5G is no longer tomorrow’s promise; it has become central to wireless connectivity globally. In the U.S., 5G powers everything from edge AI in factories to telehealth in rural clinics. In Asia, it drives smart city grids and autonomous transit. Now, you’ll see how the latest statistics map current adoption, infrastructure, performance, use cases, and trends, and what that means for business, consumers, and the future of connectivity.

Editor’s Choice

- Global 5G connections reached 2.25 billion by end‑2024, growing four times faster than 4G in its comparable phase.

- The U.S. now sees 579 million wireless connections, or ~1.7 connections per person, with 5G devices making up nearly half the base.

- The global 5G infrastructure market is projected at $14.0 billion in 2025, with a 45% CAGR to reach $574.4 billion by 2035.

- In Q4 2024, the U.S. median 5G SA download speed rose to 388.44 Mbps, up from 305.36 Mbps a year earlier.

- In North America, 5G coverage reached 77% of the population, supporting 289 million connections by end‑2024.

- Among U.S. businesses, 88% say 5G is “critical” to optimizing AI usage in workplace operations.

- Private cellular (4G/5G) networks represent a growing niche, approximately $3.5 billion market in 2025, especially in manufacturing, logistics, and healthcare.

Recent Developments

- The global 5G adoption curve continues steepening; in 2024 alone, 438 million new IoT connections were added, pushing the total IoT base to 3.6 billion.

- The number of commercial 5G networks globally reached 354 by early 2025.

- The United States saw a shift toward Standalone (SA) architecture deployments, which elevated network performance, particularly in speed and latency.

- Several operators are coupling 5G rollout with Fixed Wireless Access (FWA) to replace broadband in underserved areas.

- U.S. enterprises show strong demand for AI, often citing 5G as foundational to real-time AI operations.

- Regulatory steps around spectrum allocation and vendor sourcing are now critical focal points in many countries as networks mature.

- Manufacturers and telcos are piloting 5G‑Advanced / Release 18 features (e.g., improved energy efficiency, enhanced uplink) ahead of broader adoption.

- Some countries are exploring non-terrestrial networks (NTN), integrating satellites and airborne relays with 5G, especially for remote coverage.

