The cryptocurrency exchange Bybit has emerged as a major player in global digital-asset markets, combining high trading volume with aggressive product expansion. That growth is visible in its registered users, regulatory moves, and technological roll-out. For example, Bybit’s rise has enabled institutions and retail traders alike to access derivatives, spot trading, and tokenised assets under one roof; meanwhile, its global licensing push is reshaping how exchanges operate across jurisdictions. This article explores the latest Bybit statistics, offering a comprehensive view of the platform’s performance, reach, and impact.

Editor’s Choice

- As of May 9, 2025, Bybit had 70 million+ registered users, reaffirming its status as the world’s second-largest crypto exchange by trading volume.

- Bybit reported 0 client fund loss despite a major vendor hack, thanks to its 1:1 reserve guarantee.

- The platform secured a MiCAR licence in Austria, enabling regulatory access to 29 EEA countries.

- In July 2025, Bybit’s website recorded 22.95 million visits, up 13.8% from June.

- Web traffic shows a demographic skew, 67.6% male, dominant age bracket of 25-34 years.

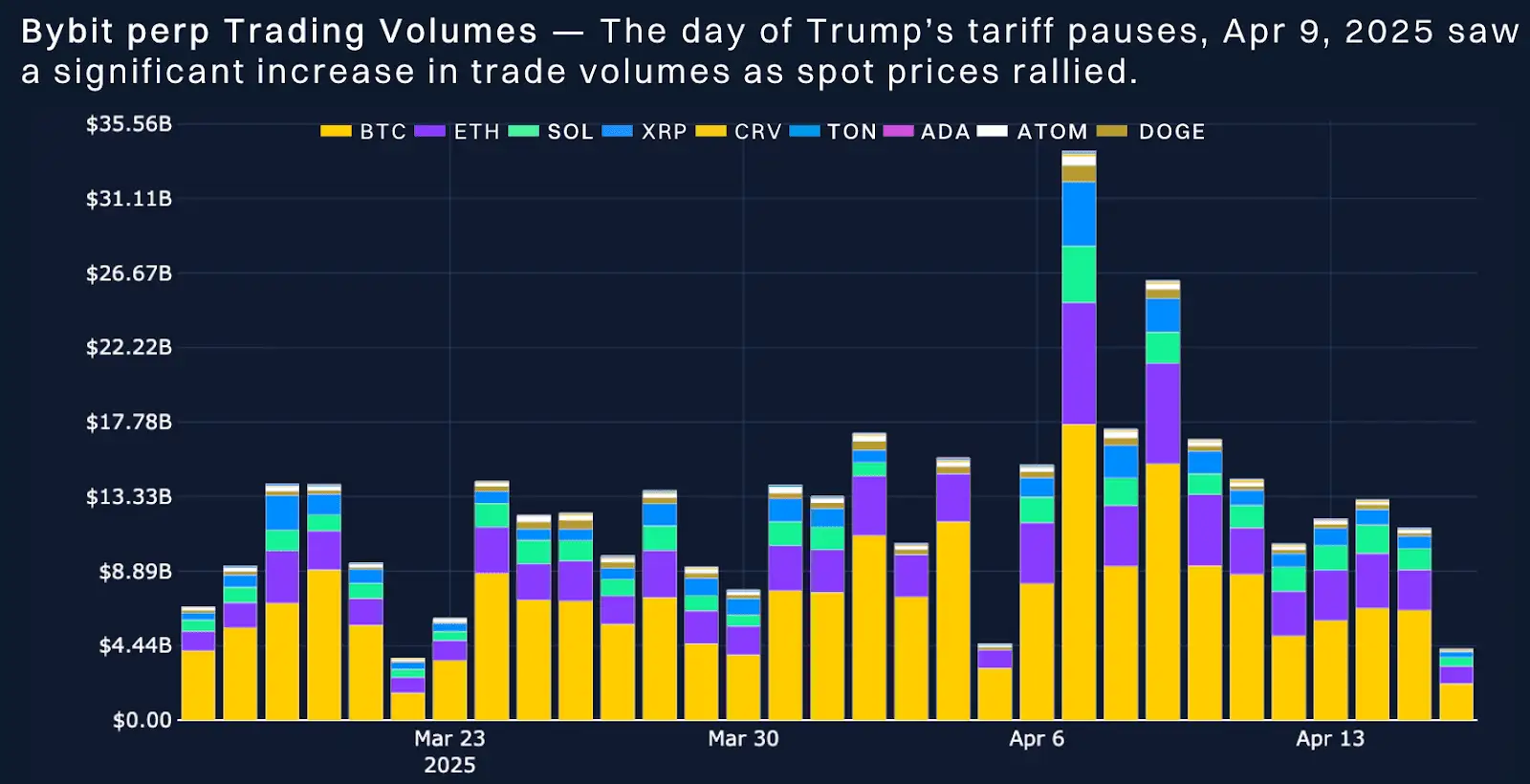

- Bybit’s daily trading volume spiked to around $35.5 billion on April 9, 2025, triggered by macro-policy news.

