Cryptocurrency has evolved from a niche financial curiosity into a mainstream asset class, and with that shift, cyber risk has risen sharply. For example, from major exchange breaches to malware mining schemes, the crypto space illustrates how technology’s promise and peril often walk hand in hand. Meanwhile, in finance, institutional investors are now assessing crypto risk as part of their broader security posture, and at the same time, millions of individual cryptocurrency holders face targeted phishing campaigns.

Editor’s Choice

- 35% , year‑over‑year drop in cryptocurrency ransomware payment volumes in 2024.

- 40% increase, growth in phishing attacks targeting crypto users in early 2025.

- 12.2%, projected growth in global cybersecurity spending in 2025.

- 20% increase, rise in cryptojacking attacks in cloud environments in 2025.

- < 1% , illicit crypto‑platform transaction volume as a share of total blockchain activity in 2025.

Recent Developments

- $2.17 billion stolen in the first half of 2025, with final 2025 crypto thefts expected to approach $4 billion.

- Despite thefts rising, illicit activity still constitutes less than 1% of overall blockchain transaction volume.

- Global cybersecurity spending is forecast to grow by 12.2% in 2025, underscoring increased investment in defenses.

- Cloud cryptojacking incidents increased by about 20% in 2025 as malicious actors exploit idle computing power.

- Phishing attacks directed at cryptocurrency users surged by approximately 40% in early 2025.

Cyber Threats Rising Rapidly

- 30,000 websites are compromised daily, spreading malware, stealing data, and launching ransomware.

- Cryptojacking incidents jumped 659%, revealing a surge in hidden crypto-mining attacks.

- Ransomware attacks on ICS rose 20%, threatening vital infrastructure systems.

Common Attack Vectors in the Crypto Space

- Phishing remains a top entry point; about 18% of ransomware attacks in 2025 began with phishing, up from 11% in 2024.

- Exploited vulnerabilities triggered 32% of ransomware incidents in 2025, making it the most frequent technical cause.

- Compromised credentials accounted for about 23% of ransomware attacks in 2025 (down from 29% in 2024).

- Cryptojacking increased by ~20% in 2025 as idle cloud resources are hijacked for mining.

- Malware campaigns now leverage smart‑contract hooks for payload delivery in blockchain‑linked systems.

- Human error remains central; globally, about 88% of breaches involve human mistakes.

- Supply‑chain / third‑party risk is rising; around 60% of organizations report they will include cybersecurity risk in vendor/transaction decisions by 2025.

- Double‑extortion ransomware (data theft + encryption) is increasingly used in crypto‑adjacent attacks.

Ransomware and Malware Attack Statistics in Cryptocurrency

- Payments to ransomware attackers in the crypto context dropped ~35% year‑over‑year in 2024.

- The median ransom payment in 2025 was $1 million, with some large cases exceeding $2 million.

- In the first half of 2025, roughly 50% of ransomware attacks resulted in data encryption, the lowest in six years.

- Approximately 49% of encrypted data victims in 2025 paid the ransom.

- The average cost of recovery (excluding ransom) fell to about $1.53 million in 2025, down from $2.73 million in 2024.

- Malware campaigns targeting blockchain infrastructure exploit both network vulnerabilities and smart‑contract code modules.

- Many ransomware incidents now also target cryptocurrency wallets and exchanges as part of their operational strategy.