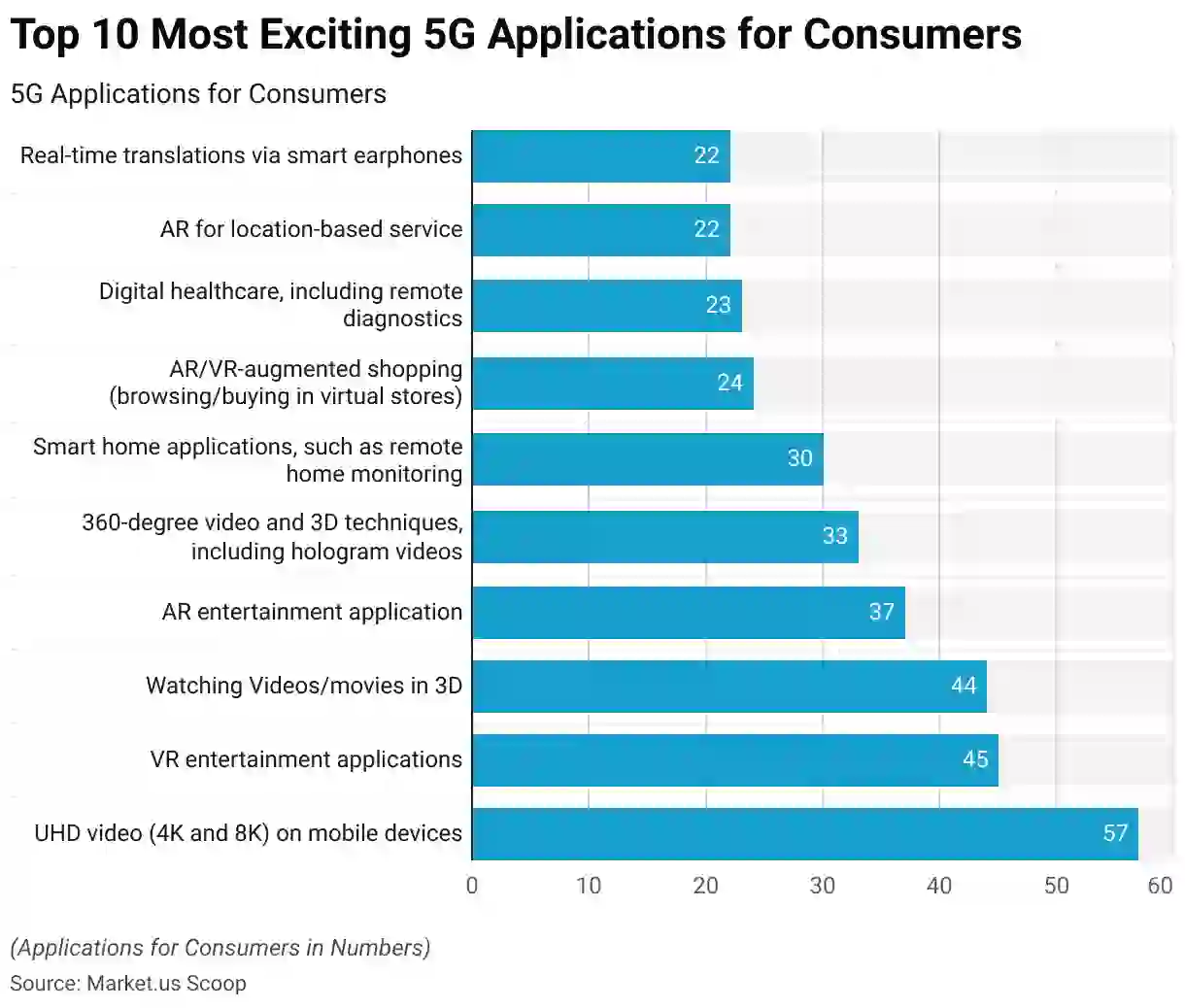

Top 10 Most Exciting 5G Applications for Consumers

- Real-time translations via smart earphones attract 22% of consumers.

- AR for location-based services engages 22% of users.

- Digital healthcare, including remote diagnostics, excites 23% of consumers.

- AR/VR-augmented shopping in virtual stores appeals to 24% of users.

- Smart home applications, such as remote monitoring, interest 30% of consumers.

- 360-degree video and hologram experiences are sought by 33% of users.

- AR entertainment apps capture the attention of 37% of consumers.

- 3D video and movie viewing is favored by 44% of users.

- VR entertainment applications excite 45% of consumers.

- UHD video (4K and 8K) streaming on mobile devices tops the list with 57% consumer interest.

Adoption and Market Growth

- As of end‑2024, global 5G connections numbered 2.25 billion, marking a steep growth curve.

- That translates to about 1.5 connections per person globally, reflecting device multiplicity rather than one-to-one user penetration.

- In North America alone, 5G connections grew from 196 million in 2023 to 289 million in 2024, a 67% year-over-year increase.

- Global forecasts suggest 8.3 billion 5G connections by 2029 (~59% of all wireless).

- In 2025, 5G is expected to account for around one‑third of global mobile subscriptions.

- Smartphone sales for 5G are projected to hit 153.3 million units in 2025 at ~35.6% growth.

- In the U.S., wireless connections reached 579 million (1.7 per capita), a sign of saturation in device counts.

- Enterprise adoption in the U.S. is becoming more urgent; 90% of firms believe AI improves security via network automation, which in turn pushes demand for robust 5G backhaul.

Regional 5G Market Share

- North America achieved 77% population coverage, supporting its leadership in per capita adoption.

- Latin America doubled its 5G connections in one year, from 38.5 million in 2023 to 76 million in 2024.

- Europe has deployed a strong mid‑band footprint; in 2025, it’s estimated that ~50% coverage is achieved in many Western countries.

