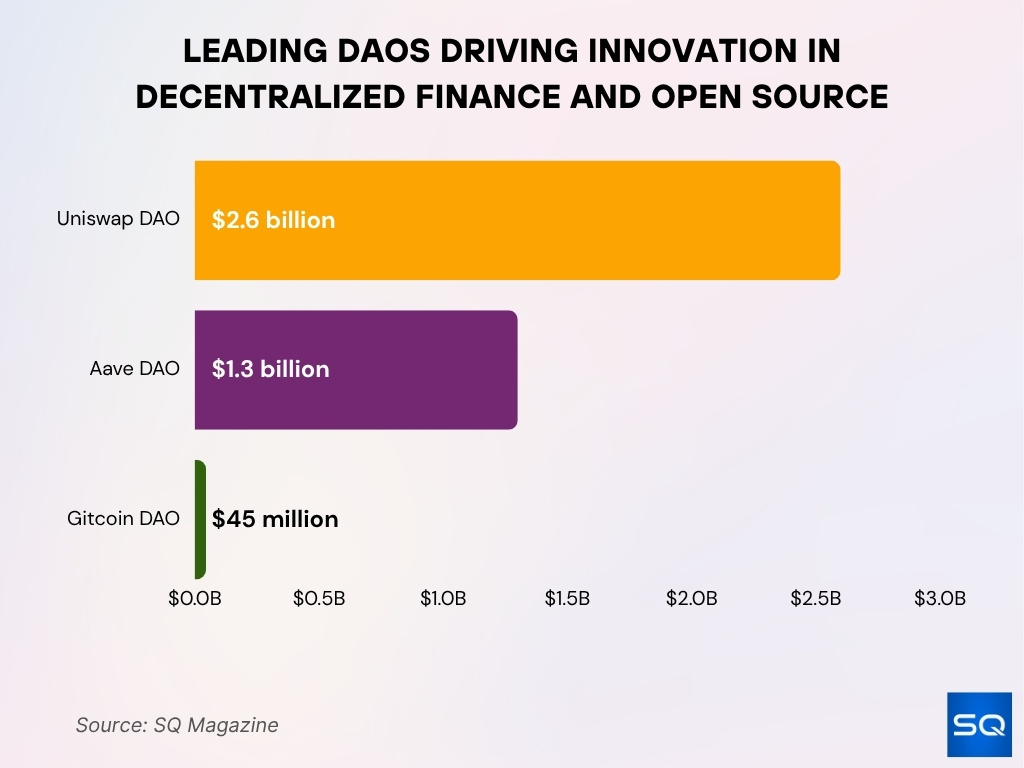

Top DAO Examples

- Uniswap DAO manages a major DEX with assets now exceeding $2.6 billion under community governance.

- MakerDAO controls the DAI stablecoin, allowing token holders to maintain its $1 peg through governance.

- Aave DAO oversees DeFi lending with $1.3 billion in treasury and governance over asset listings.

- PleasrDAO acquires iconic NFTs and cultural assets through community-shared ownership.

- Gitcoin DAO has distributed over $45 million in grants to open-source blockchain projects.

Global DAO Adoption Trends

- The Asia-Pacific region leads DAO expansion, driven by China, South Korea, and India.

- North America holds a 35%+ market share, but Asia-Pacific shows faster DAO growth rates.

- By early 2025, there will be about 500-600 sustainability-focused DAOs worldwide.

- DAO members from emerging markets now exceed 6.5 million governance token holders globally.

- Cross-border DAO operations face complex regulatory challenges, especially within the European Union.

- Over 62% of DAOs remain concentrated on major blockchain networks like Ethereum.

- Regional voter participation varies, with average DAO voting turnout around 17%, higher in some jurisdictions.

- North American DAO investments totaled over $43 million in 2023, fueling foundational growth.

Growth Rate and CAGR of the DAO Market

- DAO treasuries grew an average of 45% year-over-year from 2021 to 2024.