Recent Developments

- In February 2025, Bybit was hit by a vendor-wallet hack credited to the Lazarus Group, with losses estimated at $1.4 – 1.5 billion.

- Bybit announced it had fully reimbursed client assets, thanks to the 1:1 reserve model.

- The exchange introduced 78 TradFi instruments and 10+ tokenised stocks in H1 2025.

- Bybit secured the European MiCAR licence in June 2025, paving the way for operations across 29 EEA countries.

- The company announced 50+ security upgrades and 9 security audits following the February hack.

Trading Volume and Market Share

- Bybit’s market share dropped 0.9 points in H1 2025, landing at 7.6 %.

- Bybit’s trading volume fell 18.1 % QoQ in Q2 2025 amid broader market declines.

- Top CEXs in July 2025: Binance 39.8 %, MEXC 8.6 %, Gate 7.8 %, Bybit 7.2 %.

User Growth and Demographics

- Bybit’s user base grew from approximately 60 million in 2024 to 70 million+ by May 2025.

- The male share of users is about 67.6%, with the largest age segment being 25-34 years.

- Traffic origins show users from Russia (23.9%), Germany (6%), Ukraine (5.6%), South Korea (4.3%), and the U.S. (3.7%).

- Employee growth, Bybit’s workforce almost doubled (~99% growth) in the past year, reaching ~2,400-2,500 staff globally by mid-2025.

- The majority user segment, 25-34 age range, reflects typical crypto-native demographics, indicating high engagement potential.

- Bybit reports registration availability in 160 countries as of 2025, supporting the global user growth narrative.

- Institutional growth is cited as a key driver of new user onboarding, especially after compliance expansions.

- Bybit card program (2 M+ users) also drives user growth via real-world utility beyond trading.

Geographic Distribution of Users

- Russia accounts for approximately 22.6% of Bybit’s web traffic in October 2025.

- Ukraine represents about 5.85%, Germany ~4.96%, and South Korea ~4.90% of traffic in the same period.

- U.S. traffic share is around 3.7% of visits, showing presence, though smaller than in other regions.

- Bybit operates in 160 countries globally but is restricted in ~15 jurisdictions, including the USA and the UK.

- Europe, over 25 countries in the EEA covered via MiCAR-compliance, Bybit held ~7.2% European market share in Q1 2025.

- Asia-Pacific, South Korea traffic ~4.3% according to July 2025 data.

- Americas, South America adoption growing, e.g., Brazil traffic ~2.91% according to the country guide 2025.

Bybit Perpetual Trading Volume Trends

- Daily volumes ranged $4 billion–$13 billion through late March 2025.

- March 22 spike to $13 billion was driven by BTC and ETH activity.

- March 24–25 lows saw volumes drop to around $4–5 billion.

- April 6 volumes rebounded to nearly $20 billion.

- April 9 hit a peak of $35.5 billion after Trump’s tariff pause announcement.

- Mid-April volumes stabilized between $10 billion–$18 billion daily.

- Macro events triggered surges, especially in perpetual contract trading.

Website Traffic and Engagement

- In October 2025, Bybit’s website registered around 20.71 million visits, up nearly 9.7% from the previous month.

- For the same period, users spent an average of 00:13:10 minutes per session, indicating a high level of engagement.

- The average pages per visit reached 11.47, reflecting substantial site navigation.

- The bounce rate in October stood at about 39.81%, showing moderate retention of visitors.

- On desktop traffic, Direct sources accounted for ~87.19% of visits, while Google.com referrals comprised ~4.89%.

- Gender breakdown for visitors, 67.83% male, 32.17% female, with the most frequent age group of 25-34 years.

- Top traffic-origin countries in October include Russia ~22.57%, Ukraine ~5.85%, Germany ~4.96%, and South Korea ~4.90%.

- Organic search contributed ~11.48% of total traffic in the recent period.

- Although monthly visits stood at ~20.7 million, six-month trends show fluctuations: August 2025 ~22.27 million, September ~18.88 million, October ~20.71 million.