- Asia, especially China and South Korea, continues to dominate in total connections and rollout density.

- In North America, 5G now rivals 4G LTE in network count parity, a milestone in regional deployment balance.

- The U.S. claims nearly 579 million wireless connections, of which a growing share is 5G-enabled devices.

- Some developing regions still lag; Africa and parts of the Middle East hold single-digit 5G penetration rates in many countries.

- Regional investments in spectrum and infrastructure differ; North America and East Asia lead in per capita capital expenditure on 5G deployment.

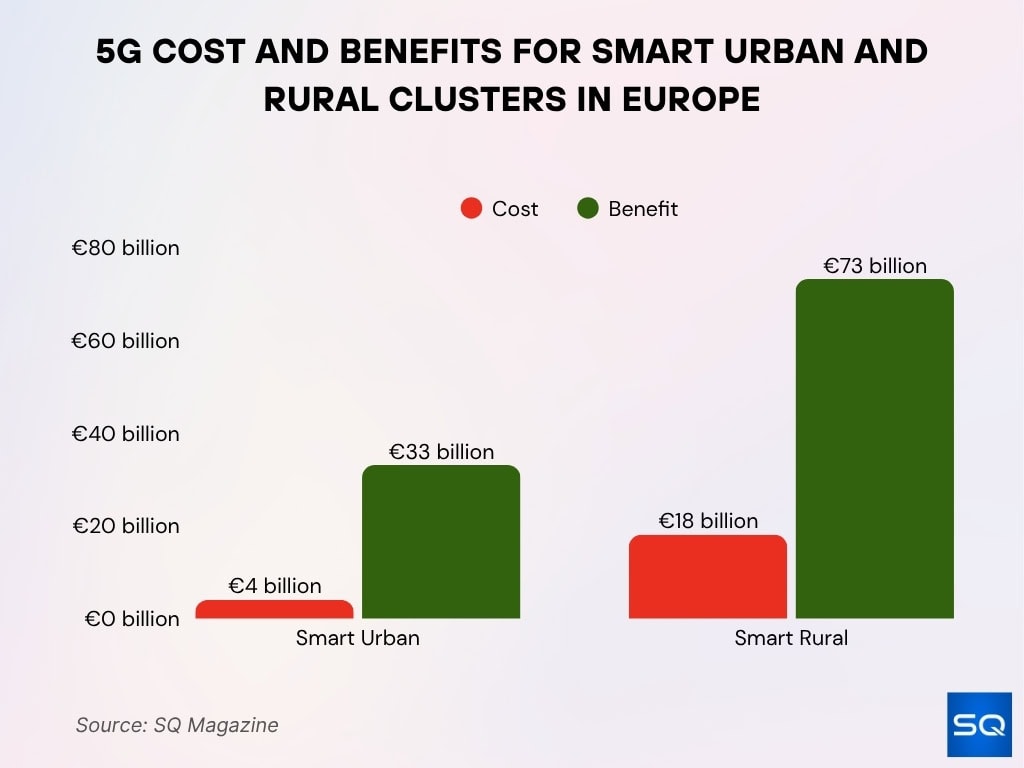

5G Cost and Benefits for Smart Urban and Rural Clusters in Europe

- Smart Urban clusters require a cost of 4 billion but deliver a much larger benefit of 33 billion.

- Smart Rural clusters involve a cost of 18 billion while generating an impressive benefit of 73 billion.

Coverage by Country and Region

- In the U.S., 5G devices constitute nearly half of wireless connections.

- South Korea consistently reports among the highest average 5G speeds and widespread mid-/high-band coverage.

- In 2024, the U.S. median 5G SA download speed stood at 388.44 Mbps, up from 305.36 Mbps in 2023.

- Japan and China, with large 5G ecosystems, reported lower median speeds (e.g., ~254 Mbps for Japan, ~225 Mbps for China).

- Some countries have hit urban 5G coverage of 90 +% (e.g,. Singapore, South Korea), though rural reach remains challenging.