- Analysts expect the DAO-as-a-Service market to expand from $123.6 million in 2023 to $680.6 million by 2033, with an 18.6% CAGR.

- The number of DAOs increased at an estimated 30% CAGR between 2021 and 2024.

- Non-financial DAOs such as gaming and media recorded over 25% year-over-year growth in 2024.

- DAO infrastructure and tooling continue to outpace DAO operations revenue, signaling an ongoing build-out phase.

- The top five DAOs hold over 60% of the total DAO treasury value, showing strong market concentration.

- The Asia-Pacific region leads DAO market development with above-average regional CAGR.

- The top 15–20% of stakeholders hold approximately 78% of DAO governance tokens.

- DAO conference participation grew 40% in 2025, showing rising community engagement.

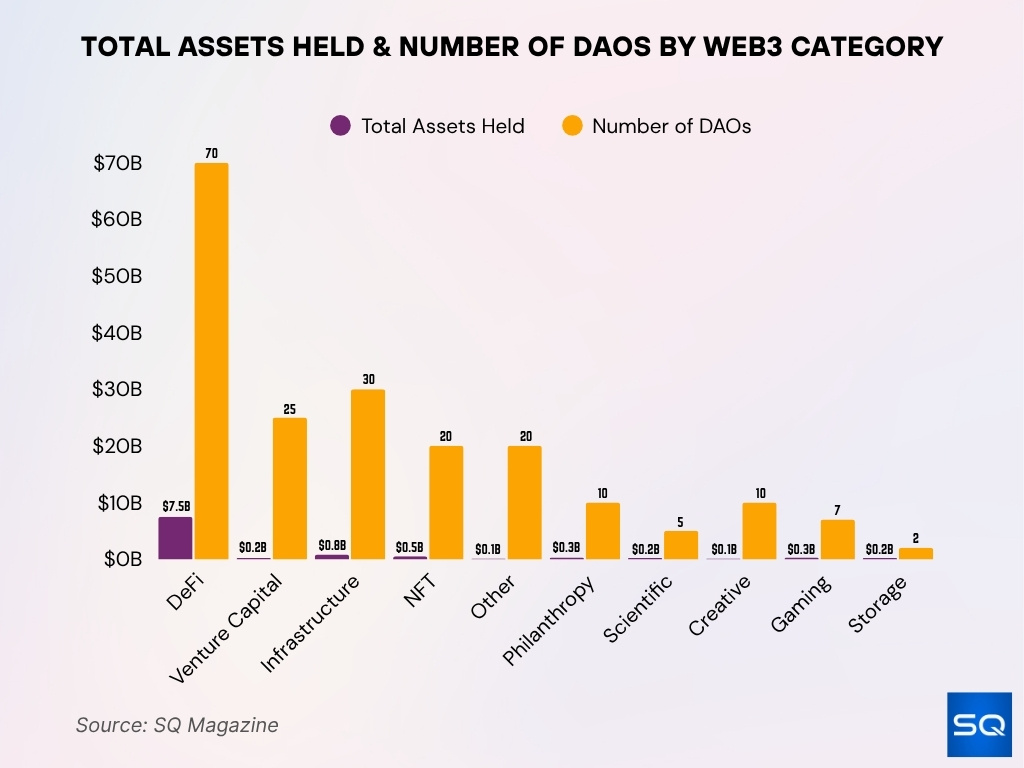

DAO Count and Asset Holdings by Web3 Sector

- DeFi leads with 70 DAOs and $7.5 billion in total assets.

- Infrastructure holds 30 DAOs managing $0.8 billion in assets.

- Venture Capital has 25 DAOs with a combined $0.2 billion in assets.

- NFTs account for 20 DAOs holding $0.5 billion collectively.

- Other categories also include 20 DAOs, managing just $0.1 billion.

- Philanthropy hosts 10 DAOs with $0.3 billion in assets.

- Creative DAOs number 10, with asset holdings of $0.1 billion.

- Scientific DAOs include 5 entities managing $0.2 billion.