Most Traded Cryptocurrencies

- Bybit’s spot exchange listed 497 coins and 665 trading pairs, as of the most recent snapshot.

- The derivatives arm shows 859 trading pairs on Bybit (Futures) with a 24-hour volume of approximately $29.79 billion, and open interest of around $15.42 billion.

- On the spot side, one data table lists Bybit at ~$4.96 billion 24-h volume among spot exchanges for the period cited.

- The most active trading pair on Bybit Futures was BTC/USDT, with a 24-hour volume of about $10.30 billion.

- While detailed ranking by coin is limited, Bybit’s report and third-party data indicate that Bitcoin (BTC) and Ethereum (ETH) consistently lead trading volume on the platform.

- In a derivatives-market share dataset, Bybit held approximately 21% of the global crypto derivatives market in 2025.

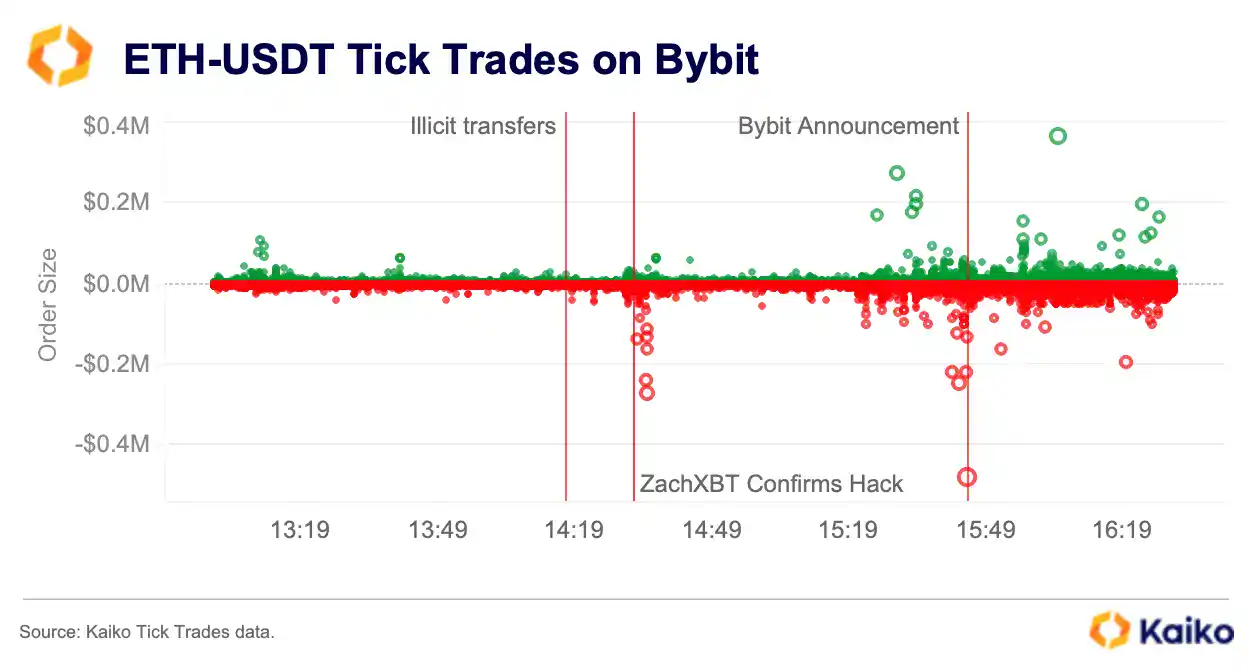

ETH-USDT Tick Trade Activity on Bybit (Intraday Volatility)

- Around 14:15, trades over $0.2 million appeared after flagged illicit transfers.

- At 14:25, trades dropped near -$0.4 million as ZachXBT confirmed the hack.

- Post-15:45, trades swung between -$0.3 million and +$0.3 million after Bybit’s announcement.

- Most trades hovered near $0.0 million, indicating consistent retail activity amid whale moves.

- Security breaches and news spikes drove abrupt shifts in ETH-USDT liquidity and order flow.

Derivatives Trading Statistics

- Bybit’s derivative platform maintained a 24-hour trading volume of about $30.37 billion in its reported snapshot.

- Open interest (total value of outstanding derivative contracts) was around $15.42 billion for Bybit Futures.

- A market-share estimate shows Bybit at ~21% of the global crypto derivatives market in 2025, placing it alongside the leading venues.

- The February 2025 hack (by the Lazarus Group) resulted in a temporary drop in derivatives open interest from ~25% to ~18% market share. Bybit recovered to ~21% by mid-year.