- In Europe, Western nations see robust mid-band saturation (~50%–70%), while Eastern and rural zones lag.

- Nations with heavy investment in fiber backhaul (like the U.S., China) tend to correlate with better 5G performance.

- In emerging markets, operators often leverage low-band 5G (as opposed to mmWave) to maximize coverage per base station.

Device and Smartphone Statistics

- Global 5G smartphone sales are expected to reach 153.3 million units in 2025, growing ~35.6% annually.

- Many smartphones now ship with multi‑band 5G support, covering low, mid, and sometimes mmWave bands.

- In the U.S., a growing share of devices in active use are 5G-capable, contributing to the ~1.7 connections per person statistic.

- OEMs aggressively expand patent portfolios; Huawei, Qualcomm, ZTE, and Samsung lead in 5G patent filings.

- IoT device penetration via 5G is rising, and forecasts expect billions of connected devices tied to a 5G backbone.

- Smartphone 5G download speeds averaged ~87.5 MB/s (~700 Mbps) in some benchmark reports compared to ~1.87 MB/s for 4G.

- The number of 5G‑capable modems and accessible chipsets in mid-range phones has driven down premium divides.

- Device replacement cycles are shortening in mature markets, as consumers upgrade for speed, latency, and new services.

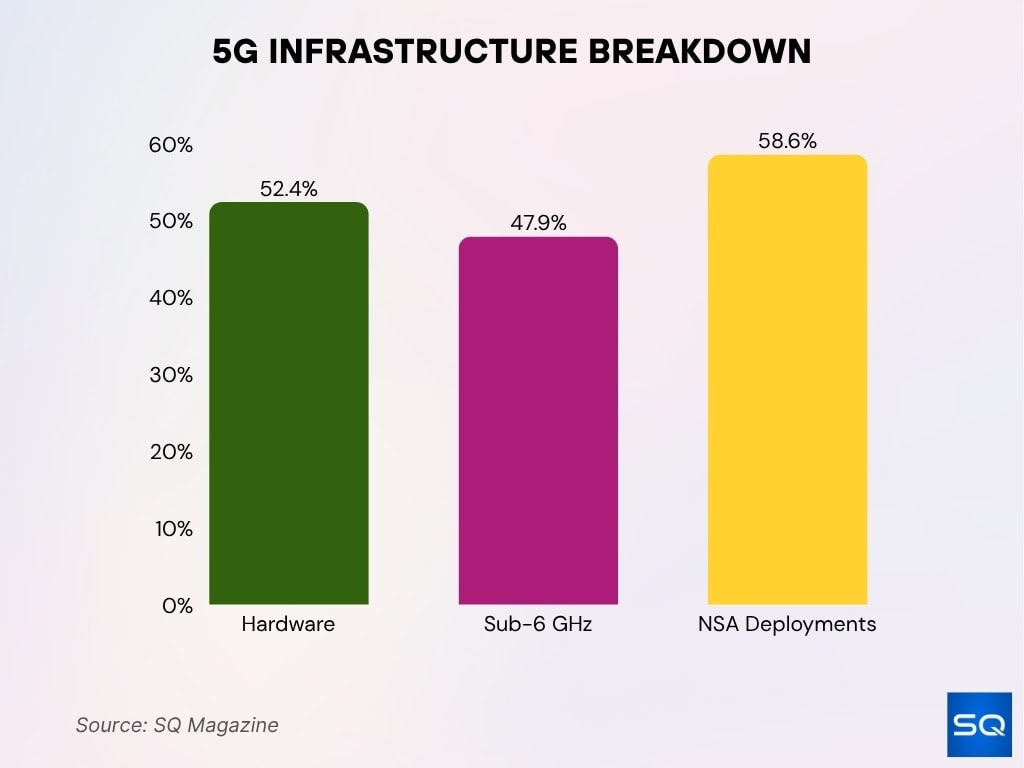

Infrastructure Statistics

- Hardware (antennas, radio units, small cells) will command 52.4% of that infrastructure market share in 2025.