- Gaming has 7 DAOs with a total of $0.3 billion in assets.

- Storage is the smallest with just 2 DAOs holding $0.2 billion.

DAO Treasury and Assets Under Management

- As of 2024, the total treasury value of DAOs surpassed $30 billion.

- Some sources estimate total assets under DAO treasuries at $21.5 billion, but this may undercount smaller DAOs.

- A breakdown by web3 category: DeFi DAOs hold ~$7.5 billion, infrastructure DAOs ~$0.8 billion, venture capital DAOs ~$0.2 billion.

- Among large DAOs, diversification is more common: about 60% of large DAOs now use treasury diversification strategies (stablecoins, ETH, real-world assets).

- For individual DAOs, one protocol held ~$260-280 million in mid-2025, with ~45% in native token, 34% in stablecoins, 14% in ETH.

- The growth from early 2023 ($8.8 billion) to early 2025 (over $30 billion) in total treasury assets suggests a more than 3× increase in ~2 years.

Governance Token Holders Statistics

- By 2025, DAOs will have over 6.5 million governance token holders globally.

- One estimate projects that DAO ecosystems will reach 11.8 million governance token holders in 2025.

- In one case study, a major DAO required 80,000 tokens (about $9–10 million) to propose a governance initiative.

- Token distribution remains highly concentrated, with the top 20% of stakeholders holding 78% of DAO tokens.

- One dataset shows active governance token holders increasing from about 1.7 million to 5.1 million between 2023–2025.

- Platforms supporting governance token holders increased usage by 45% in 2025.

- More than 100 DAOs adopted delegated voting mechanisms to let token holders assign voting power and improve participation.

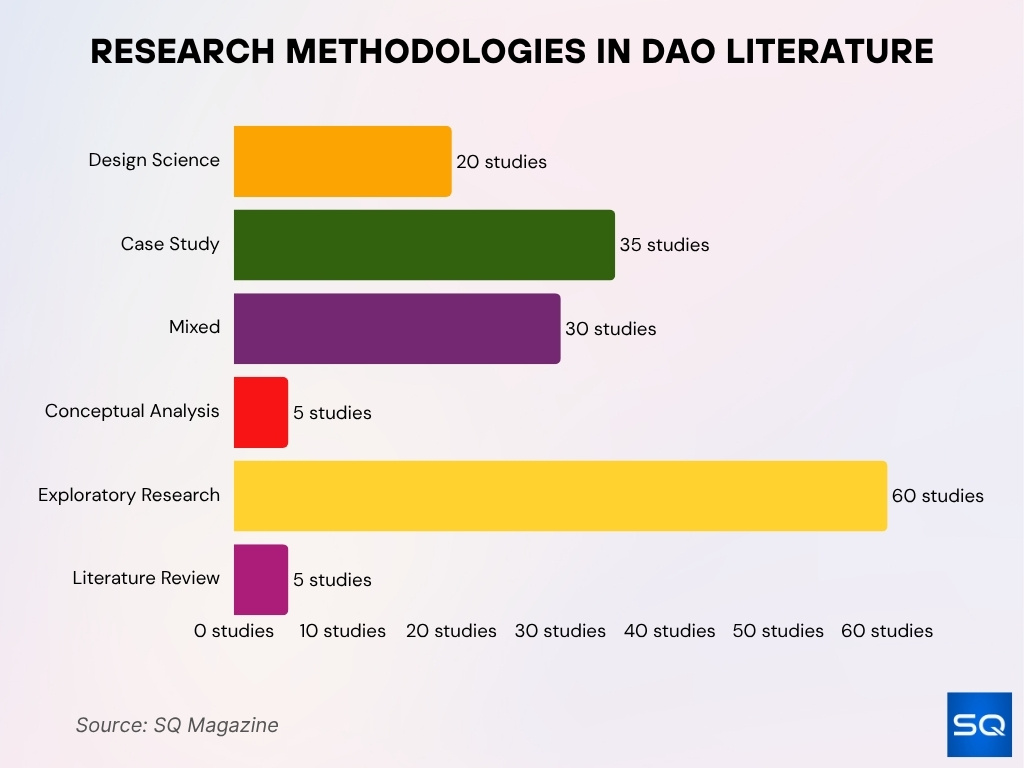

DAO Research Methodologies

- Exploratory research leads with 60 studies, reflecting the early-stage nature of DAO research.