- During the hack event, Bybit’s average daily perpetual volume remained resilient, ~$10 billion for BTC, ~$8.5 billion for ETH, and ~$1.7 billion for SOL.

- Analysts note the derivatives market recovery was “cautiously gaining stability” post-market events in 2025.

- The depth and breadth of Bybit’s derivatives business position it as a multi-product venue, not just spot trading.

Leverage and Margin Trading Stats

- Bybit offers up to 100× leverage on selected derivatives contracts.

- Spot margin trading supports borrowing against assets under cross-margin and portfolio margin modes.

- Major crypto pairs on Bybit may allow leverage up to 100×, while altcoins typically offer lower leverage caps.

- VIP tier users enjoy maker fees as low as 0.0300% and taker fees down to 0.0450% on spot trading.

- The Manual Borrowing feature, launched in October 2025, allows proactive borrowing of assets ahead of volatility.

- Bybit supports multiple collateral assets per borrowable pair, enabling diversified leverage strategies with stablecoin collateral models.

- Margin trading includes Cross Margin and Portfolio Margin modes, not isolated margin.

- Bybit’s Supreme VIP users pay zero maker fee on derivatives and 0.02–0.03% taker fees.

- 81% of derivatives positions on Bybit close within 24 hours, reflecting short-term speculation dynamics.

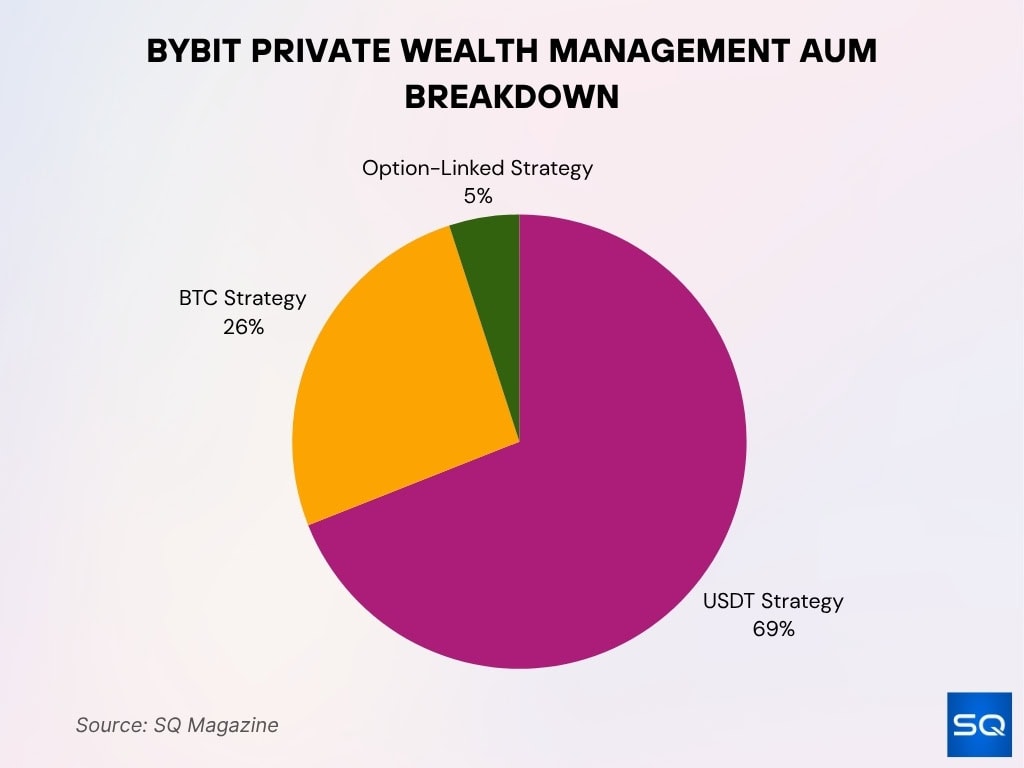

Bybit Private Wealth Management AUM Split

- USDT Strategy leads with 69%, reflecting strong demand for stable returns.

- BTC Strategy holds 26%, showing investor trust in Bitcoin’s long-term growth.

- Option-Linked Strategy at 5%, suggesting selective use of derivatives for yield.

- Clients favor stability via stablecoins, while keeping diversified exposure to BTC and options.

Market Depth and Liquidity Metrics

- Bybit’s BTC market depth recovered to approximately $13 million per day within 30 days after the February 2025 hack.