- Spectrum-wise, sub‑6 GHz bands are projected to take 47.9% share due to their balance of coverage and capacity.

- Non‑Standalone (NSA) architecture remains strong, expected to hold 58.6% share of deployments in 2025.

- The 5G infrastructure market is forecast at $14.0 billion in 2025, scaling to $574.4 billion by 2035, at a 45% CAGR.

- Archive reports estimate a 41.7% CAGR to expand the infrastructure market from $43.5 billion in 2025 to ~$675.9 billion by 2034.

- Many deployments lean on Open RAN / disaggregated architectures to reduce vendor lock-in.

- 5G base station densification is increasing, small cells and Massive MIMO installations are proliferating across urban cores.

- Private 5G networks (e.g., campus or industrial) represent a specialized infrastructure segment, estimated at $3.5 billion in 2025.

Download Speed & Performance Stats

- In Q4 2024, the U.S. achieved a median 5G SA download speed of 388.44 Mbps, up from 305.36 Mbps in 2023.

- T‑Mobile leads with 5G Download Speed Experience of 252.4 Mbps and average download speed of 177.5 Mbps.

- In the H2 2024 global rankings, T‑Mobile users saw average download speeds of 152.5 Mbps, ahead of many international operators.

- Commercial 5G networks today often deliver real-world speeds between 100 Mbps and 1 Gbps, depending on spectrum and deployment density.

- Across 26 countries, median mobile download speeds now exceed 100 Mbps, with three nations surpassing 250 Mbps.

- In many comparisons, 5G download speeds are observed at 1.4× to 14× faster than 4G, depending on conditions.

- South Korea often leads in peak speed, reporting an average 5G download speeds above 430 Mbps in recent studies.

- The U.A.E. has recorded mobile internet speeds topping 546.14 Mbps in some tests, placing it among the fastest globally.

Technology Types and Standards

- The vast majority (96.4%) of certified 5G devices now support Standalone (SA) mode, reflecting the industry transition from NSA.

- Around 48% of all certified mobile devices in 2024 included 5G capabilities, up from 38% the prior year.

- Standards such as 5G Release 18 / 5G‑Advanced are gaining traction, offering enhancements in uplink, energy efficiency, and spectrum flexibility.

- The NR (New Radio) standard supports both FR1 (below 6 GHz) and FR2 (above 24 GHz) bands, enabling varied deployment strategies.

- mmWave (high band) 5G can deliver gigabit-range speeds but requires dense small‑cell deployment due to limited range.

- Many operators and vendors are adopting Open RAN / disaggregated architectures to reduce vendor lock‑in and improve flexibility.

- RedCap (reduced capability) 5G is emerging to serve IoT / mid‑tier devices with simpler requirements, reducing cost and complexity.

- Hybrid connectivity models combining 5G, satellite, and LPWAN are becoming more common, especially for expansive or remote coverage.