- Case studies rank second with 35 studies, showing a strong focus on real-world DAO use.

- Mixed methods were applied in 30 studies, blending qualitative and quantitative analysis.

- Design science appears in 20 studies, aimed at building DAO-specific frameworks and tools.

- Conceptual analysis and literature reviews are the least used, each featured in just 5 studies.

Voter Participation and Engagement Rates

- Average voter participation in DAOs is estimated at ~17% of governance token holders in 2025.

- Some leading DAOs reach turnout of ~22-28% for major proposals.

- In one example, the DAO ArbitrumDAO reported on-chain participation of 59.83% in April 2025 (off-chain ~53.78%).

- DAOs implementing delegated voting (token-holders assign their vote) report 30-50% higher efficiency in governance outcomes.

- Heavy skew of token-holding leads to low broad engagement; some studies found fewer than 10% of token-holders actively vote in many DAOs.

- Introduction of incentive models (rewards for voting) raised turnout by ~12% average in pilot DAOs.

- The challenge of voter fatigue remains; smaller, frequent proposals often show participation under 10%, while major votes draw higher turnout.

DAO Proposal and Voting Statistics

- More than 12,000 governance proposals were created across DAOs in 2023.

- On-chain voting platform adoption (e.g., Snapshot, Tally) tripled in 2023.

- The average cost to pass a proposal (including gas, campaigning) is $500-$10,000 in many DAOs.

- Delegation structures shorten decision time and increase throughput. DAOs with delegations had 30-50% higher voting efficiency.

- For major DAOs, the passage rate of proposals is often > 70%; smaller DAOs show lower passage rates due to fewer participants.

- Some studies show that proposal authors who also hold large token positions influence outcomes; in 14.8% of evaluated proposals, contributors shifted ownership before polls.

- New AI-augmented governance frameworks (e.g., in KlimaDAO) show projected participant increases of ~40% and clearer governance alignment by ~35%.

Decentralization and Voting Power Distribution

- Approximately 78% of DAO tokens are held by the top 20% of stakeholders.

- In 7.5% of DAOs, contributors hold majority governance decision power.

- Contributors have unilaterally decided on at least one proposal in about 20.4% of DAOs.

- Voting-Bloc Entropy (VBE) metrics highlight reduced decentralization when voting blocs align strongly.

- Delegated voting boosts participation but can increase vote centralization by influential delegates.

Geographic Distribution

- As of 2025, the Asia-Pacific region leads DAO expansion, with major activity in China, South Korea, and India.

- Approximately 60–65% of active DAOs are classified as community-driven (vs. financial or protocol DAOs), according to typologies from DeepDAO and Bankless research.

- The U.S. remains a major hub for DAO infrastructure, holding over 35% market share but with slower growth than Asia.

- Europe’s DAO formation is boosted by regulatory clarity, yet DAOs number fewer than in Asia or North America.

- Latin America and Africa saw DAO growth of over 20% year-over-year in 2024.

- North America holds the largest absolute DAO treasury and tooling value, though its new DAO growth share declines.

- More than 30% of DAO members globally now participate cross-border outside their token’s country of origin.

Major DAO Tooling Platforms (Snapshot, Tally, Aragon)

- The off-chain voting platform Snapshot reportedly processes over 96% of major DAO votes in 2025.

- The platform Tally powers governance for protocols managing $5 + billion in assets.

- The treasury-management tool Safe secures more than $22 billion in DAO treasuries as of 2025.