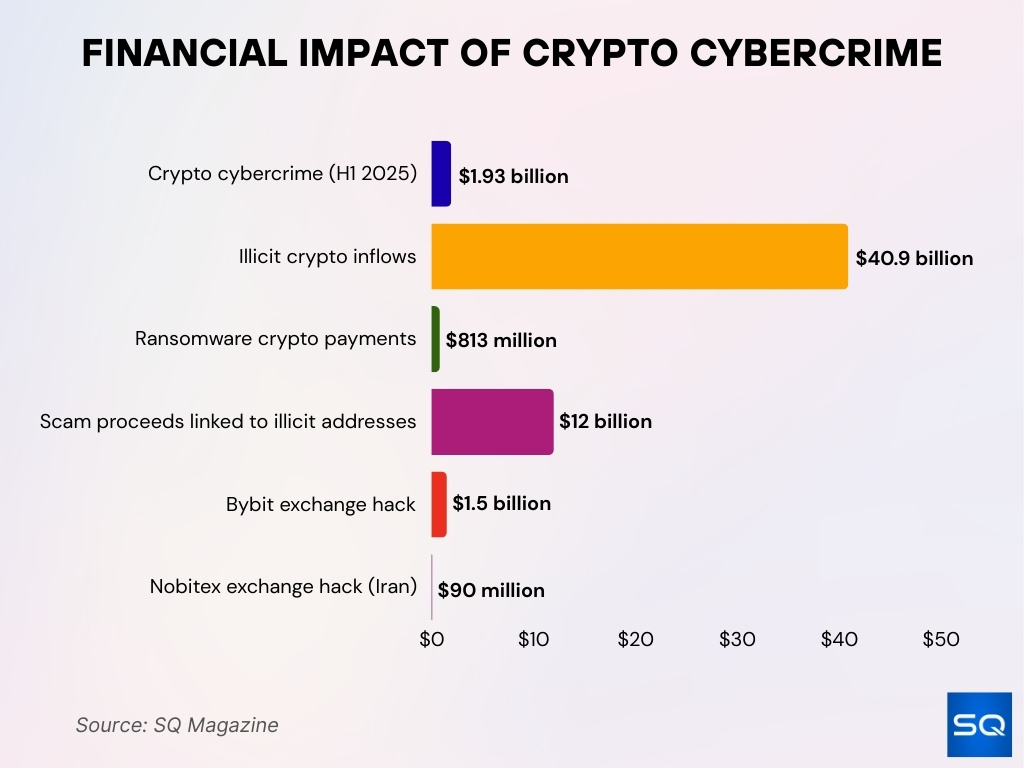

Financial Impact of Crypto Cybercrime

- $1.93 billion lost to crypto cybercrime in H1 2025 alone.

- $40.9 billion in global crypto inflows tied to illicit activity like scams and darknet use.

- $813 million paid by ransomware victims in cryptocurrency.

- $12 billion in scam proceeds linked to illicit crypto addresses per Chainalysis.

- $1.5 billion Bybit hack in Feb 2025 is the largest crypto exchange theft ever.

- $90 million was stolen from Iran’s Nobitex in a 2025 cyberattack.

- $1.2 trillion in projected annual global cybercrime damages, including crypto fraud, by the end of 2025.

Phishing Attack Statistics Related to Cryptocurrency

- In 2024, U.S. citizens lost $9.3 billion to crypto‑related scams, with phishing a large component of that total.

- According to a survey, there were 3,938 phishing cases involving cryptocurrency schemes in 2024, causing about $28.5 million in direct losses.

- Over 80,000 phishing websites were detected globally as of October 2025, up about 22% year‑over‑year, and many targeted crypto users.

- Between May 2024 and April 2025, some crypto fraud campaigns leveraging AI tools surged by 456%, with phishing and impersonation among key tactics.

- Data show that large‑scale campaigns in 2025 included 11,482 URLs across 5,390 domains linked to investment‑scam/crypto‑phishing operations.

Crypto Exchange & Wallet Breaches

- $2.17 billion was stolen across all crypto hacks, including exchanges, in H1 2025; 2025 is likely to set a new annual record.

- Roughly 62% of the value stolen from exchange hacks in 2025 involved hot‑wallet breaches.

- One major breach, about $1.5 billion stolen from the exchange Bybit in early 2025, was attributed to state‑sponsored actors.

- Wallet compromises contributed approximately $1.71 billion of the total investor losses in H1 2025 across 344 incidents.

- The total number of recorded security incidents in H1 2025 was about 121 for crypto‑asset services.