Investment and Spending

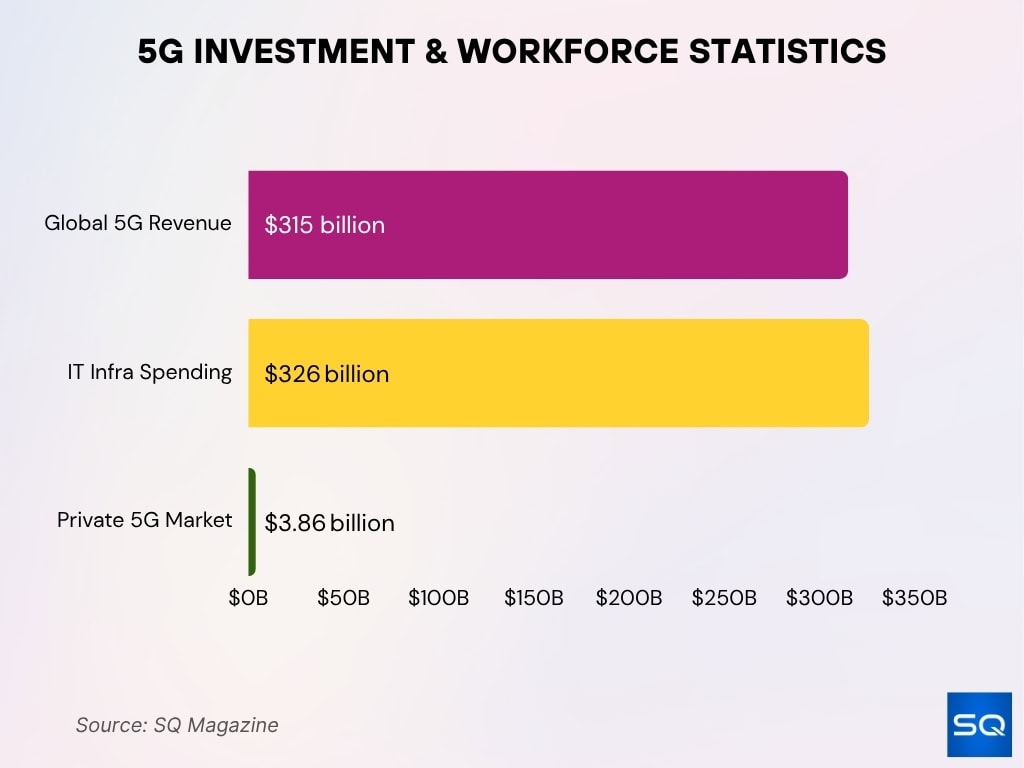

- Global 5G industry revenue is forecast at $315 billion in 2025.

- IT infrastructure spending tied to 5G (data center, edge, network hardware) is projected to exceed $326 billion by 2025.

- The private 5G market alone is valued at $3.86 billion in 2025 and expected to grow to $17.55 billion by 2030 (CAGR 35.4%).

- Telecom operators globally invest tens of billions annually in spectrum, backhaul, and upgrades.

- The 5G infrastructure market is estimated at $20.55 billion in 2025, with growth toward $131.77 billion by 2034.

- In 2024, the 5G industry reportedly achieved ~9.98% growth and supported a workforce of ~1.3 million.

- VC funding in 5G, telecom startups has increased ~15% year-over-year, with a focus on Open RAN, private networks, and edge AI.

- Major deals underscore investment scale, e.g., Vodafone Three awarded £2 billion for 5G equipment contracts to Ericsson, Nokia in the UK.

5G & Internet of Things (IoT) Trends

- By Q1 2025, global IoT connections reached ~3.7 billion and are projected to hit 4.9 billion by 2029.

- Analysts estimated the global 5G IoT market at $11.69 billion in 2025, with robust growth ahead.

- Another forecast showed the 5G IoT market expanding to $20.03 billion in 2025, up from $12.13 billion in 2024.

- IoT devices in 2025 totaled 18 billion, rising ~13% year over year.

- Forecasts predicted IoT devices would generate 73.1 zettabytes (ZB) of data by 2025.

- Enterprise IoT grew by ~14% in 2025, driven by AI and automation.

- Hybrid connectivity (5G + LPWAN + satellite) gained traction, supporting diverse IoT scales.

- eSIM and Remote SIM Provisioning adoption accelerated in IoT modules and devices.

Cloud Gaming

- 5G is enabling sub‑20 ms latency in some urban deployments, crucial for interactive cloud gaming.

- Some providers report smooth 1080p / 60 fps streaming over 5G on mobile devices in pilot markets.

- 5G uplink improvements (via 5G‑Advanced) support live gaming and interactive uploads in real time.

- Edge compute nodes over 5G reduce server-to-device lag, improving responsiveness.

- Cloud gaming adoption among mobile gamers is rising in markets where 5G is stable and fast.

- Studios now consider mobile-first game releases optimized for 5G network scenarios.

- In experimental settings, 5G networks have enabled local multiplayer games with < 10 ms delay.

Media & Entertainment

- The global media & entertainment sector is projected to consume ~30% of total mobile data traffic by 2025, with 5G enabling higher‑quality streaming and immersive content.