- Governance platform Aragon supports full-stack DAO operations (governance + treasury + legal wrap) and is cited among the top development frameworks in 2025.

- Market overviews list more than 70 major DAO-tooling platforms active in 2025, spanning governance, treasury, contributor tracking, identity, and reputation.

- Institutional adoption of tooling is increasing; one estimate suggests tooling growth of 45% year-over-year in 2025.

- Despite the mature tooling landscape, participation remains concentrated; the top 10% of token-holders control about 76.2% of voting power in many DAOs.

- Interoperability among tools (Snapshot, Safe, Tally) is improving; reports note integration depth increased by ~30% between 2024 and 2025.

DAO Innovations and Technology Integrations

- In 2025, 8.5% of DAOs will integrate AI-powered governance assistants and contributor intelligence tools.

- Cross-chain treasury and governance models now support over 60% of new DAOs.

- There are approximately 500-600 sustainability-focused DAOs globally as of early 2025.

- Modular governance mechanisms like reputation scores and holographic consensus are adopted by over 40% of DAOs.

- On-chain identity and soul-bound tokens are used in around 12% of DAOs to improve accountability.

- Contributor productivity tools linked to token allocation are adopted by about 35% of DAOs.

- Blockchain-based monitoring and verification are deployed by more than 50% of sustainability and social-impact DAOs.

- Governance dashboard analytics usage grew by over 30% in 2024.

DAO Security and Hack Statistics

- DAO hacks up to 2025 have resulted in over $310 million in losses.

- The broader DeFi ecosystem (in which many DAOs operate) has suffered $10 + billion in direct losses from crime events.

- 55% of crime events lead to negative price impacts for governance tokens, averaging ~14% decline.

- Smart-contract vulnerabilities (e.g., reentrancy, governance manipulation) remain primary vectors; one survey found that>60% of DAO proposals lacked consistent documentation or audit linkage.

- In 2025, regulatory scrutiny on DAO security increased, with insurers and custodians raising premiums or refusing coverage for DAO treasuries.

- DAOs with larger treasuries face longer recovery times; one analysis shows median time to restore governance after a hack is > 30 days.

- Over 70% of DAOs managing > $50 million in assets require multi-layer security audits, smaller DAOs less consistently.

- Flash-loan enabled governance exploits remain a major threat, one study found top 3 DAOs (by treasury size) were at risk due to vote-buying tactics.

- DAO insurance adoption is still nascent; fewer than 5% of mid-sized DAOs have formal treasury insurance coverage as of mid-2025.

Regulatory and Legal Status of DAOs

- The regulatory status of DAOs remains unsettled in over 70% of major jurisdictions as of 2025.

- Only investment-type DAOs closely resemble regulated entities under traditional frameworks.

- Courts in some cases classify DAO members as partners in unincorporated associations, exposing them to full liability.

- Governance tokens are treated as securities in 40% of jurisdictions, creating tax complexity for cross-border DAOs.

- Over 60% of regulators now require AML/KYC compliance on DAOs managing large treasuries.

- DAO-friendly legal structures like DAO LLCs exist in 5+ U.S. states, including Wyoming.

- Legal and regulatory setup costs for DAOs range from $20,000 to $150,000, depending on jurisdiction.

Frequently Asked Questions (FAQs)

Over 13,000 DAOs globally in 2025.

The top-5 DAOs hold more than 60 % of all DAO treasury assets.

About 78% of tokens are held by the top 20% of stakeholders.

Between 500 and 600 sustainability-oriented DAOs by early 2025.

Conclusion

The data confirms that DAOs are more than experiments; they are evolving organizational structures with global reach, sophisticated tooling, and meaningful treasury footprints. Yet they also face persistent challenges, geographic concentration of value, governance participation gaps, security risks, and regulatory ambiguity. The next wave of DAOs will likely be defined less by novelty and more by maturity, better legal frameworks, improved decentralization metrics, cross-chain integrations, and real-world asset deployment. For practitioners and observers alike, monitoring these trends now offers a strategic advantage.