- Exchange hacks continue to impact user trust and liquidity, for example, the largest U.S. exchange warned of up to $400 million in impact from a customer‑data breach.

- Even though the total value stolen is large, illicit transaction volume remains a small share of overall blockchain activity, less than 1% in 2025.

- Custodial risk remains high, centralized platforms still control large pools of assets and thus remain prime targets for attackers seeking concentrated payoff.

Crypto Cybercrime and Digital Asset Insurance Growth

- $1.93 billion in crypto cybercrime losses were recorded in early 2025, exposing digital asset risks.

- $4.28 billion is the projected size of digital asset insurance by end-2025 amid surging cyber threats.

- Visual data shows a strong rise in both cybercrime losses and insurance uptake across crypto markets.

- Rising bars and red trendlines highlight mounting financial strain from crypto hacks and breaches.

- Insurers and exchanges are boosting cyber protections as digital asset insurance becomes essential in 2025.

Smart Contract and DeFi Vulnerability Statistics

- Smart contract vulnerabilities in 2025 caused losses of approximately $500 million across the cryptocurrency ecosystem.

- A security study found that 40% of all smart‑contract breaches in 2025 were due to reentrancy attacks.

- Audit fees for smart‑contract assessments in 2025 generally ranged between $25,000 and $150,000, depending on complexity.

- One report found that among deployed contracts, 59% of transactions involve multiple contracts, increasing dependency risk. One small group of deployers controls ~50% of “alive” contracts on Ethereum‑type networks.

- Major DeFi protocols audited by firms such as ConsenSys Diligence and Hashlock in 2025 covered projects representing $100 billion+ in market cap.

Regulatory Responses and Compliance Measures

- 80% of global crypto firms adopted enhanced KYC/AML protocols by mid-2025.

- The U.S. SEC increased DeFi-related enforcement actions by 16% year-over-year in 2025.

- 45% rise in on-site inspections of crypto derivatives organizations by the CFTC in 2025.

- 90% of surveyed financial firms reported implementing automated compliance tools like zk-KYC.

- Cross-border regulatory harmonization efforts now cover 70% of global crypto market jurisdictions.

- Regulatory penalties in digital asset markets grew by 25% in 2025 amid stronger enforcement.

- The global KYC market for crypto compliance is projected to grow at a 16.4% CAGR through 2030.

- 62% of DeFi protocols reviewed by regulators faced increased disclosure or operational requirements.

- Industry adoption of audit trails and transaction monitoring rose to 85% among crypto exchanges globally.

How Crypto Funds Were Stolen

- 43.8% of stolen crypto came from private key compromises, the top theft method.

- 25.5% of losses were from unknown sources, complicating attribution and response.

- 11.2% involved other compromise types like hybrid or unclassified attack vectors.

- 8.5% resulted from smart contract flaws and code-level vulnerabilities.

- 6.3% were tied to general security gaps like weak infrastructure or no MFA.

- 4.7% stemmed from market manipulation and integrity-related exploits.

Industry‑Specific Cybersecurity Statistics: Finance and Cryptocurrency

- Within financial‑industry crypto exposure, institutional investors increasingly list cybersecurity failure as a top 5 risk when adopting digital‑asset strategies.

- In 2024, global crypto transaction volume grew to over $10.6 trillion, up roughly 56% since 2023.

- Financial firms active in crypto now report that wallet/private‑key compromise is among the top three concerns when connecting to DeFi protocols.

- Some crypto custodians’ breach costs (for user‑asset loss, regulatory response, and remediation) can exceed $100 million per incident, especially when major exchanges are affected.

Geopolitical Influences in Cryptocurrency Cybersecurity

- 72% of global executives factor geopolitical events into cybersecurity strategies.

- The European Central Bank links rising state-sponsored cyberattacks to geopolitical risks in 2025.

- 97% of organizations reported elevated cyber threats since the Russia-Ukraine conflict escalated.