- Bybit held average daily futures volumes of around $30 billion during turbulent market conditions in 2025.

- About 81% of derivatives positions on Bybit close within 24 hours, showing high liquidity turnover.

- Bybit’s transparency report confirmed reserves exceeding 100% collateralization post-hack.

- Daily spot trading volumes on Bybit peaked at over $1.1 billion in March 2025.

- Bybit’s derivatives daily volume share was approximately $6 billion, trailing Binance’s $15.5 billion.

- Bybit’s liquidity recovery post-hack ranks it ahead of several competitors who suffered drops beyond 30% in market depth.

Order Types and Limits

- Bybit supports Market, Limit, Conditional, Scaled, and Chase Limit orders.

- Scaled Orders divide large orders into 2 to 50 sub-orders with Flat, Increasing, Decreasing, or Custom distributions.

- The minimum total quantity for BTCUSDT Scaled Orders is 0.01 BTC, maximum of 1,000 BTC.

- Chase Limit Orders have a minimum chase distance of 0.01% and a maximum of 10%.

- Users can have up to 5 open Chase Limit Orders per user ID (UID).

- Spot trading maximum order quantities can be up to 5 times the standard size, depending on the asset and order type.

- The maximum order size for BTCUSDT market orders is 100 BTC, and for limit orders, it is 155 BTC.

Bybit Copy Trading Statistics

- Bybit’s Copy Trading module has over 32 million successful trades recorded by mid‑2025.

- The platform boasts more than 800,000 followers actively copying master traders.

- Followers in Copy Trading have realized a total profit & loss (P&L) exceeding $530 million as of 2025.

- The top master traders have a win rate of 95.24% and an average ROI of +0.94% over 7 days.

- The combined trading volume of followers’ copied trades exceeded $10 billion in 2025.

- The number of followers engaging with Copy Trading increased by ~30% in late 2025.

- The platform supports copying up to 10 master traders simultaneously in Classic mode.

Proof of Reserves and Asset Holdings

- Bybit’s 2025 Proof of Reserves audit confirms assets held in a 1:1 ratio or greater than user liabilities.

- USDT reserves stand at 110%, with $5.8 billion in user assets and a wallet balance of $6.38 billion.

- USDC reserves are 153%, holding $599 million versus $920 million in wallet balance.

- BTC reserves are 103%, with 61,976 BTC in assets versus 63,980 BTC held.

- ETH holdings are 101%, with 532,000 ETH in user assets compared to 542,000 ETH in reserve.

- Independent research indicates stablecoin holdings constitute approximately 51.28% of total assets, signifying high stablecoin reserves.

Bybit Fees and Transaction Costs

- Bybit’s base spot trading fees for non-VIP users are 0.10% maker and 0.10% taker.

- Non-VIP derivatives fees are typically 0.01% maker and 0.06% taker.

- VIP 5 spot taker fees drop to 0.0500% and maker fees to 0.0400%.

- Fiat-to-crypto pairs charge VIP 0 taker fees of 0.2000% and maker fees of 0.1500%.

- BTC withdrawal fee is approximately 0.0005 BTC with a minimum withdrawal of 0.001 BTC.

- VIP tier fees are recalculated daily based on a 30-day trading volume or asset balance.

- At a futures trade volume of $100k, Bybit fees are around $37.50, compared to Bitget’s $32.

Bybit Security and Incident Statistics

- Bybit was hacked on February 21, 2025, with $1.4 to $1.5 billion in crypto stolen (~400,000 ETH).

- The hack is the largest crypto exchange theft recorded to date.

- Over $2.17 billion had been stolen from crypto platforms in 2025 YTD, with Bybit’s hack constituting a major portion.

- Bybit confirmed full solvency post-hack, maintaining a 1:1 backing of all supported user assets.

Frequently Asked Questions (FAQs)

About 497 coins and 665 trading pairs are listed.

A reserve ratio of approximately 153% (599 million user assets vs 920 million wallet balance).

Maker fee: 0.10%, Taker fee: 0.10% for non-VIP spot trading.

Over 800,000+ followers in the copy trading module.

Conclusion

Bybit stands as a robust global crypto-exchange platform characterised by advanced order-type functionality, a nascent but growing copy-trading ecosystem, solid proof-of-reserves transparency, competitive fee structures, and a renewed focus on security resilience following a major incident. These statistics indicate Bybit’s maturation in both retail and institutional markets, while also signalling the challenges of operating in a high-risk environment. For traders, investors, and service-providers, the key takeaway is that platform capability, operational transparency, and risk-management protocols increasingly determine exchange differentiation.