- 5G supports seamless 4K/8K video streaming on mobile devices, elevating user experience in premium services.

- In augmented reality (AR) concerts, 5G has reduced lag to under 50 ms, enabling synchronized light and sound between remote viewers.

- Mobile video upload speeds (for creators and live streams) have risen, thanks to enhanced uplink throughput in 5G‑Advanced trials.

- Cloud-based production tools (e.g., remote editing, collaborative post-production) use 5G links for file transfers and preview streams.

- In gaming, 5G + edge compute enables console-quality visuals on mobile devices, boosting cloud gaming in entertainment apps.

Patent and Innovation Trends

- Over 64,000 patent families have been declared essential to 5G standards (SEPs) as of 2025.

- ETSI’s 5G Declaration list traces ~422,827 patent documents grouped into ~84,940 families.

- Major holders of 5G SEPs include Huawei, Qualcomm, ZTE, and Samsung.

- Chinese firms continue to strengthen their SEP portfolios, adding >10,000 new families annually.

- 5G patent growth aligns with broader tech innovation; patent filings in AI and telecom have surged ~30%.

- Licensing disputes and fair‑royalty debates remain central as adoption matures.

- Innovation around 5G‑Advanced, RedCap, energy‑efficient protocols, and NTN continues to attract R&D investment.

- XR and edge compute leverage are influencing patent strategies, combining 5G with XR ecosystems.

Job Market & Workforce Stats

- The 5G sector supports an estimated 1.3 million employees globally, with ~79,000 new roles added in a recent year.

- Within telecoms, roles in radio access network design, core network, edge compute, and AI/ML are in high demand.

- Job creation is especially strong in markets with expanding infrastructure, e.g., the UK merger VodafoneThree pledging thousands of new jobs.

- 5G-related job categories (network engineers, RF specialists, IoT engineers) are growing faster than general ICT roles.

- Contractors and third‑party system integrators account for a significant portion of the 5G workforce.

- In many regions, carriers are retraining legacy 4G staff in 5G and Open RAN skills.

- Ecosystem roles (devices, cloud, app developers) also see spillover demand due to 5G’s influence on services.

- Pay premiums are rising for engineers with 5G-specific skills (e.g., mmWave, slicing, core orchestration).

Key Players & Vendors

- Major equipment vendors, Ericsson, Nokia, Huawei, Samsung, and ZTE dominate the core and RAN segments.

- In Open RAN, newer players and software vendors (e.g., Mavenir, Altiostar) gain traction.

- Qualcomm and MediaTek are leading chipset suppliers for 5G devices.

- Cloud providers (AWS, Microsoft Azure, Google Cloud) compete to offer MEC, edge networking integration.

- System integrators and telco-IT firms (e.g., IBM, Accenture) play roles in deployment and orchestration.

- Private network solution providers (e.g., Celona, Rakuten Symphony) are strategic niche vendors.

- Operators increasingly form vendor diversity and neutral host arrangements to reduce risk.

- Some telcos are also innovating in the software stack (Open Core, vRAN) to internalize parts of infrastructure.

Frequently Asked Questions (FAQs)

About 2.9 billion 5G subscriptions are expected by end‑2025, making up roughly one‑third of all mobile subscriptions.

Global 5G connections reached 2.4 billion in Q1 2025, and are projected to reach 8 billion by 2029.

GSA catalogued 3,378 announced 5G devices, of which 88.1 % (2,977 devices) were commercially available.

The satellite‑based 5G network market is estimated at $6.69 billion in 2025, growing at a CAGR of 16.41% through 2034.

Conclusion

As 5G reaches the middle of its deployment curve, the numbers tell a story of accelerating adoption, strategic investment, and vibrant innovation. From media streaming to industrial automation, 5G’s influence is expanding across sectors. Challenges remain, regulatory, technical, and financial, but the future signals deeper integration of connectivity, compute, and intelligence. Join us in the full article to uncover how 5G’s continued evolution will reshape industries and society.