- Nation-states now use crypto increasingly for sanctions evasion and covert financing.

- State-backed crypto thefts surged, with North Korean groups accounting for 60% of attacks in early 2025.

- Around 60% of organizations say cyber threats from geopolitics affect financial stability.

- Russian-linked cyber operations targeting crypto exchanges increased significantly in 2025.

- Ransomware cryptocurrency heists increased by 2%, totaling over $459 million in 2025.

Insider Risks and Crypto Security

- The average cost of insider threats reached $17.4 million annually in 2025.

- 56% of organizations experienced an insider-threat incident in the past year.

- Only 23% of security teams feel confident in stopping insider threats before serious damage.

- Insider incidents typically take about 81 days to resolve on average.

- Credential theft incidents cost approximately $780,000 per case on average.

- Malicious insiders and negligence account for 55% of insider threat cases.

- Around 83% of organizations reported at least one insider attack in 2024.

- Many crypto firms rely on reactive rather than predictive insider risk models, limiting early detection.

- Insider risks in crypto intersect with supply chain and third-party vulnerabilities in 43% of cases.

- Post-incident containment budgets average $211,000 while prevention budgets lag at about $38,000.

Technological Advancements and Blockchain Security

- The global blockchain security market is set to reach $128.19 billion by 2032, reflecting a 57.3% CAGR from 2025 as sector investment accelerates.

- DeFi borrowing expanded 30% in Q1 2025, showing stronger activity that heightens overall security exposure.

- Only 3 of 53 leading crypto wallets include explicit phishing-transfer alerts, illustrating a major protection gap.

- Smart-contract vulnerabilities remain elevated, as recent analyses document complex, multi-layer threat patterns.

- Adoption of zero-knowledge proofs and multi-party computation grew by 40%+ in 2025, strengthening cryptographic defenses.

- Blockchain security now incorporates runtime protection and continuous anomaly detection, extending beyond periodic audits.

- Over 90% of blockchain security teams are adding quantum-resistant cryptography, preparing for future attack surfaces.

- Blockchain-native identity controls and proof-of-reserve protocols are applied by 75% of crypto security teams, tightening verification standards.

- Quantum-resistant methods are expected to safeguard blockchains from classical-algorithm weaknesses within 5–10 years, supporting long-term resilience.

- Continuous monitoring tools have reduced average downtime-related losses by 35% in 2025, enhancing operational stability.

Dark Web and Phishing Threats in Cryptocurrency

- Daily users of the Tor network grew from ~2 million to over 3 million by early 2025.

- The dark web’s illicit economy remains potent, and stolen credentials exceeded 15 billion accounts exposed by 2022, fueling crypto‑related fraud.

- The number of malicious emails detected in just the first five months of 2025 exceeded 12.6 million, and 25% of phishing emails were targeted at “VIP” users.

- In 2025, 32% of phishing emails contained a high volume of text, suggesting fraudsters use AI/LLMs to craft longer, more convincing messages.

- Phishing remains a key vector for crypto theft, according to the Kroll 2025 threat report. Phishing attacks targeting crypto users increased by 40%.

- Although the dark web is only about 0.01% of the internet, its role as a platform for hacking tools, stolen credentials, and crypto wallets is disproportionate.

- QR‑code‑based phishing campaigns in early 2025 involved over 1 million instances in a single month, many linked to crypto wallet prompts and fake exchange sites.

Frequently Asked Questions (FAQs)

$2.17 billion.

Over 57%.

~40% increase.

Conclusion

As crypto-assets become ever more integrated into global finance, the expanding threat landscape demands attention on multiple fronts. Specifically, geopolitical tensions, sophisticated insider risks, rapid technological advancement, and persistent dark-web-driven phishing are all shaping cyber-exposure in the crypto realm. Therefore, organizations and individuals alike must act deliberately, build resilient platforms, enforce rigorous access controls, and continuously monitor emergent vectors. Ultimately, understanding the data behind these risks is the first step toward meaningful mitigation.